Yes, you can absolutely sell a house with tenants still living in it, but your approach is key. The best approach depends on your objectives because you need to decide between maximum price or quick sale or least complicated process. Your three main choices involve waiting until your lease ends or selling the property to an investor who will maintain the current tenant or trying to get your tenant to move out early.

Start by checking your current lease agreement before you do anything else. The document together with local landlord-tenant regulations establishes your legal responsibilities and tenant rights which you need to maintain during the sales process.

Your Options for Selling a Tenant-Occupied Property

The decision to sell a rental property requires substantial financial commitment and existing tenants create additional difficulties during the selling process. The situation happens often which forces tenants to search for new homes.

A recent survey by PayProp shows that about half of tenant relocations happen because landlords decide to sell their properties. The statistic shows that these situations occur frequently.

The process requires you to identify your main choices at the start so you can proceed effectively. Think about your main priorities which should dictate your decision between high sale value and quick sale and easy transaction process. Your personal priorities will determine the direction you should take.

Key Pathways for Your Sale

The path you select will depend on your tenant’s agreement and the landlord-tenant regulations of your area together with the type of buyer you want to attract.

Here’s a breakdown of the most common approaches:

- Wait for the Lease to Expire: Honestly, this is often the cleanest way to do it. Once the lease is up and the tenant has moved out, you can stage, show, and sell a vacant property. The listing will attract the most potential buyers because it allows for immediate occupancy which benefits families who need to move quickly.

- Sell to a Buyer Who Keeps the Tenant: This is the sweet spot if you’re targeting real estate investors. A paying tenant represents an asset to a different landlord. The property generates immediate rental income starting from day one because you avoid the expenses of tenant recruitment. If your tenant loves the place and wants to stay, this can be a win-win.

- Negotiate an Early Move-Out: Let’s say you need to sell to a traditional homebuyer, but the lease still has months to go. You can always try to strike a deal with your tenant. The landlord will give their tenant a single payment to cover moving expenses and early departure costs.

Ultimately, you have a core decision to make: are you selling an income-generating investment property, or are you selling a move-in-ready home? That single choice will shape your entire sales strategy, from how you price it to how you market it.

Before we dive deeper, it’s worth summarizing these choices.

At-a-Glance Options for Selling with Tenants

This table quickly compares the main strategies for selling a tenant-occupied home, helping you see which one might align best with your goals.

| Sales Strategy | Best For… | Key Challenge |

|---|---|---|

| Wait for Lease to Expire | Maximizing sale price & attracting the largest buyer pool. | Potential loss of rental income during the vacancy and sales period. |

| Sell to an Investor | A fast, simple sale with continuous rental income. | A smaller pool of potential buyers, which may impact the final sales price. |

| Negotiate Early Move-Out | Selling quickly to a traditional homebuyer who wants to occupy the property. | Requires tenant cooperation and often involves a cash incentive. |

Each path has its trade-offs, so think carefully about what’s most important for your situation.

As you weigh these options, keep in mind there’s another route that offers a different kind of solution: selling directly to a cash buyer. Companies that buy properties “as-is” can often purchase the home with the tenant in place, which lets you bypass the headaches of showings and negotiations entirely. To learn more about how this works, check out this guide on the benefits of selling a house for cash. It’s another valuable alternative to consider.

Getting a Handle on Your Lease and Local Laws

Before you even think about putting a “For Sale” sign in the yard, your first job is to become an expert on two things: the lease your tenant signed and the local landlord-tenant laws. This isn’t just paperwork; it’s the rulebook that will dictate your every move.

Ignoring these details is a classic rookie mistake. I’ve seen it lead to legal messes, delayed closings, and a whole lot of unnecessary stress. So, let’s get this part right from the start.

What Your Lease Actually Says

That rental agreement is more than a formality—it’s a binding contract. You need to read it not as a landlord, but as a seller, looking for specific clauses that directly impact the sale.

- Fixed-Term vs. Month-to-Month: This is the big one. Is your tenant locked into a fixed-term lease for another year, or are they on a month-to-month tenancy? If it’s a fixed term, that lease almost always transfers to the new owner. A month-to-month agreement, on the other hand, gives you more wiggle room, usually requiring just 30-60 days’ notice to vacate.

