A quitclaim deed serves as a legal instrument which enables property owners to transfer their ownership rights from the grantor to the grantee. The product provides no guarantees because it fails to provide any form of warranty protection. The grantor transfers any interest they possess but they do not guarantee that the property title is free from liens or other claims. The practice exists mainly between people who share mutual trust because they include family members.

Understanding the Quitclaim Deed

The process of selling a car “as-is” works as a suitable comparison. When you do that, you’re not offering a warranty or making any promises about its mechanical condition. The buyer must accept the vehicle along with all existing defects which it contains. A quitclaim deed functions similarly because the signer gives up their rights to property ownership which then transfers their current ownership rights to another person.

A warranty deed functions differently from other deeds because it contains official legal assurances which prove the seller maintains proper ownership rights. Because a quitclaim offers no protection for the recipient, you almost never see them used in a typical arm’s-length sale between strangers. These documents serve their purpose when people already share a bond of trust.

You need to know the essential elements which define a quitclaim deed.

Quitclaim Deed At a Glance

| Feature | Description |

|---|---|

| Title Warranty | None. The grantee receives no guarantee of a clear title. |

| Transfer Speed | Fast. It’s one of the quickest ways to transfer property interest. |

| Simplicity | High. The document itself is straightforward and easy to execute. |

| Risk Level | High for the Grantee. The grantee assumes all risk for title defects. |

| Common Use | Between trusted parties (family, divorcing spouses, trusts). |

The table shows why these deeds work best for particular property transfers which do not follow standard procedures.

When Are They Typically Used?

You’ll most often find quitclaim deeds used when no money is changing hands and the transfer is based on an existing relationship.

Here are the most common scenarios:

- Divorce Settlements: One spouse signs over their interest in the family home to the other as part of the separation agreement.

- Family Gifting: A parent might use a quitclaim to give their house to a child.

- Estate Planning: People who want to avoid probate court transfer their homes into living trusts through this method. The property title needs occasional maintenance which requires adding new spouse names and correcting spelling errors.

The concept of “quitting a claim” has existed since the 12th century when people needed to transfer their property rights without any problems. Once a quitclaim document gets registered at the county office it becomes available for public access. Most U.S. counties now have digital deed records which allow users to search for documents through their online databases.

You can discover additional information about property transfer documents when you start studying their complete system.

How Quitclaim Deeds Differ from Warranty Deeds

The primary difference between quitclaim deeds and warranty deeds appears in property deeds because they include different protection levels. You need to understand this difference because it determines how much risk you should accept during property ownership changes.

Let’s use an analogy. A general warranty deed operates like a certified pre-owned car which you would purchase from an official dealership. The product includes a warranty which covers all parts and systems from one end of the vehicle to the other. The seller (grantor) provides you with their legal promise which proves they hold complete authority to sell the car to you and proves the title remains free from any encumbrances. The property stands free from any concealed loans or unexpected claims which could emerge from previous owners. The system protects you.

The document functions as a quitclaim deed. This is like buying that same car “as-is” from a private seller on Craigslist. The seller is basically handing you the keys and saying, “Whatever ownership I have in this car is now yours.” They aren’t making any promises about its history. If it turns out there’s an old mechanic’s lien or a co-owner you didn’t know about, that problem is now 100% yours. The entire risk of this transaction belongs to you because you are the buyer (grantee).

The Ironclad Guarantee of a Clean Title

A general warranty deed provides buyers with the most extensive protection which exists in the market. The property seller must follow several legally binding covenants which protect them from future title issues.

These promises typically include:

- Covenant of Seisin: A solemn promise that the grantor actually owns the property.

- Covenant Against Encumbrances: A guarantee that the property is free and clear of liens or claims, except for any specifically mentioned in the deed.

- Covenant of Quiet Enjoyment: An assurance that your ownership won’t be challenged down the road by someone with a better claim to the title.

The strong nature of these guarantees means that mortgage lenders require warranty deeds for all conventional home purchases which involve a mortgage. Banks need to verify their investment security through a marketable title before they can lend hundreds of thousands of dollars. A title company performs research duties to validate all information during this stage. Our guide explains the entire process of a title company which protects property transactions through its operations.

To make the differences crystal clear, here’s a side-by-side comparison.

