When you’re facing a foreclosure auction, the most critical thing to know is that you still have powerful, actionable options to stop the sale, even at the last minute.The fastest methods to stop a foreclosure auction right away include filing bankruptcy to activate an automatic stay and obtaining a temporary restraining order from the court and making a last-minute postponement deal with your lender.

The legal or procedural roadblock demands a pause which provides you with the necessary time to develop a long-lasting solution. Let’s be clear: time is your most critical asset now.You need to respond immediately.

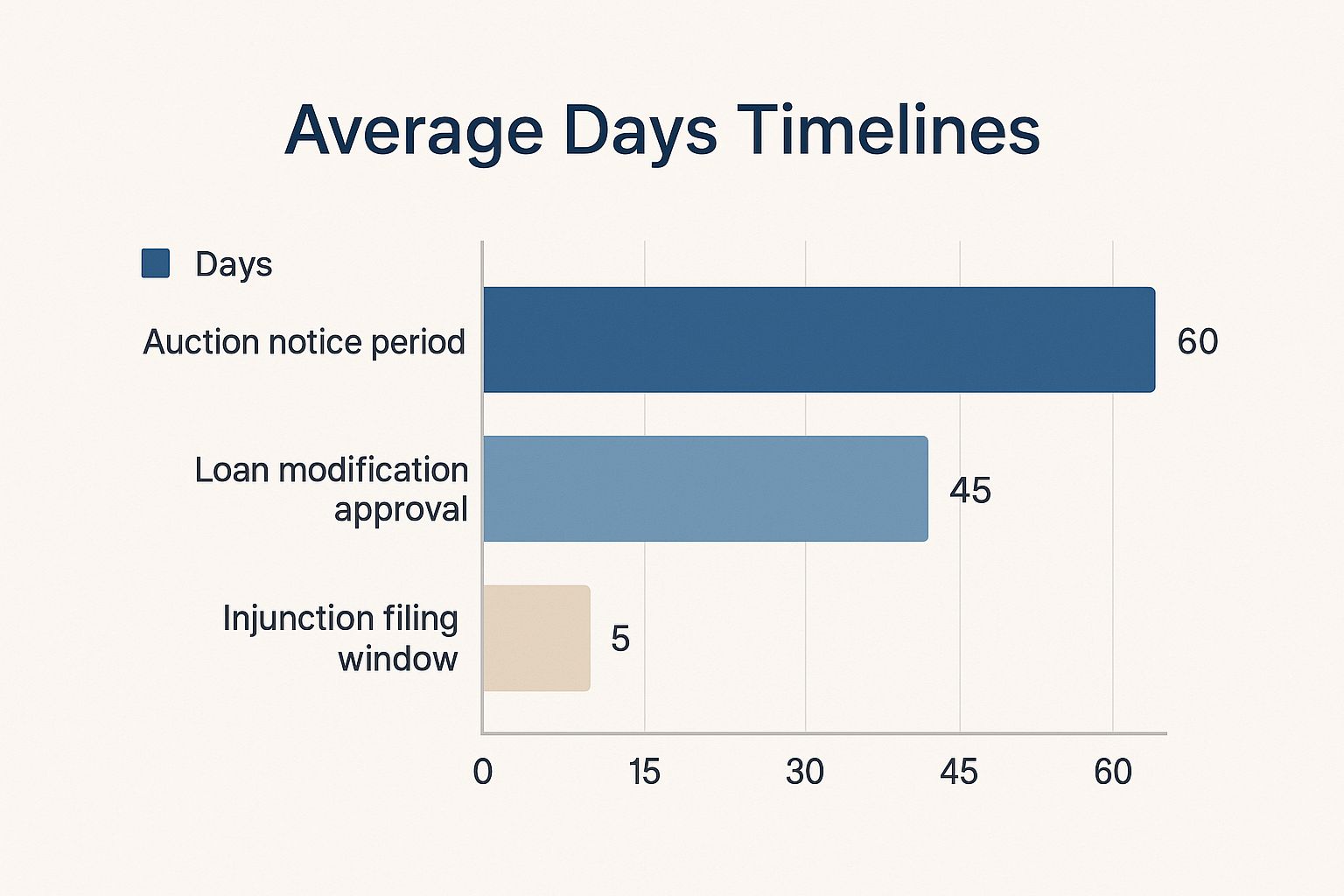

The standard 60-day auction notice period reduces rapidly according to the data. The deadline for filing an injunction usually gives you only five days to act. This is why you must act immediately.