- The “Sale of Property” Clause: Some better-written leases have a clause that spells out the process for selling. It might cover how much notice you need to give for showings or even provide a path for early termination. If you have one, you’re in luck. If not, state law becomes your guide.

- Right of Entry: The lease should specify how much notice you have to give before entering the property for showings. Attendance requirements follow your contract terms and local laws which usually require 24 to 48 hours of notice.

A properly constructed agreement from the start ensures the whole procedure runs without problems. Free rental agreement templates exist to help you establish new tenancy agreements which cover essential elements.

Why Local Laws Trump Everything

Property owners lose their way at this point because they believe their lease agreement represents the complete authority. The tenant rights in your lease agreement become void because local and state landlord-tenant laws take precedence over all lease provisions.

Laws can vary wildly from one city to to another. Several states including California and New York have established “just cause” eviction rules to protect tenants. This means you can’t just end a tenancy because you want to sell. You need a specific, legally approved reason. The seller needs the buyer to move in for the sale to work.

My Two Cents: Never, ever assume. A quick call to a local real estate attorney or your property management company can save you from a wrongful eviction lawsuit, which is a financial and emotional nightmare you want no part of.

Putting It All Together: Real-World Scenarios

The following example demonstrates the actual outcomes of this strategy.

Scenario 1: The Fixed-Term Lease

You have a wonderful tenant who has eight months remaining on their lease agreement.

- Your Strategy: Your target market consists of investors who will purchase your property. The new owner receives your tenant along with the existing lease agreement and security deposit. This can be a huge plus for buyers looking for immediate cash flow.

Scenario 2: The Month-to-Month Tenancy

The first lease agreement between you and your tenant ended so you both switched to a month-to-month rental agreement. Your city lacks specific regulations regarding “just cause” evictions.

- Your Strategy: The program provides different options for you to select from. You can provide proper written notice (say, 60 days) to terminate the tenancy. The process of selling a vacant property opens doors to many potential buyers because it allows them to move in immediately.

Tenant management becomes complicated during property sales because existing relationship issues with tenants tend to get worse. You need to have complete knowledge about your rights and duties. Learning the legal process for dealing with various tenant problems will help you defend yourself against upcoming conflicts.

Talking to Your Tenants About the Sale

You must understand your lease terms together with local landlord-tenant regulations before starting communication with your tenants. The way you handle this discussion will decide if the sale succeeds or fails. The difference between a seamless collaborative process and one filled with obstacles and hold-ups exists.

Your goal here demands more than news delivery because you must win their support for your position. Think of it as a partnership. You need to be honest in your communication and show respect to them while actively listening to their words. Remember, you’re talking about their home. A little empathy will go a long, long way.

How to Have That First Conversation

Your first conversation carries significant weight. This isn’t something you do over text or by leaving a note on the door. The process demands direct human contact through personal meetings or phone calls which require follow-up written notifications.

Your message depends on how you present it. Instead of it being a problem you’re handing them, present it as a transition you need to work through together. I always recommend starting by acknowledging that this will be an inconvenience and immediately reassuring them that you’ll respect their rights and their space.

Here’s a simple, field-tested approach you can adapt:

- Be Direct and Respectful: “Hi [Tenant Name], I’m calling because I wanted to let you know personally that I’ve decided to sell the property. The information was essential so I needed to provide it to you before anyone else.

- Reassure Them Immediately: “I want to be very clear that your lease is fully protected, and we will honor every part of it. I will do everything I can to make this experience as easy for you as possible.

- Set Clear Expectations: “Over the next few weeks, we’ll need to arrange for some showings. We will provide you with the necessary [24/48 hours] notice and we will try to accommodate your availability.

- Open the Floor: “I know this is a lot to take in. What questions or concerns are on your mind right now?”

The first conversation needs your complete attention to listen. You will understand everything through their response. Are they panicked about having to move? Are they actually curious about buying the place themselves? The key to finding a cooperative solution exists in understanding their point of view.

Creative Incentives That Actually Work

Let’s be real: even with the best communication, keeping a home “show-ready” and dealing with strangers walking through is a major hassle. The landlord needs to provide specific rewards to transform an unwilling tenant into a dedicated cooperative partner.

You can achieve faster sales and avoid problems by offering something to your customers.

- A “Show-Ready” Rent Discount: Offer a monthly rent discount between $100 and $300 while the home remains available for sale. The payment serves as compensation for their work in keeping the home clean and their willingness to show it to potential buyers.

