The real estate investment community benefits from Section 1031 of the IRS tax code through a powerful tax-deferral mechanism known as a 1031 exchange. The tax strategy lets you sell an investment property then use the entire sale proceeds for purchasing another similar property without paying capital gains taxes right away which boosts your investment potential.

Understanding the Basics of a 1031 Exchange

Let’s break it down with a simple analogy. Imagine you have a rental duplex and you want to trade up to a small apartment building. Instead of selling the duplex, paying taxes on the profit you’ve made over the years, and then using what’s left to buy the new building, a 1031 exchange lets you essentially swap them. Your equity moves seamlessly from one property to the next.

The U.S. Internal Revenue Code Section 1031 provides this outstanding benefit. The key thing to remember is that this is strictly for investment or business properties. The program does not support homeownership for personal residences. The whole point is to allow investors to defer capital gains taxes by swapping one investment for a similar, or “like-kind,” property.

The Purpose and the Players

A 1031 exchange isn’t something you do on your own; it’s a structured process with a few essential moving parts. Getting these right is absolutely critical for the whole thing to work.

Here’s a quick overview of the fundamentals to get you started.

1031 Exchange at a Glance

| Component | Brief Description |

|---|---|

| The Exchanger | That’s you—the real estate investor looking to sell one property and buy another. |

| Relinquished Property | This is the property you’re selling to start the exchange. |

| Replacement Property | The new ‘like-kind’ property you’re planning to purchase with the proceeds. |

| Qualified Intermediary | An independent third party who holds your funds between the sale and the purchase. |

A Qualified Intermediary stands as a mandatory requirement which cannot be waived. The funds from your sale remain in their possession until you gain direct control over the money. The moment funds enter your bank account for any duration ends your eligibility to defer taxes. Your main goal should be to build wealth through investments which the government cannot take away through taxes.

A successful exchange depends on finding the right time to sell. For investors facing tight deadlines, exploring every option is smart. Some find that working with companies that buy houses for cash can be a beneficial way to secure a fast, reliable closing, giving them a solid foundation to kick off the strict 1031 exchange timeline.

The correct interpretation of core rules for a 1031 exchange is essential.

To complete a 1031 exchange successfully while avoiding capital gains tax you need to follow all IRS regulations. These aren’t just friendly suggestions; they’re rigid requirements. The process depends on these protective barriers because any contact with them will cause your entire tax-deferral plan to fail.

Getting a handle on these rules is the absolute first step. The process of transferring property ownership determines whether the transaction will result in financial gain or lead to expensive tax penalties.

The Like-Kind Property Rule

First up is the “like-kind” rule, which trips a lot of people up. The policy appears restrictive but it actually provides more flexibility than most people realize. The term “like-kind” does not restrict you to exchange a two-bedroom rental property for another two-bedroom rental property. The classification of a property depends on its usage rather than its physical characteristics.

The IRS is surprisingly broad here. Your property remains tax-free as long as you use it for business or investment purposes. For instance, you could exchange:

- A rental condo for a piece of raw land you plan to develop.

- Farmland for a small commercial strip mall.

- A portfolio of single-family rentals for one large apartment building.

The bottom line is that both the property you sell and the one you buy must be for investment or business. Homeowners cannot use their principal residence for the purpose of a 1031 exchange because the law prohibits it. Your primary home is completely off-limits for a 1031 exchange. The IRS needs to see that your clear intention is to generate income or hold the asset for appreciation, not for personal enjoyment.

The rental property classification becomes more complex when you own a vacation home that you rent out during certain months each year. Your personal use of the property must not exceed 14 days annually or 10% of the total rental days—whichever number is higher. You must keep exact records to qualify for this situation.

People often believe that holding a property for one year will automatically prove their intent to the authorities. The IRS does not provide a specific holding period but experienced investors along with their advisors recommend keeping the property for at least one to two years before and after the exchange. Your investment goals become documented through this method.

