A foreclosure auction represents a public event which enables lenders to retrieve their mortgage debt from borrowers who have stopped making their payments. The property will be sold to the highest bidder whether that person is an investor or another buyer or the bank itself. The first essential step to reclaim control of your situation requires learning this process.

Your Quick Guide to the Foreclosure Auction Process

The auction represents the last step for people who face the threat of foreclosure. The process becomes simpler to understand after you master its fundamental operations. You begin to identify the exact locations where you maintain decision-making power. Death operates as a complete system which follows its own set of rules and timeline and requires specific participants to complete the process.

The entire system operates to help lenders recover their financial losses through authorized legal means. The outcome of this situation depends on the specific laws of each state. For example, about two-thirds of U.S. states allow a faster “nonjudicial” foreclosure. This can happen in as little as 90 to 120 days after a notice of default is issued.

The lender needs to obtain a court order in judicial states which can prolong the entire process by several months. For more on foreclosure trends, a great resource is PR Newswire.

Who Is Involved in a Foreclosure Auction

A foreclosure auction isn’t just a chaotic free-for-all. The process needs various essential participants who perform particular duties throughout the entire process. The identification of individuals and their roles enables us to understand the current situation.

Here’s a simple breakdown of the main participants and what they’re trying to achieve.

| Participant | Role and Objective |

|---|---|

| The Lender (Beneficiary) | Your loan exists under the ownership of either a bank or a mortgage company. Their only goal is to recover the outstanding balance they are owed, including interest and legal fees. |

| The Trustee or Sheriff | A neutral third party who oversees the sale process serves as the person in charge. In nonjudicial states, it’s a trustee. The process requires a county sheriff’s deputy to perform the duties in judicial states. |

| Bidders | The potential buyers in this category are real estate investors. The buyers come with certified funds to purchase a property at a price below its market value. |

| The Homeowner (Trustor) | This is you. The reason people have gathered here is because of your property. Your financial stability will be determined by this auction even though you may not be present. |

The direct causes of the process become apparent through this understanding of roles.

At the auction itself, the lender sets a minimum bid—usually what you owe on the loan plus all the foreclosure costs. The bank will assume ownership of the property if no bidder reaches the required amount. The property becomes an REO (Real Estate Owned) asset after the bank takes possession of it.

You learn the auction system through training but learning how to stop the foreclosure auction immediately gives you more power when you want to choose a different path.

The Timeline From First Notice to Auction Day

The foreclosure auction process follows a step-by-step procedure which includes particular legal requirements that take time to complete. The timeline serves as your most valuable tool for achieving success. Each stage is a window of opportunity—a chance to take action and change the outcome.

The entire process begins before an auctioneer ever drops the gavel. The missed mortgage payment starts the pre-foreclosure process which marks the beginning of this phase. The time period enables you to negotiate with your lender.

The Pre-Foreclosure Period

The clock starts ticking after your first missed payment. Most lenders offer a grace period, usually around 15 days, but after that, late fees kick in and your loan is officially delinquent.

Don’t panic just yet. Federal law actually stops lenders from jumping the gun. They generally have to wait until you are more than 120 days behind on payments before they can even start the foreclosure process. The rule exists to protect your rights because it gives you time to catch up on payments or seek help through loan modifications or forbearance plans.

The lender needs to actively contact you during this period to explain your available choices. The current situation does not warrant any kind of response to their communications. The process will move forward at an accelerated rate if we maintain our silence. Engaging with them is your best bet to explore every possible solution.

Receiving the Formal Notice

If you and the lender can’t resolve the delinquency within that 120-day window, they’ll move on to the first official legal step. What you receive in the mail depends entirely on where you live.

- Notice of Default (NOD): This is the standard in states with nonjudicial foreclosures. The NOD is filed as a public record, officially stating you’ve defaulted on the loan. The agreement specifies a 90-day period for you to fix the default through payment of the outstanding debt.

- Lis Pendens or Complaint: In judicial states, the lender has to file a lawsuit. The court will serve you with a summons and complaint while filing a public notice called “lis pendens” which means your property is subject to legal action.

The receipt of these documents indicates that the formal foreclosure process has started. Your credit score will suffer and your financial stability will be threatened by mortgage default so you need to understand the exact consequences.

