The process of finding a quick house sale becomes challenging because so many cash buyer companies operate in the market. The process of finding a single trustworthy collaborator who meets their promises needs to be completed as a vital step. This guide filters through all the unnecessary information to present a thorough evaluation of the top “we buy houses” companies in 2025 which will help you select the best option for your particular situation.

Who is the best cash home buyer? Your specific objectives will determine which “we buy houses” company operates as the most suitable choice for you. Sellers who want the fastest process and absolute certainty through a net offer should choose a national buyer like Eagle Cash Buyers as their top option. The decision to choose We Buy Ugly Houses franchise depends on personal preferences regarding brand familiarity and local face-to-face interaction but individual experiences differ. The guide will help you evaluate these alternatives to determine which one suits you best.

The report delivers a complete analysis of leading national franchises and independent cash buyers and major iBuyers. For each company, we will analyze key performance metrics, including:

- Offer fairness and typical purchase price ranges.

- Average closing speeds and timelines.

- The platform provides users with complete disclosure about all costs and service fees.

- Customer reviews and Better Business Bureau (BBB) ratings.

- The provider delivers services across various locations.

Sellers need to determine their property value through fair market value assessment to properly evaluate cash home purchase offers. This guide will provide you with the necessary knowledge to evaluate offers with certainty. The platform presents visual examples of each platform which shows how they operate to help you select the best method for selling your house fast.

1. We Buy Ugly Houses (HomeVestors)

We Buy Ugly Houses has built its brand recognition through its memorable “UG” caveman mascot and its widespread yellow billboard advertising which stands as the most recognized brand in the cash home buying business. HomeVestors of America operates this company as a franchise network which makes it one of the best “we buy houses” company options for sellers who want to work with a local agent while getting national brand support. The company has bought more than 140,000 homes since its establishment in 1996 while building a reputation for fast and easy transactions.

The platform exists for homeowners who want to sell their property quickly without making any changes to the property. The service provides an ideal solution for homeowners who want to sell their property without making repairs or staging their home before moving quickly. The service provides essential assistance to people who face urgent financial problems or need to relocate swiftly because of inherited property or other emergencies.

What Makes We Buy Ugly Houses Stand Out

The main distinction between We Buy Ugly Houses and its competitors exists because of its franchise business model. Your experience will be with a local franchisee who operates independently and understands the market characteristics of your specific neighborhood. The local knowledge of the agent provides an advantage which results in a more individualized service compared to working with an online or centralized iBuyer.

Their process is straightforward and hands-on:

- Initial Contact: You can call their national number or fill out a form on their website.

- Home Visit: A local franchisee will schedule a visit to your property to conduct a free, no-obligation evaluation.

- Firm Cash Offer: In many cases, the franchisee can make a firm cash offer on the spot during the visit.

- Fast Closing: If you accept, they can typically close in as little as three weeks, though they often offer flexible timelines to suit your needs.

A key benefit is their transparent fee structure. HomeVestors franchisees typically do not charge commissions or service fees, and they state they cover standard closing costs.

Pros and Cons

Pros:

- Strong Brand Recognition: Over 25 years in business provides a level of trust and familiarity.

- Nationwide Local Presence: With over 800 franchises in 47 states, you’re likely to find a local buyer.

- No Hidden Fees: They are clear about paying typical closing costs and not charging commissions.

Cons:

- Variable Franchise Experience: The quality of service, communication, and professionalism can differ from one franchisee to another.

- Lower Offer Prices: Offers are consistently below market value. The convenience and speed come at the cost of equity. Franchisees must buy low enough to cover repairs, holding costs, and their own profit margin, often using a formula like the 70% rule. For an in-depth explanation of this calculation, you can learn more about the 70% rule used in house flipping.

Visit Website: https://www.homevestors.com/we-buy-ugly-houses

2. WeBuyHouses.com

With a direct and memorable domain name, WeBuyHouses.com operates as a prominent national real estate investor network. The company functions as a powerful connection platform which helps homeowners find pre-approved licensed local investors throughout more than 200 markets in 30 states. This model makes it a strong contender for the best “we buy houses” company for sellers who value a quick connection to a local expert.

The platform is designed for homeowners needing a fast, certain, and simple sale. The service is designed for homeowners who want to sell their property without making any repairs or showing it to potential buyers. The service provides essential assistance to people who face urgent financial problems or need to relocate swiftly because of inherited property or other emergencies.

What Makes WeBuyHouses.com Stand Out

The key differentiator for WeBuyHouses.com is its marketing and referral system. It acts as a lead generation hub that provides its exclusive local partners with homeowner inquiries. This means when you contact them, you are quickly put in touch with a single, dedicated investor in your area who has been vetted by the national brand, combining nationwide reach with localized service.

Their streamlined process is built for speed and simplicity:

- Submit Your Information: You begin by filling out a simple online form or calling their number with your property details.

- Connect with a Local Buyer: Your information is instantly sent to the local WeBuyHouses.com specialist in your market.

- Receive a Cash Offer: The local buyer will contact you, potentially visit the property, and present a no-obligation, all-cash offer.

