When you hear the term home equity, what does it really mean? Put simply, it’s the slice of your home that you actually own.

Think of it as the current market value of your house minus whatever you still owe your mortgage lender. The financial interest you have in the property represents the portion which genuinely belongs to you.

Understanding Your Home Equity

The process functions in the same way as obtaining a car loan. The bank becomes the owner of your new car from the moment you drive it off the dealership lot. But every single payment you make chips away at that loan, and your ownership stake grows. Real estate equity follows the exact same principle, just on a much bigger scale.

This isn’t a fixed number, either. Your equity is a living, breathing financial asset that can grow or shrink over time. The most precise way to determine your financial status exists through this measurement because it examines your biggest investment.

The Core Components of Equity

At its heart, understanding equity in real estate is about knowing two numbers: what your home is worth today and what you still owe on it. The foundation for creating wealth through property investment starts with this straightforward calculation. And it’s a powerful concept—investor confidence in building equity is on the rise, with commercial real estate deal value recently jumping 11% to $707 billion, according to insights on real estate trends from Nuveen.

This financial cushion is what you’d walk away with if you sold your house and paid off the mortgage and any other debts tied to it. The bigger that cushion gets—either from you paying down the loan or the market pushing your home’s value up—the more financial options you have.

To make this crystal clear, here’s a quick breakdown of the core ideas.

Real Estate Equity at a Glance

| Component | Simple Explanation |

|---|---|

| Market Value | This is the estimated price your home would sell for in the current market. |

| Mortgage Balance | This is the remaining amount you still owe to your lender. |

| Equity | The difference between the market value and your mortgage balance. This is your ownership stake. |

So, you can see that equity isn’t some abstract financial term—it’s a straightforward measure of your progress.

Home equity is more than just a figure on a statement; it’s your foothold in the property market. The value of your home depends on two main factors which include your steady payments and how the housing market performs.

Getting a handle on this concept is the first real step toward using your property’s value to your advantage. Equity serves as the fundamental element which enables you to create wealth for your future financial security or to sell your property or refinance it. The guides about companies that buy houses for cash emphasize the importance of equity for homeowners who want to sell their homes quickly.

How to Calculate Your Home Equity with Confidence

The calculation of home equity requires no advanced financial education. At its core, it’s a simple subtraction problem that gives you a crystal-clear picture of your financial stake in your property.

The formula is as straightforward as it gets: take what your home is worth today, and subtract what you still owe on it. That’s it. The number you’re left with is your equity.

Your Home’s Current Market Value — Your Remaining Mortgage Balance = Your Home Equity

This isn’t just a number on a page; it represents your actual ownership and is a cornerstone of your personal net worth.

Putting the Formula into Practice

Let’s ground this in a real-world scenario. Say your home could sell for $500,000 in today’s market.

You’ve been diligent with your payments over the years, and your remaining mortgage balance is now down to $300,000.

Plugging those numbers into our formula, we get:

- $500,000 (Market Value) – $300,000 (Mortgage Balance) = $200,000 (Home Equity)

In this case, you’ve built up $200,000 in home equity. This is the portion of the home’s value that is truly yours—the cash you’d walk away with if you sold the house and paid off the bank. Property owners turn to professional real estate accounting services to track these important numbers because it helps them manage their assets effectively.

Understanding the Loan-to-Value Ratio

The same numbers you see your lender uses for equity evaluation. The Loan-to-Value (LTV) ratio serves as a risk measurement tool which they apply.

The amount you owe stands in relation to the value of the property according to this ratio. To calculate it, you just divide your loan balance by the home’s value.

Using our same example:

- $300,000 (Loan) ÷ $500,000 (Value) = 0.60, which translates to a 60% LTV.

A lower LTV is always better in a lender’s eyes. The loan demonstrates that you have invested your own money which proves you will be a less risky borrower. This is why having at least 20% equity—or an LTV of 80% or less—is such a common benchmark. The key to eliminating Private Mortgage Insurance (PMI) and obtaining home equity loans along with other financial options lies in this process.

Knowing your equity serves as the foundation for making better financial decisions. The process of determining your home equity before selling starts with understanding your current market value and outstanding mortgage balance.

The Two Main Drivers That Grow Your Equity

Building equity in your home requires more than just waiting for it to happen. The process operates through two essential driving forces which function actively. The first element depends on your personal actions but the second element stems from the market forces. Learning how these two elements work together will help you transform your home into a valuable financial investment.

The most straightforward way to build equity is the one you control directly: paying your mortgage. Every single time you make a payment, part of it covers the interest, but the rest goes toward whittling down your loan’s principal balance. The process of paying down your debt balance each month results in increased ownership of your property.

