The real estate due diligence period is a specific timeframe in a purchase contract that allows a buyer to thoroughly investigate a property before the sale becomes final. The buyers get their inspection done during this period while they receive an appraisal and review all relevant documents to detect potential problems which allows them to decide between continuing with the purchase or renegotiating the terms or ending the agreement.

You have discovered your dream home and the seller has given their approval to your proposed purchase price. Congratulations! But before you pop the champagne, there’s a critical phase you need to navigate: the real estate due diligence period. This phase allows you to test the property through an extensive evaluation process.

What Exactly Is the Due Diligence Period?

Once your offer is signed, the clock starts ticking on due diligence. This period serves as your opportunity to conduct a detailed assessment of the property to confirm it meets all its advertised features. It functions as your protective barrier which enables you to discover unexpected issues while deciding if you want to continue.

The document functions as a critical legal defense for buyers which goes beyond being a simple bureaucratic requirement. The agreement protects your business from unforeseen expenses which lets you finish the deal with full confidence. During this window, you have the right to bring in professionals to inspect, appraise, and scrutinize every aspect of the property.

Key Activities During This Phase

Due diligence requires companies to conduct a thorough investigation of all relevant information and documentation. You’re building a complete picture of the home you’re about to buy. The home inspection process stands as a crucial element which requires people to understand its basic definition.

Due diligence functions as your escape mechanism which helps you avoid getting into trouble. The contract contains a legal structure which allows you to cancel the agreement and get back your earnest money when you discover unacceptable issues.

To help you get a handle on what this all looks like in practice, here’s a quick overview of the main tasks you’ll be tackling.

Key Activities During the Due Diligence Period

The table presents a brief overview of the essential steps which buyers need to complete throughout their due diligence period.

| Activity | What the Buyer is Checking For | Typical Timeframe |

|---|---|---|

| Home Inspection | The inspector evaluates the building’s structural stability together with its mechanical systems and complete state of maintenance. | 3-5 days after contract |

| Appraisal | The process determines if the property value matches the purchase amount that both parties agreed to. | 1-2 weeks after contract |

| Title Search | The process verifies that no liens or legal claims exist which would block ownership of the property. | 1-2 weeks after contract |

| Document Review | The review process involves studying HOA rules together with property disclosure statements and all required permits. | Throughout the period |

The process needs you to verify the physical state of the home together with its market price and all legal documents related to ownership. It’s a busy period, but it’s absolutely essential for a smart purchase.

Understanding the Due Diligence Timeline

The moment you and a buyer sign a purchase agreement, an invisible clock starts ticking. The real estate due diligence period serves as the most vital stage which all property sales need to pass through. The buyer receives a specified period which they can use to inspect the property before they decide to proceed with their purchase.

