Yes, you can absolutely sell your house while it is in foreclosure. The option to sell before the auction date provides a beneficial way to handle mortgage debt and protect credit scores and maintain home equity. The key is to act quickly, as you must complete the sale before the lender sells the property at auction.

Your Window of Opportunity to Sell a House During Foreclosure

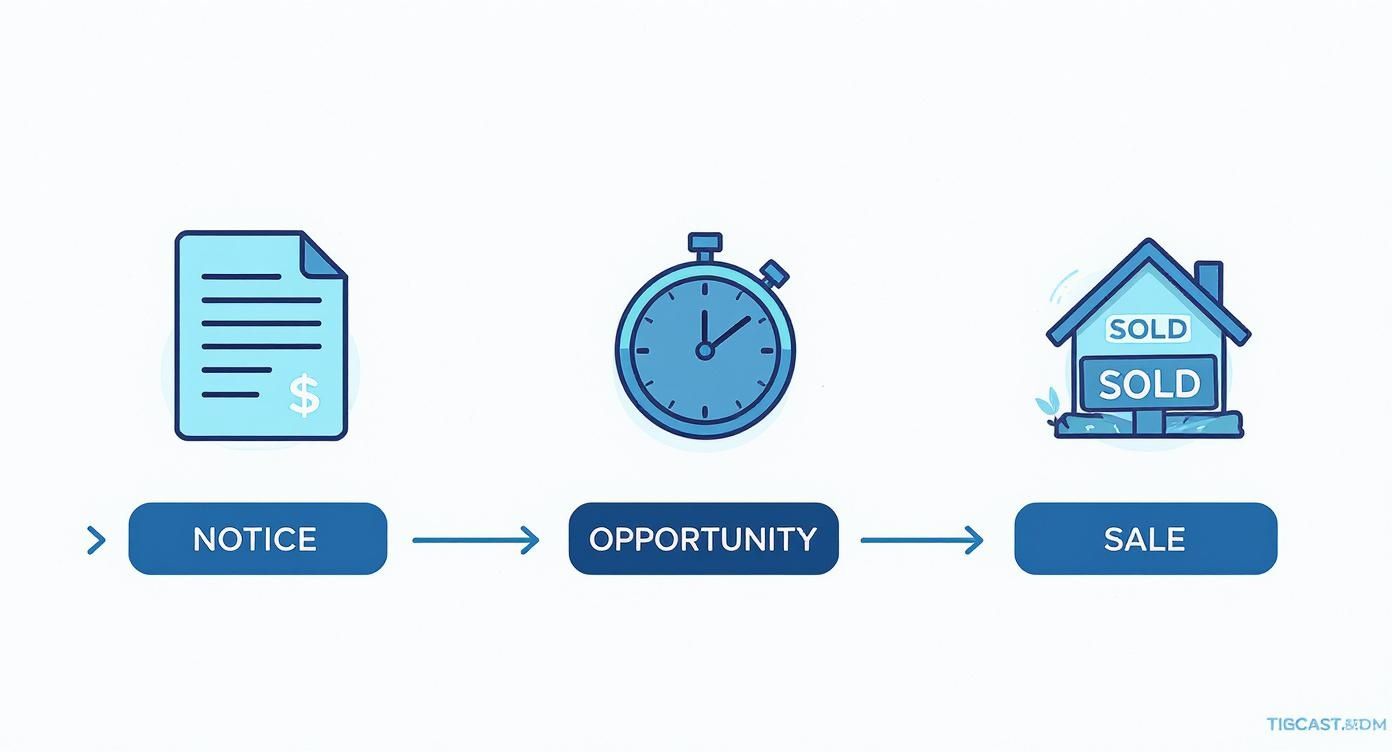

The moment you receive a foreclosure notice brings deep emotional pain. The game appears to be finished but the reality proves otherwise. That notice actually starts a countdown, kicking off a period known as pre-foreclosure.

This is your official window to act. During pre-foreclosure, the house is still legally yours, giving you the right to sell it. Most lenders prefer you to sell the property instead of them having to foreclose.

Why? Because foreclosure auctions are a headache for banks. The entire process requires a long time to complete and it ends up costing more money than the property value. A sale you initiate is a clean, direct way for them to get their money back.

Why Selling Is Such a Powerful Option

Selling the property puts you back in the driver’s seat. Instead of reacting to the bank’s legal maneuvers, you’re proactively resolving the debt on your own terms. This approach has some serious advantages over letting the bank take the house.

-

Protect Your Credit: A full foreclosure can stay on your credit report for seven years, making everything from getting a car loan to renting an apartment incredibly difficult. Selling your home beforehand sidesteps that massive credit hit.

