Yes, you can sell your Chicago house during foreclosure. The sale must reach completion before the last judicial auction takes place. You can protect your credit from foreclosure damage by acting quickly to pay off your mortgage while keeping any remaining equity.

Your First Moves When Facing Foreclosure in Illinois

Your lender will send you a foreclosure notice which creates a highly stressful situation. The combination of legal language and strict deadlines creates a feeling of being powerless. You need to realize that you have control over this situation. The notice serves as a trigger which leads to necessary changes in behavior.

The foreclosure process in Illinois operates through the court system. The lender needs to obtain a court order to acquire your property. While this sounds intimidating, the court-supervised timeline actually provides you with a critical window to find a solution. The lender initiates the lawsuit by submitting Lis Pendens which creates a public record that begins the legal timeline.

Understanding Your Immediate Rights as an Illinois Homeowner

The state of Illinois continues to protect an essential legal right after a lawsuit has been initiated. You have a “reinstatement period,” which is typically 90 days from the date you are officially served with the foreclosure summons. The process will stop when you pay the entire amount you owe which includes all overdue payments and fees and court expenses.

Your right to sell the property becomes the most effective solution when you can’t make payments. The objective is clear: sell the house before a judge orders an auction. The sale success leads to lender payment which clears your debt and ends the foreclosure case against you.

Exploring Your Primary Pathways Forward

When you decide to sell your home in Chicago, Springfield or Rockford to escape foreclosure you typically have three primary choices. Each has a different timeline, advantages, and disadvantages. The best choice depends on your specific circumstances—how much time you have before a potential auction, the condition of your home, and your financial goals.

To help you understand the landscape, here is a brief overview of your choices.

A Quick Look at Your Foreclosure Selling Options

| Option | Primary Goal | Best For Homeowners Who… |

|---|---|---|

| Traditional Market Sale | Maximize the sale price. | Have several months before a sale is necessary, a home in good condition, and can wait for a retail buyer. |

| Short Sale | Get the lender to accept less than the total mortgage balance. | Owe more on their mortgage than the home is worth and have the patience for a long, complex bank approval process. |

| Direct Sale to a Cash Buyer | Sell quickly for a guaranteed, as-is price. | Need a fast, certain closing to beat an auction date and want to avoid repairs, commissions, and financing contingencies. |

Each of these paths leads to a different outcome. Let’s examine them more closely.

- Traditional Market Sale: Listing with a real estate agent is the most common method. The method achieves the highest price but it takes the longest time to complete and produces the most unpredictable results. You need to deal with repairs and showings while handling the stress of a buyer’s financing process.

- Short Sale: This option is for homeowners who are “underwater” on their mortgage. The bank will need to accept a loss on the loan. The procedure requires substantial paperwork which takes multiple months to complete while bank approval remains uncertain.

- Direct Sale to a Cash Buyer: Companies that buy houses for cash provide the fastest solution. They can often close in a few weeks, purchasing the property completely “as-is.” The property comes without any repairs needed and you won’t have to pay for cleaning or agent commissions.

Time stands as the most important factor in this situation. The first step to regain control requires you to learn about the judicial process and its associated deadlines. The method transforms a stressful situation into a well-organized project with a definite end point.

Knowing your options is the first step. Homeowners across Illinois, from Chicago to Springfield and Rockford, have successfully used one of these paths to navigate foreclosure. The guide provides information about how to postpone foreclosure which helps you get more time to evaluate your alternatives. Your best defense for financial security exists in taking clear and decisive actions that are well-informed.

Navigating the Illinois Foreclosure Timeline

Time stands as the most essential resource when facing foreclosure. The Illinois foreclosure timeline provides a clear path which shows you your current stage and potential actions to protect your home.

The good news? The process isn’t instantaneous. Illinois operates as a judicial foreclosure state which means lenders must pursue foreclosure through court procedures. The legally required process establishes essential timeframes which enable you to take control of the situation.

