You need to decide which goal matters most when you want to sell your distressed property because you must choose between obtaining the highest price or achieving a fast sale or resolving your challenging situation through a basic method. Your main options include listing with a real estate agent for a potentially higher price, selling to a cash buyer for speed and certainty, trying an auction, or pursuing a short sale to prevent foreclosure.

Your Options for Selling a Distressed Property

The process of selling a property with major defects or financial problems becomes an extremely difficult task for property owners. The different sales methods operate through their own distinct approaches which include specific timelines and financial requirements. The initial phase of gaining control requires you to recognize the differences between these elements.

You need more than just someone to purchase your house. The process requires you to locate the ideal business transaction which matches your particular situation. You can receive a better price through conventional market sales but you will need to handle repair expenses and inspection fees while waiting through unpredictable selling periods. A fast sale approach will lead to a reduced price but it allows you to quickly get rid of your unwanted property.

The Four Main Paths for Your Property

Homeowners follow these typical methods to solve this problem which they encounter. The three strategies serve distinct purposes because they help you either extract maximum value from your property sale or reach the fastest possible sale.

Comparing Your Options for Selling a Distressed Home

The table shows the basic differences between these options through their speed and cost and certainty levels.

| Selling Method | Typical Speed | Seller Costs | Sale Certainty |

|---|---|---|---|

| Cash Buyer | 7-21 days | Minimal to none (no repairs, commissions, or closing costs) | Very High |

| Real Estate Agent | 3-6 months | High (repairs, commissions ~6%, closing costs ~2%) | Moderate (depends on market, buyer financing) |

| Auction | 30-60 days | Varies (marketing fees, commission) | Low to Moderate (no guarantee of meeting reserve price) |

| Short Sale | 4-12+ months | Low (lender often covers costs) | Very Low (requires lender approval, which can be denied) |

The table shows that each positive aspect of your situation leads to a negative consequence in another area. The following paragraphs will explain what each element becomes important for your situation.

Selling to a Cash Buyer

This method allows you to sell your property at the highest speed possible. Companies that buy houses for cash purchase properties “as-is.” The phrase contains three essential elements which state you should expect no home repairs and no real estate commissions and you will receive a definite closing date that usually arrives within three weeks. The system works best for sellers who need to sell quickly and want a guaranteed sale instead of getting the highest possible price. You can get a better feel for how it works by reading this guide on companies that buy houses for cash.

Listing with a Real Estate Agent

Going the traditional route involves hiring an agent to list and market your home. The path leads to the highest possible selling price but it requires you to deal with certain conditions. The process requires you to spend money on initial repairs while the entire sale process including property showings and buyer negotiations and financing approval will take many months to complete. This method suits best for properties which have few defects and for sellers who want to wait until they find the perfect buyer while having enough funds and time to wait.

Selling at Auction

An auction creates an environment where your property competes with other properties for bids which leads to a fast property transaction. The big unknown here is the outcome. There’s absolutely no guarantee the bidding will reach your minimum (reserve) price. Plus, the aggressive marketing needed to draw a crowd can be expensive, and you pay for it whether the house sells or not.

Attempting a Short Sale

This option comes into play when you owe more on your mortgage than the house is currently worth. A short sale occurs when you obtain your lender’s authorization to sell the property at a price below your remaining mortgage balance. The process protects people from foreclosure but it takes so long that it has become well-known for being both frustrating and time-consuming. The entire deal depends on lender approval which they delay indefinitely. You must show proof of extreme financial hardship before the bank starts its lengthy process which takes anywhere from several months to more than one year to complete the offer review. The current situation creates an impossible situation because you must obtain a solution right away.

A Direct Sale to a Cash Buyer

Most homeowners who need to sell their distressed property choose to sell their house directly to cash buyers who pay with cash. The system operates at high speed to guarantee definite results through its straightforward operation. A trustworthy company will evaluate your property at its present state before offering you a price based on its existing condition. No repairs, no cleaning, no staging. You just sell it.

