The process of handling the marital property and mortgage debt becomes a major obstacle during divorce proceedings. A loan assumption helps solve this problem. The process requires one spouse to accept full responsibility for the mortgage debt by keeping all loan conditions and interest rates at their current levels.

The legal agreement allows one person to stay in the family home while removing the other person’s name from the mortgage. The method helps people prevent complete refinancing which often leads to high expenses when interest rates reach elevated levels.

Understanding A Mortgage Assumption During Divorce

The end of a marriage turns the house into more than physical property because it represents a valuable financial asset which carries substantial mortgage debt. The home remains with the new owner through loan assumption which prevents them from needing to get a new mortgage with expensive borrowing costs.

The process of removing a name from official documents requires more than just erasing a name from the paperwork. The process results in a complete legal and financial transition of ownership.

The spouse who wants to keep the house needs to prove their financial capacity to manage the mortgage payments independently to the lending institution. The lender will examine the applicant’s income and credit score and financial stability to determine their eligibility for single-person borrowing. The process functions as a vital safety measure which protects lenders from default risk while proving the departing spouse has resolved their debt completely.

Why Is This So Popular Right Now?

The increasing mortgage rates during recent years have made loan assumptions more attractive to homebuyers. Think about it: if you secured a mortgage with a 2.8% or 3.2% interest rate a few years ago, the last thing you want to do is refinance into a new loan at 6.5% or higher.

An assumption enables you to maintain your current low interest rate which results in monthly savings of hundreds of dollars that accumulate to tens of thousands across the entire loan duration. Many divorcing couples choose this option because they face financial difficulties.

A loan assumption helps individuals maintain financial stability when their lives become unstable. The agreement locks in an affordable payment plan which protects you from the expensive closing costs and strict lending requirements of new mortgages.

Of course, this isn’t a one-size-fits-all solution. The most straightforward and effective method to separate requires selling the property when both parties lack mortgage qualification and desire a fresh beginning. If you’re planning to sell your home then you must learn about the procedure for selling a property that still needs mortgage payments.

Loan Assumption vs. Refinancing During Divorce

You have two options when you choose which person should keep the house: you can either take over the existing loan or you can get a new loan. The two methods serve the same purpose of removing a spouse’s name from the mortgage but they operate through different procedures.

Here’s a breakdown of how they stack up.

| Feature | Loan Assumption | Refinancing |

|---|---|---|

| Interest Rate | Keeps the original, often lower, interest rate of the existing mortgage. | The new loan establishes fresh interest rates which generally exceed the existing market rates. |

| Closing Costs | Significantly lower. Usually involves a small assumption fee. | The closing costs usually amount to 2-5% of the total loan amount. |

| Loan Terms | The original loan terms (length, payment schedule) remain unchanged. | You receive the ability to select fresh loan conditions because a new loan emerges during this process (for instance, you could opt for a 15-year or 30-year term). |

| Qualification | The spouse who assumes the mortgage needs to prove their financial capability through their personal income and credit record. | The spouse who keeps the home needs to prove their ability to get a new loan which typically requires more stringent qualifications. |

| Equity Payout | May require a separate agreement or loan (like a HELOC) to pay out the other spouse’s equity. | Equity can be paid out directly from the new, larger refinanced loan amount (cash-out refinance). |

| Best For… | The program suits couples who have low-interest rate mortgages because it helps them reduce their housing expenses. | The program assists couples who require funds to pay off their ex-spouse or when their current mortgage agreement does not permit loan assumption. |

Choosing between an assumption and a refinance really comes down to the numbers—your original interest rate versus current rates, the amount of equity you need to divide, and the associated costs. An assumption is often the clear winner in a high-rate environment, but a cash-out refinance provides a more straightforward way to handle the equity buyout.

Can You Qualify to Assume the Mortgage?

The first obstacle appears before you start dreaming about your future in the family home because you need to prove mortgage eligibility for individual ownership. The process of transferring ownership between parties requires more than standard paperwork. Your lender needs to be completely confident that you can handle the full mortgage payment on your own, month after month.

Think of it like applying for a brand-new loan. The bank will examine your financial details to decide if you qualify for mortgage release of your ex-spouse.

What Lenders Look For

The process begins with your lender focusing on essential financial numbers. They need to determine if your independent earnings can handle this debt.