Quitclaim Deed vs. General Warranty Deed

| Feature | Quitclaim Deed | General Warranty Deed |

|---|---|---|

| Title Guarantee | None. The grantor transfers only their interest, whatever that may be. | Full guarantee. The grantor promises the title is clean and free of defects. |

| Buyer Protection | Zero. The new owner assumes all risk for past title issues. | Maximum protection. The grantor is legally liable for title defects. |

| Common Use Cases | Adding/removing a spouse from title, gifting property to family, clearing a title “cloud.” | Standard real estate sales (e.g., buying a home from a stranger), all transactions involving a lender. |

| Associated Risk | High for the grantee (receiver). | Low for the grantee (buyer). |

The selection process between these deeds depends on the specific transaction details and how well the involved parties know each other.

Why You’d Choose One Over the Other

A quitclaim deed, with its complete lack of guarantees, is a poor choice for a typical arm’s-length real estate transaction. The tool works best in situations where people already trust each other because it does not require a complete title search.

The Bottom Line: A warranty deed defends the new owner against any claims on the title, stretching all the way back through the property’s entire history. The new owner obtains the property title through a quitclaim deed but receives no protection because the title comes with every existing defect.

You need to select the appropriate deed based on your particular situation. For a standard home purchase from a seller you don’t know, a warranty deed is non-negotiable. The fast process and simple method of quitclaim deeds make them the best option for transferring property between relatives and for placing property into living trusts.

When Using a Quitclaim Deed Makes Sense

A warranty deed stands as the top choice for most home sales but a quitclaim deed performs essential functions in its own way. Think of it as a specialized tool, perfect for situations where trust is already established and a full-blown, costly title search is simply overkill.

The deeds serve no purpose for transactions which occur between parties who do not know each other. These documents serve their purpose to transfer property rights between people who already understand the complete ownership history of the property. You should never accept a quitclaim deed from a seller you meet for the first time but the situation changes when you need to transfer a home into a family trust or give ownership to an ex-spouse who shared ownership with you for ten years. The possibility of unanticipated title defects exists at an extremely low level.

Common Scenarios for a Quitclaim Deed

The beauty of a quitclaim deed is its speed and simplicity. The document functions as a fundamental legal instrument which enables people to transfer property ownership during typical life events without going through the formal process of selling property. The fundamental rule states that the person who receives the property transfer (grantee) has already verified the title remains free from defects.

These documents prove most useful in the following common situations:

- Divorce Settlements: When a marriage ends, a quitclaim deed is the simplest way for one spouse to sign their interest in the family home over to the other. The property history knowledge of both parties makes expensive warranty requirements unnecessary.

- Estate Planning: It’s very common for people to use a quitclaim deed to transfer their home into a revocable living trust. This simple step can help their heirs avoid the long and public probate process down the road.

- Gifting Property: If parents want to gift a house to their children, or one sibling wants to give their share of a property to another, a quitclaim is the most direct way to do it. The document makes the gift official through a simplified process which eliminates the need for a sales transaction.

- Clearing Title Clouds: Sometimes, a quitclaim is just a simple “fix-it” tool. The document serves two purposes because it allows users to correct minor errors in previous deeds and it enables them to remove their ex-spouse’s name from the title after divorce.

Why It Works for Trusted Transfers

The primary objective of these cases focuses on operational efficiency instead of safeguarding buyers. The primary objective of asset division in divorce requires parties to follow the settlement agreement during the entire process of asset distribution.

Quitclaim deeds have become popular for these situations because they eliminate the need for title searches and insurance which results in up to 50% lower transfer expenses than warranty deeds. The U.S. recorded 2.5 divorces per 1,000 people in 2022 which shows why quitclaims serve as an essential tool for handling complicated property separation cases. Research about quitclaim deed applications for personal and business use is available to you.

Of course, even transfers between trusted parties can get complicated. The process of managing inherited properties which need major repairs creates its own set of difficulties. You have several choices available to you when you need to leave a difficult situation behind. Some people choose to sell their home for cash because this method protects them from dealing with home repair costs and the time delay of waiting for a buyer to purchase their property. Eagle Cash Buyers operates as a property buyer who provides an open process to purchase homes in their existing condition which helps people who require assistance.

