Selling an inherited house in New Jersey is a multi-step process that combines legal duties, financial decisions, and personal emotions. The state’s probate system requires heirs to obtain legal permission before they can sell property and handle maintenance costs and select the best selling approach for their particular circumstances. The probate process can last from nine months to more than a year yet you have three choices for selling the property: list it with a real estate agent for maximum profit or sell it yourself through FSBO or opt for a fast cash home buyer sale in its current condition.

Your First Steps After Inheriting a New Jersey Home

The process of inheriting a property brings sorrow together with sudden financial and legal duties which you must handle immediately. The first few days create a series of complex events which make this period feel overwhelming. You can bring order to the chaos by taking immediate action to prevent future problems. The first and most important objective is to safeguard the house structure.

The property needs security measures because it stands empty at the moment. Get the locks changed. The simple and inexpensive step of changing locks prevents unauthorized access to old keys which might still be in circulation. Conduct a walk-through inspection to verify that all windows and doors have been properly secured. A vacant property becomes a major concern in densely populated areas such as Newark and Jersey City because it attracts criminals who seek easy targets.

Locating Key Documents

Your following objective after securing the house will require you to search for documents. You need to find the will and any other estate-planning documents, like a trust agreement or a letter of instruction. The will serves as a complete plan for what happens next because it designates the executor who will manage the estate and documents all last wishes of the deceased. The absence of a will leads to a more complex process because the estate will probably need to follow New Jersey intestate succession rules.

As you look for the will, keep an eye out for other essential paperwork:

- Deed and Title: These documents serve as official proof of property ownership.

- Mortgage Statements: You have to find out if there’s a loan on the property. If so, those payments need to continue.

- Insurance Policies: Find the homeowner’s insurance information and call the provider. Let them know the owner has passed away and confirm the policy is still active.

- Utility Bills: Grab the latest bills for electricity, gas, water, and property taxes. This will give you a clear picture of the home’s monthly carrying costs.

Here’s a quick-reference table to help you organize these first critical tasks.

Immediate Checklist for Inherited NJ Property

| Action Item | Why It’s Important | Expert Tip |

|---|---|---|

| Secure the Property | Prevents unauthorized access, vandalism, or theft in a vacant home. | Change the locks immediately. Don’t assume you know who has a key. |

| Locate the Will | Identifies the executor and beneficiaries, guiding the entire legal process. | Check safe deposit boxes, personal files, or with the deceased’s attorney. |

| Contact Homeowner’s Insurance | Ensures the property remains covered against damage or liability. | Ask the insurer about specific requirements for a vacant property policy. |

| Manage Utilities | Prevents damage (like frozen pipes) and maintains the home’s condition. | Transfer bills to the “Estate of [Name]” instead of canceling them. |

| Gather Financial Documents | Provides a clear view of debts (mortgage) and assets (deed). | Create a dedicated folder or digital file to keep everything organized. |

This checklist isn’t exhaustive, but tackling these items first will put you on solid ground for the steps ahead.

Managing Immediate and Emotional Responsibilities

Once you have the documents, you can start managing the day-to-day needs of the house. A common mistake is to shut off all the utilities. Don’t do it. Keeping the power and water on is essential to prevent bigger problems, like pipes bursting in a cold New Jersey winter. The right move is to contact each utility company and transfer the accounts into the name of the estate. The same goes for the homeowner’s insurance—a lapse in coverage is a risk you can’t afford to take.

Inheriting a property means you are now responsible for its upkeep and security. The failure to maintain property or pay insurance and taxes will result in major financial and legal consequences for the estate.

Dealing with a lifetime of personal belongings is almost always the toughest part emotionally. If possible, get all the beneficiaries involved in these decisions to keep things fair and avoid conflict later. It’s a marathon, not a sprint, so give yourself grace. But you do need a plan. Start sorting items into four basic piles: keep, sell, donate, or discard. Getting this done is a necessary step before you can even think about putting the house on the market.

Understanding the legal framework for these initial actions is crucial. Our detailed guide provides a formal step-by-step process to transfer property ownership.

Navigating the New Jersey Probate Process

Before you can think about putting a “For Sale” sign in the yard, you’ll almost certainly have to go through the New Jersey probate process. So, what is it? Probate is the official, court-supervised process of validating a will, paying off the deceased’s debts, and legally transferring assets—like the house—to the new owners.

