Probate property sales need court supervision to proceed with the sale of properties inherited after someone passes away. The process exists to settle outstanding debts of the deceased person while distributing their remaining property to their legitimate beneficiaries. A probate sale operates under judicial oversight which makes it distinct from regular home sales because it follows specific rules and procedures that must be completed within defined timeframes.

You need to identify your choices before you can proceed with this process. The property can be sold through three main methods which include listing with a real estate agent or auctioning or selling to a cash home buyer for quick and guaranteed results. The two educational routes offer unique advantages which match different educational goals.

Unpacking the Probate Property Sale

So, what exactly is probate? The court oversees the process of creating an official inventory of all assets that the deceased person owned. The sale of a house that belongs to an estate requires following the proper legal process.

The main goal here is to turn the property into cash in a way that’s transparent and fair to everyone involved. The money from the sale doesn’t go straight to the family. The remaining funds are used to settle outstanding debts which include mortgages as well as taxes and final medical expenses. The remaining funds after paying these debts will go to the beneficiaries according to the will or state law.

The Key Players in a Probate Sale

A regular home sale usually just involves a buyer and a seller. A probate sale requires additional participants who perform specific duties according to the law. The process begins with understanding who is involved.

You’ll be dealing with:

- The Executor or Personal Representative: This is the person in the driver’s seat. The court appoints a family member who is named in the will to serve as the official estate manager. The team manages all aspects of home preparation for sale as well as the closing paperwork process.

- The Probate Court: The court is the ultimate supervisor. Every stage of the sale process needs to follow state law requirements which begin with listing price approval and end with final sale authorization. The oversight protects creditors and heirs from harm.

- The Beneficiaries or Heirs: These are the people legally entitled to inherit from the estate. The entire process exists to safeguard their rights although they do not directly handle the sale. The net proceeds will be distributed to these beneficiaries after the estate’s debts have been paid off.

A probate sale involves more than just selling real estate because it requires following particular legal steps. The court introduces additional rules and timeframes which extend the duration of probate sales compared to regular transactions because of its involvement.

Before a probate property can even be listed, understanding the comprehensive home appraisal process is crucial for setting a fair market value—something the court almost always requires. The probate sales process includes various steps which differentiate it from selling inherited property through non-probate methods. The goal of this organized method exists to reach a last determination about the financial matters of someone who has died.

A Step-by-Step Guide Through the Probate Process

The entire process becomes difficult to handle when you get assigned to sell a house that is in probate. The process functions under court supervision but you should not feel intimidated by it. The path resembles a well-marked trail rather than a maze. The process becomes easier to navigate when you understand each step which helps you meet all legal requirements.

The process starts with the initial court filing and continues until the funds reach their intended recipients.

Stage 1: Filing the Petition and Notifying Heirs

The court begins your official probate procedure when you submit your petition to the probate court. The probate process requires you to start at the county where the deceased person maintained their residence. The document functions as an official application to start the estate probate process while designating an executor when a will exists or an administrator when no will exists.

The law requires that all potential heirs and beneficiaries receive official notification after the petition is filed. The notification process stands as an essential step to maintain transparency which helps prevent future legal disputes by informing all parties involved.

Stage 2: The Court Appoints an Executor

The court will schedule a hearing after all parties have been notified. The judge will make an official appointment of the executor or administrator after all paperwork is complete and no objections have been raised.

This is a huge milestone. The court will issue a document—often called Letters Testamentary or Letters of Administration—which is the golden ticket. The document serves as legal proof which enables you to handle estate matters. The absence of this document prevents you from accessing bank accounts and selling the house and paying off debts.