- Close on Your Schedule: If you accept the offer, you can close the sale quickly, often in just 7 to 14 days, or on a timeline that works for you.

A major advantage of their system is the commitment to an “as-is” sale. Sellers can avoid spending any money or time on repairs, a significant benefit when dealing with a distressed or outdated home. You can learn more about the benefits of an “as-is” sale to see if it fits your situation.

Pros and Cons

Pros:

- Fast Connection to a Local Buyer: Their system efficiently connects sellers with a vetted investor, often within minutes.

- Recognizable and Trusted Brand: The straightforward brand name and national presence provide a sense of credibility and reliability.

- No Repairs Needed: Sells are strictly “as-is,” removing the cost and hassle of fixing up the property.

Cons:

- Varying Investor Experience: Because you work with independent local investors, the quality of service, communication, and offer terms can differ significantly from one market to another.

- Potential for Aggressive Marketing: Some online reviews mention receiving unsolicited marketing from individuals associated with the brand, though this can vary by location. It’s wise to research the specific local buyer you are connected with.

- Offers Are Below Market Value: Like all cash buyers, offers are made at a discount to account for repair costs, holding fees, and investor profit.

Visit Website: https://webuyhouses.com

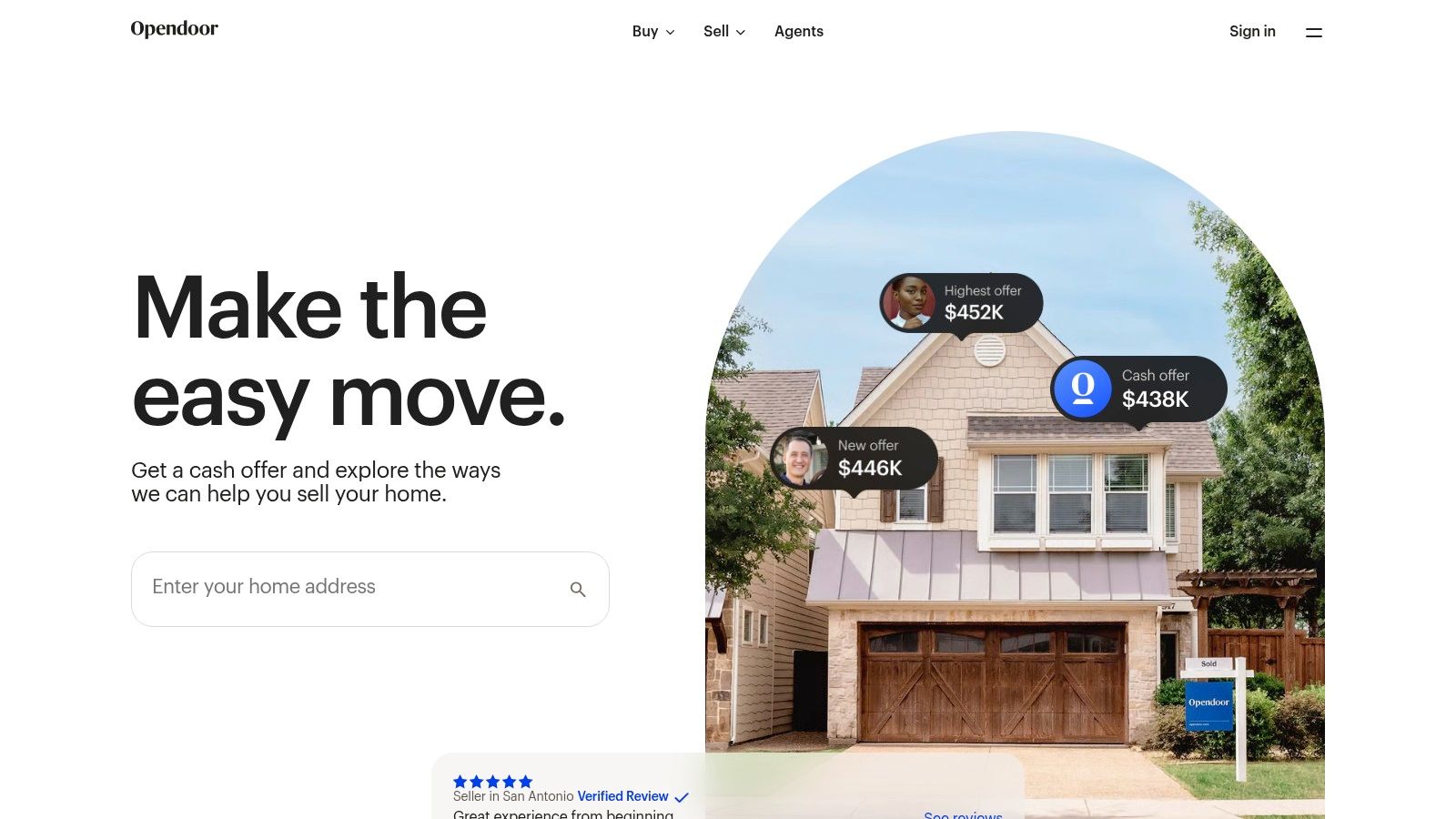

3. Opendoor

The iBuyer market received its first entry from Opendoor which uses technology to simplify the process of buying homes for cash. The company uses data algorithms to create fast cash offers for homes which are in good condition instead of focusing on properties that need repairs. The service provides a great choice for homeowners who want fast transactions yet their homes do not meet the standard fix-and-flip requirements of other cash buyers.