Do I need probate in NJ? If the house was solely in the deceased person’s name, the answer is almost always yes. Without probate, you lack the legal authority to sign a sales contract. The process begins when the executor named in the will files the death certificate and the original will with the Surrogate’s Court in the county where the deceased lived. If there wasn’t a will (known as dying “intestate”), the court appoints an administrator, usually a close family member, to manage the estate.

The Executor’s Role and Key Milestones

Being named the executor is a significant responsibility. You’re the manager of the estate, tasked with seeing everything through from start to finish. Staying organized is critical. For a full picture of what’s involved, it’s a good idea to consult a comprehensive executor duties checklist to make sure nothing slips through the cracks.

Your main duties will include:

- Taking Inventory: Creating a complete list of all estate assets, from the house to bank accounts and personal property.

- Alerting Creditors: Formally notifying potential creditors, giving them a chance to make a claim.

- Settling Debts: Paying all outstanding bills, including the mortgage, property taxes, and final utility payments, using estate funds.

- Distributing Assets: After all debts are cleared, distributing the remaining assets—including proceeds from the home sale—to the designated heirs.

Be prepared for this to take some time. A straightforward probate case in New Jersey can take nine months to over a year to complete, depending on the estate’s complexity and the court’s caseload.

Key Takeaway: Probate is the legal bridge between inheritance and ownership. You cannot sell the property until the Surrogate’s Court grants the executor the authority to act on behalf of the estate.