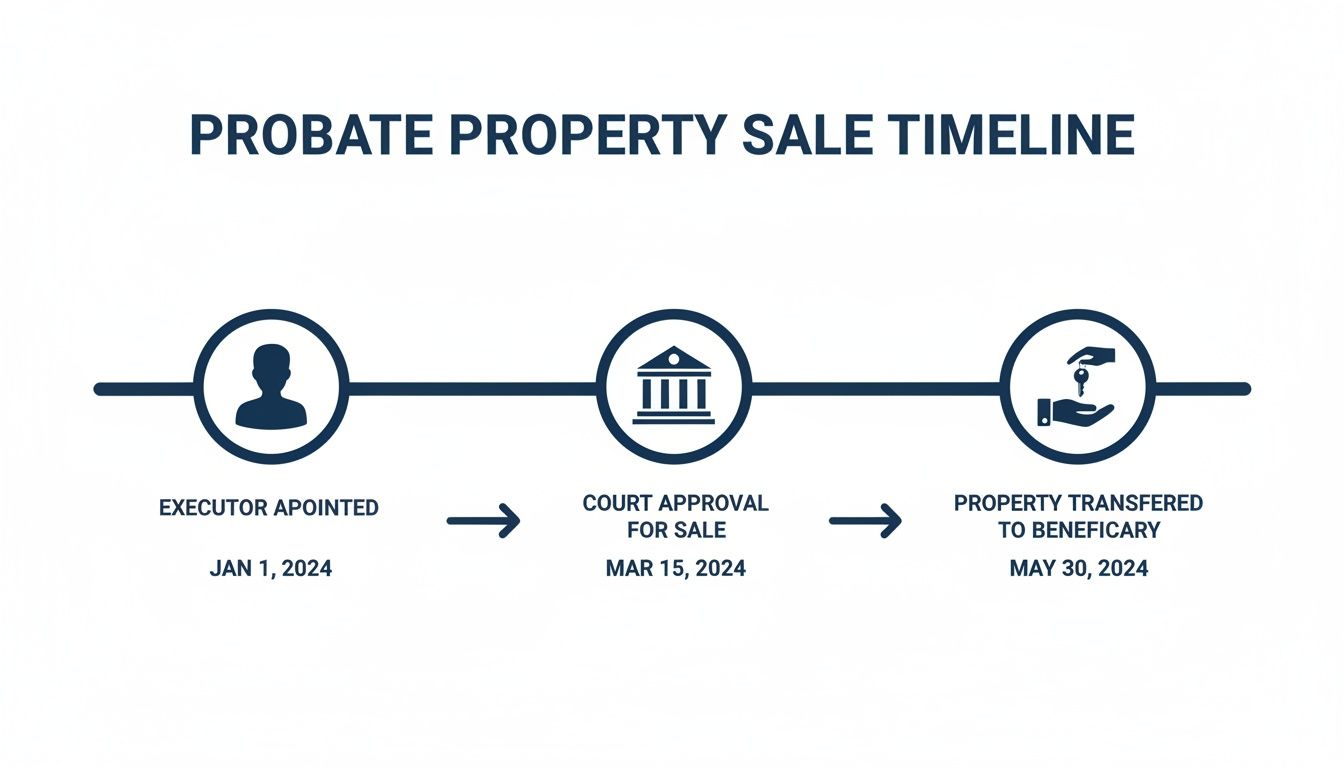

The timeline below shows you how these stages connect from your appointment to the final property transfer.

The process consists of multiple legal and administrative stages which need to be finished in sequence before moving to the next stage.

Stage 3: Inventorying Assets and Paying Debts

You must begin your work after you obtain legal authority. You need to start by listing every asset that the estate contains. The estate includes all property such as the house and bank accounts and cars and valuable personal belongings. The court needs a professional appraisal to determine the market value of real estate for its purposes.

You must identify all outstanding debts that belong to the estate. The notification process involves sending alerts to known creditors while posting a notice in a local newspaper to reach any unidentified creditors. The estate’s funds must be used to pay all valid debts as well as taxes and final expenses. The law requires you to pay your debts before you can give any money to your heirs.

