Yes, you can absolutely sell a house with code violations. The city notice you received should not make you believe there are no options left for you. The core challenge lies in determining which path will lead you to success in your selling journey.

You have three choices to consider: fix the problems by yourself or sell the house in its current state to someone who will handle the issues or find a cash buyer who specializes in these types of properties.

Your Options for Selling a House with Code Violations

Your path takes an unexpected direction when you discover code violations on your property. Each route presents its own benefits and drawbacks because you need to choose based on your financial resources and available time and willingness to handle renovation work.

The main hurdle with code violations is financing. Most traditional lenders won’t approve a mortgage on a home that isn’t up to code, which immediately shrinks your pool of potential buyers. Your plan will be built upon these facts.

Three Paths to a Successful Sale

So, how do you move forward? Your strategy will likely fall into one of these three buckets.

- Fix and List: This is the traditional route. The process of bringing contractors and obtaining permits should happen before you start listing the property. The process demands both extensive time and financial investment but it usually achieves the highest possible sale price.

- Sell As-Is on the Market: Here, you list the property exactly as it is, making sure to disclose every single known issue to potential buyers. The process eliminates the need for repairs but it leads to lower offers from buyers. Our complete guide shows you how to sell your home as-is if this sounds like the right approach for you.

- Sell Directly to a Cash Buyer: This option involves selling to a company that purchases homes in any condition, code violations and all. The process becomes simpler because you eliminate the need to handle repairs and showings and wait for buyer financing to succeed.

You must identify the problems before you can make an informed choice. A common one is an unpermitted bathroom addition, which is a huge red flag for inspectors. A good starting point is understanding relevant building regulations so you know what you’re up against.

Expert Insight: The best path is the one that aligns with your goals. If you have the cash and patience to maximize your return, fixing the issues is a solid plan. But if you need a fast, certain sale without the hassle, selling as-is is often the smartest move, whether to an individual investor or a professional home buying company.

Comparing Your Selling Options with Code Violations

The different methods produce various combinations of work required and time commitment and monetary rewards. To make the choice clearer, here is a simple table that breaks down the key differences.

| Selling Strategy | Potential Sale Price | Time to Close | Upfront Cost & Effort | Key Benefit |

|---|---|---|---|---|

| Fix and List | Highest | 3-6+ months (repairs + market time) | High (contractors, permits, materials) | Maximizes potential profit. |

| Sell As-Is | Lower | 2-4 months | Low (no repair costs) | Avoids renovation headaches. |

| Sell to Cash Buyer | Fair Cash Offer | 7-14 days | None | Speed, certainty, and no hassle. |

Seeing it laid out like this can really help you weigh what matters most to you. The process becomes clear when you know the final amount on the check and the time needed to finish the deal.

How Code Violations Can Tank Your Home’s Value and Salability

Let’s be blunt: code violations are more than just a bureaucratic headache. The properties contain real financial risks which potential buyers will see when they look at them. Buyers who want to sell a house with defects will calculate the total expenses they will face for repairs and permits and fines and all the related difficulties.

The uncertainty leads to lowball offers instantly. The calculation method for investors and homebuyers is straightforward. The buyers will calculate the total repair expenses and then deduct that amount plus an extra buffer for unexpected costs from the top of their maximum offer price. The phrase “It’s not personal, it’s just business” is a common expression.

The Problem with Traditional Buyers

Your path to success will encounter its biggest challenge when you try to secure funding. Most mortgage lenders have strict property standards and simply will not approve a loan for a home with uncorrected code violations. Major safety concerns, like shoddy electrical work or unpermitted structural changes, are an absolute non-starter for banks.

This one factor shrinks your pool of potential buyers down to almost nothing. Suddenly, you’re limited to a very small group of people who can pay all cash, which usually means real estate investors and specialized cash-buying companies.

The young family shows interest in your home during a typical situation. The buyers make a strong bid which shows the negotiation process is advancing in a positive direction. The home inspector and bank appraiser will discover the unpermitted deck you built in the past. The lender will stop the loan process until the violation receives city approval and the necessary correction has been made. Your deal will fall apart immediately which sends you back to the beginning of negotiations.

The Financial Damage and Market Stigma

Unresolved code violations become a buyer’s most powerful negotiating tool. The buyers understand your current situation so they will use it to negotiate a lower price. Studies demonstrate that homes with code violations receive market value reductions between 10% and 20% which results in major financial losses for sellers. The presence of problems in your home will make it stay on the market for 30 to 60 days longer than a problem-free home would.