The Unforgiving Timelines

Finally, we get to the two deadlines that are set in stone. The moment you close the sale on your original property, a stopwatch starts, and it doesn’t pause for anything.

-

The 45-Day Identification Period: You have precisely 45 calendar days from the closing date to give your Qualified Intermediary a written list of potential replacement properties. Not 46.

-

The 180-Day Closing Period: You must complete the purchase of one or more of those identified properties within 180 calendar days of the original sale.

These two clocks run at the same time. Your 180-day window starts ticking on the very same day as your 45-day window. If you’re curious about where these odd numbers came from, you can discover the history of these 1031 exchange timelines and the court case that shaped them.

You need to invest considerable time into preparation when working toward these deadlines. The real estate market operates unpredictably because unexpected challenges like title issues at closing can disrupt even the most thoroughly planned transactions.

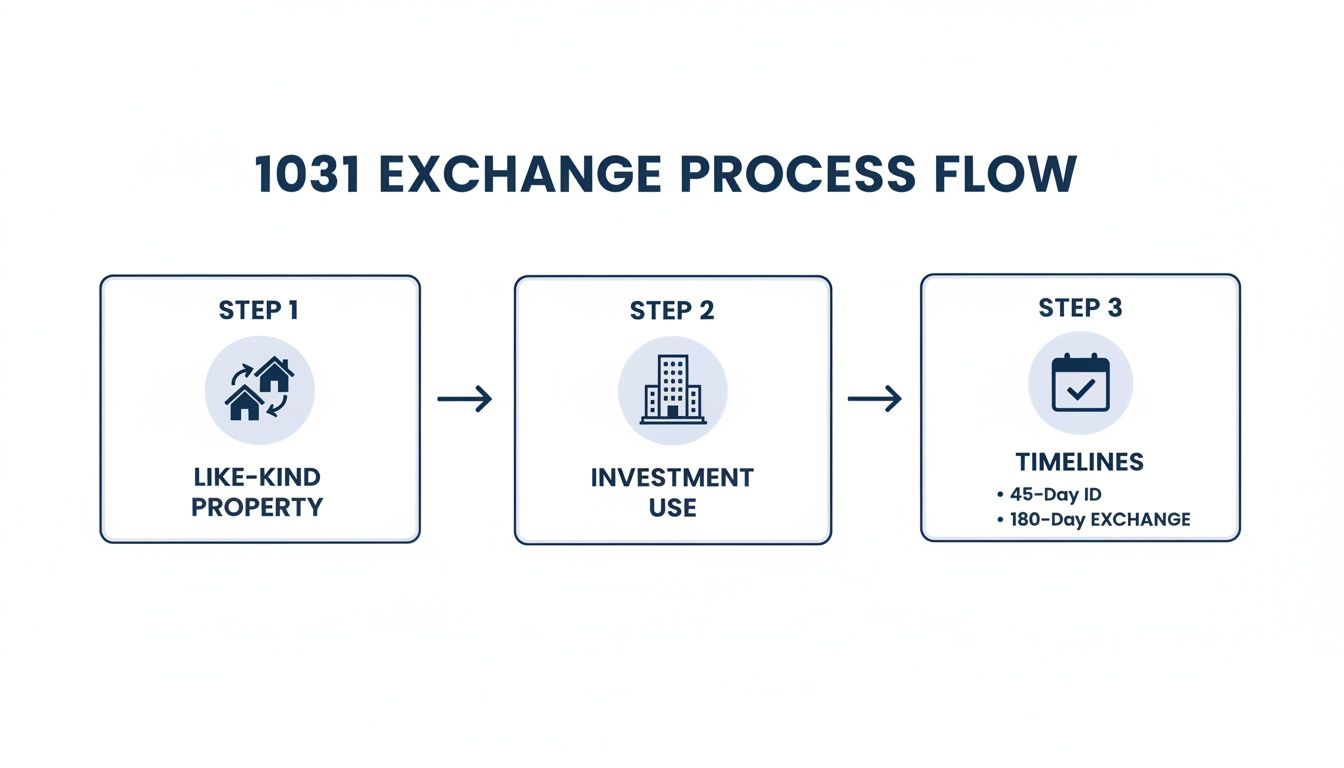

How a 1031 Exchange Unfolds Step by Step

The practical operation of a 1031 exchange in actual transactions remains unclear to many people. The process follows a structured method which requires exact timing and adherence to regulations. The whole journey kicks off the moment you sell your investment property, which in 1031-speak is called the “relinquished property.”