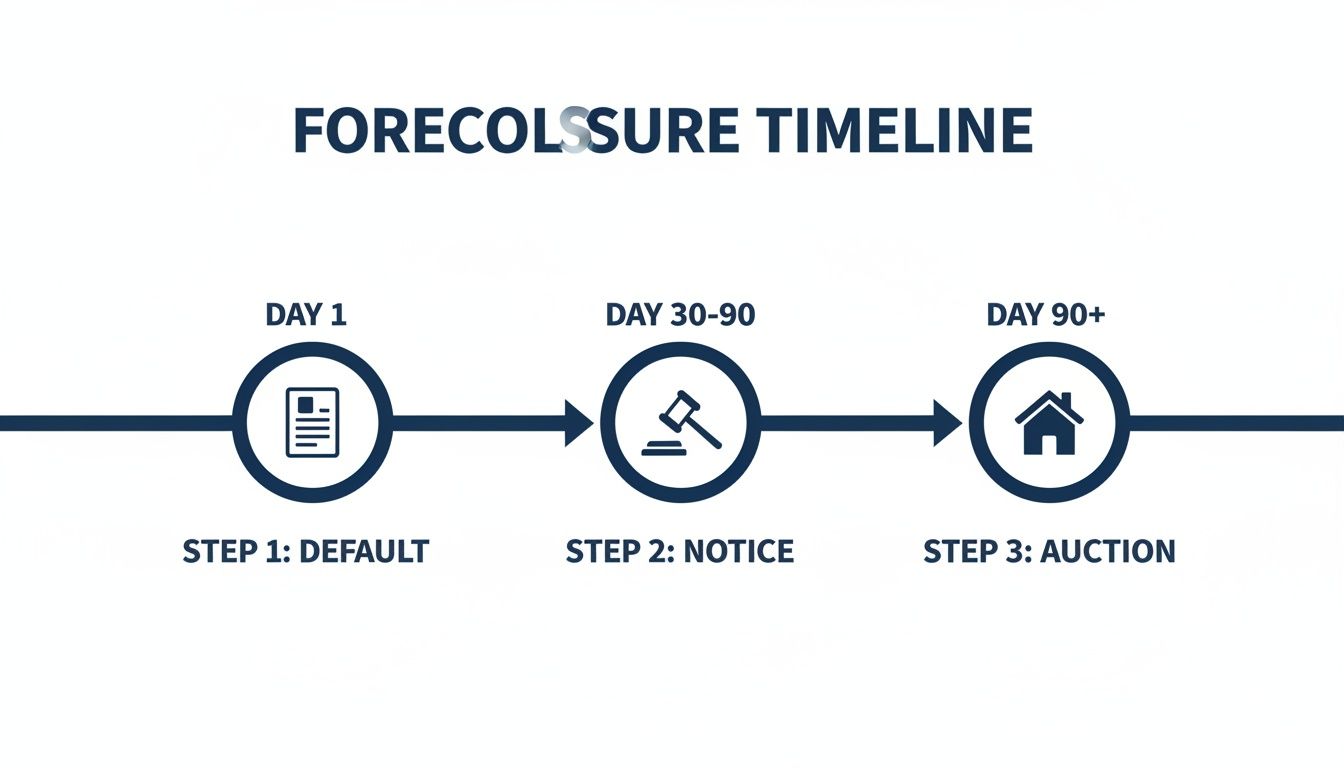

The infographic displays every essential step which leads from default up to the auction day.

The process includes particular time frames which enable homeowners to take action before their property gets sold.

The Path to the Auction Date

The lender can schedule the auction after the waiting period in the Notice of Default expires or when a judge delivers a final decision. The final phase follows its own distinct timeline.

The court will issue a Notice of Sale which will announce the upcoming sale to the public. The document specifies the exact date and time together with the location where the auction will take place. The notice requires public posting at a local courthouse and newspaper publication and direct delivery to you through the mail. The auction will take place within 20 to 30 days after this notice depending on state regulations.

Your last chance to stop the auction occurs during this final notice period. You have the option to pursue a short sale or negotiate a deed in lieu of foreclosure or file for bankruptcy which activates an “automatic stay” that prevents the sale from proceeding.

The process becomes clear when you understand each step from delinquency to Notice of Sale. The method transforms an overwhelming and scary incident into an organized sequence which shows you when and how to save your home.

Judicial vs. Nonjudicial Foreclosure Explained

The foreclosure process does not follow a single standard procedure for every case. The process of moving from a missed payment to an auction depends on your state’s specific laws which generally divide into two categories: judicial and nonjudicial. Knowing which process applies to your location stands as one of the most essential facts because it determines your timeline and legal rights and available options.