The timeline below shows the typical probate process stages with estimated timeframes for each stage.

| Stage | Description | Estimated Timeline |

|---|---|---|

| Petition Filing & Executor Appointment | The initial court filing to open the estate and legally appoint the executor. | 1–2 months |

| Asset Inventory & Appraisal | The executor catalogs all estate assets and obtains a formal appraisal for the property. | 2–4 months |

| Creditor Notification & Debt Payment | Notifying creditors and settling all outstanding debts, taxes, and estate expenses. | 4–6 months |

| Property Sale & Court Confirmation | Marketing and selling the property, which may require court approval and an overbidding process. | 3–6 months |

| Final Accounting & Distribution | The executor submits a final report to the court, distributes remaining assets to heirs, and formally closes the estate. | 1–3 months |

Keep in mind that these timeframes are just estimates. A simple, uncontested estate might move faster, while a complex one with disputes could take significantly longer.

Stage 4: Selling the Property Under Court Supervision

You can now concentrate on house sales after your debts have been resolved. Your specific actions will depend on the level of authority that the court has given you. The “full authority” status enables executors to sell property through standard sales. The court needs to approve all major decisions that include setting the list price and accepting offers.

A court-confirmed sale is a unique beast. The public auction process allows other buyers to place higher bids than your accepted offer during the courtroom hearing. The goal is to ensure the estate gets the absolute best price for the asset.

The process differs dramatically from what buyers experience when they buy a home through regular real estate transactions. The judicial process forces probate properties in the United States to sell at prices that are 10-20% lower than market value. The average probate sale process takes between 9 and 12 months to complete because of major delays. The market exists in a particular way because many of these homes are sold without any repairs being done.

Stage 5: Closing the Estate and Distributing Proceeds

The last step of the process begins after the sale has closed and the money has been deposited into the estate’s account. The executor needs to submit a complete final accounting report to the court as their last duty. The report shows all incoming funds as well as all paid bills and specifies how the remaining money will be split between the beneficiaries.

The judge will approve your accounting before you can distribute the net proceeds to the heirs who are entitled to receive it. The last step of estate administration requires you to submit a final petition which will close the estate. The tasks assigned to you have been completed.

Our guide about selling probate houses fast provides additional practical advice for anyone who wants to explore this subject more deeply.