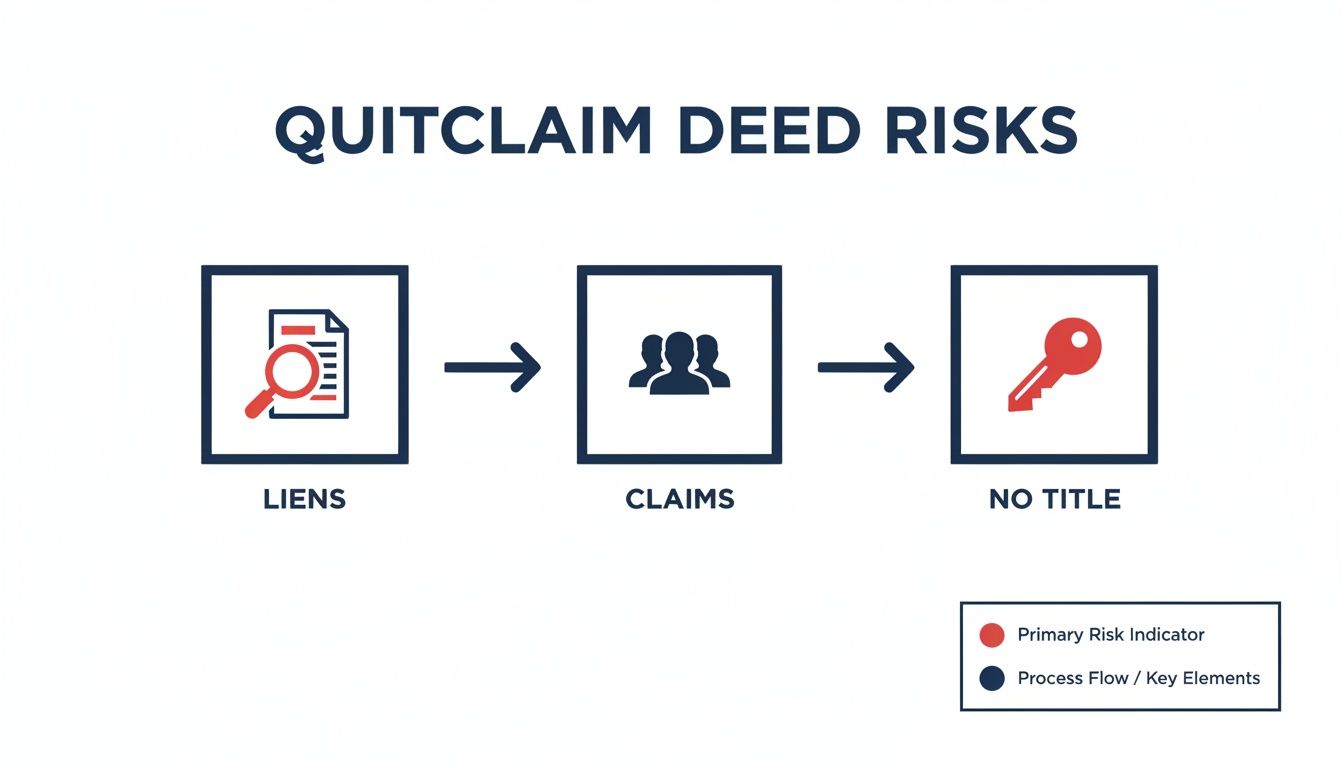

The Hidden Risks of Using a Quitclaim Deed

Quitclaim deeds serve well for basic property transfers between trusted parties but they do not provide any form of protection to the new owner. The current system allows illegal entry which creates serious financial and operational challenges that will require expensive solutions in the future.

Accepting a quitclaim deed from someone you don’t know and trust is like buying a house sight unseen. The buyer receives all ownership rights which the seller possesses but they must accept every undisclosed problem which exists with the property. The worst part? You have no legal comeback against the person who gave you the deed.

The biggest danger arises when you discover that the property title contains problems. The person who signs the deed to give it to you does not guarantee that they possess complete ownership of the property. They aren’t even promising they own it at all. This means you could be on the hook for some serious messes long after the ink has dried.