The process works like a dispute resolution system. A judicial foreclosure proceeds through a formal court process which includes judicial oversight and legal representation. A nonjudicial foreclosure is more like following a pre-written rulebook without ever stepping into a courtroom.

The Judicial Foreclosure Process

The lender in a judicial foreclosure state requires court approval to proceed with home sales. The creditor must file a lawsuit against you to obtain judicial approval for the seizure of your property. The court monitors this process to protect homeowners by requiring a full legal assessment before property can be taken.

The court system handles this process which makes it take longer to complete. The lender submits a complaint while you receive a summons which requires you to respond within a specific timeframe. The legal process between parties can last for months or even up to a year which provides you with additional time to discover a solution.

Here’s what that typically involves:

- Lawsuit Filing: The lender begins the process by submitting a lawsuit to civil court.

- Homeowner Response: You have the legal right to respond, raise defenses, or even contest the foreclosure entirely.

- Summary Judgment: If your defense isn’t strong, the lender might ask the judge for a quick ruling in their favor.

- Final Judgment: The court will issue a judgment of foreclosure and an order to sell the property at auction if the court rules in favor of the lender.

The process provides you with various official chances to present your case before receiving a judgment from the court.

The Nonjudicial Foreclosure Process

The entire foreclosure process of nonjudicial foreclosure occurs outside of court proceedings. The method requires a “power of sale” clause in your mortgage or deed of trust documents. The contract includes this vital clause which lets the lender sell your property to recover their funds if you default while following state laws.

The lender can complete the process through courts which leads to a faster and less expensive procedure for them. The process operates as an administrative procedure which a neutral third party known as a trustee typically manages.

The core idea behind nonjudicial foreclosure is simple contract enforcement. The power of sale clause became binding when you signed your loan agreement so the lender now has the legal right to enforce it.

The process follows these straightforward steps:

- The lender records a Notice of Default.

- A legally required waiting period begins, giving you a chance to cure the default (pay what you owe).

- If you can’t cure it, a Notice of Sale is issued, and the auction date is set.

This speed means you have far less time to react. The time for finding an escape route shortens rapidly so you need to act right away. You might be interested in learning how to delay foreclosure to give yourself more time to find a better solution.

Which Process Applies to You

Knowing your state’s rules is everything. Florida New York and Illinois operate as judicial states which require foreclosures to proceed through the court system. The states of California Texas and Georgia operate under nonjudicial foreclosure systems which enable faster processing times.

Your state may follow either path but you still have ways to prevent the auction from happening. The foreclosure process can be stopped by homeowners who choose to modify their loans or sell their property through a short sale or by putting it on the market.

What Happens on the Day of the Auction

The auction day brings together all previous legal proceedings and notifications which have taken place over several weeks or months. The property’s destiny will be decided during this final moment which usually takes only a few minutes. The ceremony takes place in public spaces which typically include county courthouse steps and government building meeting rooms. The process reveals why homeowners need to find an alternative before this day arrives.

The crowd isn’t your typical open house group. The room will be filled with experienced real estate investors who bring cashier’s checks to find their next bargain. The bank which provides the loan will send a representative to protect their investment. The trustee or sheriff’s deputy will supervise the entire process to ensure all legal requirements are met.

The Bidding Process Unpacked

The auction begins when the official reads the property description together with its address and any remaining liens that will transfer to the new owner. Then comes the most important number: the opening bid. This isn’t just an arbitrary starting point; it’s the absolute minimum the lender will accept.

The initial bid amount equals the mortgage balance plus all foreclosure costs and legal expenses which the bank must pay. The objective aims to recover the amount which the lender initially gave.

The process follows a conventional auction system from that point forward. The bidders who need to pay immediately with certified funds will start bidding. The price goes up in steps until no bidder wants to pay more. The auctioneer hits the gavel while announcing the property is sold and the winner must pay at once.

The Two Possible Outcomes of The Auction

The auction will end in one of two ways after the bidding period ends. The bank faces two distinct results from these situations which produce different effects on the property.

-

The Property Sells to a Third-Party Bidder: The lender wants the property to be sold to a third-party bidder. An investor outbids everyone else, paying at least the opening bid amount. The buyers will pay the amount due to receive their certificate of sale before they become the official owners. The extra funds which result from the final price exceeding the loan amount will be returned to the former homeowner as surplus.

