Quick Answer: A cash sale requires buyers to pay for title insurance and escrow fees as well as recording expenses and transfer taxes while sellers cover agent commissions and some of the escrow or transfer taxes.

Who Pays Cash Buyer Closing Costs

Parties in a cash sale must follow local customs which establish cost allocation yet these rules function more as suggestions. A mutual agreement between you and the other party should establish payment responsibilities according to your budget and available time.

- Buyer takes on expenses for title insurance and escrow fees and recording fees and transfer taxes.

- Seller is responsible for agent commissions alongside partial payment for escrow fees and transfer taxes in some cases.

- Eagle Quick For Cash exemplifies cash buyers who take charge of all seller expenses for rapid secure closings explained in our We Buy Houses For Cash guide.

Summary Of Cash Sale Closing Cost Responsibility

The table shows that buyers are required to pay for title insurance, escrow, recording costs and transfer taxes.

| Party | Typical Responsibility | Notes |

|---|---|---|

| Buyer | Title insurance, escrow, recording fees, transfer taxes | Transaction essentials |

| Seller | Agent commissions, part of escrow fees, sometimes transfer taxes | Local customs vary |

Follow this structure to begin negotiations but ensure you review standard practices in the area while reaching an agreement that benefits all parties.

Understanding Closing Costs In Cash Sales

To properly handle the closing fees in cash transactions you need to know all the related expenses. When you choose to sell your property for cash you eliminate traditional lender costs which include loan origination, underwriting and appraisal fees. Your focus switches immediately to the basic expenses of title insurance and escrow services along with recording and transfer taxes. The transition in payment methods will lead to a substantial reduction in your final costs and accelerate the completion of your transaction.

Key Closing Cost Components

- Title Insurance provides protection for both the buyer and seller in case of unforeseen ownership problems.

- Escrow Fees provide payment to a neutral third party that acts as the fund holder and distributor.

- Recording Fees cover the official paperwork recording expenses that go to your county office.

- Transfer Taxes differ between local jurisdictions with some charging a fixed fee while others base the tax on sale price percentages.

The selling party still needs to pay real estate agent commissions which typically amount to 5–6% of the selling price. To ensure smooth transactions, you can choose to divide escrow or notary fees with the buyer.

Our guide about selling a house includes information about property tax duties during the closing process.

Average Closing Cost Insights

The research found that nationwide cash buyers typically spend 1.06% of the purchase price amounting to $4,661 in closing costs. Real estate fees in New York and Texas differ significantly from the nationwide average of $4,661:

| Location | Average Cost | Percentage |

|---|---|---|

| Nationwide | $4,661 | 1.06% |

| New York | $16,849 | 3.1% |

| Texas | $4,548 | 1.5% |

The knowledge of every specific charge grants you an unobstructed view of the total sales amount which prepares you to conduct equitable discussions.

“A detailed breakdown of all fees provides total clarity on sales earnings while boosting negotiation strength.”

The removal of even a few hundred dollars from title or escrow costs will have a significant impact. Study your preliminary closing documents immediately to avoid unexpected expenses and set practical projections for regional cost differences.

The following section examines how to divide payment responsibilities between sellers and buyers and details effective strategies for obtaining cash buyer concessions as well as methods for reaching optimal purchase terms. Before proceeding with the sale, consult with your title company to obtain precise local payment information.

Splitting Closing Costs Between Buyers And Sellers

Buyer and seller must determine how they will divide the expenses of the closing process. The process of splitting closing costs between the parties usually resembles the way people share restaurant bills based on standard regional practices. When you understand who pays which costs your bill will become simple to understand.

- The buyer must provide funds for title insurance and escrow fees and recording charges and transfer taxes.

- The seller needs to handle agent commissions and they normally manage the processing of lien releases.

Following local payment traditions allows both buyers and sellers to negotiate their agreements freely.

Negotiation And Local Customs

The person who files the paperwork has to pay recording fees for deeds or lien releases. The specific costs of these individual items can be extremely different between the recording offices of different counties.

The amount of transfer taxes and notary fees that buyers need to pay can change significantly depending on the state or county where the transaction occurs. The small print in the agreement will determine which party has to pay for each specific cost.

In the state of Texas, buyers must assume responsibility for all transfer taxes. In Florida, it is the seller who must take care of this payment. In order to attract fast cash offers sellers sometimes commit to covering the full escrow costs.

Knowing these regional practices will help you calculate your final earnings so you can bargain confidently. You can adjust who takes on what fees in your purchase agreement by using clear contract terms.

Read our guide about real estate commission to understand how agent fees impact the final value.

Every deal can adjust these splits, so clear cost-sharing agreements cut surprises at closing. Before you sign anything, have a detailed conversation with your agent about the specifics.

How Cash Buyers Reduce Closing Costs

When a buyer makes a purchase using cash, closing costs must be paid although the expense structure changes significantly (Learn more about closing cost findings).

Cash buyers use specific strategies to cut down their closing expenses.

- Title Insurance provides protection for both the buyer and seller in case of unforeseen ownership problems.