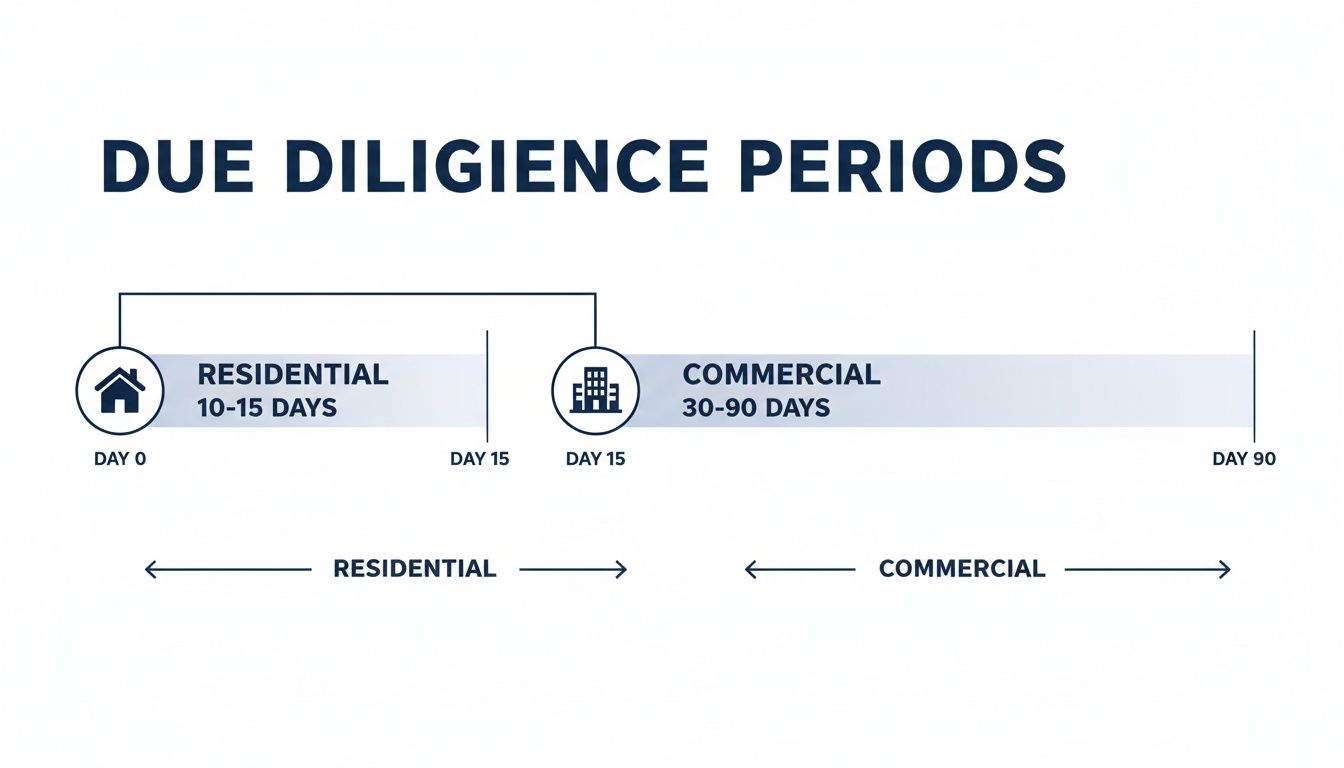

The process moves at a fast pace when dealing with a standard single-family residence. The standard residential contract provides buyers with 10 to 15 days to finish their required tasks. The time frame usually lets you bring in a home inspector to check for pests and review all HOA documentation. The scope is pretty straightforward because we’re talking about one house.

Why Commercial Timelines Are So Different

The commercial real estate sector operates under an entirely different set of rules which govern its activities. The due diligence process here can extend from 30 to 90 days with some cases taking even longer than that. So, what’s with the massive difference? The size and complexity of the deal created the large gap.

When someone buys a commercial property, they’re not just buying a building; they’re buying a business asset. The investigation needs to expand its scope until it reaches an extreme level.

- Lease Agreements: They need to pour over every single tenant lease, verify the rent rolls, and check payment histories to make sure the income stream is solid.

- Zoning and Land Use: The property needs to have its current use approved by the law while its intended purpose matches what the buyer wants. Verifying this is a must.

- Environmental Assessments: Buyers almost always perform environmental site assessments to check for nasty surprises like contaminated soil or groundwater.

- Financial Audits: The team will analyze all financial documents including income statements and expense reports to confirm the property generates the profit it shows.

This isn’t just a buyer being difficult; it’s essential risk management. The worldwide real estate investment market reached an incredible total value of $613.6 trillion during the year 2023. The huge amount of money moving around makes even a small mistake during due diligence into a disastrous financial error.

The extended schedule for commercial buildings exists because these properties require higher levels of risk management. The financial impact of a residential home mistake exceeds home expenses yet commercial building mistakes will lead to investment firm bankruptcy.