First Things First: The Qualified Intermediary

Your first action must be to engage a Qualified Intermediary (QI) before you proceed to any further steps. The QI functions as an impartial third-party official who supervises the process. Your sale proceeds will be kept by the escrow agent as part of their duties.

Your funds remain protected from withdrawal at this stage. If those funds land in your personal bank account, even for a minute, the IRS considers it “constructive receipt,” and your entire tax deferral is off the table. Game over.

The Clock Starts Ticking: Identification Rules

The day you close the sale on your old property, a countdown begins. You have exactly 45 days—and they mean exactly—to formally identify potential replacement properties. This isn’t just a wish list in your head; you have to deliver a signed, written list to your QI.

The IRS gives you a few ways to do this, offering a bit of flexibility. You only need to follow one of these three rules:

- The Three-Property Rule: The simplest and most popular choice. You can identify up to three potential properties, and their value doesn’t matter.

- The 200% Rule: Need more options? You can identify more than three properties, but there’s a catch. Their total combined value can’t be more than 200% of what you sold your original property for.

- The 95% Rule: This one is rarely used and for good reason. If you go over the limits of the first two rules, you’re stuck with this one, which requires you to actually buy at least 95% of the total value of all the properties you identified. It’s a high-stakes play.

As you can see, sticking to the like-kind property rules, maintaining investment use, and nailing the timelines are the pillars of a successful exchange.

The Final Sprint: Acquiring Your New Property

Once you’ve locked in your identification list, you enter the final phase. You have a total of 180 days from the day you sold your first property to close the deal on your new one (or ones). Remember, that 180-day window includes the 45-day identification period, so they run at the same time.

When you’re ready to close, your QI sends the funds directly to the title company or closing agent to complete the purchase. This final how to transfer property ownership is what officially seals your tax-deferred exchange.

Once the new deed is in your name, you’ve done it. You’ve successfully rolled your investment forward and kept your hard-earned capital working for you, all without writing a big check to the IRS.

When you’re considering a 1031 exchange, it’s crucial to look at it from all angles. This strategy can be a game-changer for growing your real estate portfolio, but it’s not a free pass. The benefits are massive, yet the rules are strict and the potential pitfalls are real. Let’s break down what you stand to gain and what you need to watch out for.

The number one reason investors get excited about a 1031 exchange is, without a doubt, the tax deferral. Think about it: instead of handing over a chunk of your profits to the IRS, you get to roll that entire amount into your next investment. The approach delivers two benefits to investors who want to save money on their first transaction and then use that saved amount to acquire more valuable properties at an accelerated rate.

The tax deferral program enables you to upgrade your property portfolio while gaining access to another major benefit. Your rental property that demands high maintenance can be replaced with a new property which requires less upkeep. You have the choice to exchange your single-family home for a small commercial building which would allow you to access a different market segment. A 1031 exchange gives you the flexibility to strategically reposition your assets as your goals evolve.

Navigating the Downsides

Now for the reality check. A 1031 exchange is not a walk in the park, and the biggest hurdle for most people is the brutal timeline. You have just 45 days from the sale of your property to identify potential replacements and a total of 180 days to close on one of them. In a hot market where good deals get snapped up in a flash, that clock ticks down incredibly fast and can create a ton of pressure.