The platform is designed for homeowners in major metropolitan areas who want to bypass the uncertainties of the open market, such as showings, open houses, and buyer financing contingencies. The service provides an online platform which provides sellers with an easy digital process and transparent pricing to sell their home through an offer backed by data.

What Makes Opendoor Stand Out

The main distinction between Opendoor and its competitors exists because of its technological approach and its straightforward pricing system. Unlike many traditional cash buyers whose offers are based on a post-repair value formula, Opendoor provides an initial offer based on market data. The process is almost entirely online, minimizing in-person interactions until the final assessment, which is often a brief video walkthrough or an exterior inspection.

Their streamlined process offers remarkable convenience:

- Initial Offer: Homeowners submit their address and property details on the Opendoor website and receive a preliminary, no-obligation cash offer within minutes.

- Home Assessment: If the seller proceeds, Opendoor conducts a virtual or exterior assessment to verify the home’s condition.

- Final Offer: A finalized offer is provided, which includes a clear breakdown of their 5% service fee and any deductions for necessary repairs.

- Flexible Closing: Sellers can choose a closing date that suits their schedule, typically between 14 and 60 days.

This model is a hybrid between a traditional sale and a local cash investor. For a deeper understanding of the differences, you can explore our guide on cash buyers vs. iBuyers.

Pros and Cons

Pros:

- Transparent Fee Structure: Their standard 5% service fee is clearly stated upfront, similar to a traditional agent commission.

- Flexible Closing Dates: Sellers have the power to choose their closing day, providing control over their moving timeline.

- Convenience and Speed: The process is fast, digital, and removes the need for public showings and stagings.

Cons:

- Limited Availability: Opendoor only operates in specific metropolitan markets, excluding many rural and suburban areas.

- Repair Deductions: The final offer can be significantly lower than the preliminary one after repair costs are deducted, which can be a surprise for sellers.

- Stricter Property Criteria: They typically only purchase homes in good condition built after a certain year, disqualifying many distressed or older properties.