And it gets worse. Code violations are often public record. A knowledgeable real estate agent or buyer will use online resources to research your property’s past history. The moment they see a history of violations, a stigma is attached to your home, scaring off potential interest before anyone even steps through the door.

Here’s a real-world example: Say you converted your garage into a family room without getting the proper permits. An appraiser is legally not allowed to count that space in the home’s official square footage. The “bonus room” you thought was an asset actually works against you when buyers assess the property. The project requires either demolition or complete code compliance which leads to a major decrease in property value.

How Buyers View Different Types of Violations

It’s important to understand that not all violations are created equal. The two parties will give different weight to these factors which helps them develop realistic expectations.

- Minor Fixes: Things like a missing handrail on a small set of stairs or a bathroom fan that isn’t vented properly are usually seen as manageable. The buyer requests a credit to fix the problem but it does not seem to threaten the sale.

- Major Safety Hazards: Now we’re talking about the big stuff. A residential property would be flagged as dangerous if it contains defective electrical systems and unauthorized structural modifications and basement bedrooms that lack exit windows. The two main obstacles to selling a house are safety hazards and costly repairs.

Every single violation, big or small, chips away at your home’s value and appeal. The decision to fix problems or accept a lower offer depends on how much financial loss you would encounter from selling your house without any repairs. Sellers who need to make many costly repairs often choose direct sales to avoid financial losses and long periods of uncertainty.

The Financial Burden of Fines and Penalties

The notice you get about a code violation goes beyond being just a document. Think of it as a leak that’s actively draining your home’s equity. A financial countdown starts when you receive that notice which can lead to rapidly growing costs. The most costly mistake you can make is to ignore the problem.

Your city or county will send you an official notification to start the process. The document will specify the exact problems and provide you with a specific timeframe for correction. The fines will activate when you fail to act by the specified date. The penalties continue to accumulate every day because they serve as an ongoing method to make you pay attention.

How Fines Escalate and What It Means for Your Equity

The financial stress begins to build up at an alarming rate. The daily fines for code violations usually fall within the range of $250 to $1,000. The monthly cost can rise to $7,500-$30,000 in certain large urban areas. The 2024 Global Status Report for Buildings and Construction shows how minor problems can lead to major financial issues.

The debt you owe will be deducted from the money you receive when you sell your property. Every single dollar you owe in fines is a dollar you won’t see at the closing table. Your home sale with code violations requires immediate action to achieve the best possible outcome.

The Threat of a Property Lien

What happens if the fines keep piling up and you don’t pay them? The municipality won’t just let it go. The property lien serves as a powerful mechanism which enables them to collect their outstanding debts. A lien is a legal claim they place against your property for the unpaid debt.

For any homeowner planning to sell, this is a game-changer. A lien gets attached to your property’s title, and you cannot legally sell or transfer ownership to a new buyer until that debt is paid off. So your sale will stay on hold until the city receives its payment.

Key Takeaway: A property lien isn’t something you can negotiate away at closing. The title company has a legal duty to clear all liens before the sale is finalized. The total amount you owe will be subtracted from your payment earnings.

The addition of a lien feels like a devastating loss of equity for property owners who already deal with troubled properties. Our detailed guide shows you how to sell a home with a lien so you can grasp everything about this process.

Why Acting Quickly Is Your Best Financial Strategy

The data shows that you should act quickly when handling code violation fines because time works against you. The problem will only get worse when you leave it untreated.

Here’s why you need to move fast:

- Stop the Bleeding: The sooner you address the violation, the sooner those daily fines stop racking up.

- Avoid a Lien: Solving the problem before it gets out of hand means you won’t have to deal with a lien, which keeps the closing process much cleaner.

- Stay in Control: Taking charge lets you control the conversation with buyers, instead of being on the defensive and reacting to the city’s demands.

While you’re figuring this all out, it’s also a good idea to know what your insurance covers. The complete guide to homeowners insurance policy shows you potential coverage for damages that caused the original violation.

Ultimately, whether you decide to fix the issues yourself or sell to someone who will, the goal is to stop the financial damage. For many sellers watching fines pile up, selling to a cash buyer provides a clean break. The buyers will acquire the property in its current condition while taking responsibility for all existing violations and settling all outstanding fines at the time of closing. The process enables you to walk away from your home without any continuing financial obligations.