The law remains consistent throughout the state yet local court schedules can change the timing of cases. For instance, Cook County’s busy court system might extend the process, but you should never rely on delays. The key is to understand the official process so you can identify the exact time frame for selling your house before it goes to auction.

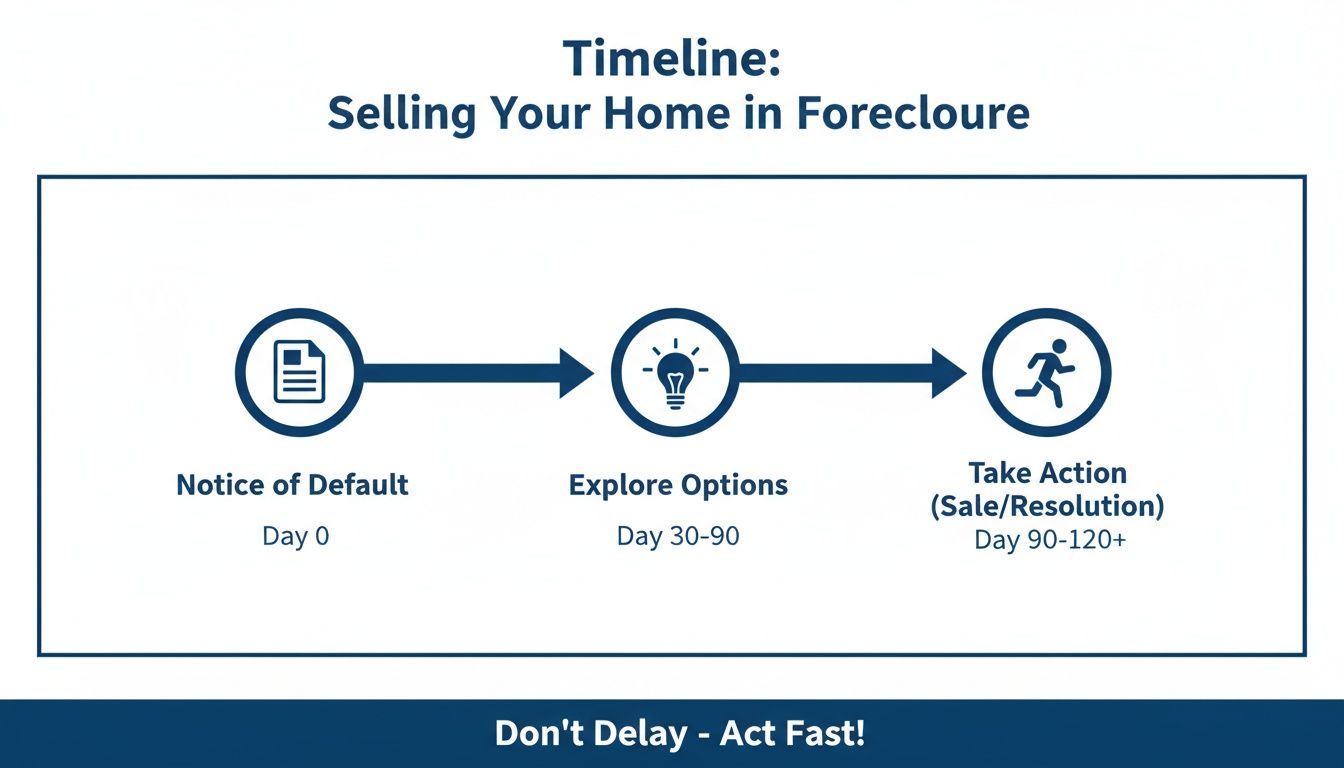

The following steps demonstrate how a sale can stop the foreclosure process: you get the notice then you evaluate your options before taking action.

Do not view the initial notice as an ending point but rather as the beginning of the race. The moment has arrived to choose and acknowledge that a sale remains within reach.

The First Signs: Pre-Foreclosure and Lis Pendens

The first official move from your lender usually isn’t a lawsuit. The document is called a “Breach Letter” or “Notice of Default.” The system sends you a warning to let you know your payment is late while providing you with an opportunity to make a payment.