The standard process requires an extended period to complete home sales. The built-in delays between processing times create major stress for sellers who need to sell their homes quickly because they face imminent foreclosure. The extended period of uncertainty creates difficulties for making decisions about what to do next. The foreclosure process becomes more clear when you understand why every day holds such vital importance during these situations. The complete system exists to defend buyers but this protection system creates difficulties for sellers who need quick guaranteed deals.

The Buyer’s Due Diligence Checklist

The buyer starts to take action as soon as your home enters into a contract. The real estate due diligence period serves as their assessment window which lets them examine all property details to verify their purchase decision. The seller will gain an immediate advantage when they understand what the buyers are searching for.

The process needs to go beyond a basic walkthrough because it requires a comprehensive assessment of your property’s entire condition. The buyer along with their team will perform a systematic evaluation of inspections and reviews to discover hidden problems which were not visible during the initial showing.

The Inspection Gauntlet

The general home inspection stands as the first and most important inspection to complete. A licensed inspector will spend a few hours combing through your property, looking at everything from the foundation and roof to the plumbing, electrical systems, and HVAC. The report will contain numerous pages which document all inspection results from major to minor findings.

But it usually doesn’t stop there. The buyer will need to bring in experts who specialize in different fields depending on the house’s age and location and any identified problems. The following inspections represent the most frequent additional inspections which occur:

- Pest and Termite Inspections: A must-do to check for wood-destroying insects that can quietly cause massive structural damage.

- Radon Testing: The test identifies a dangerous invisible gas which people cannot detect through smell.

- Mold and Air Quality Tests: These tests become necessary when past water leaks or musty odors develop in the property.

A knowledgeable buyer along with their inspector will search for various possible defects during their inspection. The team needs to learn bed bug detection because it represents the initial stage of their complete problem-solving process.

Financial and Legal Verification

The inspection team conducts property assessments while the second group examines all financial records together with legal documents. The due diligence process needs to be completed with equal importance because it shields buyers from hidden liabilities which they cannot identify through regular inspection.

An appraisal will be ordered by the buyer’s mortgage lender. The document serves as the only tool to verify that the house market value matches the amount which all parties agreed to. The loan process faces danger because of a low appraisal which forces all parties back to the negotiation stage.

During due diligence, the buyer is essentially building a case for their investment. Every report, from the inspection to the title search, serves as a piece of evidence to confirm the property’s value and clear any potential risks before closing.

The title search process will begin simultaneously with the title company’s operations. The process verifies that you hold absolute legal ownership of the property without any concealed debts or ownership conflicts or other legal claims. Unresolved title problems are deal-killers, which is why a clean record is so important. We cover the many ways this can go wrong in our guide to title problems that can arise at closing.

The buyer can access all documents which include bylaws and financial statements and meeting minutes when your home resides in an HOA community. The group investigates potential warning signs which include pending association lawsuits and upcoming special assessments and any association rules that would disrupt their way of life.

The timeline shows you how long due diligence usually takes to complete home inspections and commercial property inspections.

The residential property process moves faster because it contains fewer elements than a commercial transaction.

Your Responsibilities as the Home Seller

The buyer holds complete control during the real estate due diligence period yet you maintain an active role in the process. The seller needs to perform their essential duties at this time. The host must organize an essential multi-week event which functions as a fundamental requirement. Your main job is to be cooperative and responsive, ensuring everything keeps moving toward the closing table.

The combination of proactive behavior and easy collaboration will prevent delays which threaten to derail a sale. Your property will require access from the buyer’s team which consists of inspectors and appraisers and surveyors who might need to enter your property with little to no advance warning. Your ability to adapt will help these teams reach their targets on time.

The cooperative approach extends its principles to the handling of all paper-based documents. The buyer needs to view all types of documents which will reveal the complete history of the property and its operational costs.

Key Documents to Prepare

You should prepare your documents before receiving any requests because this approach will make a big difference. As soon as you accept an offer, start pulling these together:

- Property Disclosures: This is the big one—a legal form where you outline any known problems with the house. Be honest and thorough.