- Escrow Fees provide payment to a neutral third party that acts as the fund holder and distributor.

- Recording Costs cover the official paperwork recording expenses that go to your county office.

- Transfer Taxes differ between local jurisdictions with some charging a fixed fee while others base the tax on sale price percentages.

The rapid execution not only reduces costs from utilities and taxes but also minimizes the risk of buyer financing falling through.

Reduced Fee Structure

Are Closing Costs Ever Handled by Sellers When Buyers Pay Cash? Yes, this happens often. The basic cash transaction requires the property seller to pay their real estate agent’s commission along with a portion of escrow and transfer tax expenses. You can add value to your offer through discussions about who will bear the costs of escrow, recording or transfer fees.

Fast Closing Timelines

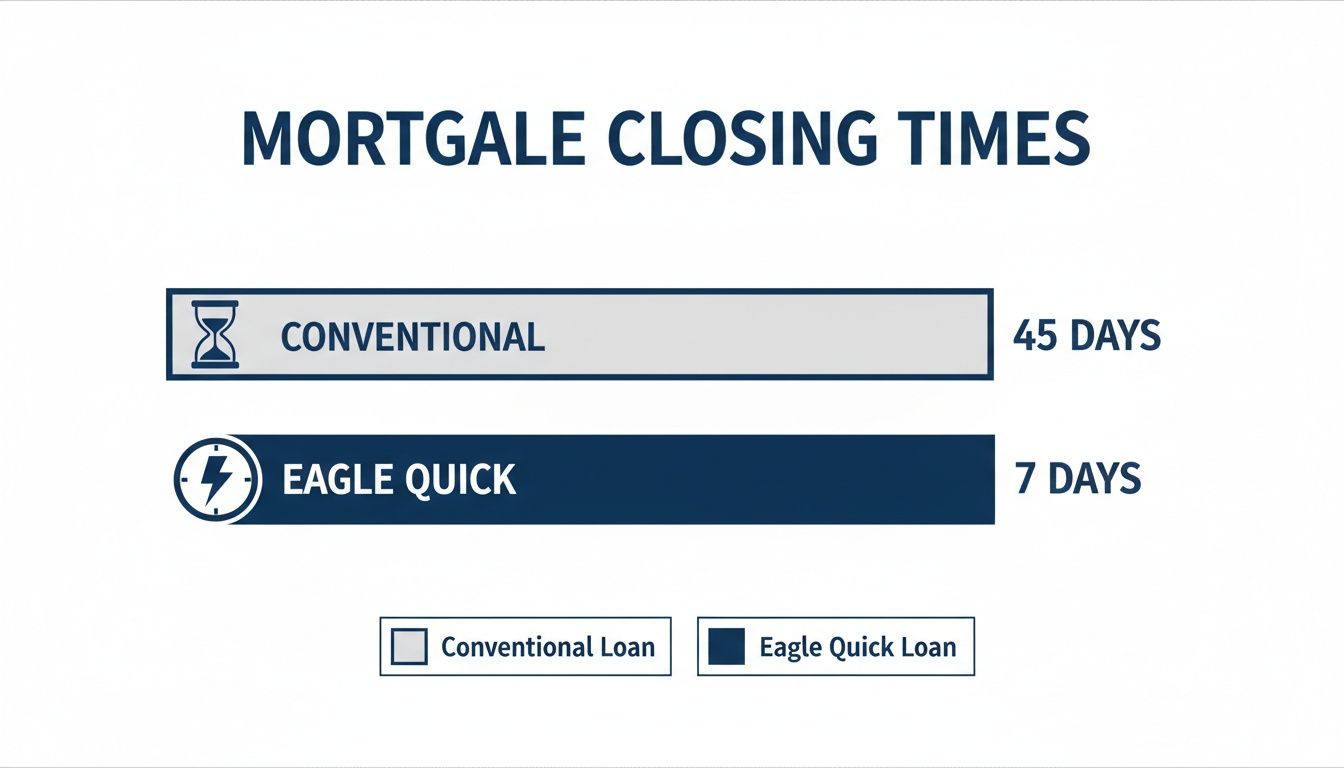

Cash transactions complete within seven days on average while traditional financing takes between 30 and 45 days.

Learn more about the benefits of selling your house for cash in our article on Benefits of Selling Your House for Cash.

- Faster funds for your next move.

- Less paperwork and fewer contingencies.

- Certainty without waiting on loan approvals.

Opting for cash locks in your proceeds early and sidesteps financing headaches. Before you sign, though, take a close look at that closing statement and run the figures by a trusted title expert. Coming up, we’ll cover negotiation tactics to help you hold onto even more of your sale proceeds.