The lender will file a foreclosure complaint in court if you fail to make your missed payments. The filing of Lis Pendens with the County Recorder of Deeds occurs simultaneously with the lawsuit filing. The phrase means “suit pending” in simple terms.

The document functions as a public signal which reveals your property is currently under legal dispute. The lien requires removal before any prospective buyer can proceed with the purchase. This is the moment your window to sell officially opens.

Your Two Lifelines: Reinstatement and Redemption Periods

Illinois law provides two essential ways for you to escape. You need to understand them thoroughly.

-

Right of Reinstatement: gives you 90 days to reinstate your loan after receiving official foreclosure summons. You must pay all your outstanding debts which include missed payments and late fees and legal costs of the lender. If you do this, the foreclosure stops.

-

Right of Redemption: gives you the ability to sell your property for debt repayment. The right exists from the moment the foreclosure process starts until the judicial auction concludes. Your home sale will generate enough money to pay off your entire loan balance.

That redemption period is your window of action. It’s the timeframe you have to find a buyer, accept an offer, and close the deal before the court orders the auction.

Selling a house in foreclosure is a race against the legal clock. The entire goal is to close the sale and pay off the lender before a judge authorizes the auction.

Timing is everything. Properties in neighborhoods with many foreclosures such as Chicago Rockford and Springfield experience value changes. The data shows that foreclosure remains present in Chicago despite national filing decreases because 3,789 new foreclosure cases started in the Chicago metro area during the first quarter of 2024.

Buyers and investors use these numbers to determine their offers for distressed properties at 10 to 30 percent below market value. The reason homeowners who sell during pre-foreclosure get more equity is because this process lets them keep more money than they would get from a bank foreclosure.

The Final Stages: Judgment and Auction Sale

The court will issue a “Judgment of Foreclosure and Order of Sale” if you fail to reinstate your loan or sell your property during the redemption period. The court issues an official order which determines the exact date and time and location for your home’s public auction.

The pressure becomes overwhelming after the auction date gets scheduled. The property remains available for sale until the auction starts but your time for selling is effectively over. The auction sale of your property will end your right to sell it independently.

The sale must be stopped at this stage. Our guide on how to stop a foreclosure auction immediately provides information about these last-ditch efforts. The redemption period demands your immediate action because it stands as the most vital factor for achieving a favorable result.

A Practical Comparison of Your Selling Options

The state of Illinois offers multiple options for homeowners who want to avoid foreclosure through the sale of their property. Every case requires its unique approach. Each option comes with its own set of trade-offs, and the best choice depends on your priorities.

Are you aiming for the highest possible sale price? Your credit score stands as your top priority. Or do you simply need a fast, guaranteed exit? A home seller has three choices to sell their property when deciding between Chicago Rockford and Springfield.

Trying to Sell with a Realtor on the Open Market

This is the traditional route most people are familiar with. Your agent will list your home on the MLS while you hold open houses to find the best retail buyer offer. In a normal market, this method is designed to maximize your sale price.

The foreclosure process will present you with multiple challenges during your race against time.

Time stands as the most important factor here. A typical sale can easily take 90 to 180 days from listing to closing. The entire process requires you to prepare your home for showings while waiting for buyer mortgage approval. Any delay—especially a buyer’s financing falling through at the last minute—can send you right back to square one, with the auction date looming closer.

The uncertainty level creates a major problem for any homeowner who wants to prevent foreclosure.

The Complexities of a Short Sale

A short sale happens when your home value drops below your mortgage balance which means you owe more than the property is worth. The buyer will need your assistance to get the lender to approve a sale at a price lower than the loan amount.

The process lets you avoid full foreclosure from appearing on your credit report but it requires a lengthy and bureaucratic process.