You need to understand your available choices when you have limited time to work with. For a broader look, this comprehensive guide on stopping the foreclosure process can be an invaluable resource.

The Three Paths to Halting an Auction

Time constraints force people to pick the single most important choice which will produce the greatest results. These methods exist as functional home protection techniques which homeowners apply to safeguard their properties during their daily routines.

- Legal Intervention: This means using the court system to your advantage.The most dependable way to stop an auction is through bankruptcy because this process creates an automatic stay which requires lenders to stop the auction.

- Direct Negotiation: Sometimes, the simplest path is picking up the phone and talking to your lender.The property owner will accept a forbearance plan at the last minute which will lead them to postpone the foreclosure sale. It’s always worth a shot.

- Strategic Exit: If keeping the home isn’t feasible, another option is to sell it.The traditional home selling process takes too long so a quick sale becomes essential to stop the auction and resolve your debt while protecting your home equity.

Each of these methods provides a solution to stop the current danger. The website https://www.eaglecashbuyers.com/blog/how-to-delay-foreclosure/ provides multiple strategies to create space which you can discover there.

We will explain the process of accessing these emergency options in the following section.

Comparing Emergency Strategies to Halt a Foreclosure

I will present your immediate choices by showing their speed levels and complexity and their typical results.

| Strategy | How It Stops the Auction | Typical Speed | Best For Homeowners Who… |

|---|---|---|---|

| Bankruptcy Filing | Triggers an immediate “automatic stay” by federal law, legally forcing the lender to stop. | Instantaneous (once filed) | Need a guaranteed, immediate stop and plan to reorganize their debts under court protection. |

| Court Injunction | A judge issues a temporary restraining order based on evidence of lender error or wrongdoing. | 24-48 Hours (requires an emergency hearing) | Have clear proof the lender made a significant mistake in the foreclosure process. |

| Lender Negotiation | The lender voluntarily agrees to postpone the auction, often through a forbearance or loan modification. | 24-72 Hours (depends on lender response) | Have a good reason for their hardship and can propose a realistic repayment plan. |

| Emergency Cash Sale | You sell the home to a cash buyer, paying off the loan balance before the auction occurs. | 3-7 Days (can close very quickly) | Cannot keep the home but want to protect their credit and salvage any remaining equity. |

The table provides an overview of each method’s expected results. The best choice really hinges on your specific financial situation, how much time you have, and whether you ultimately want to keep the house.

The legal system stands as your most effective protective barrier when you face an auction deadline although it creates an intimidating atmosphere. While talking to your lender is always a good idea, a legal filing is a direct, powerful action that can stop a foreclosure in its tracks.Your established rights need protection through existing rules to create extra time for yourself.

The trick is knowing which tool is right for your specific predicament and acting fast.The timing between now and the upcoming foreclosure auction holds vital importance.

Using Bankruptcy’s “Automatic Stay” to Your Advantage

The only method which guarantees a complete stop to foreclosure auctions is filing for bankruptcy according to most experts. The moment your petition is filed with the court, an automatic stay is triggered.The court issues an immediate order which stops the auction from taking place at any time after the order becomes valid.

This stay is a powerful legal injunction.The court order requires all creditors to stop collection activities which includes your mortgage company as well. The auction requires an immediate stop.