Another common trap is something called “boot.” This is a term for any extra cash or non-like-kind property you receive from the exchange. The IRS will tax any leftover proceeds from your sale if you don’t reinvest the entire amount or if your replacement property costs less than your previous property. The deal has to be structured just right to avoid a nasty, unexpected tax bill.

Finally, the sale of your original property can throw a wrench in the works. A slow, traditional sale with financing contingencies and endless negotiations can eat up valuable time in your 180-day window. This is exactly why many savvy investors explore the benefits of selling a house for cash. A fast, certain closing gives you a clean start and maximizes the time you have to find that perfect replacement property.

1031 exchanges serve as a major economic engine which drives the United States economy. The programs serve two purposes because they help individual investors while creating new jobs which boost GDP growth and increase tax revenue in the future. A 2021 study revealed these properties maintained 568,000 jobs while producing $55.3 billion GDP growth which represents up to 20% of commercial transactions.

To help you weigh your options, let’s put the good and the bad side-by-side.

Pros and Cons of a 1031 Exchange

The table presents a concise overview of the main advantages against the essential obstacles you need to get ready for.

| Benefits (Pros) | Risks (Cons) |

|---|---|

| Tax Deferral: Postpone capital gains to maximize your investment capital. | Strict Timelines: The 45/180-day rules are rigid and stressful. |

| Increased Buying Power: Roll 100% of your equity into a new, larger asset. | Finding Property: Locating a suitable replacement in time can be difficult. |

| Portfolio Diversification: Swap into different property types or locations. | Risk of “Boot”: Imperfect structuring can lead to unexpected taxes. |

| Improved Cash Flow: Exchange for properties that generate higher rental income. | Reduced Basis: Your new property’s tax basis is carried over, not reset. |

A 1031 exchange works best for serious investors who understand its major benefits and associated risks.

When a 1031 Exchange Is the Smart Move

Knowing the rules is just the start. The real skill lies in recognizing the perfect moment to pull the trigger on a 1031 exchange. The strategy offers more than just tax deferral because it lets you actively shape your investment portfolio to align with your changing financial objectives.

Your personal needs as an investor should determine the right time for an exchange. A landlord who deals with late-night calls about leaking faucets would understand this scenario. A 1031 exchange lets you trade your high-maintenance rental property for a completely passive investment like a triple-net lease property where the tenant assumes all costs. Your money will continue to work for you while avoiding the usual investment stress.

Common Scenarios for a Strategic Exchange

Portfolio consolidation continues to be a popular strategy that investors use. New investors often begin their journey by acquiring multiple small rental properties throughout their initial years of investing. Managing multiple locations and tenants and repair schedules becomes an overwhelming task for landlords who start with one property.

A smart approach would be to trade your various properties for a single bigger property like an apartment building. The process becomes easier to handle for both management and financial tasks while providing the chance to boost your income through a single tax-exempt deal.

The 1031 exchange works best when you deal with property that has been passed down to you through inheritance. If you and your siblings inherit a rental property on the other side of the country, selling it outright could trigger a massive tax bill. You have the option to exchange your property for a similar investment property in your local area which makes tax deferral possible while simplifying property management.

The majority of property exchanges involve single-family homes yet the actual value of transactions stems from multifamily buildings and warehouses. You can discover more insights about 2024 exchange trends to see how different asset classes are stacking up.

Making the Right Financial Decision

The decision to proceed with an exchange requires thorough evaluation of your available choices. Your current property sale speed and reliability function as a crucial determinant for this process. The 45-day identification period will expire before you get started if your property sale takes longer to complete. The right moment to sell your house for cash depends on various factors which will help you start your timeline through an immediate sale.

The 1031 exchange operates as one financial instrument among many in your investment portfolio. There are numerous tax-efficient investing methods which help you reduce your tax burden while increasing your investment gains. A strategic exchange at the right time can transform your financial growth by helping you enhance your portfolio through consolidation or relocation of your investments.

Considering Your Options and Planning Next Steps

Now that you’ve got a handle on the mechanics of a 1031 exchange, it’s time to map out your own game plan. The path to success requires making strategic decisions while starting with professional guidance as your essential first step.