Visit Website: https://sell.opendoor.com

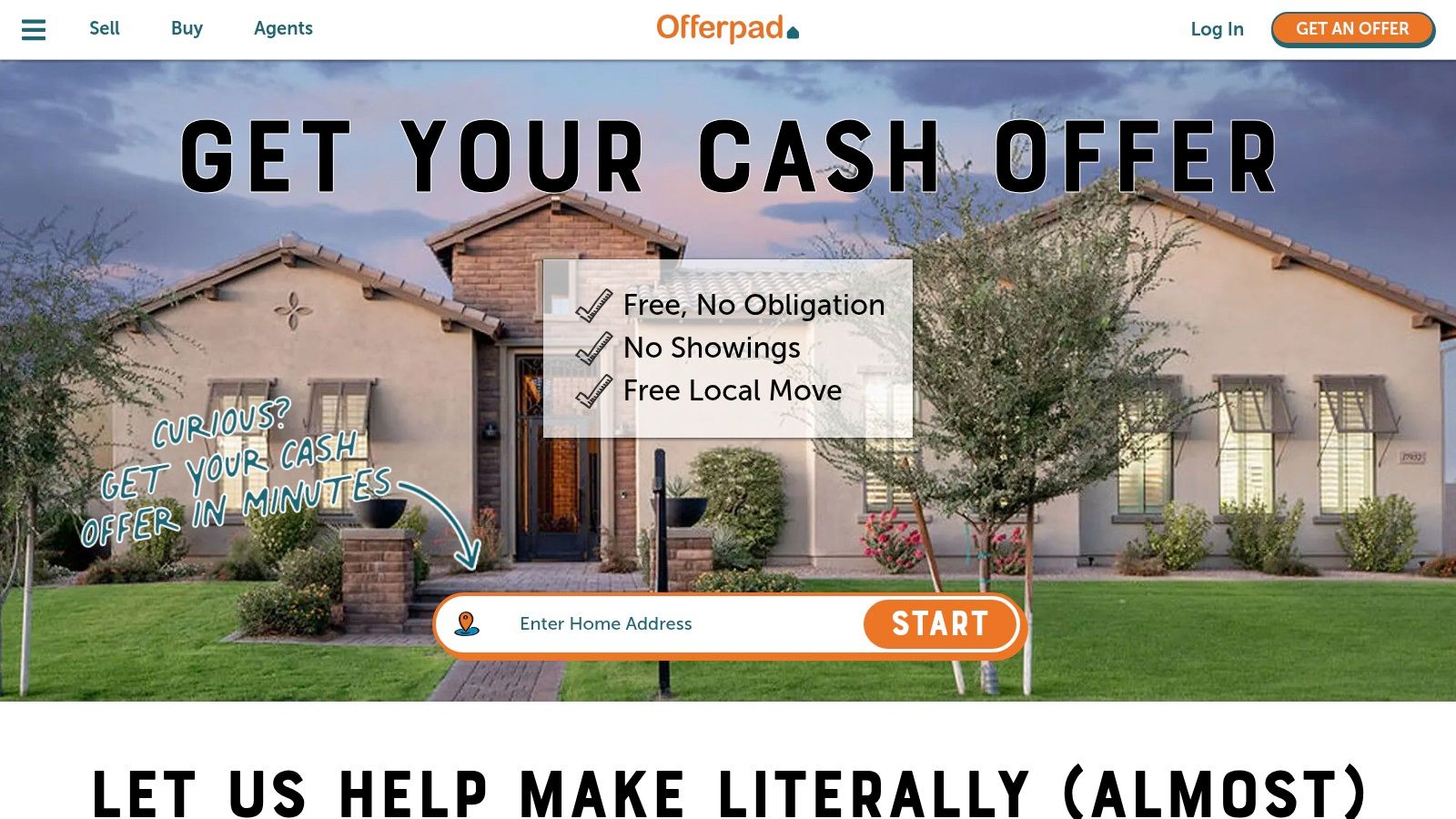

4. Offerpad

Offerpad operates as a prominent iBuyer (“instant buyer”), leveraging technology to provide homeowners with quick cash offers and a streamlined, modern selling experience. The service distinguishes itself from traditional “we buy houses” companies because it focuses on homes that need minimal repairs instead of properties that require major renovations. The platform operates as a digital solution for sellers who want to finalize their transactions quickly while avoiding the need for property viewings and open house events.

The service presents an excellent opportunity for eligible homeowners who want to sell their properties quickly yet have properties that do not match traditional fix-and-flip criteria. The company offers a modern digital solution which stands apart from the conventional franchise system to serve customers who prefer digital transactions when selecting their “we buy houses” service provider.

What Makes Offerpad Stand Out

Offerpad stands out because it provides a unique combination of selling methods to its customers. The platform provides sellers with an instant cash offer while maintaining the option to list their home on the market through its “Offerpad Flex” program. The unique model enables homeowners to test the market while maintaining a cash offer backup that provides them with security and control over their sale.

The process is designed for digital convenience:

- Request an Offer: You submit details about your property on their website and typically receive a preliminary cash offer within 24 hours.

- Home Assessment: If you proceed, Offerpad conducts a thorough virtual or in-person home assessment to verify the property’s condition and finalize the offer.

- Flexible Closing: Upon accepting the final offer, you can choose your closing date, often within a window of 8 to 90 days.

- Added Perks: In certain markets, Offerpad includes valuable perks like a free local move, which adds a layer of convenience not offered by most cash buyers.

The platform’s flexible design enables users to evaluate the instant benefits of cash offers against potential higher market sale prices. The many advantages of a quick, certain sale are significant, and you can explore the benefits of selling a house for cash on eaglecashbuyers.com to see how it compares.

Pros and Cons

Pros:

- Multiple Selling Options: The ability to receive a cash offer, list on the market, or do both simultaneously provides unparalleled flexibility.

- Convenience and Speed: The entire process is largely digital, with fast offers and the ability to choose your closing date.

- Extra Perks: The free local move (where available) is a tangible benefit that saves sellers time and money.

Cons:

- Service Fees and Repair Costs: Offerpad charges a service fee, which third-party analyses often report is around 5% to 8%, plus deductions for any necessary repairs found during the assessment. These costs can significantly reduce your net proceeds.

- Limited Availability: Offerpad only operates in specific metropolitan areas across a limited number of states, making it inaccessible to many homeowners.

- Best for Homes in Good Condition: Their model is not designed for heavily distressed properties, meaning sellers with homes needing major repairs may not receive an offer.