Selling Options: Traditional vs Cash Buyers

When timing and costs are top of mind, it helps to compare selling routes side by side. Below are three common approaches:

Traditional Agents

- Timeline: 30–60 days to sell

- Costs: 5–6% agent commissions, staging and marketing

- Process: Listing, showings, negotiations, financing contingencies

iBuyers

- Timeline: 14–30 days

- Costs: 1–3% service fees

- Process: Automated valuations, online offers, digital closings

Private Cash Buyers

- Timeline: Often under seven days

- Costs: No financing contingencies, direct negotiations

- Process: Property evaluation, cash offer, quick closing

Eagle Quick For Cash

One example of a private cash buyer, Eagle Quick For Cash covers all seller closing costs—title insurance, escrow fees, recording charges, and transfer taxes. After a swift property review, you’ll get a no-obligation offer and can close in as few as seven days.

Learn more in our detailed guide: Learn More About Our Process

Closing Cost Scenarios And Examples

Real cases reveal how closing costs shift dramatically depending on state rules and the property’s condition. Sellers often face very different fee structures from one market to the next.

Below, we walk through three scenarios—each with its own timeline, fees and negotiation tips.

Florida Distressed Home Example

In Florida, transfer taxes are surprisingly low at 0.2% of the sale price. But title and escrow fees can still add up when you’re dealing with a run-down property.

- Transfer Taxes: 0.2% of sale price

- Title Search Fees: $600 flat rate

- Escrow Charges: $1,200 average

- Total Seller Closing Costs: about 1.2% of sale price

Inherited Property In Pennsylvania

Handling an inherited home in Pennsylvania often means steeper recording and estate charges. On a $250,000 valuation, closing costs climbed past 4%.

- Estate Recording Fee: $1,200

- Title Insurance: $2,800

- Transfer Tax & Miscellaneous: $6,634

- Total Seller Closing Costs: roughly 4.3%

Pennsylvania leads all states with the highest closing cost of $10,634 while Maryland stands at $14,721 and Arizona at $4,701 and Texas at $4,548. For a detailed examination of closing costs by state, turn to RealEstateBees’s comprehensive closing cost analysis.

California Foreclosure Sale

Foreclosure transactions in California carry the usual state fees plus higher escrow and trustee charges. All told, sellers often pay close to 3% of the final sale price.

- Recording & State Fees: 1.5% of sale price

- Trustee’s Fee: $850

- Escrow & Notary Charges: $2,250

- Total Seller Closing Costs: about 3.0%

That graphic highlights a stark contrast: conventional closings average 45 days, while Eagle Quick For Cash can wrap up in as few as 7 days.

- Negotiate transfer tax splits to reduce your out-of-pocket

- Shop around multiple title companies for better fee schedules

- Schedule a pre-closing walkthrough to catch unexpected charges

Regional Closing Cost Comparison For Cash Buyers

| Region | Average Cost | % Of Sale Price |

|---|---|---|

| Florida | $3,210 | 1.2% |

| Pennsylvania | $10,634 | 4.3% |

| California | $7,500 | 3.0% |

| Arizona | $4,701 | 1.2% |

These figures should help you set realistic expectations and refine your negotiation strategy before you sign on the dotted line.

Takeaways For Sellers

- Review local fee schedules early to avoid last-minute surprises

- Compare offers that include covered closing costs versus those that don’t

- Factor closing timelines into your moving and financing plans

“Seeing real examples helps you plan your net proceeds and negotiate with confidence.”

Estimate closing costs with your title company as soon as you list, so you won’t be caught off guard at signing.

FAQ On Cash Buyer Closing Costs

Even when a buyer brings cash to the table, closing costs don’t disappear—they just get divvied up differently.

Do Sellers Ever Pay Closing Costs With Cash Buyers?

Often, yes. In a typical cash deal, sellers still cover their agent’s commission and a portion of escrow or transfer taxes. You can also haggle over who picks up escrow, recording or transfer fees to make the offer more attractive.

Which Fees Can Sellers Negotiate?

Sellers have leverage, especially in a competitive market. Common negotiating points include:

- Escrow Charges: Offer to pay all or part of them.

- Recording Fees: Waive them to sweeten your offer.

- Transfer Taxes: Propose splitting these costs.

These concessions can tip the scale in your favor when multiple cash bids land at the same time.

What Does Eagle Cash Buyers Cover?

When you sell to Eagle Cash Buyers, you keep 100% of your net proceeds. We handle:

- Title insurance on the seller’s side

- All escrow fees

- Recording charges

- Transfer taxes

No hidden line items. The number in your offer is what lands in your pocket.

How Fast Can a Cash Sale Close?

Surprisingly quick. Most cash deals wrap up in as little as 7 days, compared to 30–45 days with traditional financing. That speed not only cuts carrying costs like utilities and taxes but also shrinks the window for buyer financing to fall through.

Tips To Maximize Savings

- Request a preliminary closing statement early in the process

- Compare fee estimates from multiple title companies

- Negotiate who pays specific closing line items

“When closing costs are fully covered, sellers report greater confidence at the table.”

How To Prepare For Closing

- Obtain a detailed closing cost estimate from your title officer

- Go line by line to understand each charge

- Amend your contract to cover any unexpected fees

Armed with this knowledge, you’ll walk into closing with clarity and confidence—no surprises, no stress.

Ready to skip the hassle and eliminate surprise fees? Get your no-obligation offer with Eagle Cash Buyers today.