Timelines Can Vary by County: Newark, Jersey City, and Trenton

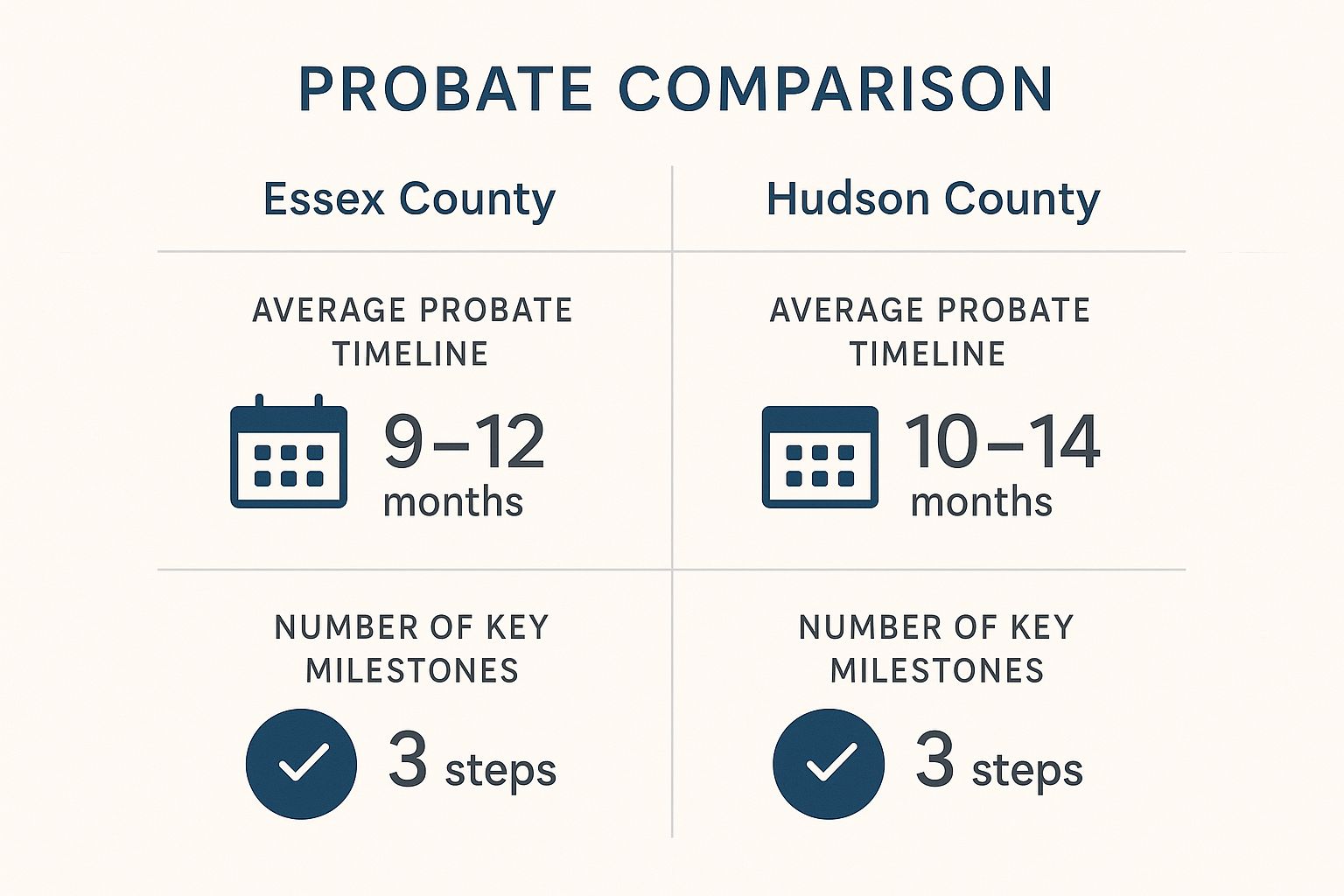

While the state sets the rules, the actual timeline you’ll experience can change depending on where you are. The courts in busier, more populated areas like Newark (Essex County) or Jersey City (Hudson County) often have heavier caseloads, which can mean longer waits. In contrast, a city like Trenton (Mercer County) may have a slightly more streamlined process. Always check with the specific county’s Surrogate’s Court for the most accurate information.

This infographic gives you a side-by-side look at how probate timelines and milestones can differ in these major New Jersey counties.

Dealing with the legal side of things can feel overwhelming, but it’s a necessary step. If you want to dive deeper into how this all affects the sale itself, we’ve put together a detailed guide on selling a house in probate.

Weighing Your Options for Selling the Inherited NJ Home

Once you have the green light from the probate court, it’s time to decide how to sell the property. In New Jersey, you’ve got a few different avenues to consider, and the right one really boils down to your family’s goals. Are you trying to get every last dollar out of the sale, or is a quick, hassle-free closing more important?

The market itself plays a huge role in this decision. The median home price in New Jersey exceeded $500,000 during 2025 while home prices increased from the previous year. However, homes were also sitting on the market longer, indicating that buyers are being selective. A home that looks perfect and modern will sell quickly at top price but properties needing work tend to stay on the market longer. For a deeper dive, you can always check the latest New Jersey housing market trends on Redfin.

So, what are your choices?Let’s break them down.

Comparing Methods to Sell an Inherited NJ Home

The decision about how to sell your property stands as one of the most important choices you will make. Each career path follows its own schedule while presenting distinct expenses and advantages. The table below offers a side-by-side comparison to help you see which approach best aligns with your family’s situation.

| Selling Method | Best For | Typical Timeline | Key Pro | Key Con |

|---|---|---|---|---|

| Real Estate Agent | Maximizing sale price on a well-maintained home. | 2-6 months | Highest potential retail value. | Highest costs (commissions, repairs) and longest process. |

| For Sale By Owner (FSBO) | Sellers with real estate experience and a strong network. | 3-7 months | Savings on seller’s agent commission. | Extremely time-consuming; high risk of mispricing. |

| Cash Home Buyer | A fast, certain sale, especially for homes needing repairs. | 7-30 days | Sells “as-is” with a guaranteed closing date. | Offer is lower than top market value. |

Ultimately, there’s no single “best” way—only the best way for you. Consider your financial needs, how much time you can personally invest, and the actual condition of the property.

The Traditional Route: Listing with a Real Estate Agent

This is the path most people think of first. You hire a local agent who knows the ins and outs of towns like Newark or Trenton. They’ll list the home on the Multiple Listing Service (MLS), market it to a wide audience, manage all the showings, and handle the back-and-forth of negotiations. The goal here is to get the highest possible price from a traditional buyer.

But this route isn’t without its challenges. It often requires you to spend money out of pocket before you see a dime. Think repairs, fresh paint, professional staging, and photos—all necessary to compete. You’re also looking at a timeline that can stretch for months, and once you do sell, you’ll pay agent commissions, typically 5-6% of the final sale price, plus other closing costs.

Going It Alone: For Sale By Owner (FSBO)

Selling the house yourself, or FSBO, is another option. The biggest draw is avoiding the seller’s agent commission, which can save you a significant chunk of money. When you sell FSBO, you are in the driver’s seat for every decision, from setting the price to running open houses.

However, that control comes with a mountain of responsibility. You’re now the marketer, the scheduler, the negotiator, and the paperwork expert. Pricing the home correctly is the single biggest hurdle; without access to professional data, it’s easy to get it wrong. FSBO can work if you’ve got a background in real estate and a solid understanding of the local NJ market, but for most people inheriting a property, it’s a stressful and overwhelming undertaking.

Expert Insight: The biggest risk with FSBO is mispricing the home. Price it too high, and it sits on the market for months; price it too low, and you leave significant money on the table for the estate.