Visit Website: https://www.offerpad.com

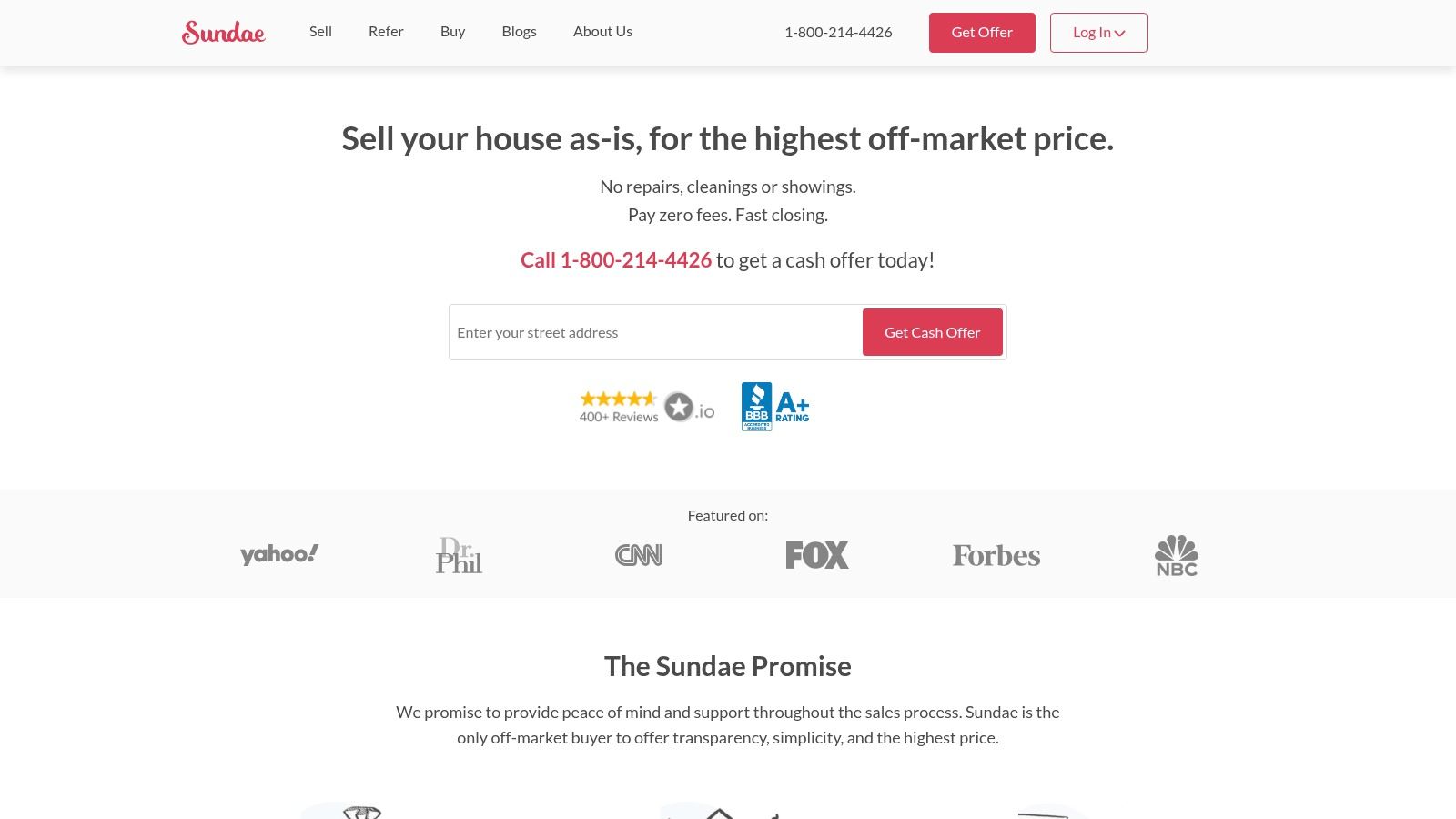

5. Sundae

Sundae operates as a marketplace which provides a fresh approach to the conventional cash home buying business. Instead of making a single direct offer, Sundae connects sellers of distressed or dated properties to a network of vetted local property investors. The platform enables homeowners to create a competitive bidding environment which can increase the final sale price beyond what they would get from selling their property in its current state.

The service is designed to help people who want to get a fast cash offer but want to ensure they get the best deal possible. By exposing a property to multiple investors at once, Sundae aims to give sellers more confidence that they are receiving a fair price under their circumstances, making it one of the more transparent options in the “we buy houses” company landscape.

What Makes Sundae Stand Out

Sundae operates as a marketplace which enables competitive bidding between buyers. The platform uses a bidding system which contrasts with the single-offer model that most direct cash buyers use. The process is structured to give sellers more leverage while maintaining the core benefits of a fast, as-is transaction.

Their process is designed for transparency and seller convenience:

- Initial Consultation: You provide details about your property online or over the phone.

- Property Assessment: A Sundae Market Expert visits your home to assess its condition and prepare a detailed property profile.

- Investor Bidding: The property profile is listed on their marketplace for a limited time, where qualified investors place bids.

- Review Offers: At the end of the auction period, you receive the highest offers to review with no obligation to accept.

- Fast Closing: If you accept an offer, you can close in as little as 10 days and may be eligible for a cash advance of up to $10,000.

A significant benefit is that Sundae typically does not charge sellers any fees or commissions for using the platform. The investors pay Sundae a fee, meaning the offer you see is closer to your net proceeds.

Pros and Cons

Pros:

- Competitive Bidding: The marketplace can generate multiple offers, which often results in a higher sale price compared to a single cash offer.

- No Seller Fees: In most cases, sellers pay no platform fees, agent commissions, or closing costs.

- As-Is Sale: Sells properties in any condition, eliminating the need for costly repairs, cleaning, or staging.

- Cash Advance Option: Eligible sellers can receive a cash advance before closing to help with moving or other expenses.

Cons:

- Limited Availability: Sundae’s service is not nationwide and is concentrated in specific major metropolitan areas.

- Variable Outcome: The final sale price is not guaranteed and depends entirely on investor interest and the bids received during the auction period.

- Slightly Longer Process: The bidding window means the process might take a few days longer than an instant offer from a direct buyer.