Your lender is the only one who has authority over this matter. The bank will request you to provide various financial documents to demonstrate your financial distress yet they might still refuse your application. The process becomes a frustrating negotiation between your agent and the bank’s loss mitigation department, which can drag on for months with no guarantee of success.

The short sale process requires involvement from three parties. The bank controls the entire negotiation process. The bank has no obligation to approve the deal regardless of the buyer’s offer quality.

The process takes between four and twelve months to complete. Many homeowners find the constant stress and paperwork are too much to handle when time is of the essence.

Selling Directly to a Cash Home Buyer

Homeowners who need speed and certainty above all else should consider selling directly to a cash home buyer as their best option. This option cuts out the middlemen and delays that are common in other methods.

The fastest method to get things done serves as the primary benefit. A cash buyer will provide a binding offer within 24 hours which leads to closing the sale in one to three weeks. The quick payment method enables you to pay your lender and stop foreclosure proceedings immediately.

Another huge advantage is that the sale is completely “as-is.” You don’t have to fix a leaky roof, update the kitchen, or even clean out the closets. The method saves you significant time and money while reducing your stress levels. Our detailed comparison between cash buyers and iBuyers shows how this model stands apart from other models.

Finally, there are no commissions or closing costs. The cash offer you receive is what you walk away with. This financial clarity is priceless in a tough situation. The offer price will be below market value but it provides a guaranteed quick sale that many homeowners in foreclosure find beneficial.

Comparing Ways to Sell Before Foreclosure

The following analysis provides detailed information about the benefits and drawbacks and expected results for each selling option available to homeowners facing foreclosure.

| Method | Typical Timeline | Financial Outcome | Credit Impact | Key Benefit |

|---|---|---|---|---|

| Traditional Realtor Sale | 90-180+ Days | Highest potential price, but minus repairs, commissions (5-6%), and closing costs. | Sale may not close in time to avoid credit damage from late payments or foreclosure. | Maximizes potential profit in a normal market. |

| Short Sale | 4-12 Months | Lender accepts less than you owe. You may walk away with nothing but avoid foreclosure. | Less severe than foreclosure but still a significant negative mark. Reported as “settled for less than full amount.” | Avoids a formal foreclosure on your record when you’re underwater on your loan. |

| Cash Buyer Sale | 7-21 Days | Lower than market value, but offer is net (no fees, commissions, or repair costs). | Can prevent foreclosure entirely, preserving your credit score from the most damaging event. | Speed, certainty, and an “as-is” sale with no out-of-pocket costs. |

Your personal schedule and what you value most will determine which path to choose. The right choice depends on your particular situation because you need to evaluate these elements carefully.

A Cash Sale Offers an Immediate Resolution

The scheduled judicial sale date requires you to act with both speed and certainty. Many Illinois homeowners find cash buyers to be their most reliable solution for foreclosure situations. The procedure exists to prevent delays and uncertainties which might derail time-sensitive transactions.

A cash sale lets you avoid the complete stressful process of home repairs and staging and showing and loan approval waiting.

The Mechanics of a Cash Sale During Foreclosure

A cash offer means a guaranteed closing date, often in a matter of weeks, not months. This speed is critical. The funds enable you to make a full payment to your lender which stops the foreclosure lawsuit and cancels the auction.

Furthermore, it’s an “as-is” deal. This means you don’t spend any money on repairs or updates. A cash buyer will purchase your home as-is regardless of whether it needs kitchen upgrades or roof repairs or deep cleaning. The method saves you significant time and money while reducing your stress levels.

The core advantages are simple and powerful:

- No Financing Hurdles: The sale won’t fall through because a bank denies the buyer’s mortgage at the last minute. The funds are secure.

- No Agent Commissions: You avoid the typical 5-6% realtor commission, which means more of the sale price stays in your pocket.

- No Closing Costs: Most reputable cash buyers cover all closing costs. The offer you see is the net amount you will receive.

By eliminating these common roadblocks, a cash sale provides a firm resolution date. You can settle your debt, potentially protect some of your remaining equity, and avoid the seven-year credit impact of a finalized foreclosure.