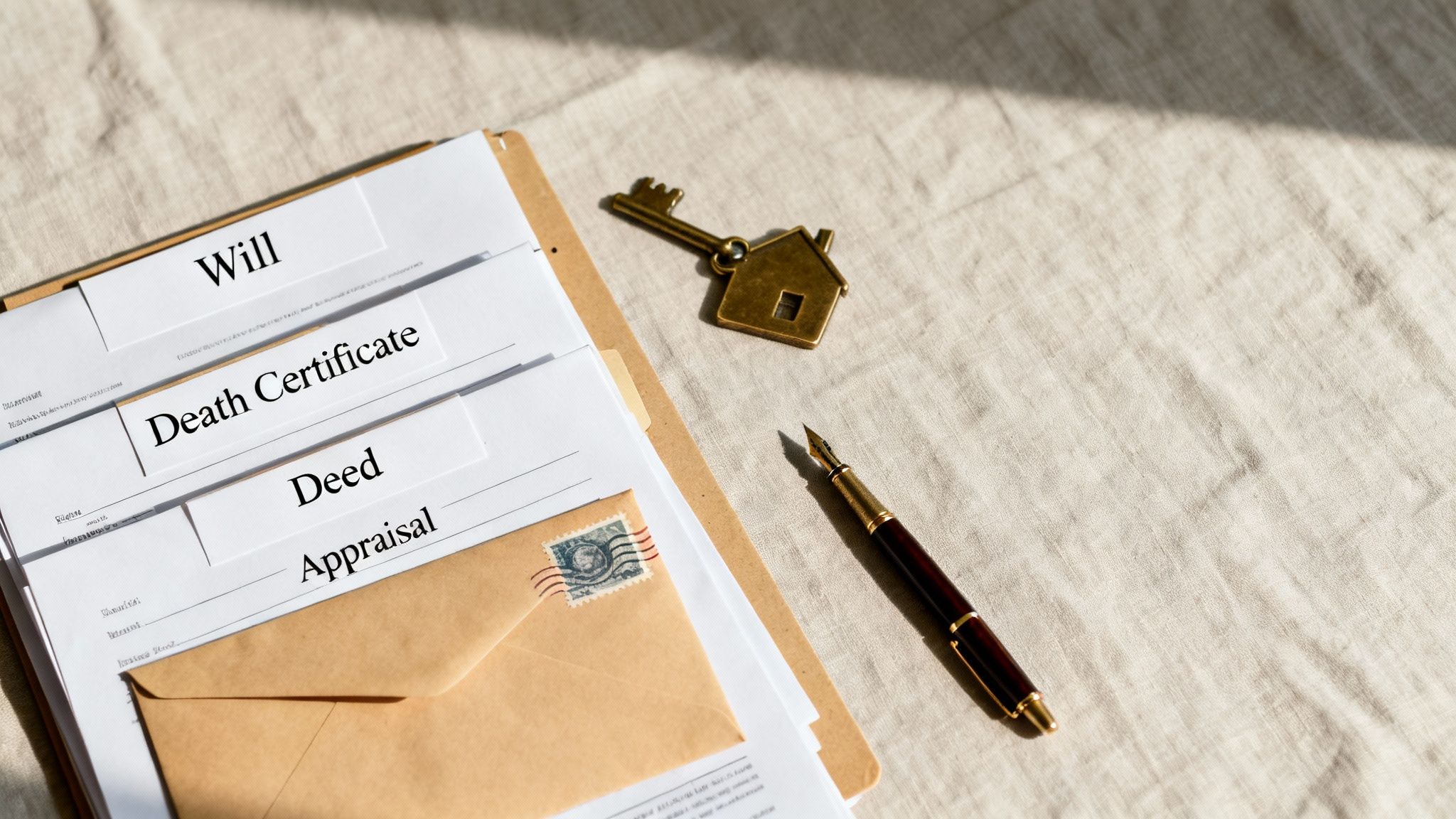

Gathering Your Essential Legal Documents

The process of selling a probate property feels like solving a complex puzzle because the legal documents play a crucial role. The entire process will come to a halt if you miss even a single piece. The best way to achieve a smooth sale process starts with getting your documents organized properly from the beginning.

The court requires a complete paper record to perform its duties effectively. Every document serves a particular purpose because some documents prove the owner’s death while others establish your legal authority to sign contracts.

Your Core Document Checklist

Before you can even think about listing the house, you’ll need to track down a few critical documents. The following documents represent the essential list of probate requirements which serve as the fundamental set for all probate cases:

-

Certified Death Certificate: This is the official starting gun. The court along with lenders and title companies require certified copies instead of photocopies to establish legal recognition of the owner’s death.

-

The Original Last Will and Testament: If there’s a will, it’s the instruction manual for handling the estate. The document contains the deceased person’s chosen executor and their detailed plans for handling their property.

-

Letters Testamentary or Letters of Administration: Honestly, this might be the most powerful piece of paper in the whole process. The probate court issues this official document to grant legal authority to the executor or administrator for estate management. The absence of this document prevents you from listing the property and signing sales contracts and transferring the title. We cover this in more detail in our guide on how to transfer property ownership.

Property-Specific Paperwork

The next set of documents becomes essential after you establish legal authority to proceed with the house matter. These documents serve as essential elements to determine pricing and create marketing materials and finalize property sales.

The process of gathering documents right now will prevent you from having to deal with major problems down the road. The last-minute rush creates the worst situation because it makes buyers nervous and causes court delays.

Maintaining your documents in perfect order goes beyond organization because it represents a legal requirement. The probate sale will experience delays that can last for weeks or even months because of missing deeds and outdated appraisal reports. The delay leads to higher carrying costs and creates stress during the time when you have the least capacity to handle it.

You need to start collecting the following documents:

- The Property Deed: This is the legal instrument that proves the deceased was the home’s rightful owner.

- Recent Appraisal Report: The court almost always requires a formal appraisal to determine the property’s fair market value as of the date of death.

- Mortgage Statements and Loan Information: You need a clear picture of any outstanding mortgage balance or other liens attached to the property.

- Property Tax Statements and Utility Bills: These are essential for settling all the estate’s final accounts and correctly prorating costs at closing.