Here’s exactly what they’ll dig into:

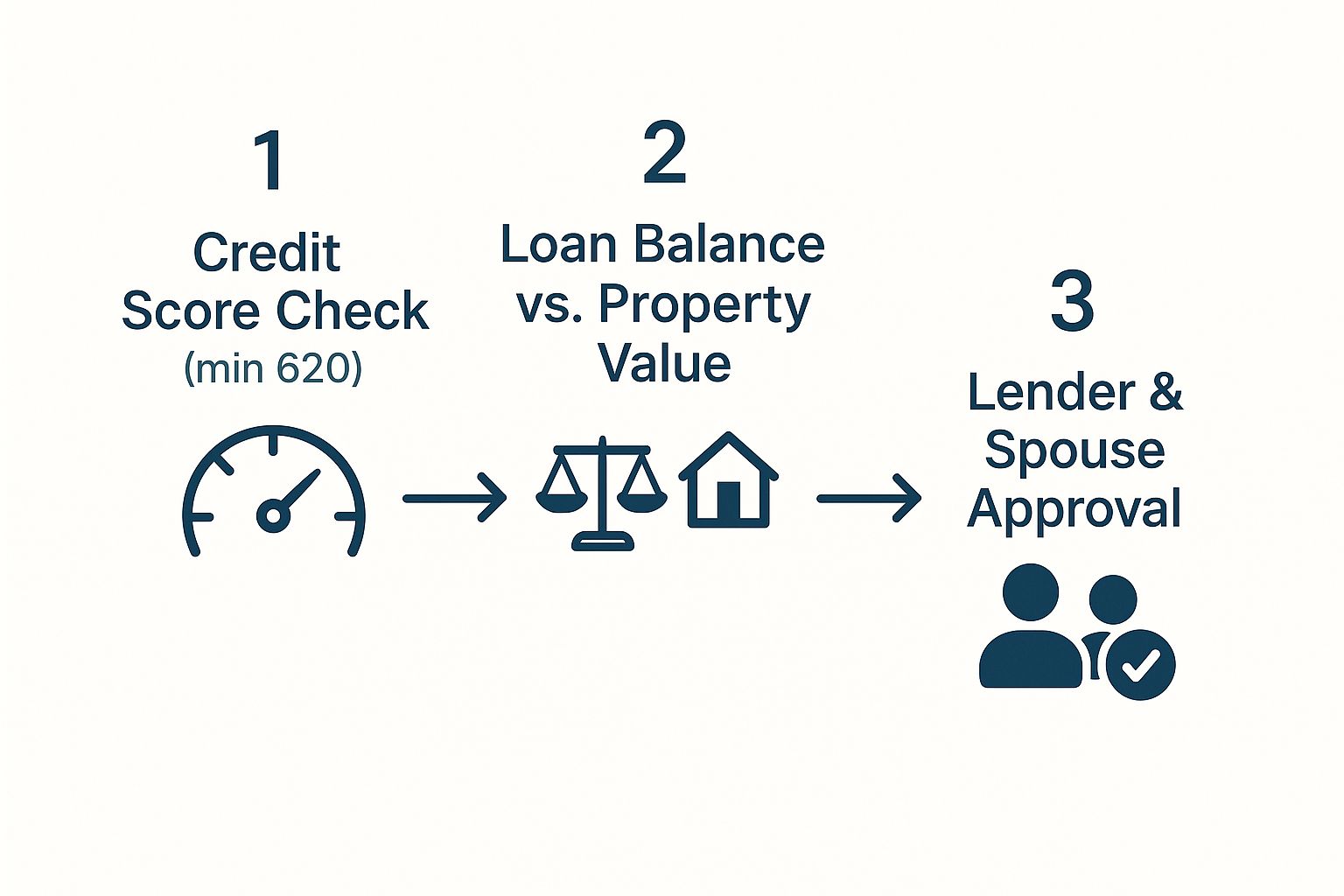

- Credit Score: Your credit score needs to reach at least 620 to get approved by most lenders but having a score above 700 will increase your chances.

- Debt-to-Income (DTI) Ratio: The debt-to-income ratio stands as the most critical factor. Lenders determine your debt-to-income ratio by adding all your monthly debts including car loans and credit cards and mortgage payments then dividing that amount by your total gross monthly earnings. The number should remain under 43% according to the ideal standard.