Homeowners encounter two distinct bankruptcy choices:

- Chapter 13 Bankruptcy: Think of this as a reorganization.The program operates as a “wage earner’s plan” which enables you to build a repayment schedule for your mortgage arrears within three to five years. The best option for you depends on your current income stability and your willingness to stay in your home.

- Chapter 7 Bankruptcy: This is a “liquidation” bankruptcy.The program lets you remove unsecured debts but it provides only short-term protection for your home. The temporary restraining order stops the foreclosure sale from happening right away but it does not establish a permanent plan to pay off your mortgage debt. The program provides temporary relief but it does not solve the problem permanently.

You need to hire an experienced bankruptcy attorney for professional legal advice because bankruptcy filing creates major financial consequences which harm your credit rating. The professionals will explain the consequences to you while confirming your decision is appropriate. The quickest and most dependable legal tool to use remains this method despite its intricate nature. The process of selling your home during bankruptcy impacts your assets so you need to study this topic through our Chapter 13 bankruptcy home selling guide.

Filing for a Temporary Restraining Order (TRO)

What if you believe your lender has made a serious mistake?A judge might grant you a Temporary Restraining Order (TRO) when you present solid evidence of improper conduct from the other party. A Temporary Restraining Order (TRO) functions as an emergency court order which suspends the foreclosure sale process until you receive your day in court.

The method requires more than just feelings of injustice about the foreclosure process. You need a rock-solid, legally valid reason.

Strong grounds for a TRO often include:

- Major Servicing Errors: You have bank statements or cancelled checks showing your lender misapplied your payments, causing a wrongful default.

- Violations of State Law: Every state has a strict foreclosure process.If your lender failed to provide required notices or violated any specific rules during the process then you have a strong case.

- A Pending Loss Mitigation Application: Under federal law, if you submitted a complete application for a loan modification more than 37 days before the scheduled auction, the lender may be prohibited from going forward until it’s reviewed.

Expert Insight: A TRO lives or dies on the strength of your evidence.The documents together with emails and payment records need to support your claim. This is a complex legal motion, and having an attorney file it for you is almost always essential for it to succeed.

Why Timing and Legal Action Are Everything

These legal tools operate as your final protective barrier to defend your home when all other attempts to preserve it have failed. The numbers demonstrate that homeowners maintain their strength. The United States saw 187,659 foreclosure property filings during the initial six months of a particular year. Many homeowners used these emergency tactics to stop their auctions from proceeding.

The clock stands between you and your choice to file for bankruptcy or seek a Temporary Restraining Order. You need to act fast to collect all necessary documents which include loan statements and lender communication and income proof and any evidence of wrongdoing. Find a good attorney, lay out your situation, and be ready to act decisively.

Negotiating With Your Lender for a Last-Minute Reprieve

It might feel like a long shot, but your lender often wants to avoid a foreclosure auction just as much as you do.Banks face significant troubles with auctions because they cost a lot of money and take a long time to complete and banks do not get back the full amount they lent out. The shared desire to avoid the auction block stands as your strongest bargaining power.

This isn’t about pleading for mercy.The focus lies in creating a business argument. Your task is to demonstrate to them that partnering with you provides better financial value than attempting to sell their property at a courthouse auction. The key is to act fast and be professional, even when you’re under an incredible amount of stress.

Opening a Productive Dialogue Under Pressure

The initial phone call serves as the foundation for your upcoming auction deadline. You need to be prepared, direct, and ready to propose a real solution.Give your problems explanation but also deliver a plan during your phone call.

Your initial outreach needs to hit three key points right away:

- Your name, loan number, and property address.

- Your direct request to postpone the scheduled auction.

- A brief, honest reason for the hardship and an outline of your proposed solution.

You need to send a formal request to delay the auction date which starts on [Date]. The new employment opportunity that I have accepted will begin next month and I can provide the offer letter as evidence. I’d like to apply for a forbearance agreement to cover this gap.

Pro Tip: Never, ever rely on a verbal promise.If someone promises to postpone the sale during a phone call then you should wait for written confirmation before considering it final. A verbal “okay” won’t stop the auctioneer’s gavel from falling.

