The main distinction between cash buyers and iBuyers exists because cash buyers function as local investors who purchase properties in any state of repair but iBuyers operate as large tech companies which use algorithms to acquire homes that meet specific condition standards. The decision requires selecting between a tailored flexible solution and a fixed automated system.

Cash Buyers vs. iBuyers: Understanding the Core Differences

When you need to sell your home fast, bypassing the traditional real estate market can be a significant advantage. Two of the most common alternatives are traditional cash buyers and iBuyers (Instant Buyers). The two platforms enable users to sell homes rapidly without using a real estate agent but they function through distinct methods.

The companies function through completely different methods and business models and they acquire different types of residential properties. The knowledge of these differences helps you pick the best option for your individual circumstances and financial objectives.

Key Differences at a Glance: Cash Buyer vs. iBuyer

We will examine the primary distinctions between these two options. The table presents a quick overview of the differences between these two options.

| Factor | Traditional Cash Buyer | iBuyer (e.g., Opendoor) |

|---|---|---|

| Business Model | Local investors or companies buying properties to fix-and-flip or rent. | Large, data-driven tech companies that resell homes quickly. |

| Property Condition | The company buys homes in any condition including properties that require extensive repairs. | The program needs homes to be in good condition while following particular eligibility rules. |

| Offer Process | The assessment takes place in person to create a customized offer which can be negotiated. | The process starts with an automated online valuation which then moves to a formal inspection before you get a revised offer. |

| Fees & Costs | Usually there are no fees because closing costs get paid by the buyer. The offer is usually the net amount. | The service charges a 5% fee and deducts repair costs from the total amount. |

| Flexibility | Highly flexible on closing dates and terms to suit the seller’s needs. | The process moves quickly but follows strict rules which limit negotiation possibilities. |

Traditional cash buyers provide a flexible hands-on method which suits particular properties but iBuyers deliver a fast automated process for homes that meet their existing condition requirements.

A traditional cash buyer is usually a local investor or a company specializing in buying homes directly from owners. The company excels at buying properties which require major renovations including both foundation work and kitchen modernization. Their model is built on simplicity and providing solutions for sellers. The process of companies that buy houses for cash operates in a way which makes them worth exploring if this sounds like what you need.

An iBuyer functions as a major technology company which often receives venture capital funding to produce instant offers through Automated Valuation Models (AVMs). Think of well-known names like Opendoor or Offerpad (Zillow is no longer in the iBuyer space). They are focused on homes that are already in good condition and located in specific, high-demand markets. Their process is designed to be as uniform and hands-off as possible.

Who Are Traditional Cash Buyers Really?

The term “cash buyer” might bring to mind simple, handwritten “We Buy Houses” signs. The world of traditional cash buyers extends beyond these signs because it includes many professional investors.

The basic definition of these entities describes them as people or businesses which acquire real estate through cash payments. The main benefit of this method exists because it bypasses the slow and often unpredictable process of mortgage approval. Sellers gain both speed and certainty through this method because bank financing stands as the primary cause for most real estate deals to fail.

The Different Faces of Cash Buyers

All cash buyers do not operate in the same manner. The buyers have distinct objectives for the properties they acquire which helps you understand why your home matches their investment criteria.

- Fix-and-Flip Investors: The Fix-and-Flip Investors are the traditional home buyers who purchase properties to renovate and then sell for profit. They specialize in locating homes which require repairs before updating them to contemporary standards for profitable resale. The investors see potential in distressed properties which most people tend to miss.

- Buy-and-Hold Landlords: The investors maintain a long-term investment approach. The investors purchase properties to build their rental portfolio which generates regular income. The investors concentrate on fundamental aspects of a property which include its location and structural condition.

- Specialized Real Estate Companies: Eagle Cash Buyers operates through a combination of these approaches. Their systems and resources allow them to process numerous transactions efficiently while maintaining a personal local experience. Their business operates to offer sellers a dependable professional solution for quick home sales.

The common thread among all these buyers is their ability to find value where others see problems. A house with an outdated kitchen, foundation issues, or deferred maintenance isn’t a dead end—it’s an opportunity.

Their business model is built to solve complex real estate challenges. A cash buyer offers a quick and simple solution for those who need to sell their property fast or have inherited a property they cannot manage or want to avoid home maintenance. The process of selling a house to an investor becomes clearer through this detailed guide about the entire procedure.

The True “As-Is” Advantage

A traditional cash buyer operates through methods which differ from the iBuyer model. When a local cash buyer makes an “as-is” offer, they mean it. The buyers have already factored in the expenses for necessary repairs and renovations into their price. There are no extra fees or deductions that appear after the inspection process is completed.