- A Small Thank You: A small gesture with immediate effect can produce significant results. The real estate agent receives $50 gift cards for local coffee shops and restaurants every time their property gets shown to potential buyers.

- The “Cash for Keys” Offer: This is your go-to when a buyer wants the property vacant and the lease isn’t up. The landlord gives the tenant a specific amount of money to end their lease agreement and move out by a certain date. The amount is always negotiable, but a good starting point is one to two months’ rent, plus the immediate and full return of their security deposit.

Always, Always Get It in Writing

Finally, while a good relationship is built on trust, a good business transaction is built on documentation. After each important phone call or conversation you should send a brief email summary of what was discussed. The platform creates an easy-to-follow paper trail of all communication and agreement details.

You need to document all showing requests and any incentive agreements and notice confirmations you have made. This isn’t about being paranoid; it’s about being professional and making sure everyone is on the same page. If a misunderstanding ever pops up, you’ll be glad you have it all documented.

Choosing Your Buyer: Investors vs. Traditional Homebuyers

The process of selling a house with tenants requires you to market the existing rental situation to potential buyers. Your homebuyer market divides into two distinct groups because of this reality: traditional homebuyers and real estate investors. A successful sale begins with determining the right group to target.

The open market with Multiple Listing Service (MLS) allows you to find potential buyers who seek their permanent residence. These buyers are often driven by emotion and will pay top dollar for a move-in-ready house they can fall in love with.

You need to market your property directly to real estate investors according to the other method. Your property exists as a numerical value on their financial records. The investors analyze cash flow together with return on investment and future growth possibilities. A good tenant isn’t a problem; they’re a core part of the asset.

The Challenges of Attracting Traditional Buyers

The process of selling a home with tenants to a traditional buyer creates challenges which feel like fighting against the current. These buyers want to start fresh because they cannot visualize their future when someone else is living in the space.

Here are the hurdles I see landlords face all the time:

- Showing Headaches: The process of scheduling home showings to fit around tenant availability requires complex planning. You need to schedule showings at times which do not interfere with tenant activities because they have work and family responsibilities and require personal space.

- Lived-In Condition: A tenant’s home is their space, not a professionally staged showroom. Buyers struggle to recognize the true value of the property because of everyday clutter and personal decorations and normal wear and tear.

- Occupancy Delays: Most homebuyers are on a tight timeline. Your clients must finish their previous home sale or lease termination before they can start their new residence. The new lease term of several months with a current tenant will prevent most buyers from making an offer.

A traditional buyer sees a tenant as a roadblock to moving in. The investor views a good tenant as an immediate source of income because they consider the tenant a valuable asset that increases the property’s value.