The Direct Path: Selling to a Cash Home Buyer

There’s a third option that prioritizes speed and simplicity: selling directly to a cash home buying company. The method provides an effective solution for heirs who need to sell assets quickly to pay for estate debts or when the inherited property requires major repairs.

Companies that purchase homes for cash make offers on properties in their current “as-is” condition. This means:

- No Repairs Needed: You can avoid fixing a leaky roof or renovating a dated kitchen.

- No Showings: You skip the endless cleaning, staging, and interruptions from potential buyers.

- Fast Closing: The entire process can often be completed in a few weeks, not months.

- No Commissions: The offer you get is the net amount, without agent commissions.

A cash offer will be less than what you might get on the open market with a retail-ready home. The deal provides both certainty and quick results. The benefits of this option exceed its disadvantages for many families who receive an inheritance. The cash home buying business model becomes clear when you study companies which buy homes for cash. The simple process provides a quick sale method for those who want to avoid the traditional lengthy process.

Getting the Inherited Property Ready for Sale

Stepping into a loved one’s home to prepare it for sale is one of the toughest parts of this process. The process of sorting through a lifetime of memories when dealing with a property can be emotionally exhausting. The key is to separate the emotional process from the practical one.

The very first step—and it’s a big one—is handling all the personal belongings. Give your family the time and space to go through everything. I’ve found the best way to tackle this without getting overwhelmed is to create four simple piles: keep, sell, donate, and discard. The method creates order from the confusion while preventing future problems by involving all heirs in the process.

Get an Honest Look at the Home’s Condition

Once the house is cleared of personal items, you can finally see it for what it is: a piece of real estate. Now it’s time to put on your buyer hat and walk through the property with a critical eye.

Look past the sentimental value and focus on the big-ticket items. The roof’s age together with the furnace and AC unit’s appearance from a previous era will become evident. Check for signs of leaks under the sinks and take a peek at the electrical panel. These are the things that will jump out at any inspector or serious buyer.

This initial walkthrough will help you decide which path to take:

- Go for a full renovation: This only makes sense if the estate has the cash, you have the time, and the local market supports a high return on investment.

- Stick to minor cosmetic fixes: A fresh coat of paint, updated light fixtures, and a professional deep clean can do wonders for attracting traditional buyers without breaking the bank.

- Sell it completely as-is: This is the fastest, most straightforward option, especially if the house needs a lot of work or the heirs want to avoid the stress and cost of repairs.

The Big Question: To Repair or Not to Repair?

Sinking money into an inherited property is a major financial decision, and honestly, it’s often a gamble. A $30,000 kitchen remodel might be a smart move in a hot neighborhood in Jersey City, but you’d be lucky to get half that back in some parts of Trenton. The goal is to avoid over-improving a house for a market that won’t pay for it.

You have to be realistic about what New Jersey buyers are looking for right now. If a home is dated or needs work, you have to price it accordingly or it will just sit on the market. For most heirs, especially if they live out of state or are dealing with a parent’s older home, selling “as-is” is simply the most practical choice. It takes the financial risk and contractor headaches completely off the table. This is where a direct cash buyer can be a strong option, since they buy properties in any condition. You can explore this route further in our guide on selling a house that needs repairs.

Expert Tip: Before you spend a dime on contractors, get a professional home inspection. It’ll cost you a few hundred dollars, but it gives you a definitive, unbiased list of everything wrong with the house. The report will help you decide between fixing the problems or selling the property in its current condition.

Understanding the Tax and Financial Side of Things

The process of handling inheritance financial details becomes too complicated for many people to handle. The knowledge of New Jersey’s tax regulations will help you avoid numerous problems which could emerge later. The most important concept you’ll want to understand is called the “stepped-up basis.” The federal tax system includes this rule which provides major financial relief to most beneficiaries.

Here’s how it works: you don’t inherit the property at what your loved one originally paid for it. Instead, its value is “stepped up” to whatever its fair market value was on the date of their passing.

Why is this so great? It means if you turn around and sell the house quickly, your capital gains tax—the tax you pay on any profit—is often tiny, or even zero. For instance, say the house was valued at $400,000 when you inherited it. If you sell it for $405,000, you only owe capital gains tax on that small $5,000 difference. You’re not on the hook for the decades of appreciation.

Don’t Forget New Jersey’s Inheritance Tax

This is a big one that catches people off guard. New Jersey is one of only a handful of states with its own inheritance tax. The tax applies to beneficiaries who receive inheritances from a deceased person but the amount they pay depends on their family connection to the deceased.