-

Keep Your Equity: If your home is worth more than the mortgage balance, that extra money is your equity. Selling allows you to pay off the bank and pocket the difference. If the house goes to auction, you could lose every penny of that equity.

-

Get a Clean Break: Managing the sale gives you closure. You settle the debt and can move on without the weight of foreclosure dragging you down for months or even years.

The most valuable thing you have after a foreclosure notice is time. You gain more control over the results when you start considering a sale early in the process. Waiting until the eleventh hour leaves you with very few good choices.

It’s also crucial to know your options even if you’ve just started missing payments. The best way to handle any problem is to address it before it becomes unmanageable. The initial step to avoid foreclosure requires understanding how to sell your house when you fall behind on payments. The main objective requires paying back the lender which becomes more achievable through a well-thought-out property sale.

Understanding the Foreclosure Timeline

When you’re facing foreclosure, time becomes your most important asset. Homeowners lose vital chances and sometimes their entire property because they fail to understand the correct procedure of the process. The process of regaining control happens through multiple stages which give you different chances to take back control. Figuring out exactly where you are in that timeline is the first real step to finding a solution.

The whole thing usually kicks off after your first missed mortgage payment. The official foreclosure process starts after you miss your mortgage payments for at least 90 to 120 days even though most lenders offer a grace period. From there, it becomes a formal legal process that looks very different depending on which state you live in.

As you can see, that period between getting the formal notice and the scheduled auction date is your make-or-break window. It’s when you have the best chance to sell the house and pay off the debt on your own terms.

The Key Stages of the Foreclosure Process

The first official document you’ll likely receive is a Notice of Default (NOD). The lender files this public record to officially document your loan default status. The document will specify the amount you need to pay for reinstatement and set a deadline known as the reinstatement period. Take this notice seriously—the clock is officially ticking.

The next phase begins if you fail to pay your debt during this time frame. The lender will then either file a lawsuit (if you’re in a “judicial” state) or issue a Notice of Sale. The document establishes the exact date and time and location for your property auction. Your property may also have a Lis Pendens filed in certain areas which serves as a public notice about ongoing legal matters.

It’s a tough situation, but you’re not alone. The first six months of this year saw 187,659 properties enter foreclosure filing proceedings. That’s a 5.8% jump from last year and means that 1 in every 758 homes in the country was facing foreclosure.

Judicial vs. Non-Judicial Foreclosure States

Your state’s legal system establishes the specific timeframe you must adhere to when selling your home. The foreclosure process exists in two distinct forms which create a major difference in how long each process takes.

-

Judicial Foreclosure: In states like Florida and Illinois, the lender has to go through the court system. The process requires lenders to submit a legal complaint which judges must approve before they can proceed with foreclosure. The process takes several months to complete which allows homeowners to search for solutions during this extended period.

-

Non-Judicial Foreclosure: In states like Texas and California, the courts aren’t involved. The entire process operates at a much quicker speed. Lenders just have to follow the steps outlined by state law, and the timeline from the Notice of Default to the auction can be as quick as 90-120 days.

Key Takeaway: The first thing you need to know after receiving a Notice of Default is to determine which state you live in regarding judicial or non-judicial foreclosure. The information from this one document will establish your entire plan of action and show you how long you have until the auction.

A Real-World Timeline Example

Let’s look at two homeowners who both just received a Notice of Default.

-

Sarah in Florida (Judicial State): Sarah likely has anywhere from 180 to 365 days before her home is auctioned. The court process creates a built-in buffer, giving her enough time to hire a real estate agent, list the property, and wait for a buyer who needs traditional financing.

-

Mark in Texas (Non-Judicial State): Mark is on a much tighter schedule. The auction will take place 41 days after the Notice of Sale is issued. For him, a traditional sale is pretty much off the table. His best option is a solution that can close in less than a month, like selling to a cash buyer.

These two scenarios show why a one-size-fits-all plan just doesn’t work in foreclosure. Your location dictates your strategy. If that auction date is just around the corner, you need immediate answers. The guide on how to stop a foreclosure auction immediately provides urgent solutions for those facing immediate deadlines. The following selling options match your particular timeline.

Exploring Your Options to Sell Before the Auction

The first step to avoid foreclosure auction requires you to understand your timeline so you can start selling your home before the auction takes place. Every day counts, and each option comes with its own unique process, costs, and chances of success. Your choice will depend on how much time you have left and your financial situation and the level of certainty you require.

Selling your house is a powerful move to sidestep the serious, long-term damage a foreclosure can do to your credit and financial future. The method lets you take back control of your financial situation. This isn’t just a niche idea; homeowners across the country are using a sale as their exit ramp, especially in states with high foreclosure rates like Illinois, Florida, and Nevada. The website resimpli.com allows you to study further foreclosure statistics by examining their numerical data.

The property sale will happen through one of three main methods before the auctioneer begins.