Visit Website: https://sundae.com

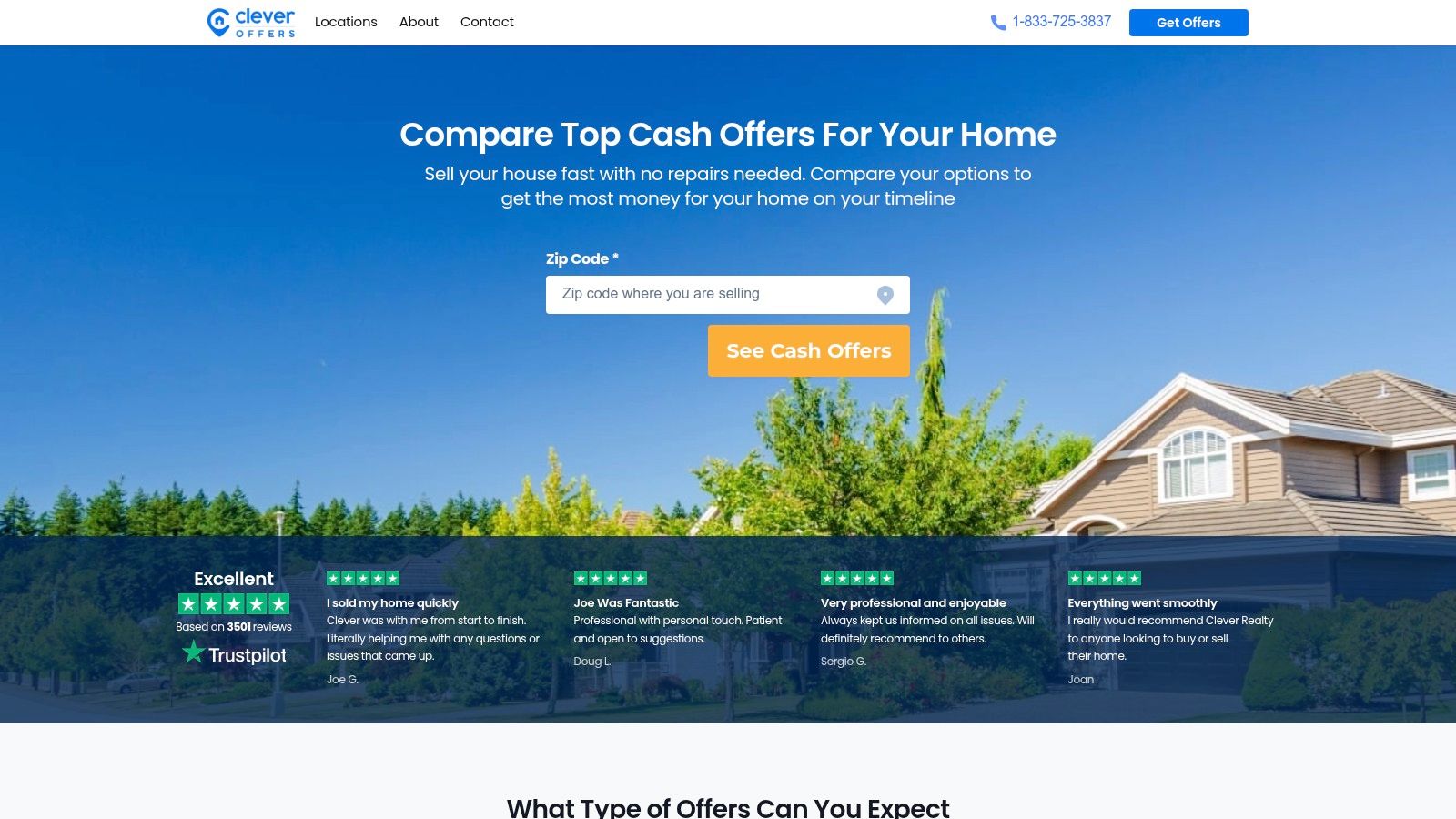

6. Clever Offers

Clever Offers operates as a marketplace which provides a free service for sellers to connect with pre-screened cash buyers. The platform enables homeowners to get multiple competitive offers by submitting their property details once. This model, powered by the well-known real estate service Clever Real Estate, is designed to give sellers more leverage and transparency, making it a unique and powerful option on our list of the best “we buy houses” company choices.

The platform operates as a solution for sellers who want the speed and convenience of cash sales while maintaining the ability to get competitive prices. The Clever Offers platform enables homeowners to compare pre-screened investor options through its no-cost, obligation-free service which includes two programs: 7-Day Sold and Instant Cash Offer. The service provides an excellent option for people who want to maximize their property sale value while staying away from traditional market selling.

What Makes Clever Offers Stand Out

Clever Offers operates as a competitive marketplace which sets it apart from direct buying services. The system allows sellers to get up to 10 cash offers from buyers with just one straightforward submission. The platform verifies all buyers in its network by checking their financial backing and past investment history to protect sellers from working with unqualified buyers.

The process is designed for comparison and convenience:

- Single Form Submission: Sellers provide details about their property through one online form on the Clever Offers website.

- Receive Multiple Offers: The platform submits this information to its nationwide network of cash buyers, who then present their offers.