No Protection Against Title Defects

Accepting a quitclaim deed means you agree to receive the property title without any changes. This situation exposes you to multiple severe financial and legal problems which a proper warranty deed would protect you from.

Some of the most common title defects include:

- Unknown Liens: You could suddenly find yourself responsible for old debts tied to the property. The property faces three possible claims which include unpaid taxes and a contractor’s mechanics lien and old judgments that affect previous owners. When you weigh the advantages and disadvantages you need to include current property liens in your assessment.

- Ownership Claims: What if a long-lost heir pops up out of the woodwork? Or a co-owner who never actually signed off on the sale? They could show up later and challenge your ownership in court.

- Invalid Title: The worst-case scenario would show that the grantor never possessed the legal authority to transfer this property. The deed you possess would become completely worthless if this situation occurs.

A quitclaim deed provides absolutely no warranty of title. You need to handle all financial and legal matters which arise from title defects because you will need to pay for their resolution.

Financial and Legal Complications

A quitclaim deed will start a series of serious issues which will affect your property ownership when you have a mortgage or want to sell the property. The “due-on-sale” clause appears as a major concern because it exists in most mortgage agreements. The lender can activate this clause through a simple title transfer which would force you to pay the entire remaining balance of your loan without delay. The grantor must pay federal gift tax because the IRS will treat the transfer as a gift.

The real problem emerges because of the following circumstance: obtaining title insurance for properties which people have received through quitclaim deeds becomes almost impossible. Title insurance companies refuse to issue property insurance because they cannot verify the ownership history through a warranty deed. The absence of title insurance creates an impossible situation for future property sales or refinancing because lenders and buyers refuse to accept this level of risk. Our complete guide explains the methods title insurance uses to defend your property investment.

These hidden dangers are exactly why quitclaim deeds are almost always the wrong tool for any real estate deal where you don’t have 100% trust in the other person.

How to Correctly Fill Out and File a Quitclaim Deed

The process of obtaining a quitclaim deed seems simple at first but it hides complex requirements which prove challenging to achieve. One tiny mistake can create massive headaches later on. The entire process requires four essential steps which include obtaining the proper form, completing it correctly, getting it notarized, and then submitting it for official recording.

You need to obtain the appropriate quitclaim deed form which belongs to your state before you can begin the process. These forms exist on your county recorder’s website and you can also get them from an attorney who practices real estate law in your area. I strongly advise against using an online template because property laws differ significantly between different states.

Key Information for the Deed

You must provide accurate data when you begin the process of completing the form. A single typo has the power to create property title problems which will persist for years. The document requires your full attention to all its fields.

- Grantor: This is the person currently on the title who is giving up their interest. Their name must be written exactly as it appears on the current deed. No nicknames, no shortcuts.

- Grantee: The person who will receive the property interest becomes the grantee. Obtain their complete legal name which includes all necessary details.

- Property Description: You can’t just put the street address here. The official legal description of the property needs to be obtained from either the latest deed or the county’s public record system.

- Consideration: This is what’s being exchanged for the property. If it’s a gift between family members, it’s common to see language like “$10 and other good and valuable consideration” to make the contract legally binding.

The grantor must sign the completed document at a designated location after all fields have been completed. The signature must happen in front of a notary public. The notary public verifies signer identity and records the signature which they confirm through their signature and official stamp. Don’t sign it ahead of time!

The process of gathering details activates the skills which you have developed during your research activities. A quitclaim offers no protection against hidden issues from the past.

The property faces two major problems which include old liens and multiple ownership rights that suddenly emerge. A minor mistake in the deed would enable these issues to enter the property which would result in legal conflicts regarding property ownership.

The final, crucial step is taking that signed and notarized deed down to the county recorder’s office in the county where the property sits. The public record becomes official when you record the deed which documents the property transfer. The transfer will remain legally incomplete because you chose to skip this step which leaves your new ownership rights unprotected. The system will assist you in solving typical title problems which occur during the closing process.

Navigating Inherited Property with a Quitclaim Deed

The process of receiving a property inheritance generates various emotional responses in people. The gift brings people happiness but it creates unexpected duties which become especially complicated when multiple heirs need to determine their next steps. A quitclaim deed becomes the ideal solution for this situation.