-

The Property Reverts to the Lender: This happens all the time. If nobody bids, or the bids don’t reach the lender’s minimum, the bank itself effectively “buys” the property for the amount it’s owed. The home is now officially Real Estate Owned (REO). The bank takes possession and will then try to sell it through traditional real estate agents.

The Financial Reality of an Auction Sale

Many people think an auction will bring in a fair price for a home, but that’s rarely the case. A property usually sells for a price that is significantly lower than its actual market value. The website kaplancollectionagency.com provides additional data on foreclosure sale prices but buyers usually get properties for at least 20% less than their market value.

The investment comes at a low cost because investors accept high risks. The buyers cannot inspect the property before purchasing because they will need to pay for eviction costs when someone continues to live there. Foreclosure becomes an essential matter for all homeowners who must deal with it. Letting the house go to auction almost guarantees you won’t get its full value. Many people choose to explore different options before the auction date because they want to achieve better financial results.

Understanding Your Rights as a Homeowner

The anticipation of a foreclosure auction creates a sense of powerlessness in people. The law provides you with continuing protection of your rights throughout the entire process. The knowledge of these methods allows you to move from feeling trapped to feeling in control by showing you additional possibilities.

The entire foreclosure process is built on strict legal procedures, and lenders have to follow the rules to the letter. The right to proper notice stands as one of your fundamental safeguards. The lender must provide you with advance notice before scheduling an auction. The law requires them to send you written notices at specific times to inform you about the default and their plans for foreclosure.

Your Right to Cure the Default

The auction process only starts after you have exhausted all options to cure the default. The process functions like a reset button. The right provides you with a limited timeframe to stop the foreclosure process by paying all your past-due amounts to the lender.

The following components make up the “reinstatement amount” which you need to pay:

- All the mortgage payments you’ve missed.

- Any late fees or penalties that have piled up.

- The lender’s legal costs incurred so far in the process.

Your loan will show as current after you make this payment which lets your mortgage continue as though the default never took place. The right exists for a limited time because it expires at a particular number of days before the auction date which demands quick action from you.

Understanding the Right of Redemption

The right of redemption serves as a powerful legal mechanism which you can use in your defense. The process functions through two separate methods which depend on your state’s legal system and the moment you decide to act. The foreclosure auction process requires homeowners to understand this essential concept.

Your legal right to redeem your property requires you to pay off your complete loan debt together with all associated fees. Your home sale will be prevented from happening during this period.

Every state in the United States grants the equitable right of redemption as a legal protection. The right enables you to act before the auction takes place. The full loan payment including all missed payments needs to be paid back. The law protects your right to stop a sale but it requires a significant amount of time.

The statutory right of redemption exists as a legal right which only applies in particular states. This one is really unique because it allows you to buy back your property after it’s already been sold at auction. The winning bidder will take possession of the property but you have a legally defined timeframe that ranges from several months to one year to pay them back. The total amount you need to pay equals their auction price plus all interest charges and additional expenses they have incurred.

Taking Control Before the Auction

Knowing your rights is one thing; using them is what really counts. Your current situation contains multiple chances to change your path through these rights. Most people in this situation lack the funds to use the powerful options of curing the default or property redemption.

Getting proactive is essential because it allows you to handle challenges effectively. Selling your house during foreclosure through alternative methods will provide you with enough money to pay off your lender completely which will stop the auction from happening forever. The move protects your credit from foreclosure damage while it lets you keep any equity left in your home.

Practical Alternatives to a Foreclosure Auction

The sight of an upcoming foreclosure auction creates intense anxiety in homeowners. The auction process needs you to focus on this essential fact. The path to your final destination includes various exits which you can take before you reach the end. You need to take action immediately because the number of available options decreases as the auction date approaches.

The trick is to find a solution that puts you back in the driver’s seat. The process of exploring these alternatives helps you find the best solution for your specific debt situation so you can resolve it in a way that works for you.

Working Directly with Your Lender

Your initial phone call should go to your lender according to Believe it or not. Their purpose is to provide loans and retrieve them rather than owning property. Most people want to find solutions which will stop them from losing their homes at auction.

Here are a few common solutions they might offer:

- Loan Modification: This isn’t a temporary fix; it’s a permanent change to your original mortgage terms to make the payments more manageable. The lender may choose to reduce your interest rate or lengthen your loan term or in specific cases decrease your outstanding debt.