Leveraging Loss Mitigation Applications

The main tool you possess exists in the form of a formal loss mitigation application. The document holds binding legal power in addition to being standard paperwork. The federal law requires lenders to stop the auction process when you submit a complete application more than 37 days before the scheduled sale date.

The application shows your commitment to resolve the problem even when you handle it within the 37-day timeframe. This is your formal request for an alternative to foreclosure.

Here are the most common options you’ll be applying for:

- Loan Modification: This permanently restructures your loan to make the payments affordable, maybe by lowering the interest rate or extending the term.

- Forbearance: This is a temporary pause.The program provides short-term financial relief through payment suspension or reduction which helps you recover from brief financial difficulties.

- Repayment Plan: The repayment plan enables you to pay off your missed bills by spreading out the overdue amount across your regular monthly payments during a specific time frame.

The application needs backing from solid evidence. A hardship letter together with new income proof and medical bills collection can lead to success. Our complete guide will show you various methods to stop foreclosure.

What to Do When You Hit a Roadblock

The first person who tells you no should not end your call. Ask to speak to a supervisor or someone in the dedicated loss mitigation department.The employees have more decision-making power than customer service representatives because they can make choices that representatives cannot.

Maintain your persistence but continue to use polite language. Every time you call, write down the date, time, and the name of the person you spoke with.The log will function as important evidence when you need to prove your efforts to resolve the problem.

And remember, you’re not alone in this.The government supports various programs which work to stop foreclosure proceedings. Fannie Mae and Freddie Mac have prevented 60,592 foreclosures through their modification programs during the last quarter. The programs have delivered more than 7.1 million foreclosure prevention services which shows their effectiveness for thousands of families.

The negotiation process does not guarantee success. You need to seek alternative solutions because the lender has shown no progress and the auction date nears. Exploring every possible route becomes essential when you need to stop the auction because your financial security depends on it.

Finding Last-Resort Financial Solutions

https://www.youtube.com/embed/r1jZbB5FD5A

The legal process together with lender negotiations may lead you to face a difficult situation. The only way to prevent an upcoming foreclosure auction usually requires a single lump sum payment of cash. Emergency financial resources need to be discovered when you have a plan to restore your loan but lack the necessary funds.

Be warned, though.The path ahead requires you to evaluate every option before making any decisions. These aren’t long-term fixes; they’re last-ditch efforts to get the capital needed to pay off the lender and halt the sale.You make a choice to exchange your upcoming financial responsibility for immediate relief but you need to understand the risks before proceeding. With the clock ticking, you need to know your options, and you need to know them now.

Tapping into Your Own Assets and Resources

The starting point for outside help requests must begin with your current environment. Most homeowners start their asset evaluation by looking at their current possessions and existing relationships. These methods provide quick access to money but they usually require your personal belongings and create substantial financial obligations.

Here are a few of the more common financial plays people make when facing a foreclosure deadline:

- Borrowing from a 401(k): Many retirement plans let you borrow against your savings.The main advantage of this method comes from its speed because you borrow from your own funds which results in a fast approval process. The downside? It can absolutely cripple your retirement savings.The loan becomes fully payable right away if you lose your job because this situation would replace your current financial troubles with a new crisis.

- Getting Help from Family: A loan or even a gift from a family member can feel like a godsend.The platform provides zero interest rates and flexible payment options which banks do not offer. The risk, however, is the immense strain it can put on your relationships if you can’t pay it back as promised.

- Securing a Hard Money Loan:These are short-term, high-interest loans from private investors, secured by your property.The short approval process of hard money loans makes them faster than traditional bank loans but they carry high interest rates and additional costs. Think of a hard money loan as a temporary bridge, not a sustainable solution.

A Word of Caution: I can’t stress this enough—each of these paths is incredibly risky.A hard money loan can create an ongoing debt cycle that threatens your financial stability and raiding your 401(k) savings threatens your financial security. Always weigh the real cost of saving your home against the long-term damage these options might cause.