- Utility Bills: Buyers will want to see recent copies of your electric, gas, water, and trash bills to get a real-world estimate of their monthly expenses.

- HOA Documents: If you live in a community with a homeowners association, have the bylaws, budget, and recent meeting minutes ready to go.

- Maintenance Records: Collect any warranties or receipts for major work you’ve had done, like a new roof, furnace, or major appliance.

Your goal during due diligence is to eliminate surprises. The process of sharing clear information and providing simple access to data helps you build trust with buyers because they understand you have nothing to hide which makes them more confident about their purchase decision.

The buyer’s inspection report will become your main focus during this process. The buyer will most likely return with a list of repairs which they expect you to complete. You should not accept every deal but you need to show your willingness to negotiate with honesty. The home seller warranty functions as a solution which provides buyers with confidence about their home’s essential systems. Our guide explains home warranties for sellers through a detailed explanation.

The entire process depends on having clear lines of communication between all participants. Your prompt responses to buyer and agent questions will keep the deal moving forward while showing your dedication to complete the transaction. Your decision to stop talking or become uncooperative will create problems which could lead to the complete failure of the sale.

How to Handle Repair Negotiations

The home inspection report has arrived but it shows no signs of being a perfect document. All parties involved in the real estate due diligence process reach a point where they hold their breath before making any decisions. The buyer will probably return with a list of repairs which will include minor maintenance work and major expenses such as replacing the electrical panel and roof.

The negotiation process starts when both parties enter this stage. You don’t have to accept every item they place on their list. Think of their request as the opening offer in a conversation, not a final ultimatum. Your duty involves finding a solution which satisfies the buyer while maintaining the deal’s progress without exceeding your financial limits.

Weighing Your Negotiation Options

You should stop reading the repair list after you receive it in your email. Don’t react immediately. Instead, sit down with your real estate agent and review it carefully. You have three main ways to respond, and knowing them ahead of time will help you make a clear-headed decision.

Here are the paths you can take:

- The simplest way to proceed is to agree to make the repairs. The buyer will receive proof of work completion through licensed professional repairs which will occur before the closing date.

- You can provide the buyer with a credit at closing to cover repair expenses instead of dealing with contractor management. The buyer receives this money through closing cost deduction and they can choose when to use the funds for home repairs. This is a popular option.

- Decline Some or All Requests: You have the right to say no, particularly if the issues are purely cosmetic or if your asking price already baked in the home’s current condition. The path carries risk because the buyer could decide to leave the deal.

The way you respond to repair requests will create a foundation which determines how all future interactions in the deal will unfold. A transparent collaborative system between buyer and seller will build trust because it demonstrates your commitment to working together until you reach your final goal.

Navigating Difficult Property Conditions

What if the inspection uncovers something major? The inspection would reveal unexpected major expenses which include foundation problems and a broken HVAC system and widespread mold contamination. These unexpected findings bring traditional home sales to a complete stop because sellers do not have enough time or money to manage these issues.

The situation requires you to understand all your available choices because you face these obstacles. The process of fixing these problems would require a large amount of money which would also extend the timeline of the project. The company has the ability to offer customers a steep discount. The third method exists to help sellers who want a quick process with no negotiation battles.

One effective alternative is to work with a cash buyer. Eagle Quick For Cash operates as a company which buys homes in their current condition for cash payment without requiring inspections or appraisals or repair negotiations. The process leads straight to closing without any delays or unknown issues which major repairs typically cause. Our guide to selling a house that needs repairs will provide you with additional information about this process.

How a Cash Sale Turns Due Diligence on Its Head

The due diligence and repair negotiation process makes sellers wonder if there is a simpler solution for them to achieve their goals. The cash buyer method revolutionizes the entire process because it offers a fast sale with no need for due diligence.

The standard sale process requires lenders to work with appraisers and inspectors through a lengthy procedure which can last for several weeks. But a cash sale cuts a much more direct path. Companies that buy houses for cash use their own capital, which instantly knocks out two of the biggest and most stressful hurdles of a traditional deal.