The method brings great relief to sellers. The program eliminates the need for you to fix any roof leaks or water heater replacements or to remove long-term household items. The buyer assumes full responsibility for all duties. The straightforward method they use keeps them at the top of the market.

Recent studies show these companies have an impact on the market. The first half of 2025 saw cash buyers participate in 32.8% of all home sales in the United States. The data shows that 33% of home sellers select cash deals because they provide both convenience and certainty. For more information about all-cash sale trends you can visit Realtor.com.

How the iBuyer Model Actually Works

The image from Opendoor’s website perfectly captures the iBuyer promise: a clean, simple, tech-driven way to sell your home. The process starts when you enter your address to get a quick data-based experience.

The process of a traditional cash buyer starts with a phone call or site visit. Companies like Opendoor have built their entire system to be online-first. Their goal is to remove much of the human back-and-forth from the initial valuation, relying heavily on technology to generate offers almost instantly.

An Automated Valuation Model (AVM) serves as the engine which powers this process. The algorithm processes extensive real estate data sets which include home sales and neighborhood patterns and public property information to generate a first cash offer. The system provides you with an initial estimate number within minutes after you submit your home information.

The Standard iBuyer Seller Journey

The buying process between iBuyers and their customers shares a similar structure despite small differences in their methods. Understanding these steps is crucial when deciding between an iBuyer and a local cash buyer.

- Online Submission: The process begins on their website where applicants need to input their address and complete a questionnaire about their home’s condition and age and size and recent updates.

- Preliminary Offer: The AVM generates an initial offer. This is an important step, but remember: this number is not final. The property assessment will determine the final amount.

- Property Assessment: Next, an iBuyer representative schedules a thorough inspection. The property evaluation process includes either an in-person visit or a video call which allows you to show the property to potential buyers.

- Revised Final Offer: After the inspection, you receive the final, official offer. The final number will deduct a service fee of 5% together with any necessary repair costs.

The iBuyer process reaches its final stage when the initial proposal reaches its ultimate position. The initial attractive price point becomes less appealing after service fees and repair costs get deducted from the total amount.

The multi-step process differs from the single-step approach which local cash buyers typically use. The process of Eagle Cash Buyers stands in sharp contrast because it requires only one home inspection to produce a final offer that does not include any additional deductions.

Strict Property and Market Criteria

The primary characteristic which distinguishes the iBuyer system from other home-buying models exists in its selection process. The business model relies on buying homes for fast resale through open market channels. The criteria for houses they will consider remains very specific and unchanging.

An iBuyer will almost certainly pass on your home if it:

- Is older or has significant deferred maintenance.

- Is located outside a major city or its immediate suburbs.

- Has unique architectural features that an algorithm can’t easily value.

- Is a mobile home, has foundation problems, or unpermitted additions.

The company maintains its core business strategy through strict property selection. Their high-volume, low-margin business cannot absorb the time or financial risk associated with properties needing major work. The iBuyers offer an excellent solution for certain sellers but they exclude many homeowners who do not meet their specific requirements.

The company has gained market presence in particular areas through its focused strategy. The iBuyer sales accounted for less than 1% of all U.S. home sales in 2020 but their market share in cash buying has expanded particularly in tech-driven cities including Phoenix Atlanta and Dallas.

Analyzing Offers, Fees, and Timelines

The numerical data shows the actual differences between cash buyers and iBuyers. The key difference between the two methods lies in their offer calculation and fee structures and their closing speed. Your final profit and sales experience quality depend on these factors.

We will compare these two choices side by side to determine how a local cash buyer’s offer stands against a tech-driven iBuyer’s proposal.

The Offer Process: A Tale of Two Approaches

The way you receive an offer sets the tone. The process with an iBuyer feels automated and distant. The website allows you to enter property information which generates an initial offer through an algorithm that works within minutes. The first estimate is a computer-based prediction which does not represent a binding agreement.

A traditional cash buyer, in contrast, is much more hands-on. The process starts with a discussion and then a brief home inspection. Based on what they see in person, they will make a firm “as-is” offer. The method enables buyers to negotiate directly while showing their pricing calculations to sellers.

Key Insight: The initial offer from an iBuyer always leads to price reductions after their inspection process. A local cash buyer’s offer is typically the final number you’ll see, with repair costs already factored into the price.

This is a critical distinction. The instant gratification of an iBuyer estimate is tempting, but it can lead to disappointment when the final offer comes back thousands of dollars lower after they account for repairs and their service fee.