Why Speed and Certainty Matter in the Illinois Market

The real estate markets in Chicago, Springfield, and Rockford each have their own pressures. The Chicago metro area, for example, consistently logs high numbers of new foreclosure filings. ATTOM reported that the Chicago area had 3,789 foreclosure starts in the first quarter of 2024 alone, leading the nation.

This creates intense competition among homeowners in similar situations across the state. This market reality makes a fast, guaranteed exit strategy incredibly valuable. A cash offer provides exactly that—a way to secure a sale before the lender takes the house.

Is a Cash Offer Right for You?

When time is your biggest enemy, a cash sale can be a powerful solution. It’s an excellent option for Illinois homeowners who need to sell during foreclosure and are focused on a clean, reliable, and fast outcome rather than maximizing the price on the open market.

Of course, a fair price is still crucial. A reputable cash buyer will base their offer on the home’s “as-is” condition and current market values, reflecting effective strategies for pricing a home for a fast sale. If you want to learn more, our guide to the benefits of selling a house for cash goes into much greater detail.

Making a Successful Pre-Foreclosure Sale Happen

Selling your home before the bank forecloses isn’t just about finding a buyer. It’s about being smart and organized to protect your financial future and any equity you’ve built. The process hinges on having your paperwork in order, maintaining clear communication with your lender, and learning to identify predatory scams.

Getting these steps right from the start helps you avoid costly mistakes and puts you back in control, setting you up for a better outcome long after the sale is finalized.

Get Your Paperwork in Order

Before you begin the selling process, get organized. Lenders and serious buyers will ask for specific documents, and having everything ready saves precious time.

You’ll want to gather these key documents:

- Mortgage Statements: Your most recent statements will confirm your exact loan balance, interest rate, and contact information.

- Foreclosure Notices: Keep every letter from your lender or their attorneys, especially the Notice of Default and the court summons. These contain critical deadlines and case numbers.

- Payoff Statement: You’ll need to request an official payoff letter from your lender. This document states the exact amount required to close out the loan and will be needed for any potential sale.

- Property Tax and Utility Bills: Having these on hand helps establish the home’s total carrying costs, which is useful information for any buyer.

Keeping these files organized will make it easier to communicate with all involved parties and demonstrate your commitment to resolving the situation.

Talk to Your Lender—They’re Not the Enemy

It’s easy to view your lender as an adversary, but they are a business trying to avoid a loss. Keeping them informed about your plan to sell can often smooth the process.

A phone call to let them know you’re actively seeking a buyer to pay off the loan can sometimes pause more aggressive collection efforts. They see a clear path to recovering their investment. It also creates a record of your good-faith effort to handle the debt without being forced into an auction.

How to Spot and Avoid Foreclosure Rescue Scams

Unfortunately, a public foreclosure filing can attract scammers. These “foreclosure rescue” companies often target vulnerable homeowners with promises that are too good to be true. Knowing the red flags is your best defense.

Be extremely wary of anyone who pressures you to make a fast decision or sign documents you don’t fully understand. Reputable professionals will encourage you to seek legal advice and take your time.

Keep an eye out for these classic warning signs:

- Large Upfront Fees: Legitimate housing counselors do not charge exorbitant fees for their services. Never pay for help in advance.

- “Guarantees” to Stop the Foreclosure: No one can guarantee this outcome. It’s a legal process, and anyone who claims otherwise is being dishonest.

- Pressure to Sign Over Your Deed: This is a major red flag. Scammers may trick you into signing over your home’s title, promising you can rent it back and buy it later. This often results in eviction and the loss of your home and all its equity.

- Advising You to Stop Paying Your Mortgage: Do not take financial advice from anyone who isn’t a certified housing counselor or your own attorney.

The history of foreclosures in Chicago shows how certain areas can be disproportionately affected, creating environments where scams can thrive. During the peak of the 2008-2009 housing crisis, nearly 40% of residential properties in predominantly Black census tracts in Chicago experienced a foreclosure-related filing. This long-term pattern has reshaped neighborhoods, often leading to disinvestment that can impact today’s resale values and buyer perceptions for anyone trying to sell a Chicago house during foreclosure.