Probate property sales represent a major portion of the real estate market yet they typically take longer to complete than standard transactions. The legal challenges and fees which amount to $20,000-$50,000 in major markets lead these homes to sell at a 5-15% discount. An organized documented process functions as an essential defense system to protect the total worth of the estate. The estate achieves its best potential sale results when all documents are properly prepared.

Comparing Your Property Selling Options

The court will allow you to proceed with selling the property once you receive their approval. Your choice of selling method will determine the entire process outcome because it affects both the sale price and the speed of inheritance distribution and your level of stress as an executor.

There’s no magic formula here. The “best” choice really depends on what the estate needs most. Are you chasing top dollar, even if it takes a while? Or is a fast, clean, no-fuss sale the top priority? Let’s break down the three main paths you can take.

Option 1: Listing with a Real Estate Agent

The first option is the traditional method which most people are familiar with. You hire a real estate agent (ideally one with probate experience) to list the home on the open market, coordinate showings, and negotiate with potential buyers.

The biggest draw is market exposure. A real estate agent who is competent will list your home on the Multiple Listing Service (MLS) which exposes your property to thousands of potential buyers. The competition between buyers will help you get the highest price possible. The opportunity for high returns comes with major risks.

- Timeline: This is usually the slowest path. It takes weeks to prepare the house for sale and then months to find a buyer who will need 30 to 60 days to get mortgage approval before closing becomes possible.

- Costs: You must pay agent commissions that range from 5 to 6 percent of the sale price along with closing costs and potentially need to spend thousands on repairs and updates that modern buyers seek.

- Effort: You’ll be hands-on with getting the home show-ready, dealing with open houses, and wading through offers and negotiations. It’s a real time commitment.

Best for: Estates where maximizing the final sale price is the absolute top priority, the house is in good shape, and there’s no pressure to settle the estate quickly.

Option 2: Selling at an Auction

The auction works as a fast-paced competitive bidding system which functions as a high-stakes alternative. You set a specific date for the sale and sell the property to the highest bidder who appears on that day instead of waiting for offers to come in gradually. The method creates an urgent feeling that serves as a beneficial selling point for your product.

The auction system enables you to obtain a fair market price at a particular moment. The final price depends on both the number of buyers who participate and their level of interest during that specific day. You can set a “reserve” price (a minimum you’ll accept), but setting it too high can scare away bidders.

The auction process protects buyers from any required repairs because all sales occur “as-is” which means sellers are not responsible for making any fixes. Buyers need to have cash or pre-approved financing which makes it very unlikely for a deal to fall through. The all-or-nothing nature of an auction runs the risk of scaring off a significant number of potential buyers.

Option 3: Selling Directly to a Cash Home Buyer

The option of selling to a cash home buyer provides executors with an effective solution when they need a quick and easy sale. The direct property buying method enables you to avoid listing your property on the market.

The method functions as the quickest and most straightforward option for selling. The cash offer process usually takes a few weeks to complete which results in a quick sale. The service provides vital assistance to estates which need to settle debts and stop paying taxes and insurance and maintenance costs for vacant properties.

Here’s what makes this option different:

- No Repairs Needed: The home is sold completely “as-is.” You don’t have to clean it out or fix anything.

- No Fees or Commissions: Most cash buyers do not charge commissions and will often cover closing costs.

- Guaranteed Closing: Since cash buyers use their own funds, there is no risk of a buyer’s loan falling through.

The convenience of selling your home quickly comes with the trade-off of receiving a lower sale price than you would get by listing it on the open market. The right moment to sell a house for cash depends on comparing the value of a quick stress-free sale to the possibility of earning more profit in the future.