- Consistent Income History: Lenders require proof of steady financial history. You must show proof of steady income by submitting documents which include two years of employment records and current pay statements and tax documents. A spouse who works in a W-2 position will usually find it easier to qualify than someone who recently started working for themselves.

Assumable vs. Non-Assumable Loans

The first essential detail to understand is that not every mortgage qualifies for assumption. The eligibility of this option depends on the type of loan you possess.

The good news is that government-backed loans are typically assumable. The bucket contains the following loan programs:

- FHA Loans (Federal Housing Administration)

- VA Loans (Department of Veterans Affairs)

- USDA Loans (U.S. Department of Agriculture)

The story is different for most conventional loans. The mortgages which lack government backing usually have a “due-on-sale” clause in their terms. The clause requires complete payment of the loan when the property undergoes any sale or transfer process. The system exists to stop people from making assumptions. The original mortgage agreement serves as the key document which determines divorce-related mortgage responsibilities.

The Bottom Line: Your loan type is the first and most critical piece of the puzzle. Your conventional loan contains a rigid due-on-sale clause which makes loan assumption impossible. You will need to explore different options because loan assumption stands as your only available solution.

This is more important now than ever. The current mortgage rates exceed 7 percent which makes refinancing unfeasible for most borrowers because rates were below 3 percent during the previous few years. It’s just too expensive. A successful loan assumption allows you to maintain your first interest rate from the original loan agreement while receiving a lower monthly payment amount. As you can read on lynchowens.com, interest rates generate major difficulties for people who divorce. The huge financial advantage you have makes eligibility determination your first step.

How to Navigate the Loan Assumption Process

Your mortgage becomes assumable so you have made a choice to use this method in your divorce settlement. The actual work begins at this point. The process requires more than just filling out a form because every piece of information needs to be accurate. Think of it as applying for the loan all over again, but this time, you’re on your own.

Start by finding your original mortgage contract. You’re looking for the specific clause that officially states the loan is assumable. Your next step requires you to contact your lender’s assumption department by phone. Be ready to clearly explain your situation—that you’re divorcing and, as part of the settlement, you’ll be taking over the mortgage solo.

Kicking Off the Application With Your Lender

When you contact the lender you need to request their “assumption package.” The document serves as your guide which details all the information and documents they require from you. Getting this right from the start will save you from dealing with numerous delays. The lender manages multiple cases so an organized loan package will receive faster approval than an unorganized one.

The process will examine your financial situation in the same way they would any other new loan applicant. This is why having your financial house in order is absolutely critical. The lender requires proof that your income will cover the loan payments without assistance.

Your financial stability determines the outcome. The lender will examine your financial situation to decide if you are able to handle the loan repayment. After that, they’ll look at the property’s value and the legal agreements solidifying the transfer.

Getting Your Paperwork in Order

The entire process requires the application package as its core element. The main cause of delayed assumptions according to my experience is poor organizational skills. The lender needs to see your complete financial information in order to approve the transfer and protect your ex-spouse from future financial obligations.

To get a clearer picture, here’s a breakdown of the typical documents you’ll need to pull together for your lender.

Essential Documents for a Loan Assumption Application

| Document Type | Purpose | Key Details to Include |

|---|---|---|

| Fully Executed Divorce Decree | Official proof that the court has awarded you the property. | The court needs to finalize the decree through a judge’s signature which must explicitly state that you bear responsibility for the mortgage. |

| Assumption Agreement | The form serves to transfer ownership according to lender requirements. | The legal document requires both you and your ex-spouse to sign it. |

| Proof of Income | Proof of your ability to pay the monthly amount on your own. | You should submit your current pay stubs from the past 30 to 60 days together with your last two W-2 forms and possibly your tax returns. |

| Bank Statements | To show you have sufficient assets and a stable financial history. | The financial institution needs access to your last two or three months of statements for all your checking and savings accounts and investment accounts. |

| Credit Report Authorization | Allows the lender to assess your creditworthiness. | The process requires you to give consent for a hard credit inquiry which will lead to a short-term decline in your credit score. |

The process of collecting these documents seems overwhelming but basic organization methods will help you get through it.