The first step requires you to meet with both a qualified tax advisor and a real estate attorney. Your financial strategy will become complete through their assistance because they will help you create a plan which achieves your financial targets while following IRS guidelines.

Once you have your team of experts in place, you can start weighing the different ways to sell your current property. Each option comes with its own mix of speed, convenience, and potential return.

Evaluating Your Path Forward

You have three different options to choose from when you want to sell your investment property. The Traditional Sale: This is the classic route—listing your property on the open market with a real estate agent. The method focuses on achieving the highest sale price but does not establish any specific timeline for the transaction. The 45-day identification period becomes extremely stressful because buyers face uncertainty about their property choices.

Sell and Pay the Taxes: Sometimes, the simplest choice is the right one. If the strict deadlines and rules of an exchange feel too restrictive for your situation, you can always just sell the property. Paying the capital gains tax gives you immediate cash and complete freedom to do whatever you want with the proceeds.

A Direct Cash Sale: For investors who value speed and certainty above all else, selling directly to a cash buyer is a powerful option. The process delivers an immediate sale which puts funds into your Qualified Intermediary’s account to initiate your 1031 exchange period without any market-related delays.

A direct cash sale can be a strategic tool for a smoother exchange. Setting a specific closing date lets you control your 180-day clock to the fullest extent. The process eliminates the uncertainty of standard property sales which allows you to focus on discovering your perfect replacement home.

No matter which path you lean towards, doing your homework is essential for a successful outcome. The comprehensive guide to finding the best 1031 exchange property serves as an excellent resource for developing your strategy and discovering potential investment opportunities.

If the certainty and speed of a cash sale sound like the right fit for your situation, a company like Eagle Cash Buyers can provide a fair, no-obligation offer. The method lets you start your exchange with certainty because it gives you both time and peace of mind to find your best investment opportunity.

Common Questions About 1031 Exchanges

The process of 1031 exchange continues to generate various questions which appear even after people understand the basic steps. Let’s tackle a few of the most common ones to help clear up any confusion before you dive in.

What Happens if I Miss a Deadline?

The answer is straightforward because the deadlines are absolutely strict. The entire exchange becomes invalid when you fail to identify replacement properties within 45 days or close on one within 180 days.

The funds your intermediary holds become taxable once any deadline passes. You’ll be on the hook for capital gains taxes on the sale of your original property for that tax year. There are no extensions, so planning every step is absolutely critical.

Can I Exchange a Vacation Home?

Sometimes, but you have to be very careful with how you’ve used it. A vacation home only qualifies if its primary purpose is rental income, not personal getaways.

The IRS has a specific test for this. Your personal use of the property can’t exceed the greater of 14 days a year or 10% of the total days it was rented out. If you’ve been using it more than that, it likely won’t qualify as an investment property for a 1031 exchange.

What is “Boot”?

You’ll hear this term a lot. “Boot” is simply anything you receive in the exchange that isn’t “like-kind” property. The exchange may include cash you receive along with the reduction of your mortgage debt and any personal property like furniture that was part of the deal. The IRS treats all boot received as taxable income.

How Can I Avoid Boot?

To defer all of your capital gains tax, you have to avoid boot entirely. The strategy comes down to two simple rules:

- The property you buy must be worth the same as, or more than, the property you sold.

- You must reinvest all the cash proceeds from the sale into the new property.

Follow those two principles, and you’ll be on your way to a fully tax-deferred exchange.

A 1031 exchange requires both thorough planning and exact timing to achieve success. One option for a predictable start to your exchange is a direct sale. The quick cash sale option becomes an ideal starting point for buyers who want to begin their property search.

For example, Eagle Cash Buyers provides sellers with a fair, no-obligation cash offer. This approach can offer an efficient start to the 1031 process. You can get an offer by visiting us at https://www.eaglecashbuyers.com.