Comparing Probate Property Selling Options

The court will review your case to choose one of the three main probate property selling methods. The following information will help you determine which option works best for your estate goals.

| Selling Method | Pros | Cons | Best For… |

|---|---|---|---|

| Listing with an Agent | • Highest potential sale price • Wide exposure to retail buyers |

• Longest timeline (months) • High costs (commissions, repairs) • Requires significant effort and management |

Executors who need to maximize profit, when the property is in great condition and time is not a factor. |

| Selling at Auction | • Fast, with a fixed sale date • Property is sold “as-is” • Creates buyer competition |

• Unpredictable final price • Smaller pool of potential buyers • Marketing costs can be high |

Executors needing a quick sale with a set deadline, especially for unique properties or distressed homes. |

| Selling to a Cash Buyer | • Extremely fast closing (weeks) • No repairs, commissions, or fees • Guaranteed, certain sale |

• Sale price is below full market value | Executors who prioritize speed, certainty, and avoiding the hassle and cost of repairs and showings. |

Your role as an executor requires you to make decisions that benefit the estate and its beneficiaries above all else. By understanding these options clearly, you can move forward with confidence, knowing you chose the path that best fits your unique situation.

Avoiding Common and Costly Probate Pitfalls

You will need to avoid specific elements more than execute correct actions during the probate property sale process. The entire process contains numerous potential errors which can extend the sale duration while depleting the estate’s funds and creating excessive stress during your busiest times. You need to know where these typical pitfalls exist to avoid them effectively.

The most dangerous mistake people make involves ignoring the property itself. A vacant house creates an open invitation for various problems which include winter pipe bursts and vandalism and squatting. Basic upkeep neglect by an executor leads to property value decline which results in lower sale prices during the final sale.

Pricing Problems and Market Misjudgments

Figuring out the right price for a probate home is a tricky balancing act. The house will remain on the market for months while you pay carrying costs that include taxes and insurance and utilities. The current situation represents a major error because probate sales already experience prolonged timeframes. According to US data properties in probate need 6-18 months to sell which results in price drops of 15% or more because of property deterioration and mounting expenses. The current US housing market outlook makes this situation even more difficult to handle.

The court will not accept a low price unless you provide sufficient proof to justify it. The other heirs might claim that you fail to achieve the best price possible for the estate. A professional appraisal conducted by an expert serves as your most effective defense against both selling your property for less than it is worth and overcharging potential buyers.

Family Disagreements and Communication Breakdowns

The combination of grief and financial matters creates a challenging situation. Probate sales tend to bring back old family disputes which often lead to heated confrontations. The entire process comes to a halt when disagreements arise about selling details such as listing price and real estate agent selection and the decision to sell at all.

Your job as the executor demands that you work for the benefit of the entire estate rather than trying to satisfy each individual heir. The best tool you have for navigating this is clear, consistent, and documented communication.

Your communication plan must establish its first point of contact at the beginning of the project. The team leader should maintain consistent communication with the team through scheduled updates which should continue even when there are no new developments. Sharing information with others establishes trust and prevents minor disagreements from turning into costly legal battles.

Don’t forget about hidden title issues, either. The closing process will experience major delays because of last-minute discoveries of old liens and ownership disputes. We cover this in detail in our guide to common title problems at closing.

How a Strategic Sale Can Bypass These Pitfalls

The main reason behind these problems stems from the slow and uncertain process of selling through regular market listings. Your decision about how to sell the property will determine the best strategy for your situation.

-

For neglect and maintenance issues: Selling to a cash buyer takes this problem off your plate. They typically buy properties completely as-is, meaning you don’t have to lift a finger on repairs or worry about ongoing maintenance.

-

For pricing and market timing: A direct cash offer gives you a certain price, right now. The tool removes all estimation work from the process while preventing financial losses caused by properties that remain unsold for months.

-

For family disputes: A fast, guaranteed sale provides a clean and final end to the process. It allows the estate to be settled quickly so heirs can get their inheritance and move on, without a long, stressful sale hanging over everyone’s heads.

Your Top Probate Sale Questions, Answered

The process of probate property sales becomes easier to understand when you think of it as learning a new language. You suddenly dealing with legal terms and court timelines on top of everything else. The section answers the most common questions that executors and heirs ask by providing direct answers to help them through the process.

Let’s clear up the confusion so you can move forward with confidence.

Can a House Be Sold Before Probate Is Granted?