Choosing Your Path: Should You Fix It or Sell As-Is?

So you’ve gotten the official rundown on the code violations and you know what the fines could look like. Now you’re at the most critical fork in the road: do you roll up your sleeves and pour money into fixing everything, or do you cut your losses and sell the house as-is?

Let’s be clear—there’s no magic “right” answer here. Your bank account size and personal timeframe and tolerance for difficulties will determine the best course of action. The evaluation process follows basic cost-benefit analysis principles because it evaluates financial expenses and personal time and emotional stability.

The Case for Fixing the Violations

The traditional approach of addressing violations before listing your home aims to achieve the highest possible sale value. When you bring a property up to code, you’re opening it up to the biggest pool of buyers—the ones who need a traditional mortgage. A property that meets all requirements receives approval from banks and lenders which makes financing easier for your prospective buyer.

But this path requires a serious upfront commitment. Your budget should include expenses for contractors and materials as well as permit fees which tend to be expensive. The process will take a while. The process of handling contractor schedules and city inspections can extend your timeline by several months before you can display a “For Sale” sign in your yard.

My Two Cents from the Field: Before you even think about committing to repairs, get at least three detailed, written quotes from licensed contractors. The document serves as both a budget and proof of repair expenses when you sell your home as-is to justify your asking price.

The Case for Selling As-Is

The sale of a house in its current state provides the fastest path to completion. The method serves as the primary option for sellers who lack repair funds and need fast sales or those who want to avoid major renovation work. The process eliminates your need to deal with contractors and stay home for inspections.

The trade-off, of course, is a lower selling price. Your buyers will almost certainly be investors or professional home-buying companies. They’re going to calculate their offer by subtracting the repair costs, their own holding costs, and their profit margin from the home’s potential value.

Full transparency is absolutely non-negotiable here. You are legally required to disclose every known code violation. Trying to hide something is a surefire way to end up in a lawsuit.