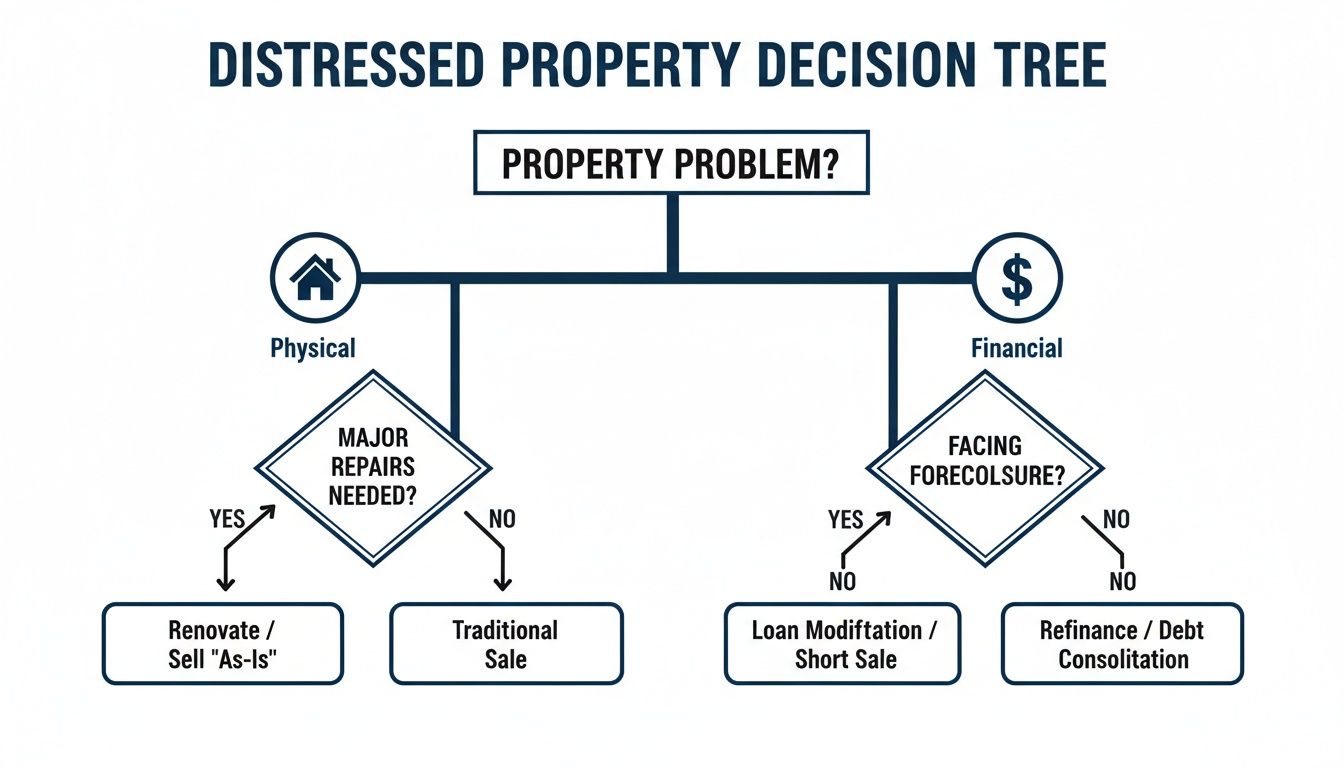

The decision tree helps you understand which path to follow based on your property’s particular issues.

The graphic demonstrates that your best approach will vary depending on whether your main problem involves physical damage or financial issues.

The process is transparent. A cash buyer determines home value through post-repair assessment and then subtracts repair expenses and ownership costs and acceptable profit margin. The number they give you is a net offer. The process eliminates any unexpected agent fees or closing expenses which will appear during the later stages. If you want to dive deeper, you can explore the pros and cons of selling to a cash buyer.

The option has started to gain value because of the increasing economic difficulties which people face. Experts predict that FHA loan policies will become more strict which will lead to an increase in loan defaults between 2023 and 2026. Homeowners who need to sell their homes in cash to prevent financial disaster because they face this situation each year.

Eagle Cash Buyers and similar companies provide a straightforward solution which lets you proceed without any charges when you choose their no-nonsense approach. The service lets you receive a cash offer without any obligations and you can choose your closing date while avoiding compensation fees and property repair expenses. Get your free cash offer today at https://www.eaglecashbuyers.com.