Insider Tip: I always tell my clients to create a dedicated digital folder for the assumption. Save every document you receive through scanning and assign them specific names which should include the date of receipt (for example “June 2024 Pay Stub” or “Final Divorce Decree – Signed”). You can quickly send documents through email attachments instead of wasting time searching through physical paper stacks when the lender requests something.

The waiting period starts immediately after you send your application. The lender’s approval process duration differs between 30 and 90 days depending on their current workload. The borrower needs to maintain their regular mortgage payment schedule during this phase. Any missed payments could derail the entire approval.

The lender will give you approval before you can proceed with the final legal steps which include signing the release of liability and updating the property deed officially. Our guide about property ownership transfer will help you understand this part of the process better by explaining deeds and title transfers.

What Are Your Other Options for the Marital Home?

The loan assumption divorce strategy helps you keep your low-interest mortgage but you should know there are other alternatives to consider. The best choice depends on your financial situation and emotional readiness and the goals you share with your partner.

The first thing you need to do is evaluate all your options before choosing a plan. Every option has its own pros and cons, and what works beautifully for one divorcing couple might be a complete nightmare for another.

Selling on the Traditional Market

The most common route, by far, is simply selling the home on the open market and splitting the proceeds. The program offers a fresh financial start which proves beneficial during challenging times.

The traditional path will help you get the highest possible price for your property when market conditions are favorable. But be warned: it’s rarely a fast process. The process involves property repairs and home staging and multiple showings until you get the perfect offer. The process requires several months to complete while simultaneously draining your emotional resources.

Considering a Home Equity Buyout

A home equity buyout stands as a valuable alternative. The process requires one spouse to purchase the other spouse’s share of the home’s equity which results in complete ownership of the property.

People often think this requires a refinance, but that’s not always the case. The spouse who remains in the house can use their savings and investments and retirement account shares to compensate their ex-spouse for their share of the property. A buyout is a great way to keep things stable, which is a big deal when kids are involved.

The main hurdle, of course, is having the funds to make it happen. You need to obtain an expert appraisal that remains objective to determine the accurate market value of your property. The right number must be determined because it helps establish an equal buyout value that works for all parties involved.

The house exists as a single component within the complete financial puzzle. Reviewing the entire situation will help you while you work on this task. This financial planning guide for divorcees provides useful strategies to handle your money after a divorce.

When a Fast, Simple Sale Is the Priority

The process of dealing with extended procedures becomes overwhelming for many people. A traditional sale can last for several months but a buyout might not be within your budget. The quick cash sale option becomes very appealing when this situation emerges.

The solution serves couples who want to end their relationship without delays or complications. The process of selling your home to a cash home buyer company eliminates all the standard obstacles which occur during a traditional home sale. The process with Eagle Quick For Cash is simple and straightforward:

- No Repairs Needed: You sell the house completely as-is. No need to spend a dime or a weekend on updates.

- No Showings: Forget about the stress and inconvenience of having strangers traipse through your home.

- A Fast Closing: The entire sale can often be wrapped up in a matter of weeks, not months.

The path gives you fast access to cash which helps you move on from the property along with your ex-spouse. The decision makes sense when other choices appear to be too difficult.

Legal Steps You Absolutely Cannot Skip

The mortgage assumption process becomes simpler when your lender grants their approval but you need to wait before you start celebrating. The next stage of the process requires legal documentation to establish financial separation which safeguards both parties from future financial complications.

The lender’s approval process functions as the first stage in the deal but legal documents establish the final binding agreement. The last essential steps require proper attention because neglecting them will create financial problems which become challenging to resolve in the future.

The entire process depends on two essential legal documents which include the quitclaim deed and the release of liability. These aren’t just suggestions; they are the non-negotiable final steps to make sure the house and the debt are properly and legally transferred.

The Role of the Quitclaim Deed

First up is the quitclaim deed. Property ownership transfers from one person to another through this legal document. Your ex-spouse will give up their ownership rights to the property when they sign this document.

Once recorded with your county recorder’s office the deed becomes part of the public record. The legal procedure enables you to transfer property ownership to another individual. But here’s a critical distinction to remember: a quitclaim deed only handles ownership. The mortgage debt will stay on the mortgage debt even after divorce decree issuance.