Costs and Fees: Unpacking the Bottom Line

The financial models show their actual differences at this point. The fee structure knowledge will help you determine your actual earnings after deductions.

-

iBuyer Fees: iBuyers charge a service fee, which is similar to a real estate agent’s commission. The fee usually amounts to 5% of the sale price. The company assesses your property in detail to create a list of required repairs which they deduct from your payment.

-

Cash Buyer Costs: Reputable cash buyers do not charge fees or commissions for their services. Their business model is straightforward: they buy a property at a fair price that accounts for the necessary work, fix it up, and then sell it. The offer they make is a net offer—what you see is what you get.

The following example demonstrates how this concept works in practice.

Financial and Process Breakdown: Cash Buyer vs. iBuyer

The financial and procedural aspects of selling to a traditional cash buyer differ significantly from working with an iBuyer. The initial offer from an iBuyer looks better but the actual amount you receive after all deductions are taken into account may differ.

| Attribute | Traditional Cash Buyer | iBuyer | Key Takeaway |

|---|---|---|---|

| Initial Offer | The initial offer is based on ARV minus repairs and profit margin and is non-negotiable from the start. | The first offer comes from an algorithm but it may change after the inspection process is complete. | The cash buyer’s offer is solid; the iBuyer’s is an estimate. |

| Fees | The service does not charge any fees for commissions or service fees. | A service fee of around 5% of the sale price. | The cost difference between these two options will directly affect your final profit margin. |

| Repair Costs | The initial offer already includes repair costs which do not get deducted after the inspection process. | The offer price will be reduced based on the findings of the property assessment. | A cash buyer will handle all repairs needed for the property. |

| Flexibility | High. Can often adjust closing dates to fit your schedule. | The process follows a standardized approach which limits the ability to make personal adjustments. | Cash buyers are better for sellers with unique timeline needs. |

| Human Interaction | High. Direct contact and negotiation with the buyer. | Low. Primarily online and automated communication. | Choose based on your preference for personal vs. digital interaction. |

The knowledge of these differences enables you to choose the best option. The first offer from an iBuyer seems better but it often ends up lower than what you would get from a traditional investor. To get a better sense of all the costs you’re avoiding, you can learn more about how real estate commissions and other fees affect a sale.

Both cash buyers and iBuyers rely heavily on the After Repair Value (ARV) to formulate their offers. The free ARV calculator will give you an approximate idea about their potential thoughts.

Timelines and Flexibility

The two options provide different types of speed although both deliver faster results than a traditional market sale. An iBuyer’s process is quick but rigid. The standard closing process takes about two weeks but it does not allow for any special circumstances.

Local cash buyers also close fast, sometimes in just seven days. Their real advantage, however, is flexibility. A local buyer can work with you to create a customized closing schedule which matches your requirements for additional moving time or probate-related delays.

Property Condition: The “As-Is” Litmus Test

Your house condition becomes the main factor which decides the outcome. The iBuyer service operates with a selection process. Their business model only works for homes that are in good shape, nearly market-ready, and fit specific criteria for age and location. They won’t touch a house with major problems like a bad foundation, a failing roof, or years of deferred maintenance.

The main strength of traditional cash buyers exists in this area. They buy properties in any condition including distressed homes and those that require substantial repairs. A cash buyer will purchase homes in their current state which means they do not require any repairs to be done. The market does not accept these types of homes for purchase by iBuyers.

Choosing the Right Option for Your Situation

So, cash buyer or iBuyer? The truth is, there’s no single “best” answer. Your home sale decision depends on what matters most to you and your property condition and your need for certainty in the sale. The solution needs to match your particular situation.