Paying Down Your Mortgage Principal

I like to think of each mortgage payment as you buying back a little slice of your home from the bank. The initial payments of your 30-year loan mostly go toward interest payments which creates the appearance that you are not making progress. But over time, that balance slowly shifts. The portion of your payment which goes toward principal repayment grows as you make more payments on your loan.

This is the slow-and-steady, guaranteed way to grow your equity. Your ownership percentage will continue to increase because you maintain regular payments regardless of what the market does.

Benefiting from Property Appreciation

Property appreciation serves as the primary factor which drives the value of your home to increase on the market. Your equity receives significant support from external forces which work hard on your behalf without you having to take any action.

So, what makes a home’s value climb? A few key things:

- Market Demand: A booming local economy, new jobs coming to town, and not enough houses for sale can send prices soaring.

- Neighborhood Improvements: Think new schools, trendy coffee shops, or a beautiful park being built down the street. These all make your area a more attractive place to live.

- Home Upgrades: Smart renovations can add real value. For example, a well-planned kitchen renovation’s return on investment can be surprisingly high.

Of course, this is a two-way street. A market downturn can just as easily eat into your equity, at least temporarily. And if you take out new loans against your home, like a HELOC, you’re adding to your debt and directly reducing your equity. Professional investors have all sorts of formulas for this, like the 70% rule to assess a property’s potential, which helps them navigate these complex market dynamics.

It’s crucial to remember that real estate is hyper-local. Global trends exist in various directions. Real estate transaction volumes have experienced a strong recovery in Europe and the United States but certain Asia Pacific markets have experienced a decline because of economic challenges. PWC.com provides additional information about worldwide real estate market trends.

At the end of the day, building equity is a blend of your own financial discipline and the health of the market you live in.

Tapping into Your Equity Without Selling Your Home

Your home equity serves as a strong financial resource which allows you to generate income through methods that do not involve selling your property. The program functions as a built-in savings account which lets you borrow money for important life goals such as home renovations or debt consolidation or college expenses.