- Forbearance Agreement: This is more of a short-term pause button. Your lender agrees to temporarily reduce or suspend your payments for a set period, giving you breathing room to handle a financial setback like a sudden job loss or medical emergency.

- Repayment Plan: Let’s say you’ve fallen behind but are now back on your feet. A lender might set up a plan where you pay your normal mortgage amount plus a little extra each month to gradually catch up on the past-due balance.

The following options serve as excellent choices for people who want to stay in their home while building a plan to resume mortgage payments. The application process needs multiple documents but approval is not guaranteed.

Options When You Need to Leave the Home

Your family might need to move even when staying in your current home seems like the best choice. The main objective becomes leaving your home with dignity while protecting your financial stability and credit history. Working with your lender stands as the most effective way to handle this situation.

Short sales serve as one of the most effective proactive solutions because they stop foreclosures from appearing on your credit report which can affect your ability to get loans for seven years.

A short sale is exactly what it sounds like: the lender agrees to let you sell the house for less than what you owe on the mortgage. The process needs lender approval for any offer you receive which makes it complex but it usually leads to better results for all parties involved.

The process of foreclosure becomes easier to handle through a deed in lieu of foreclosure. You hand over the property title to the lender voluntarily in exchange for debt forgiveness. The lender must approve this process but they usually deny it when other creditors have existing liens on the property.

The Fast and Certain Solution: Selling for Cash

Homeowners experience increased stress when dealing with extended waiting periods and uncertain outcomes of alternative solutions. The auction clock demands an immediate dependable solution which will deliver a guaranteed result. The sale of your home to a cash buyer proves to be an effective option during this time.

The process is refreshingly straightforward:

- You get a no-obligation cash offer for your house, exactly as it is.

- If you accept, the sale can close in a matter of weeks—often in as little as 21 days.

- The cash from the sale pays off your mortgage debt in full, stopping the foreclosure process in its tracks.

- If there’s any money left over (your equity), it goes straight into your pocket.

This approach completely sidesteps the unpredictability of listing your home on the open market. The process eliminates the need for repairs and open houses and protects against buyers whose financing might fail at the final stage. The use of proven techniques to boost property value will enhance your selling position when the time comes to sell.

Selling to a company like Eagle Cash Buyers provides a clean break. The process stops the auction while paying off the lender and giving you money to start fresh without damaging your credit score. The website teaches you methods to sell your home before foreclosure which enables you to regain control of your destiny.

Common Questions About Foreclosure Auctions

The process of foreclosure auction brings so many questions that it becomes overwhelming to handle them all. The following answers tackle the main concerns of homeowners to create a clear route for moving forward.

Can I Stop a Foreclosure Auction at the Last Minute?

Yes, it is often possible to stop an auction even just days before it’s scheduled. The automatic stay which begins when you file for bankruptcy serves as a common legal mechanism that halts foreclosure proceedings immediately. Your available options decrease as time passes. Time is your most valuable asset, so acting early gives you the most leverage and the best chance at a favorable outcome.

What Happens to My Personal Belongings If My House Is Sold?

The new owner will take possession of the property after an auction so you’ll need to vacate the premises. State laws are very specific about personal property left behind. The new owner generally cannot simply throw your items away. The law requires them to provide at least one notification and enough time for you to collect your possessions. The best way to avoid problems is to move your belongings before the eviction starts. If you’re unsure of your rights, contacting a local legal aid service can provide clarity based on your state’s rules.

Will I Owe Money After the Foreclosure Auction?

It’s possible. The term deficiency refers to the difference between the auction sale price of your home and the remaining mortgage balance you have left to pay. The ability of your lender to pursue you for the deficiency amount depends on the specific laws of your state. Some states allow lenders to file for a “deficiency judgment” against you, which could lead to wage garnishment or other collection actions. Other states have anti-deficiency laws that protect homeowners. This is a critical detail to understand, as taking proactive steps before the auction, such as selling the home, can help you avoid this risk altogether.

The process of answering these questions may seem challenging but you have the ability to do it. Letting the house go to auction is not your only path. You have options, from negotiating with your lender to arranging a short sale or taking control by selling the property yourself. A fast cash sale, for instance, provides a clean break, allowing you to settle the debt and sidestep the auction entirely. Companies like Eagle Cash Buyers can give you a clear offer and close on your schedule, letting you pay off the mortgage and move on. The solution you need is available through guaranteed house selling methods.