Why the Release of Liability Is Everything

The Release of Liability stands as the vital document which the departing spouse must receive according to my personal perspective. The document provides official proof from your mortgage lender that your ex-spouse has been removed from mortgage loan responsibility.

Once this document is signed the lender has the right to seek repayment from you alone. Without this release, even with a quitclaim deed filed, your ex is still legally tied to the mortgage. If you miss a payment down the road, the lender can—and will—go after them, and their credit score will get hammered right along with yours.

Securing a signed Release of Liability is the final checkpoint in a successful loan assumption divorce. The document serves as the only legal proof which establishes the financial link between the departing spouse and the mortgage debt.

The risks of failing to get this release are enormous. The unresolved joint mortgage will prevent your ex from obtaining new home financing and their credit score will stay damaged for an extended period. The high expenses of divorce make loan assumption a beneficial choice to maintain your low-interest rate but only when you properly remove your ex-spouse from all financial responsibilities. For a wider view on this topic, you can find more information about the financial dynamics of divorce rates on annaklaw.com.

Your divorce decree needs to explicitly state that the spouse who receives the home must obtain this release. Our guide about house departure during divorce will help you navigate these legal obstacles. My best advice? Consult an experienced family law attorney who will safeguard your case details to prevent any potential financial problems in the future.

Common Questions About Divorce and Loan Assumption

The process of loan assumption divorce leads to several specific practical matters which require answers. The process becomes overwhelming because small factors create challenges which affect the entire process despite having a solid plan. Let’s tackle some of the most common concerns I hear from people in this situation.

What Happens If My Lender Denies the Assumption?

A lender denial will deliver a hard blow to your heart but it does not indicate that the path ahead has closed. A lender will typically reject an assumption request when the spouse attempting to assume the loan does not fulfill the lender’s individual income and credit requirements.

Your initial action should be to ask the lender for their denial explanation and make sure to get it documented in writing. Knowing why they said no is critical.

Your next actions will become evident when you get that information:

- Try Again Later: If the issue was a credit score that was a little too low or a debt-to-income ratio that was too high, you can spend some time shoring up your finances. Make sure you pay off debt and keep all your payments current before applying again.

- Pivot to Plan B: The reason why having a backup plan in your divorce decree is so important. The assumption process would require you to consider selling the home or exploring different financing options for an equity buyout.

How Long Does This Process Usually Take?

You’ll need a healthy dose of patience here. The processing time for lenders varies between 30 and 90 days after you submit your complete application. Think of it this way: the lender is essentially underwriting you as a brand new borrower, and that’s not an overnight process.

The biggest culprit for delays? Missing documents. The system encounters delays because of minor issues that occur in most cases. The best way to keep the gears turning is to be incredibly organized and respond to your lender’s requests right away. Don’t wait until the last minute to get started on this; kick off the process as soon as you have your finalized divorce agreement in hand.

An assumption isn’t just a signature on a form; it’s a comprehensive financial review. The process requires lenders to verify your financial capacity for loan repayment through a verification system which needs appropriate time to work effectively.

Will a Loan Assumption Affect My Credit Score?

Yes, absolutely. The final agreement will create long-term effects which will affect both parties in most situations.

For the spouse who’s keeping the house, the mortgage will now report only to their credit file. The payments need to remain current because this will help establish a strong credit history which will enable you to handle your finances independently.

The spouse who moves out will experience the most severe effects. When the lender gives you the official Release of Liability your entire mortgage debt will be deleted from your credit report. The process will decrease their debt-to-income ratio which results in better credit scores and improved loan approval chances.

When you work through the financial aspects of your separation you should also study the complete tax effects of divorce because your property management decisions will impact your tax situation. The house sale process during divorce becomes more complicated when an assumption exists but our complete guide explains everything you need to know.

The process of handling marital property during divorce requires multiple options for consideration with loan assumption standing as just one of them. Each path—from assuming the loan to a traditional sale or a quick cash sale—has its own benefits. The quick cash sale option from Eagle Cash Buyers provides a straightforward solution when you need to sell your property quickly. We buy houses as-is for cash, allowing you to close on your timeline and move forward without the stress of repairs or showings. The website https://www.eaglecashbuyers.com provides a free cash offer service that allows you to check if this option suits your requirements.