Evaluating Offers and Finding the Right Partner

When an offer comes in, especially a cash one, you have to look beyond the price. A reputable buyer will provide a clear, written offer with no surprise fees or complex contingencies. They will be transparent about their process and will not pressure you.

Always ask potential buyers for proof of funds and check their reputation with organizations like the Better Business Bureau. If you’re attempting a traditional sale, mastering essential real estate staging tips can make a real difference in attracting buyers quickly.

If you choose to work with a cash buyer, ensure they have a solid track record of closing on homes in foreclosure. Our guide on how to sell your house before foreclosure offers more tips on what to look for. Your goal is to find a partner who offers a reliable, fast solution that protects your equity and helps you move on.

Your Top Foreclosure Questions Answered

When you’re facing a foreclosure notice in Illinois, your mind is likely filled with urgent questions. The deadlines can feel overwhelming and the legal terminology is confusing. Let’s clarify some of the most common concerns for Illinois homeowners.

Can I sell my house before the foreclosure auction in IL?

Yes, absolutely. In Illinois, you have the legal right to sell your home at any point up until the final foreclosure auction (also known as the judicial sale) is completed. This window of opportunity is defined by your “right of redemption.”

Selling your home before the auction is the most effective way to resolve the situation. The proceeds from the sale are used to pay off your mortgage debt, which immediately stops the foreclosure lawsuit. Crucially, this prevents a foreclosure from being recorded on your credit report and allows you to retain any equity you have in the property. The key is to act quickly to find a buyer and close the sale before the scheduled auction date.

Do banks allow you to sell your house before foreclosure?

Yes, banks generally prefer that you sell the house. You do not need the bank’s permission to list your property or accept an offer. A pre-foreclosure sale means the bank gets paid back without having to go through the costly and time-consuming process of foreclosing, auctioning, and then managing a property.

However, you must coordinate with the bank to complete the sale. You will need to request an official payoff statement from your lender. This document details the exact amount required to satisfy the loan, including principal, interest, and any accrued legal fees. This amount must be paid at closing for the sale to be finalized.

The one exception where you absolutely need the bank’s formal approval is a “short sale.” This is when your best offer is less than the total you owe. In that case, you have to formally negotiate with the bank and convince them to accept the lower amount and release their lien on the property.

Will Selling Before the Auction Still Wreck My Credit?

Selling your house before the foreclosure is finalized is one of the smartest things you can do for your credit score. While the missed mortgage payments that led to foreclosure have likely already caused some damage, a successful sale prevents the actual foreclosure—a major negative event—from ever being recorded on your credit history.

A completed foreclosure can remain on your credit report for up to seven years. It makes obtaining new loans, credit cards, and even renting an apartment extremely difficult. A pre-foreclosure sale is a much cleaner exit and is far better for your long-term financial health.

What Happens If I Don’t Sell My House in Time?

If the auction date arrives and your house has not been sold, it will be sold to the highest bidder at the judicial sale. Often, the highest bidder is the bank itself. The property then becomes what is known as “Real Estate Owned,” or REO.

After the auction, a court hearing is held to confirm the sale. Once the judge approves it, you officially lose ownership of the property. This is the outcome everyone wants to avoid. It results in a foreclosure on your credit report, and you lose any equity you had in the home. This is why exploring all your options, including a fast, guaranteed sale to a cash buyer, is so vital—it gives you a reliable way out before you lose everything.

If you are facing foreclosure in Chicago, Rockford, Springfield, or anywhere in Illinois and need a fast, certain solution, it is important to know all your options. A direct sale to a cash buyer is one path that provides a quick resolution. Eagle Cash Buyers is one such company that provides fair, no-obligation cash offers to help homeowners pay off their lender, protect their credit, and move forward. Find out how we can help you today.