Exploring Your Right of Redemption

Even if the auction goes through, some states offer one final, powerful safety net: the statutory right of redemption.The law exists only in particular states and it provides homeowners with an opportunity to reclaim their property after the foreclosure sale has taken place.

The law establishes a specific time frame during which you can reclaim your property as the original owner. This period typically ranges from several months up to twelve months. To complete the process you need to pay the auction winner the full price along with all related expenses and interest charges. The tool provides excellent value but only to individuals who can obtain substantial financing after their purchase.

To see if this is an option for you:

- Do a quick search: Google “[Your State] statutory right of redemption foreclosure.”

- Talk to a pro: A local real estate or foreclosure attorney will give you the most accurate information on your rights and the specific timeline you’d be working with.

The right to contest foreclosure holds significant value for you. The strategy provides you with a backup plan which can influence your entire approach even when you cannot prevent the auction from happening. The process needs you to have a large sum of money accessible in a short time frame.

When the Numbers Don’t Add Up, Consider a Quick Sale

The best solution to handle these dangerous financial moves requires you to take control in a different way. The best solution when you cannot obtain last-minute financing is to sell your home straight away.

This approach isn’t about giving up; it’s about preventing the absolute worst-case scenario.A foreclosure sale would destroy your credit rating for many years while making you lose all your property rights. By selling to a cash buyer, you can often close the sale in just a few days.

The funds you receive will help you pay off your mortgage debt and prevent foreclosure while safeguarding your credit rating. You might even be able to walk away with your remaining equity.Eagle Quick For Cash provides a solution for homeowners who need urgent cash during challenging times. The program provides a complete solution which allows you to start fresh with your finances.

Selling Your Home Quickly to Avoid Foreclosure

The house becomes unavailable for keeping when foreclosure auction proceedings start. The auction process stops immediately when you sell your property because this method protects your credit score and gives you back total control of your finances. The situation appears to be a defeat yet it shows you have control over a situation which seems to be getting worse. You choose to handle your debt repayment through methods that work best for you.

A traditional home sale, with its open houses, lengthy negotiations, and even longer closing periods, just won’t cut it when the clock is ticking.Selling your home quickly becomes the most strategic choice when time is of the essence.

The Power of a Strategic Exit

The decision to sell your home fast gives you back control of your situation. The bank conducts the auction process at its own pace but you get to decide when to start the process. The method allows you to escape debt while keeping your dignity intact and protecting your remaining equity which auctions typically do not offer.

The primary benefit of this approach exists in its ability to provide certainty. An auction is a total gamble where your home could sell for a fraction of its worth.The quick sale process provides a definite price which you can use to settle your mortgage debt and move forward with your life.

How a Cash Home Sale Works

The home selling process becomes quick when you sell to cash buyers. These companies are in the business of buying properties fast, cutting through all the typical red tape you’d find in a traditional real estate deal.

The process is refreshingly straightforward:

- You get in touch with a cash buyer and give them the basic details about your property.

- The company will evaluate your property through an online process which usually leads to a cash offer within 24 hours.

- If you like the offer, you can close in as little as a week. The company handles the paperwork, and you get the money.

The tool provides the exact speed you require to stop a foreclosure auction from happening. The proceeds from the sale will settle your complete mortgage debt before the auctioneer begins the bidding process. A good way to understand this market is to see it from the other side; learning about how to find distressed properties for investing shows you exactly what these buyers are looking for.

Finding a Trustworthy Cash Buyer

Research is essential before you start working with cash home buyers because they all function differently.

When you’re vetting companies, look for these green flags:

- A Proven Track Record: You want a company with a solid history and good customer reviews.Your business should maintain an A+ rating from the Better Business Bureau as this rating shows your business has high credibility.

- No Hidden Fees or Obligations: A legitimate buyer will never charge you for an offer or pressure you into accepting it.The offer should be free, with no strings attached.