Option 1: The Traditional Sale with a Real Estate Agent

Your first instinct might be to call a local real estate agent. The traditional method involves professional photos and a “For Sale” sign in the yard and open houses along with buyer negotiations. The method works when your home equity exceeds the remaining mortgage balance and agent commission fees and closing expenses.

Option 2: The Short Sale

A short sale is a negotiation, not a guarantee. The lender can flat-out reject the buyer’s offer, demand you bring cash to closing, or simply drag their feet for so long that the auction date arrives anyway.

We have a guide on how to delay foreclosure that shares strategies to buy you more time for complex options like this one.

Option 3: The Cash Sale with a Home Buyer

When your priorities are speed and certainty, selling your house directly to a cash home buyer is almost always the most reliable solution. Companies that specialize in buying homes quickly can cut through the red tape that stalls traditional sales.

How a Cash Sale Can Stop Foreclosure Fast

When the auction date is just weeks—or even days—away, you’ve run out of time. In this high-stakes scenario, speed and certainty aren’t just nice to have; they are everything. A cash sale often becomes the most direct and reliable way to sell your house during foreclosure, giving you a clear path to settling your debt before the lender takes legal ownership.

This option is built for one purpose: to stop the foreclosure process dead in its tracks. Because cash buyers use their own funds, they completely bypass the slow, unpredictable mortgage approval gauntlet that stalls traditional sales. This is exactly how a closing can happen in as little as 7 to 14 days, a timeline that’s practically impossible with other selling methods.

This direct approach provides a crucial lifeline, especially as market dynamics shift. Recently, completed foreclosure auctions saw a 31% increase compared to previous quarters, hitting a 10-quarter high. This means more properties are ending up on the auction block, highlighting just how urgent it is for homeowners to find a fast resolution. You can learn more about recent trends by reviewing the data on existing home sales from nar.realtor.

During this time, every dollar counts. Beyond selling your home, figuring out How to Sell Unwanted Items for Quick Cash can provide some much-needed breathing room as you work to get back on your feet.

For many homeowners facing this situation, it’s the most practical and powerful tool available. If you want to dive deeper into the specifics, check out our guide on how we buy houses for cash to see a full breakdown of the process. It’s a reliable way to regain control and start rebuilding your financial future.

Your Action Plan for Selling and Moving Forward

Knowing your options is the first step, but taking action is what will actually change your situation. When you’re staring down a foreclosure, you need a clear, deliberate game plan. This is where we shift from theory to action—a practical guide to get your house sold and move past the stress.

Get Your Paperwork in Order

Before you even think about making calls, it’s time to gather every document related to your home and mortgage. Walking into a conversation prepared shows everyone you’re serious and makes the entire process smoother.

Open a Line of Communication with Your Lender

Believe it or not, your lender isn’t the enemy. They’re a business, and their primary goal is to recover their investment. A foreclosure auction is an expensive, messy last resort for them, too.

How to Vet Potential Buyers

Whether you list on the MLS or look for a direct cash offer, you absolutely have to be careful about who you work with. A buyer who falls through can be devastating, eating up precious time and pushing you dangerously close to the auction date.

When you’re racing against the clock, knowing the right strategies to sell your house quickly is critical.

Common Questions About Selling a House in Foreclosure

When you’re facing foreclosure, a million questions are probably running through your mind. It’s a stressful, confusing time, and getting straight answers is the first step toward finding a solution. Let’s tackle some of the most pressing concerns homeowners have when they need to sell under pressure.

Will the Bank Really Let Me Sell My House?

In nearly all cases, yes. It’s a common misconception that the bank wants to take your home. The reality is much simpler: they’re a business, and their main goal is to get their money back.

Can I Actually Get Any Money from the Sale?

This is the big question, and it all comes down to one word: equity. Equity is simply the difference between what your house is worth and what you still owe on the mortgage.

To understand the specifics, check out our guide on whether a short sale can ruin your credit.

How Fast Do I Need to Move After a Foreclosure Notice?

You need to act immediately. The clock starts the second you get that Notice of Default. How much time you have before the auction date is set depends on state law, but it can be a terrifyingly short window—sometimes just 30 to 90 days.

How Badly Will This Hurt My Credit?

Selling your home before the foreclosure is finalized is a much, much better outcome for your credit score. Sure, any late mortgage payments have already done some damage, but a pre-foreclosure sale lets you satisfy the loan completely.

Facing foreclosure is one of the toughest challenges a homeowner can experience, but you don’t have to navigate it alone. If you need a fast, reliable way to sell your house before the auction, Eagle Cash Buyers can give you a fair, no-obligation cash offer. We can close on your timeline, take care of the paperwork, and provide a clear path forward. Find out how we can help at https://www.eaglecashbuyers.com.