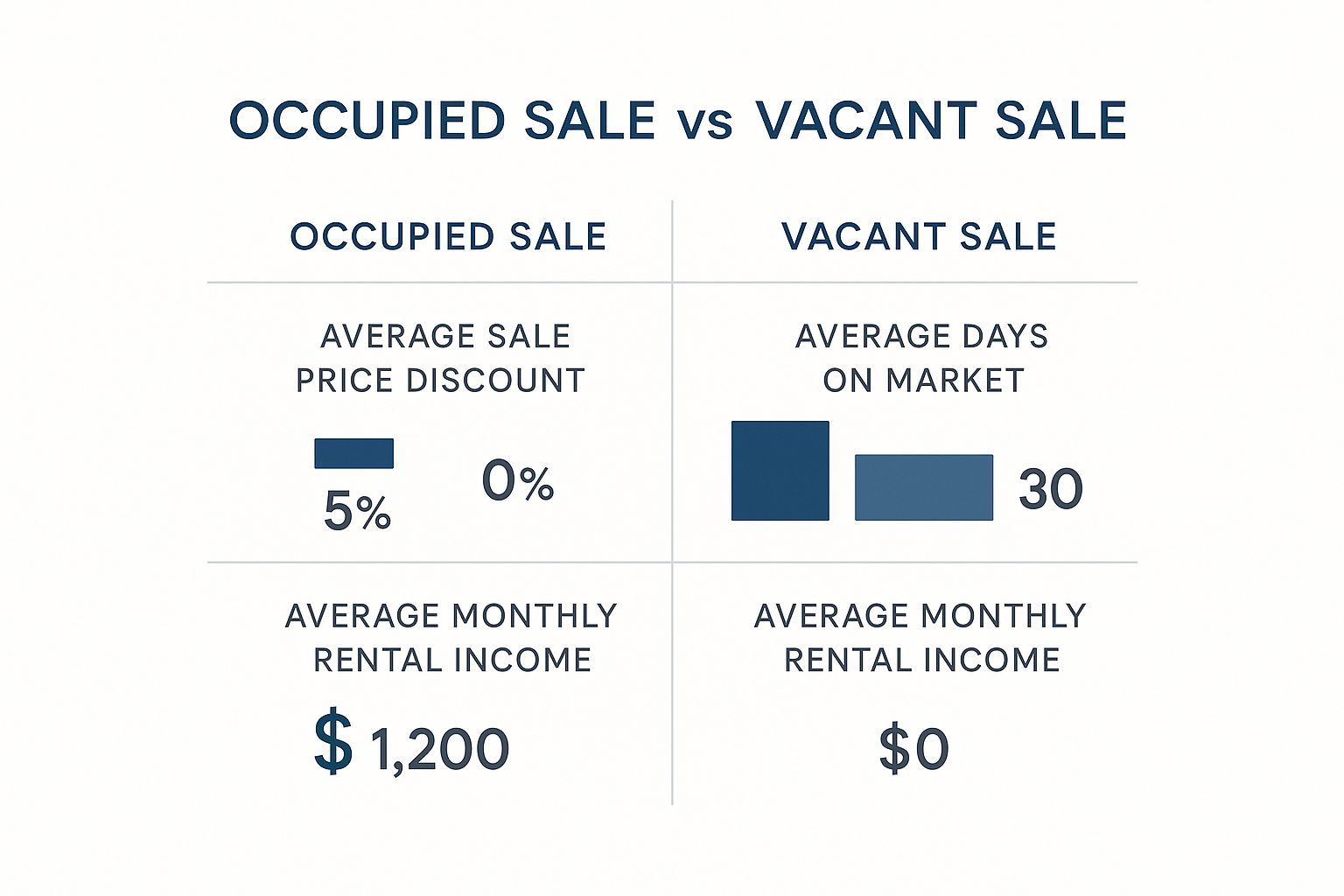

The reality is that selling an occupied home on the traditional market often involves trade-offs.

Your property will need more time to sell when you have tenants living in it. You might need to reduce your price to attract buyers who would avoid dealing with tenants.

Why Investors See Things Differently

A real estate investor views a property with tenants as a ready-to-go investment opportunity. The residential rental market has reached a significant scale because experts predict its value will reach US$5.62 trillion by 2025. A property with a reliable, paying tenant is a performing asset from day one.

An investor will find property sales with tenants to be beneficial:

- Immediate Cash Flow: The tenant does not have to spend time or money on tenant screening and selection. The new lease agreement will start producing rental income immediately after your tenant receives their keys.

- Zero Vacancy Costs: Your property will lose money every day when it remains vacant. By buying your occupied property, investors skip this costly gap in rent entirely.

- Proven Tenant History: A tenant with a solid payment history is a known quantity. The risk becomes lower than when you take a chance on a brand-new renter.

Understanding the mindset of different investors can also be a huge advantage. Real estate investors have two main groups: those who prefer active involvement and others who choose to be hands-off investors.

To make the choice clearer, let’s look at a direct comparison.

Investor Sale vs. Traditional MLS Sale Comparison

| Feature | Selling to an Investor | Selling on the MLS |

|---|---|---|

| Speed of Sale | Typically 10-14 days | Often 60-90+ days |

| Showings | One or two visits, if any | Multiple showings, open houses |

| Repairs | None – sold “as-is” | Often requires repairs and updates |

| Tenant Situation | Tenant stays – seen as an asset | Tenant must often vacate |

| Financing | Usually all-cash, no financing contingency | Subject to buyer’s loan approval |

| Closing Costs | Fewer fees, often covered by buyer | Agent commissions (5-6%), other fees |

Your choice between maximum price and quick sale will direct your path forward because these factors need your attention.

The Cash Buyer: A Path of Least Resistance

Your property sale process becomes complicated because you must market your home and conduct multiple showings and lengthy negotiations. The third option exists for those who want to avoid lengthy negotiations and showings and prefer faster sales.