- Compare and Choose: You receive the offers on a single dashboard, allowing for an easy comparison of net proceeds and terms. A dedicated concierge provides support throughout the process.

- Close with Buyer: If you accept an offer, you proceed directly with the chosen buyer to finalize the sale and closing.

A significant benefit is the cost structure. The service is entirely free for sellers, with Clever receiving a fee from the buyer only after the sale successfully closes. This removes any financial risk for the homeowner.

Pros and Cons

Pros:

- Multiple Competing Offers: The marketplace model can drive up offer prices compared to approaching a single cash buyer.

- Free for Sellers: There are no fees or commissions charged to the homeowner for using the platform.

- Vetted Buyer Network: Provides peace of mind that you are dealing with credible investors with proven funds.

- Nationwide Coverage: The service is available in all 50 states and Washington D.C., offering broad accessibility.

Cons:

- Acts as an Intermediary: Clever facilitates the connection, but the seller must still vet and negotiate the final terms with the chosen buyer.

- Offer Quality Varies: The strength and number of offers received depend entirely on the buyers active in your specific market at that given time.

Visit Website: https://cleveroffers.com

7. Eagle Cash Buyers

Eagle Cash Buyers operates as a top-tier choice for homeowners who want to sell their property fast through a transparent process that guarantees trust. Operating as a direct, investor-backed buyer rather than a franchise, the company provides a level of consistency and control that sets a high standard in the industry. The company operates in about 44 states to provide a simple solution for sellers who need to sell properties with various issues including foreclosure and inherited homes and properties that need major repairs.

What truly makes Eagle Cash Buyers a strong option is its commitment to certainty and simplicity. Because they use their own capital to purchase homes, the entire process is free from the financing contingencies that often derail traditional sales. The direct funding structure provides sellers with genuine peace of mind because it prevents sudden loan denials and appraisal problems. The company’s impressive closing stats—over 1,000 successful transactions in its 6+ years of operation and an A+ BBB rating—further solidifies its reputation for dependability.

Key Features & Operational Strengths

Eagle Cash Buyers has refined its process to eliminate common seller pain points. Their approach is built on three core principles: speed, transparency, and convenience. This focus is evident in every step of their operation.

- Direct Investor Model: Unlike franchise-based competitors where service quality can vary significantly by location, Eagle Cash Buyers offers a standardized, professional experience nationwide. Your point of contact and the process itself remain consistent, regardless of your property’s location.

- Guaranteed, As-Is Sales: The company purchases homes in any condition. This means sellers are completely relieved of the burden of repairs, cleaning, staging, or even removing unwanted items. This is a significant advantage for those with distressed properties, inherited homes filled with belongings, or landlords dealing with post-tenant messes.

- Transparent Net Offer: Eagle Cash Buyers covers all traditional closing costs. The cash offer they present is the exact amount you will receive at closing, with no deductions for commissions, service fees, or hidden charges. This transparency simplifies financial planning and removes the ambiguity often associated with home selling.

The Seller Experience: A Streamlined Process

The user experience is designed for maximum efficiency. The journey from initial contact to closing is a straightforward, three-step flow that respects the seller’s time and urgency. You can learn more about how their process works by visiting their website. The company’s emphasis on clear communication and a single walkthrough (virtual or in-person) minimizes disruption to the homeowner’s life.

Expert Insight: “The direct-buyer model used by Eagle Cash Buyers is a key differentiator. It eliminates the ‘middleman’ and potential for inconsistent service that can occur with large franchise networks. The direct control over funding and operations leads to faster and more dependable closings for the seller.”

Ideal Use Cases

The service works best for sellers who need a quick sale but it can also serve other homeowners who want fast closings.

- The service enables homeowners to stop foreclosure while protecting their credit rating by offering an immediate guaranteed sale.

- The service helps homeowners manage the difficult process of selling inherited property and probate homes especially when they live far away.

- The service provides an excellent solution for properties that have major structural problems and code violations and unpaid tax liens.

- The service provides an immediate sale option which benefits people who need to relocate quickly for work or family matters.

Website: https://www.eaglecashbuyers.com

Top 7 We Buy Houses Companies Comparison

| Provider | 🔄 Implementation Complexity | ⚡ Resource Requirements | ⭐📊 Expected Outcomes | 💡 Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| We Buy Ugly Houses (HomeVestors) | Low — local franchise 3‑step flow with in‑home consult | Local franchisees fund purchases; typically pay closing costs; no seller fees | Quick as‑is cash sales (often ~3 weeks); offer levels vary by operator 📊 | Sellers needing speed or unwilling to make repairs | Strong national brand; local market knowledge; no commissions |

| WeBuyHouses.com | Low — 4‑step routing to local investor partners | Connects to licensed local buyers across 200+ markets; sellers avoid repairs | Fast path to offers and closings; quality and terms vary by market 📊 | Fast, as‑is sales where broad market access helps | Wide market coverage; streamlined connection to investors |

| Opendoor | Medium — instant online estimate then home assessment | Publishes ~5% service fee; final adjustments for repairs; market‑limited | Transparent fee structure; flexible closings (15–60 days); predictable net ⭐📊 | Sellers who want fee clarity and online convenience | Clear pricing, low fall‑through risk, quick online process |