- Total Transparency: The entire process should be crystal clear.Your contact person must explain all their steps completely while answering every question you might have.

Key Takeaway: A fast cash sale empowers you to resolve your mortgage debt, stop the auction, and potentially walk away with your equity.The single proactive step you take today will protect your credit from the long-term damage that foreclosure causes.

If this sounds like the right path for you, companies like Eagle Quick For Cash can provide a fair offer and help you close before the auction.You can get a better sense of the process by reading our guide on https://www.eaglecashbuyers.com/blog/how-to-sell-my-house-fast-for-cash/

Answering Your Urgent Foreclosure Questions

When you’re fighting the clock, you need clear, direct answers.The upcoming foreclosure auction demands immediate answers to urgent questions while vague answers prove worthless. The following discussion will address the most vital issues which homeowners face when their sale is about to happen within the next few days or hours.

How Late Can I File Bankruptcy to Stop an Auction?

You may file for bankruptcy at any time up until the auctioneer hits the gavel during the auction. The court will immediately stop the foreclosure sale when your petition enters the court system because the “automatic stay” takes effect at that moment.

But let me be clear: this is a razor’s edge strategy.The last possible moment to wait eliminates all chances for mistakes. A much safer approach is to file at least one or two business days beforehand.This process allows the court to handle your case while your lender receives proof that you have been served.

If you delay the process until the last minute and any issue arises such as a delayed court clerk or missing email to the lender’s attorney then the sale might proceed without your knowledge. The illegal recording develops into a complicated legal situation which becomes extremely costly to resolve after the event.

Will a Loan Modification Stop a Foreclosure for Good?

Yes, a permanent and successful loan modification officially ends the current foreclosure action.The loan modification process requires you to transform your current loan agreement into a new contract which includes updated terms that fit your financial situation better.

The process starts with a trial period. Your payment schedule will follow the new terms for multiple months. The lender will end the foreclosure case after you finish the trial period and sign the final modification documents.

Just remember, this is a fresh start.The lender has the authority to start a new foreclosure process if you fail to meet the new loan terms.

What Is the Difference Between a Short Sale and a Deed-in-Lieu?

The two methods serve to help homeowners avoid foreclosure by giving up their homes but they follow distinct procedures. The best option depends on your particular circumstances because both methods help avoid the severe credit damage that comes with full foreclosure.

-

Short Sale: This is where you sell your house for less than you owe on the mortgage, but only with your lender’s permission.You will need to locate a buyer and reach an agreement before submitting a large amount of documentation to the bank for approval. It’s often a long, uncertain process.

-

Deed-in-Lieu of Foreclosure: This one is much more direct.You voluntarily sign the property’s title (the deed) straight over to the lender.In return, the lender agrees to forgive the mortgage debt.The process moves faster but lenders need the property to be free from any additional liens including second mortgages or unpaid property taxes.

Both options are better than foreclosure, but they still have a significant impact on your credit.The website provides information about mortgage default consequences which you can use to understand the situation better.

Is a Verbal Promise From My Lender Enough to Stop the Sale?

Absolutely not.This is one of the most dangerous and common mistakes a homeowner can make.A verbal assurance from a customer service rep over the phone holds zero legal weight and will not stop a foreclosure auction.

Critical Takeaway: Any agreement to postpone an auction, approve a modification, or accept a payment arrangement must be in writing.

Until you have a signed document or an official email confirmation in your hands, you have to assume the auction is still moving forward.Your trust should not be affected by a casual promise. Continue to explore every possible solution that exists for you.

No matter your situation, you have options.You need to sell your home for cash because it presents a guaranteed solution to stop the auction from happening. The process of selling your home through Eagle Quick For Cash enables you to get a quick cash offer which leads to a fast sale that settles your mortgage debt before the foreclosure auction begins. Visit https://www.eaglecashbuyers.com to get your no-obligation offer today.