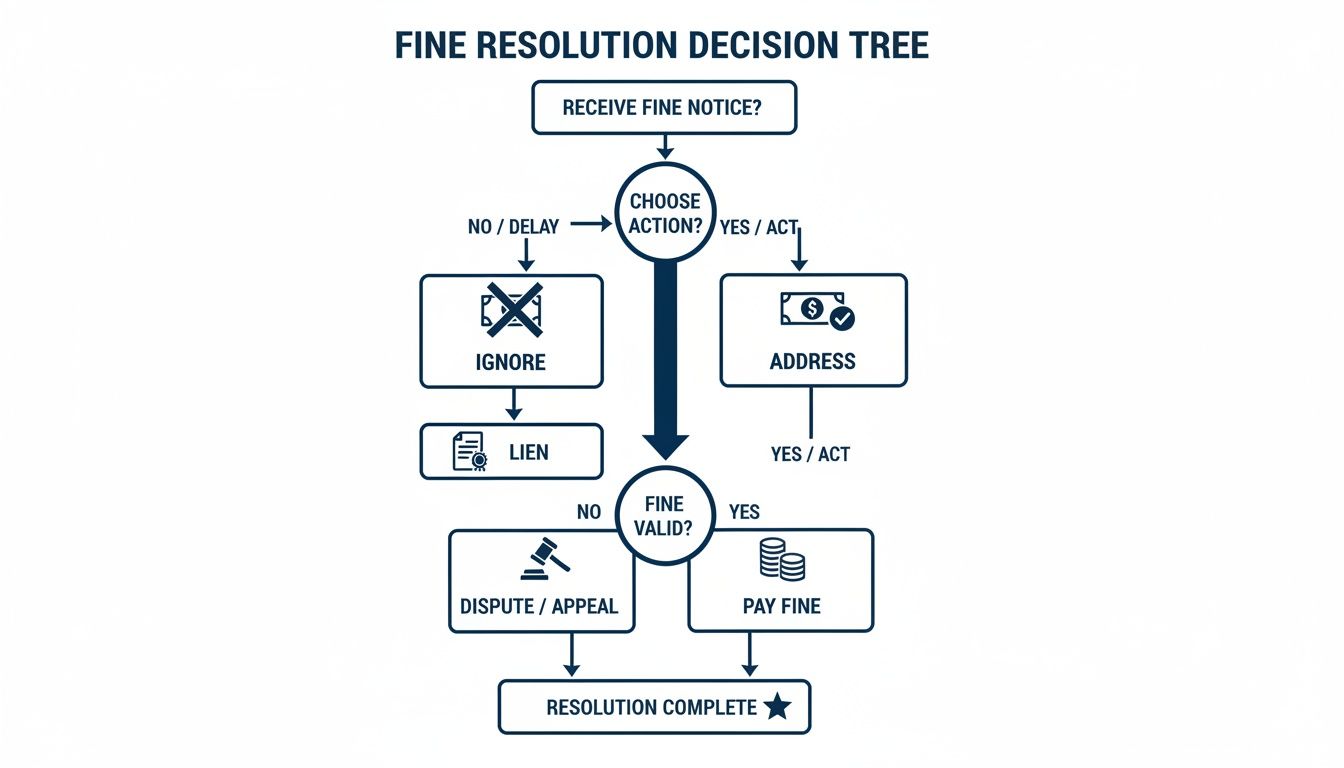

This flowchart nails a critical point: ignoring violations means the city eventually puts a lien on your property, and they start calling the shots. Selling as-is isn’t about hiding the problems; it’s about finding a buyer who is equipped to handle them. For a deeper dive, check out our guide on selling a house that needs repairs.

A Data-Driven Way to Decide

To really make a smart decision, you have to run the numbers. Laying it all out in a table can cut through the noise and give you the clarity you need to move forward with confidence.

Cost-Benefit Analysis: Repair vs. Sell As-Is

| Factor | Repairing Before Sale | Selling As-Is | Notes & Considerations |

|---|---|---|---|

| Potential Sale Price | $300,000 (Full Market Value) | $210,000 (Discounted Offer) | This assumes a house worth $300k if all repairs are done. |

| Repair & Permit Costs | -$40,000 | $0 | This is your biggest variable. Get actual quotes from contractors. |

| Holding Costs (6 mo) | -$9,000 (Mortgage, taxes, insurance) | -$1,500 (1 mo holding) | Don’t forget these! They add up fast during a long renovation. |

| Closing Costs/Fees | -$24,000 (Agent commissions, etc.) | $0 (If selling to a buyer who pays costs) | Many cash buyers cover all closing costs, which is a significant saving. |

| Net Proceeds | $227,000 | $208,500 | The final difference in your pocket is often much smaller than the initial price difference suggests. |

When you lay it all out, the financial gap between the two options often shrinks dramatically. The “higher” price from fixing it gets eaten away by repairs, holding costs, and commissions.

For many homeowners, especially those facing down a long list of expensive violations, selling directly to a cash buyer makes sense. These companies specialize in houses with these kinds of complex problems. They buy your home as-is, which means the repair costs, the holding fees, and all the uncertainty become their problem, not yours. You get a guaranteed closing on your timeline so you can just move on.

The Cash Buyer Solution: A Direct Route to Closing

After weighing the options of making repairs versus selling as-is on the open market, some homeowners look for a more direct path. Selling to a cash home buying company is one such alternative that skips the renovation headaches and the waiting game common in traditional sales.

This approach boils the selling process down to its simplest form. Forget about juggling contractors, passing inspections, or sweating out bank approvals. The process involves direct collaboration between you and a professional buyer who understands how to handle properties with major issues including code violations.

How a Direct Cash Sale Works

The entire process is built for speed and simplicity. The process involves a direct sale between you and the buyer which eliminates all third-party involvement and typical obstacles that arise during conventional sales.

You need to start by sharing basic information about your property. The cash buyer will conduct a brief inspection to assess the property’s condition and determine the extent of code violations.

You will receive a cash offer without any obligation from them after that. The number they provide reflects the property’s current condition after they calculate all necessary expenses to bring it up to code. The deal can be finalized in a few weeks after you accept the offer.

The Core Benefits of Selling for Cash

A direct cash buyer provides several benefits to sellers who want to save time and money and avoid stressful situations.

- No Repairs Needed. Period. This is the big one. You sell your house exactly as it stands. The buyer takes on the responsibility for that unpermitted deck as well as the faulty wiring and leaky plumbing.

- A Guaranteed Close. Cash sales don’t hinge on a bank’s approval. This completely removes the risk of a deal falling through at the last minute because a lender gets spooked by the violations.

- Speed and Certainty. The timeline shrinks dramatically. A cash deal can often be finalized in as little as 7 to 21 days, putting cash in your hand fast so you can move on.

- No Hidden Fees or Commissions. Reputable cash buyers usually pay for all the closing costs. The offer they make is the net amount you walk away with.