Companies like Eagle Quick For Cash operate as professional real estate investment firms which purchase properties in their current condition including all existing tenants. The method provides an easy solution to traditional sales problems because it avoids the need for market exposure. The process requires no showings or repairs or financing delays. The process is simple: you get a fair cash offer, and if you accept, you can close on your schedule.

How to Market and Show a Home With Tenants

Selling a vacant property is one thing, but marketing a home with tenants still living there requires a completely different playbook. You can’t just stage it to perfection and host open houses whenever you feel like it. The whole game hinges on a strategy that respects your tenant’s space while still highlighting your property’s best features.

You need to change your perspective about the situation. Think of your tenant as an asset instead of considering them an obstacle. The way you view this shift will transform all aspects of your real estate business operations from listing properties to handling showings.

Frame the Tenant as a Selling Point

Your property listing functions as the first marketing tool which helps potential buyers recognize your property. With a tenant already in place, you have a golden opportunity to appeal directly to investors looking for a property that’s already making money.

Forget vague descriptions. Provide exact details about the investment potential.

- Highlight “Instant Rental Income”: This is your biggest hook. Use the phrases “Turnkey investment with a reliable tenant in place” and “Start earning rental income from day one.” The language targets investors by focusing on their financial interests.

- Showcase the Tenant’s Track Record: If you have a great tenant, let people know. The statement “Long-term tenant with a perfect payment history is happy to stay” serves as strong evidence of a stable investment with minimal risk.

- Provide the Financials Upfront: Don’t make investors guess. The listing needs to contain the current monthly rent together with the lease expiration date. The listing shows the property details to help buyers determine their interest in the property.

The story you present to your audience needs to show that this property goes beyond being a standard home for sale because it generates income. The focus on numbers and stable tenancy will attract investors who understand the value of your property.

Handling Showings with Respect and Strategy

The biggest challenge for most people is getting potential buyers to visit their property. You need to establish a rhythm which protects tenant privacy while providing necessary access to buyers. The process of showing a home in a disorderly or uncooperative manner can lead to the complete loss of a sale.

Always provide the legally required notice, which is typically 24-48 hours. The practice of going beyond minimum requirements creates substantial goodwill according to my professional experience. A friendly text like, “Hey, would sometime tomorrow afternoon work for a quick 15-minute showing?” shows you respect their schedule.

A showing-ready checklist for your tenant can be useful to create. The list provides basic tasks which do not demand extra resources:

- Tuck away personal mail or family photos.

- Make sure any pets are secured.

- Open the blinds to let in some natural light.

The process of setting expectations requires significant effort. The home will not appear as a model home that has been staged but this is the expected outcome. A professional real estate agent will inform buyers before their visit that the property contains tenants so they can set their expectations correctly.

Alternative Options for a Simpler Sale

The process of marketing and showing tenant-occupied properties becomes too challenging for many landlords to handle. The good news is, you have other options that let you skip these challenges altogether.

Broader market conditions, like low rental vacancy rates and construction trends, can also complicate things. The limited availability of vacant units makes it more challenging for sellers to negotiate and complete sales quickly. You can discover more insights about these housing market trends on hamiltonproject.org.

For a quicker sale process choose Eagle Quick For Cash to sell your property to a cash buyer. This method removes the need for public advertising and property showings. They buy properties “as-is” with tenants already in place, letting you bypass the complexities and head straight to the closing table. For more on this, check out this guide on how to sell your house quickly.

Navigating Offers and Closing Your Sale

An offer is currently being presented to you. The home selling process begins with this important step yet working with tenants requires additional steps beyond the standard closing process. The closing process needs a careful touch, especially when it comes to tenant-related finances and legal notifications, to make sure the handover goes off without a hitch.

Reading Between the Lines of an Offer

When an offer comes in for a tenanted property, you have to look past the sale price. The tenant has to receive special attention when reading through the contingencies section. A typical homebuyer includes a requirement for vacant possession of the property in their offer. The clause becomes a permanent deal breaker when your tenant has signed a long-term lease agreement.

The tenant serves as an advantage for the investor who makes the offer rather than a problem. The landlord needs to verify the lease agreement and payment history and security deposit details of the tenant. This type of offer makes the closing process easier because it avoids the need for tenant move-out negotiations.

The Landlord’s Closing Checklist

The legal and financial transfer process requires your complete focus once you accept an offer. There are specific tasks which need to be done when selling a property that still has tenants living in it.