The fundamental question here has only one answer which is no. The court needs to grant probate and appoint an executor (or personal representative) before you can legally finish the sale of a house.

The court approves the estate through a process called “Letters Testamentary” or “Letters of Administration” which functions as the official key. The estate will not have any authorized individual to sign sales contracts without this document. The signature will be considered invalid when you try to sell the property before receiving that document because it resembles a new CEO attempting to sign a major contract before their first day at work.

You don’t have to wait idly by. You can get a huge head start by:

- Securing the property and handling basic upkeep.

- Sorting through and clearing out personal belongings.

- Interviewing real estate agents or getting offers from cash buyers.

- Gathering important documents like the deed, mortgage statements, and property tax bills.

The preparation work you complete now will help you start quickly once the court grants approval which will reduce the entire sale process by several weeks or months.

Who Is Responsible for the Mortgage and Bills?

The estate takes responsibility for all bills that relate to the property throughout the probate process. The list includes all expenses starting from mortgage payments and property taxes to homeowner’s insurance and maintenance costs and utility bills.

The estate’s funds serve as your resource to keep these accounts up to date. The estate requires a dedicated bank account to handle all its financial transactions. Every payment must be documented with precise accuracy when keeping records.

The estate will build up debts because it lacks enough cash to pay these bills. The money from the home’s sale must be used to pay off these debts before any funds can be given to the heirs.

A fast sale is essential to achieve this exact outcome. The sale of a property that stays on the market for an extended period of time leads to financial losses that eat up the inheritance beneficiaries are supposed to receive.

What Taxes Are Owed on an Inherited Home Sale?

Selling property always involves tax concerns but inherited homes provide some positive aspects regarding taxes. The stepped-up basis tax rule enables heirs to minimize their capital gains taxes to almost nothing.

The property’s tax value for inheritance purposes receives a stepped-up valuation to its market value at the time of the owner’s death. The tax system bases your taxable amount on property value appreciation between the date of acquisition and the date of sale.

Let’s break it down with an example:

- Original Purchase Price: $100,000

- Value on Date of Death (Your New “Stepped-Up Basis”): $400,000

- Final Sale Price: $410,000

The taxable gain for this case amounts to $10,000 because your $400,000 basis exceeds the $410,000 sale price. You completely avoid paying taxes on the $310,000 appreciation that happened while the original owner was alive. The quick sale will generate minimal profits which leads to no tax liability. Of course, it’s always a good idea to run the numbers by a tax professional.

Do All Heirs Need to Agree to Sell the Property?

The subject tends to create emotional reactions in people. The executor holds the legal power to sell real estate which stems from their authority to manage estate property. The executor who possesses power of sale according to the will may proceed with selling without needing to obtain unanimous consent from all beneficiaries.

The catch is that the property must be sold as-is. The process of selling property with equity can be challenging. The general rule states that selling a home as-is will lead to a lower sale price.

The executor has a fiduciary duty which represents a legal requirement to make decisions that benefit the estate and its beneficiaries. The process of decision-making must follow principles of fairness and reasonableness. The heirs can file a court challenge to dispute the sale if they believe it will harm the estate’s interests.

The best way to avoid conflict is through clear and constant communication. Keeping everyone in the loop about why a sale is necessary, the offers on the table, and the overall process can help get everyone on the same page. When family dynamics are complicated, a quick, clean sale to a cash buyer can be the perfect solution to sidestep debates over repairs, pricing, and timing.

The probate process requires you to manage various legal responsibilities and financial matters but you do not need to handle everything by yourself. You can explore alternative options if the idea of repairs and home staging and waiting for a buyer becomes overwhelming. The no-obligation cash offer represents a guaranteed as-is sale which gives you control over the timing of the sale.

At Eagle Cash Buyers, we specialize in handling probate property sales to provide a stress-free process for our clients. If you determine that a fast, as-is sale is the best path for the estate, we can provide a no-obligation cash offer. We buy houses in any condition, cover all closing costs, and can close in as little as 21 days. Visit us at https://www.eaglecashbuyers.com to see how we can help you settle the estate quickly and confidently.