A Real-World Scenario: Picture this: someone inherits a house with an old, unpermitted garage conversion and an ancient electrical panel. The repair estimate comes back at $35,000 but they don’t have that kind of money. Instead of taking on debt, they sell to a cash buyer. The buyers close the deal in two weeks while they avoid paying property taxes and insurance costs for months before they finally get rid of the problem.

Is This Option Right for You?

A direct cash sale will work best for sellers who need a fast and stress-free transaction instead of maximizing their property value. The method works best for property owners who need urgent cash sales because they lack repair funds or want to end their property ownership with minimal effort.

This route gives you a clear, predictable outcome. You know the exact dollar amount you’ll get and the specific date you’ll close. The method enables you to avoid the extended waiting period that usually occurs when trying to sell a property with code violations through traditional methods. Our detailed guide explains more about why property owners choose companies that we buy houses for cash when backed into a corner.

If this sounds like a potential solution for your situation, companies like Eagle Cash Buyers specialize in these complex sales. They can provide a fair, transparent offer that empowers you to move forward with confidence and true peace of mind.

Selling with Code Violations: Your Questions Answered

The process of selling a home becomes extremely difficult when city code violations exist. The process seems complicated which leads to many people seeking answers. I will show you the most common questions that homeowners ask so you can understand what to expect in the future.

Do I Really Have to Tell Buyers About the Violations?

The short answer? Yes, you absolutely do. Your legal obligation requires you to reveal all material defects that you are aware of which includes any current code violations.

Trying to sweep these issues under the rug is a recipe for disaster. The buyer will have grounds to sue you for fraud or misrepresentation if they discover the defects after the purchase. Complete transparency serves as both an ethical practice and the most effective legal defense. A good real estate agent can help you navigate your local disclosure laws, but the rule of thumb is always: when in doubt, disclose.

Can I Just Sell the House “As-Is” and Make It the Buyer’s Problem?

You can, and this is often the most practical solution. The trick is finding a buyer who’s actually willing and able to take on that kind of project.

A typical homebuyer who obtains a mortgage from a bank does not fit this description. Lenders refuse to finance properties that show safety problems and structural defects and existing code violations because these represent major warning signs.

So, who is the right buyer?

- Real Estate Investors: These are pros who look for properties with problems they can solve to add value.

- House Flippers: Their entire business is built on turning distressed houses into market-ready homes, so they have the experience and crews to handle compliance work.

- Cash Home Buyers: Companies like Eagle Cash Buyers specialize in these exact situations. The new owners will use their available funds and experience to address all violations that exist at the time of purchase.

My Take: When you’re selling a home with code violations, your target audience shrinks significantly. You’re no longer marketing to the general public but to a small, specialized group of professional buyers.

What if the City Put a Lien on My Property for Unpaid Fines?

If you’ve let violation fines stack up, the city has likely placed a lien on your property to make sure they get paid. A legal claim exists against your house which needs to be resolved before you can sell it legally.

The deal stays intact but your final profit margin will take a hit. The title company will discover the lien when you proceed with the sale process. The total amount owed including both the original fines and any penalties will be deducted from your sale proceeds before you receive any money.

If the sale price isn’t high enough to cover the lien and what you owe on your mortgage, you could end up in a “short sale” scenario. This gets complicated fast and requires your bank’s approval, which is why it’s so important to tackle these fines head-on.

Won’t a Regular Home Inspection Find All the Code Violations Anyway?

A home inspector’s job isn’t to enforce city code, but they are trained to spot problems with a home’s major systems. The inspection process usually reveals multiple code violations because inspectors discover various issues during their work.

For instance, an inspector will absolutely point out things like:

- An electrical panel with funky wiring or double-tapped breakers.

- A “creative” plumbing job under the kitchen sink that isn’t vented right.

- A staircase missing a required handrail.

- A basement bedroom that doesn’t have a proper emergency exit window.

The report functions as an official citation during the sales process. The document shows all defects to both buyers and their lenders which makes it impossible for them to disregard the problems. Your initial approach to the process should always be honest with others.

Feeling the pressure of dealing with code violations, liens, and a complicated sale? You don’t have to go through it alone. If you’ve considered all your options and decided that a quick, as-is sale is the right path, Eagle Cash Buyers can help. We specialize in buying homes in any condition, including those with major code issues. We make a fair cash offer, handle all the closing costs, and work on your schedule. Get your no-obligation offer today and discover a simpler way to sell.