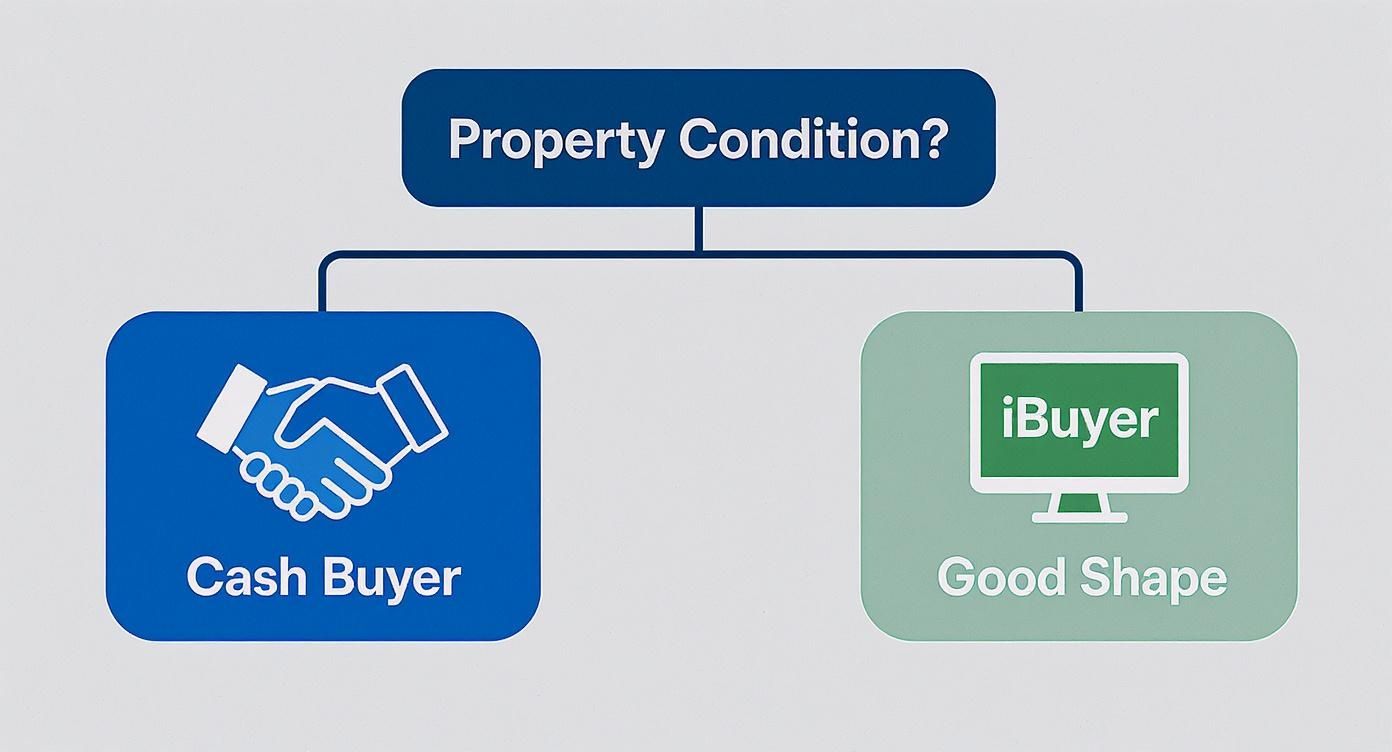

The decision tree provides a visual system which helps you pick the best path according to your property’s current state.

The main decision point in your house condition as shown in the diagram. A cash buyer will be your best option if your property requires repairs. An iBuyer will be a good choice if your house is ready for sale.

When a Traditional Cash Buyer Is Your Best Bet

Traditional cash buyers who operate locally excel at handling complex real estate transactions. The company built its business model to deal with problems which normally stop regular real estate transactions from happening.

A local cash buyer is probably the right call if you find yourself in one of these situations:

- Your Home Needs Significant Repairs: This is the classic reason to choose a cash buyer. A leaky roof, foundation cracks, or a completely outdated kitchen are deal-breakers for most buyers, but not for them. They expect to buy “as-is,” and iBuyers will almost always pass on these homes.

- You’ve Inherited a Property: An inherited property from another state creates two main difficulties for owners. Cash buyers proceed with the purchase of the property together with all its contents which eliminates the need for you to perform a thorough and costly cleanout.

- You’re Facing a Difficult Life Event: The need for a quick sale arises when life becomes difficult because of events such as divorce or imminent foreclosure or unexpected job relocation. A cash buyer guarantees a quick sale through its offer which eliminates the risk of financing problems that buyers encounter.

- You’re a Tired Landlord: The landlord who has grown tired of managing tenants will find a cash buyer as the perfect solution to end their situation. The market offers buyers who want to purchase properties with tenants already living there.

Key Takeaway: Traditional cash buyers offer a lifeline for properties and personal situations that don’t fit into the tidy, standardized box that iBuyers require. The offer you receive will be slightly lower but you get complete certainty and the convenience of a sale that requires no contingencies.

When an iBuyer Might Be the Right Fit

The iBuyer service operates with strict quality standards which make it perfect for certain sellers. Their automated, low-touch process is designed for maximum convenience—as long as your home meets their high standards.

An iBuyer could be a good option if your situation looks like this:

- Your Home Is in Excellent Condition: Your house needs to be almost new, perfectly maintained, and require only the most minor cosmetic updates to qualify. The iBuyers seek properties which need no repairs and can be sold quickly with minimal work.