Cutting Out the Middlemen and Their Delays

The mortgage lender removal process enables you to eliminate two essential contingencies which frequently cause last-minute deal failures.

- The Financing Contingency serves as the standard buyer’s emergency exit button which activates when their loan application fails. A cash buyer doesn’t require a loan so this entire risk disappears. Your sale is solid from the get-go.

- The Appraisal Contingency: Lenders order an appraisal to make sure they aren’t lending more than the house is worth. Cash buyers determine property values through their own methods which eliminates the need for you to worry about a low appraisal affecting the sale.

The simplified process provides major advantages because it replaces the traditional method which becomes more complex every day. The worldwide market for due diligence investigations will double from $8.5 billion in 2024 to $16.7 billion by 2034 with North America taking about 37% of the total market. The industry continues to grow because it proves its worth to customers. You can dive deeper into these numbers in this detailed due diligence market report.

A cash sale essentially condenses the entire drawn-out due diligence marathon into a single, straightforward property walkthrough. The process eliminates all bank approval waiting periods and negotiation sessions which provides sellers with a simple and predictable way to reach closing.

The method serves as a revolution for homeowners who need to sell their properties quickly without facing typical complications. Eagle Quick For Cash operates as a company which buys homes in their current condition to provide immediate cash offers. The process eliminates all repair negotiations and buyer inspections and staging requirements and lets you choose any closing date you want.

Common Due Diligence Questions

The due diligence period creates a complex network of potential outcomes which people refer to as “what-ifs.” Sellers need to understand the answers to their most common questions during this critical home sale phase which determines the success of their sale.

Can a Buyer Really Just Walk Away During Due Diligence?

In short, yes. The due diligence clause acts as a buyer’s emergency escape route. The standard contract includes an option period which lets buyers cancel the deal for any reason during this time without losing their earnest money.

What usually triggers this? It could be anything from a troubling inspection report or a low appraisal to simply getting cold feet. The seller faces the most uncertain period during the time before the transaction reaches its closing point.

Do I Have to Fix Everything on the Buyer’s Repair List?

The answer is absolutely not. A list of requested repairs is the opening line in a negotiation, not a set of demands. You have three main ways to respond:

- The process will advance most easily through complete agreement but this approach will likely lead to the highest costs.

- The negotiation process will reach a settlement when you fix major problems such as a leaking roof but you must refuse to handle minor cosmetic damages.

- The buyer receives this money through closing cost deduction and they can choose when to use the funds for home repairs. This is a popular option.

- Decline all requests: You can stand firm and sell the home as-is, but this risks the buyer walking away.

There’s a bit of strategy involved here. Your real estate agent’s experience will be invaluable in helping you decide which path gives you the best chance of closing the deal on your terms.

How Does “As-Is” Change the Due Diligence Process?

Selling your home “as-is” sends a clear signal: you don’t plan on making any repairs. The process of inspection does not prevent buyers from exercising their right to evaluate the property.

The buyer receives a due diligence period during an as-is sale which lets them discover the exact details of their purchase. The buyer has the option to cancel the contract and receive their earnest money back if they find a problem which they cannot accept.

A cash buyer conducts an actual sale without any conditions which defines their as-is purchase method. The buyers conduct a single brief inspection which eliminates the need for formal inspections and appraisals and financing requirements. The seller benefits from this situation because it creates an easy-to-predict path for reaching the closing stage.

The process of handling inspections and repair talks and potential last-minute cancellations creates major difficulties. You have multiple options available to you if you want a simpler approach. One such option is selling to a cash buyer. At Eagle Quick For Cash, we simplify the process by buying homes as-is, for cash.

You can avoid the extended due diligence process and repair negotiations and bank loan approval risks when you use this method. We provide a fair, straightforward offer and a closing date you can count on. You can get a no-obligation cash offer today at https://www.eaglecashbuyers.com if you want to learn about selling without stress and following your preferred schedule.