It breaks down like this:

- Class A beneficiaries are totally exempt. Good news if you’re a spouse, child, grandchild, or parent.

- Class C beneficiaries (like siblings or a son/daughter-in-law) get a $25,000 exemption but then pay a progressive tax on the rest.

- Class D beneficiaries (nieces, nephews, cousins, or friends) have a much smaller exemption and pay a higher rate.

Remember, this is completely separate from any federal taxes. You’ll need to account for it in your planning.

Covering the Bills Until Closing Day

From the moment you inherit the property, the estate is on the hook for all the ongoing expenses—what we call holding costs. The process needs you to maintain your mortgage payments and house insurance and property tax payments and utility bills until you transfer ownership.

If there’s more than one heir, it’s absolutely critical to agree on how these costs will be split to avoid arguments. For a deeper dive into this, you can learn more about who pays property taxes when selling a house.

And of course, there are the costs of the sale itself. Don’t forget to budget for things like agent commissions, attorney fees, and the various closing costs that will come out of the final sale price.

Common Questions from New Jersey Heirs

Going through the process of inheriting and selling a home in New Jersey naturally brings up a lot of questions. Let’s tackle some of the most common ones I hear from heirs, so you can move forward with a clear head.

How Long Do I Have to Sell an Inherited House in New Jersey?

There’s actually no legal deadline hanging over your head to sell an inherited house in New Jersey. You can technically hold onto it for as long as you like.

But here’s the practical reality: the estate is on the hook for every single ongoing cost. Think property taxes, insurance, any mortgage payments, and general upkeep. These expenses don’t just pause while you decide what to do. The probate process itself can easily stretch from nine months to over a year. That’s why most heirs make the decision to sell as soon as probate is wrapped up. The cleanest way to sell assets while paying off debt and distributing inheritance among beneficiaries is through this process. This approach prevents ongoing costs from reducing the value of the inheritance.

Can you sell an inherited house quickly?

Yes, you can sell an inherited house quickly, but the speed depends entirely on your selling method. Listing with a real estate agent is the longest route, often taking 2-6 months from listing to closing, and that’s after you’ve spent time on repairs and staging. The fastest way to sell is directly to a cash home buyer. This option bypasses the traditional market’s uncertainties. A cash buyer can make an offer within a day or two and typically close the sale in as little as 7 to 30 days, allowing you to settle the estate promptly.

What Happens If Heirs Disagree on Selling the House?

It happens more often than you’d think. Disagreements among beneficiaries can stall everything and create a lot of tension.

Usually, if one heir is set on keeping the house, the simplest path forward is for them to buy out the other heirs. This means paying them for their share of the property based on its fair market value, which is typically set by a professional appraiser to keep things fair and impartial.

A Word of Caution: If you truly hit a brick wall and can’t agree, any co-owner has the legal right to file a “partition action” with the court. This is a lawsuit that forces the sale of the property. The court then supervises the sale to ensure the money is split equitably. Consider this the absolute last resort—it’s expensive, drags on for a long time, and can strain family relationships.

Can I Sell an Inherited House in NJ If It Has a Mortgage?

Yes, absolutely. Selling a house with a mortgage is standard practice. The mortgage is simply a debt of the estate that must be settled when the property sells.

The executor’s most important job here is to keep making those monthly mortgage payments during the entire probate and sale process. Missing payments can lead to default, which is a major headache you want to avoid. When you get to the closing table, the title company handles it all. They’ll use the sale proceeds to pay off the outstanding mortgage balance first. After that, they’ll settle any other liens or closing costs. Whatever is left over is the estate’s net profit, ready to be distributed to the heirs.

Do I Need to Be in New Jersey to Sell an Inherited House?

Not at all. You don’t need to be physically present in New Jersey to oversee the sale. Many heirs I’ve worked with manage the entire thing from out of state. You can hire a good local real estate attorney and an agent to be your boots on the ground. For an even more hands-off approach, selling to a cash buyer is a fantastic option for remote sellers. These companies are pros at handling out-of-state transactions. They use electronic signatures and can arrange for remote closings, making the whole process incredibly smooth, no matter where you are.

Navigating the sale of an inherited home is a complex journey, but you don’t have to go through it alone. If you’re exploring your options and find that a fast, “as-is” sale without repairs or commissions aligns with your goals, consider a direct sale. At Eagle Cash Buyers, we specialize in helping heirs by providing fair cash offers and a simple, guaranteed closing process. Find out how we can help at https://www.eaglecashbuyers.com.