- You Live in a Major Metropolitan Area: iBuyer operations are almost exclusively found in large, busy real estate markets where their valuation algorithms work best. If you’re in a rural area or a smaller town, you’re likely outside their service area.

- You Prioritize a Digital, Hands-Off Process: The iBuyer’s online-first system will appeal to you if you dislike back-and-forth negotiations. You can manage nearly the entire sale from your computer.

- You’re Willing to Pay for Convenience: The iBuyer model comes at a cost. The service fee amounts to 5% of the sale price in addition to any repair costs that the company will deduct from your payment. The process will be smooth if you accept this trade-off for a simple and predictable experience.

Location also plays a huge role. The percentage of cash buying activity varies across different regions with Florida’s vacation markets showing a higher proportion of cash sales than other areas. The current market conditions make some areas attractive to cash buyers while iBuyers fail to establish a presence in these locations.

Making a Final Decision for Your Home Sale

The decision between a traditional cash buyer and an iBuyer depends on your specific needs rather than which option is superior overall. The decision depends on which option will best serve your needs. Your personal goals, your home’s condition, and your ideal timeline are what matter most. The two options provide a quick sale but they operate through distinct methods.

Think of it like this: traditional cash buyers are problem-solvers. They excel when a property has issues, needs repairs, or is part of a complicated situation. They offer a true “as-is” sale, meaning you don’t have to fix a thing. iBuyers, on the other hand, are about automated convenience for homes that are already in great shape and just need to be sold quickly.

A Final Checklist to Guide Your Thinking

You need to answer these questions before deciding on a move. Your answers should make the best path forward clearer.

- How important is avoiding repairs? The traditional cash buyer model exists to help those who want to avoid home renovations and spending money on repairs.

- Do I prefer a personal or an automated process? If you’d rather speak to a real person and negotiate directly, a local cash buyer is your best bet. If you’re more comfortable with a digital, hands-off experience, an iBuyer might be more your speed.

- How much certainty do I need in the final offer? A local cash buyer’s offer is almost always a firm, all-in number. An iBuyer’s initial offer is just an estimate that will likely change after they factor in fees and repair costs.

The most powerful tool you have is information. The process of getting a cash offer without obligation will give you a definite number which enables you to make a well-informed choice.

The process becomes more effective when you understand property ownership fundamentals. You can get a clearer picture by understanding how to legally own your real estate and the responsibilities that come with it. The knowledge you acquire from comparing actual offers will help you choose with confidence. You can also see what other homeowners have experienced by checking out different we buy houses reviews.

The only way to find out for sure is to perform a direct comparison between your options. Eagle Cash Buyers along with other local cash buyers provide cash offers with no obligations. The evaluation system generates a precise market value for your home in its current state which becomes a dependable benchmark to compare against iBuyer offers and open market prices.

Frequently Asked Questions

The selection process between cash buyers and iBuyers generates various questions for buyers. The following answers address the most commonly asked questions to help you make an informed decision.

Are iBuyers Better Than Investors?

The choice between these two options depends on your specific needs as there is no universal solution that works best. They are designed for entirely different situations.

iBuyers are an excellent fit if you have a newer home in a major metro area that is already in great condition. Their entire model is built around speed and convenience for a very specific type of move-in ready property.

A traditional investor, on the other hand, is the go-to solution for homes that need work. An investor will handle your property better when you need closing flexibility or have repair issues or title problems. They specialize in buying homes “as-is,” a market where iBuyers often can’t compete.

Will I Get a Higher Net Offer From a Cash Buyer or an iBuyer?

Your main focus should be on the net offer because it represents the exact amount of money you will receive. The initial offer from iBuyer appears promising but it represents only the beginning of the negotiation process. The sale price will be reduced by a service fee of 5% or more and by any repair costs that the inspection reveals.

A standard cash buyer would present their final offer to you. The offer includes all costs based on the home’s current condition and required repairs so you get the exact amount shown with no extra deductions. No last-minute deductions. Your best move is to ask both for a net sheet to see the true bottom line.

Is There Room to Negotiate With an iBuyer?

Not really. The algorithm behind iBuyer uses market comparison data to generate its offers. The system does not evaluate your home’s special features or recent improvements that you made. The offer price might be reduced based on your ability to prove specific repair deductions but the overall price will remain fixed.

Traditional cash buyers, especially local investors, are a different story. Negotiation is almost always part of the process. The negotiation process lets you discuss price and closing terms with the buyer which results in a more adaptable experience.

Ready to explore one of your options? Many local investors can provide a fair, transparent, all-cash offer for your home as-is. The free offer from Eagle Cash Buyers will provide you with a market value estimate for your property. Get your free offer today and compare it against your other choices.