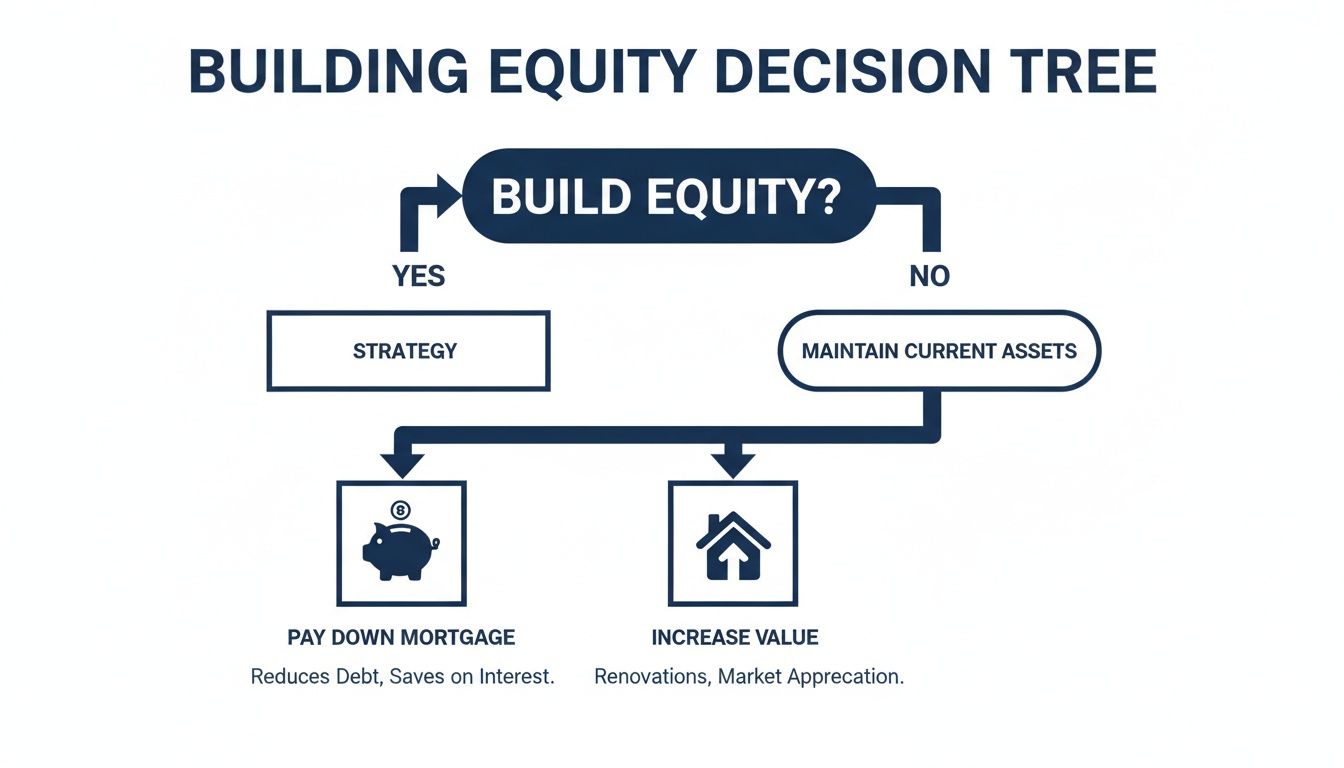

This graphic breaks down the two main ways you can grow the equity you have available to access.

The key to success lies in paying down your loan while simultaneously increasing your home’s worth. The two fundamental steps enable us to access the powerful financial opportunities which we will explore next. Homeowners can access this value through different methods that do not require placing a “For Sale” sign in their yard.

Home Equity Loans (HELs)

A Home Equity Loan (HEL) is often called a second mortgage, and it’s pretty straightforward. The process starts when you receive a single lump sum payment which you then repay through fixed monthly installments during a predetermined time frame. The full loan amount becomes available to you immediately after which you start paying it back through fixed monthly payments with interest.

This option is perfect for big, one-time expenses where you know the exact cost ahead of time. The loan functions as the primary source of funds which enables you to complete significant kitchen renovations and pay for major medical expenses. The fixed rate payment system allows you to know your monthly costs in advance which helps you plan your finances better.

Home Equity Lines of Credit (HELOCs)

A Home Equity Line of Credit (HELOC) operates similarly to a credit card. Instead of getting a single lump sum, you’re approved for a revolving line of credit up to a certain limit. You have the ability to withdraw from it when necessary and repay the amount before taking out additional funds.

HELOCs function as an excellent financing solution for expenses that occur regularly or at unexpected times such as home maintenance needs and business startup costs. The main reason people choose this option is because of its adaptability but you should keep in mind that interest rates vary which might affect your monthly payments.

One critical point: Both HELs and HELOCs use your home as collateral. The lender may take possession of your property through foreclosure if you are unable to repay the loan. It’s absolutely essential to borrow responsibly and have a solid repayment plan in place.

Cash-Out Refinance

The process of cash-out refinance requires you to replace your current mortgage with a new mortgage that has a higher loan amount. The difference between your original loan amount and the new loan amount becomes your cash payout. The property value at $400,000 allows you to refinance for $250,000 which covers your $200,000 debt and provides you with an additional $50,000. The new loan would pay off your previous debt and leave you with $50,000 in cash.

The strategy works best when interest rates drop because you might get a better rate for your entire mortgage and access cash at the same time. The process of refinancing your loan will start your payment schedule over again which could lead to higher interest costs throughout the duration of your loan. New loan term comprehension requires special attention because divorce situations often involve loan assumption for home retention.

The Different Methods to Access Home Equity

The process of selecting the best equity access method becomes difficult because each option provides different benefits and drawbacks. The table below breaks down the key differences to help you decide which path might be the best fit for your financial goals.

| Method | How It Works | Best For | Key Considerations |

|---|---|---|---|

| Home Equity Loan (HEL) | Borrow a one-time lump sum against your equity. Repay it in fixed monthly installments over a set term. | Large, single expenses with a known cost, like a major renovation or debt consolidation. | Payments are predictable due to a fixed interest rate. Your home is used as collateral. |

| Home Equity Line of Credit (HELOC) | Get a revolving line of credit you can draw from as needed. Pay interest only on what you use during the “draw period.” | Ongoing, unpredictable, or staggered expenses, like phased home repairs or tuition payments. | Offers great flexibility but usually has a variable interest rate, meaning payments can change. |

| Cash-Out Refinance | Replace your existing mortgage with a new, larger loan. You receive the difference in cash. | Accessing a large amount of cash, especially when you can also lower your primary mortgage’s interest rate. | Resets your mortgage term. Involves closing costs, and your overall interest paid could increase over the new loan’s life. |

Your selection of the best option depends on your cash requirements and the purpose of the money and your risk tolerance level. A HEL offers stability, a HELOC provides flexibility, and a cash-out refinance lets you restructure your primary debt while pulling out cash.

How Your Equity Creates More Options When You Sell

The amount of equity you have built up will determine your entire home selling experience. Your financial starting point functions like a launch pad which sets the foundation for your future financial achievements. More equity translates directly into more choices, less stress, and a smoother path to whatever comes next.

Having a healthy amount of equity means you have the cash on hand to cover all the typical selling expenses—things like closing costs, moving trucks, and, of course, paying off the rest of your mortgage.