| Offerpad | Medium — instant offer + assessment; hybrid listing options | Fees often reported ~7–8% + repair deductions; selective metro availability | Convenience and choice; net proceeds can be reduced by fees/repairs 📊 | Sellers comparing cash vs. listing or needing moving perks | Multiple selling paths (cash/list/hybrid); local perks (e.g., moves) |

| Sundae | Medium — investor marketplace with competitive bidding | Investor bids determine price; typically no platform seller fees; metro coverage | Potentially higher net from bidding; outcome depends on investor interest ⭐📊 | Distressed or dated homes where competitive bids may raise price | Competitive bidding, fast closings, often no seller fees |

| Clever Offers | Low–Medium — aggregator marketplace; concierge support | Free for sellers; vetted buyers provide competing offers; nationwide | Multiple vetted cash offers to compare; final net varies by buyer choice 📊 | Sellers who want side‑by‑side offer comparison at no cost | Free service, up to ~10 competing offers, nationwide coverage |

| Eagle Cash Buyers | Low — streamlined 3‑step process; one brief walkthrough | Company funds; pays closing costs; no repairs or staging; ~44‑state coverage | Fast, guaranteed cash sale often 14–21 days; offers typically below retail 📊 | Foreclosure, inherited property, relocation, divorce, problem rentals | Transparent net offers; A+ BBB; no commissions or hidden fees |

Making Your Final Decision: Franchise vs. Independent Buyer

Navigating the landscape of “we buy houses” companies can feel overwhelming, but after reviewing the top players, you’re now equipped to make an informed choice that aligns perfectly with your unique situation. The market consists of national franchises like We Buy Ugly Houses and digital iBuyers such as Opendoor and Offerpad. Your selection of the best we buy houses company depends on your individual needs and preferences.

You must decide between two main options which consist of the large franchise with brand recognition and the direct independent buyer with a streamlined process. The last step to achieve a fast home sale requires you to understand the main differences between these two options.

The Franchise Model: Brand Recognition vs. Local Variation

The franchise networks We Buy Ugly Houses (HomeVestors) and WeBuyHouses.com provide the security of established brand recognition. Their extensive marketing and national presence mean they are often the first companies sellers encounter. The model depends on a network of individual franchisees who pay to use the brand name while following a standard operational framework.

However, this structure introduces significant variability. The quality of your experience, the fairness of your offer, and the transparency of the process can differ dramatically from one local office to another. One franchisee might be a seasoned professional with a stellar local reputation, while another in a neighboring territory could be inexperienced or less scrupulous. You are ultimately dealing with a local businessperson operating under a national umbrella, not the corporation itself.

The Independent Buyer Model: Consistency and Direct Accountability

In contrast, an independent cash buyer like Eagle Cash Buyers operates under a single, unified system. There are no franchisees, no middlemen, and no regional variations in process or integrity. The team you interact with, the offer calculation methodology, and the closing procedures are consistent regardless of where your property is located.

This direct model fosters a higher level of accountability and transparency. When you receive an offer from an independent buyer, it’s typically the net amount you will receive. There are no hidden franchise fees or surprise deductions at closing. Companies like Eagle Cash Buyers build their reputation not on a licensed brand name, but on a proven, repeatable track record of successful, transparent closings. With over 1,000 homes purchased and a steadfast A+ BBB rating, their entire business model rests on delivering a consistent, reliable experience every time.

Key Takeaway: Your choice isn’t just about the company name; it’s about the business model. A franchise offers a familiar brand but with potential inconsistency, while a dedicated independent buyer provides a direct, standardized, and often more transparent process from start to finish.

Actionable Next Steps: Your Personalized Decision Checklist

Before making a final call, use this checklist to clarify your priorities:

- Define Your Top Priority: Is it the absolute highest possible cash offer, the fastest possible closing date, or the most straightforward, transparent process with zero surprises? Your answer will guide you to the right type of buyer.

- Request Multiple Offers: Never settle for the first offer you receive. Contact at least one franchise, one iBuyer (if available in your area), and an independent buyer to truly compare your options.

- Scrutinize the Fine Print: Ask each company explicitly about their fees. “Are there any service fees, repair credits, or closing costs I will be responsible for?” The best we buy houses company will give you a clear, unambiguous answer.

- Verify Their Reputation: Look beyond the company website. Check their BBB rating, read recent customer reviews on third-party sites, and ask for proof of funds or case studies of recent local closings.

Selling your home is a significant financial decision, but it doesn’t have to be a stressful one. By understanding the core differences between the business models and doing your due diligence, you can move forward with confidence, knowing you have selected the partner that truly meets your needs for speed, certainty, and peace of mind.

If, after weighing your options, you value a direct, transparent, and guaranteed cash offer from a company with a proven national track record, you might consider getting a no-obligation quote. Independent home buyers like Eagle Cash Buyers can provide a clear path to a fast closing without the variability or hidden costs of a franchise model. To explore this option, you can see what your certain, as-is offer looks like by visiting Eagle Cash Buyers today.