- Prorating the Rent: The new owner receives all rental payments for the days they own the property during that particular month. The title company will calculate this at closing and distribute the amount to the buyer by deducting it from your final sale proceeds.

- Transferring the Security Deposit: You are legally required to transfer the full security deposit, plus any accrued interest, to the new owner. The security deposit transfer happens during the closing process and you will see it as a debit on your settlement statement while the buyer will see it as a credit.

- Handing Over Documentation: The buyer requires a complete file. Make sure you have copies of the signed lease, any addendums, and the tenant’s original rental application and payment history ready to go.

A common and costly mistake is mishandling the security deposit. You can’t just keep it. The money belongs to the tenant and the new landlord receives ownership of it when the property sale reaches completion.

Notifying Your Tenant About Their New Landlord

The last important work of your deal requires you to officially inform your tenant about their new landlord. This isn’t just a professional courtesy; in most places, it’s a legal requirement.

Your written notice should include the following details:

- The new owner’s name and contact information.

- Clear instructions on where and how to pay rent moving forward.

- The landlord needs to provide proof that they have transferred the security deposit to the new owner.

The final letter establishes a complete separation between you and the tenant which enables them to move forward with their life. You will determine your final expenses during the time you wrap up your affairs. The property tax distribution information is available in our complete guide to property tax payments during home sales.

There are multiple ways to handle this situation. Selling your home to Eagle Quick For Cash will help you close the sale with no problems. The team has extensive knowledge in purchasing properties with tenants and they handle all documents to make the process quick and stress-free.

Your Top Questions Answered About Selling with Tenants

The process of selling a property with existing tenants requires extreme care because it functions as a high-risk balancing act. You need to protect your tenants’ rights and follow all legal requirements during your efforts to obtain the best possible deal. You must understand that asking questions requires zero shame or wrongdoing.

Let’s address the core issues which frequently concern landlords. The process will become simpler when you acquire these details because it helps you avoid future obstacles.

Can I Make My Tenants Leave Because I’m Selling?

The short answer is usually no, not if they have a fixed-term lease. The lease agreement functions as a binding contract which remains in effect during the transfer of property ownership. The new owner needs to uphold the lease agreement until it reaches its expiration date.

Your tenant agreement with month-to-month status gives you more options for flexibility. The law allows you to give written notice to tenants for eviction purposes with a 30 to 60 day period depending on the state you reside in. Be careful, though. Some cities have strict “just cause” eviction laws that might only let you end the tenancy if the new buyer plans to move in themselves. Always, always check your local regulations first. A wrongful eviction lawsuit is a headache you don’t want.

The Bottom Line: A fixed-term lease holds the highest value. The tenant receives protection against eviction through this process. Your choices depend on the type of lease agreement you have and the landlord-tenant laws of your region.

Do I Have to Lower My Price If I Sell with a Tenant?

The buyer you choose will determine this. A tenant who is currently living in the property will increase its value for the next real estate investor buying your property. The property generates immediate cash flow because it has a paying tenant who has proven to be reliable. For them, the tenant isn’t a problem; they’re the entire point, which can support a strong asking price.

On the flip side, if you’re trying to attract a typical homebuyer who wants to live in the house, a tenant is a major hurdle. The buyers need to find alternative housing because they cannot move in immediately and they want to avoid the process of showing the property or inheriting an existing tenant. The requirement to vacate your current home before moving into a new one will reduce the number of potential buyers and force you to accept lower offers. Your pricing strategy needs to be realistic about whether you are selling an income property or a move-in-ready home.

What Happens to the Security Deposit?

This is a simple one, but it’s critical to get it right. Your security deposit will transfer to the new owner during the closing process. It’s not your money to keep.

You must legally hand over the funds to the buyer, who then takes on the full responsibility for that deposit. You also need to inform the tenant in writing that their deposit has a new home, providing the new owner’s name and contact information. The new landlord becomes responsible for the deposit from the date of transfer and must follow the original lease terms and state laws for its return.

The process of juggling tenant laws together with showings and closing procedures can become overwhelming. The process becomes easier when you select Eagle Quick For Cash as your selling option. We buy houses “as-is” with tenants in place, so you can bypass the stress of showings, repairs, and drawn-out negotiations. Visit our website at https://www.eaglecashbuyers.com/ to learn more.