Your net proceeds consist of the money you’ll keep after paying all required expenses. The money you get after selling your home will become a strong down payment for your next property which will boost your buying power.

Selling with Healthy Equity

You gain control of the situation when you build up a substantial amount of equity. You have the financial cushion to wait for the right offer, handle any pre-listing repairs to boost your sale price, and comfortably cover all the costs involved.

This financial buffer is what makes a smooth sale possible. The equity you have in your home allows you to:

- Pay off the mortgage: Your equity is what clears the remaining loan balance in full.

- Cover closing costs: You’ll have the funds for title fees, transfer taxes, and other transaction costs without scrambling.

- Fund your next down payment: Larger net proceeds mean a more substantial down payment, which can lead to lower monthly payments on your next mortgage.

In short, strong equity gives you control. Your financial decisions will follow your personal goals because you will no longer need to base your choices on financial necessity. If you’re curious how selling costs can affect your final payout, you can learn more by understanding real estate commission.

Selling with Little or Negative Equity

On the flip side, trying to sell with little or no equity is a much tougher situation. The term “underwater” describes a situation where your home’s market value falls below the outstanding balance on your mortgage loan.

The money you get from selling the property might not cover your loan balance and selling expenses. The need to bring your own cash to closing could become necessary for you to be able to walk away.

Your available choices will reduce significantly when your equity level becomes insufficient. The market improvement strategy remains out of reach for people who need to relocate because of work or personal circumstances or financial difficulties.

You need to get creative and explore every possible route. Homeowners who need a fast and certain sale should consider working with cash buyers as their selling option. The process becomes easier through this method because it eliminates the need for repairs and agent fees which makes it a good option when traditional selling methods fail. The objective is to discover the solution which meets your current requirements while safeguarding your financial stability for the long term.

Common Questions About Home Equity

The learning process about real estate equity creates new inquiries about actual property market operations. The following list presents common questions from homeowners which will help you understand how these financial concepts work in your own financial situation.

Think of this as the practical part—clearing up any lingering confusion so you can move forward with confidence.

How Long Does It Take to Build Significant Equity?

Building a substantial amount of equity requires time because it functions as a long-term process. The time required depends on four main variables which include your down payment amount and mortgage duration and additional payments and local market conditions.

The typical borrower who gets a 30-year mortgage at a steady interest rate will see major progress in their loan repayment between 5 and 7 years. The first payments of your mortgage seem unproductive because they primarily go toward interest payments. The portion of your payment which goes toward principal repayment grows as you make more payments on your loan.

Of course, you can definitely speed things up. A bigger down payment gives you a huge head start. A hot real estate market can also do the heavy lifting for you, sometimes creating a surprising amount of equity in just a couple of years.

Can My Home Equity Be Negative?

Absolutely. The terms “underwater” and “upside-down mortgage” describe this situation when your home value drops below your mortgage debt. You owe more on your mortgage than your home is worth in the current market.

This usually happens when the housing market takes a nosedive and property values drop across the board. It can also happen if a homeowner borrows too much against their property with things like home equity loans, pushing their total debt above the home’s value.

Being underwater puts you in a tough spot. The process of selling or refinancing becomes impossible unless you bring cash to the closing table to cover the shortfall.

Equity vs. Net Proceeds: A Key Distinction

Your home equity is the theoretical value you have in your home (Market Value – Mortgage Debt). Your net proceeds are the actual dollars you pocket after selling. Don’t forget to factor in selling costs—like agent commissions, closing costs, and taxes—which can easily eat up 6-10% of the sale price. Your net proceeds will always be less than your total equity.

Should I Use Home Equity to Pay Off Debts?

The process of using your home’s equity to get a loan or HELOC for paying off high-interest debt such as credit cards represents a wise financial strategy. The main draw is swapping a high interest rate for a much lower one, which can save you a bundle and get you out of debt faster.

But there’s a major risk you have to be comfortable with. Your home becomes the security for your debt which was originally unsecured.

What that means is if life throws you a curveball and you can’t make the payments on that new equity loan, you could be at risk of foreclosure. Before you make this move, be honest with yourself about the spending habits that created the debt in the first place. It’s always a good idea to chat with a financial advisor to make sure it’s the right move for you.

Understanding your home equity is one thing; knowing what to do with it is another. The first step toward any home-related financial decision requires understanding your available choices.

The option to sell your home for cash quickly becomes available to you when you explore this method. The company Eagle Cash Buyers offers free home evaluations to all interested sellers. The method provides an easy way to access your equity without dealing with the usual sale process delays and challenges. You can learn more at https://www.eaglecashbuyers.com.