The family home exists under shared ownership because multiple siblings received it as an inheritance. The siblings usually select one of them to receive ownership of the property. The other siblings can use quitclaim deeds to transfer their ownership rights to the sibling who wants to keep the property. The document system organizes the title under a single name without needing a formal sales process.

From Inheritance to Action

The actual process of inheriting property tends to be more complex than what people expect. Heirs must deal with property maintenance that has been delayed for years while also facing overdue property taxes and the urgent need to access funds for estate settlement expenses. The process of handling home repairs and listing the property and waiting for buyers to show up seems completely impossible to manage when you are currently grieving.

The current situation allows you to choose from several different routes.

- Keep and Rent the Property: This can create a long-term income stream, but it also means you’re suddenly a landlord, responsible for maintenance and tenants.

- Renovate and Sell: The property value will increase through renovation but this method demands substantial time and work and requires you to spend money on repairs before selling.

- Sell As-Is on the Market: This lets you skip the renovation headaches, but a home in disrepair may sit on the market for a while and often sells for a lower price.

- Sell Directly to a Cash Buyer: For those who prioritize speed and convenience, selling to a cash-buying company can be an effective way to resolve the situation quickly without dealing with repairs or real estate agent commissions.

Quitclaim deeds have served as a fundamental method for transferring family properties throughout history. The system provided essential support to people who died without leaving a will during the 19th century. In an interesting 1856 case the court used quitclaim deeds which all heirs signed to establish the complete family lineage after a man died without a will. The method provided a smart solution to establish ownership boundaries. You can read more about how deeds clarified family estates on GenealogyBlog.com.

A Direct Path for Heirs

Heirs who want to avoid a lengthy property sale have an alternative solution which proves very effective. Selling the inherited house directly to a cash buyer offers a clean and efficient path forward. The program enables you to sell your home without needing to make repairs or pay real estate agent fees or deal with the uncertainties of a normal sale. Our guide to handling probate property sales explains this procedure in detail.

Selling to a cash buyer will allow you to receive a quick and definite solution for your inherited property within a few weeks instead of the typical months. The process offers you a fair cash offer while they will manage all complex matters to help you close the estate and move forward.

Eagle Cash Buyers stands as a potential solution for your situation when it matches your needs. Our company specializes in these specific situations by providing fair property offers which include all closing expenses and we follow your preferred timeline. The solution offers a simple resolution which benefits both you and your family.

Your Quitclaim Deed Questions, Answered

The basic knowledge about quitclaim deeds does not prevent people from having essential questions about them. People who want to use this tool need to address the most common questions which arise during their decision-making process.

Does a Quitclaim Deed Affect My Mortgage?

The situation requires immediate attention. Yes, it absolutely can, but maybe not in the way you think.

The process of signing a quitclaim deed will transfer your ownership rights but it will not remove your name from the mortgage document. You are still legally on the hook for the entire loan balance. Most mortgages include a “due-on-sale” clause which serves as a standard provision. The lender can activate this clause through a simple title transfer which would force you to pay the entire remaining balance of your loan without delay.

Before you even think about using a quitclaim deed on a property with a mortgage, you need to talk to your lender. It’s the only way to avoid accidentally triggering a very costly problem.

Can You Reverse a Quitclaim Deed?

A quitclaim deed becomes legally binding after the new owner receives it following the signing and notarization process. The transfer becomes legally binding and final once all parties reach a mutual agreement.

The person who gave up their interest can’t just change their mind and take it back. The only way to reverse the transaction is for the new owner to willingly sign a brand-new deed transferring the property back to the original owner.

What Are the Tax Implications?

The tax side of a quitclaim deed can get complicated fast. The IRS might view this transfer as a gift depending on the situation. If the property’s value exceeds the annual gift tax exclusion amount, it will result in federal gift tax obligations.

The transaction requires you to pay local taxes in addition to all other applicable taxes. The transaction will face real estate transfer taxes from various states and counties which apply to the deal even when no money exchanged hands.

Expert Tip: Never execute a quitclaim deed without first talking to a tax professional. The experts will help you understand your complete financial situation while protecting you from unexpected tax liabilities which could become expensive.

The process of handling inherited or distressed properties creates numerous problems which make it difficult to resolve these issues. You can find several ways to move on which will keep you free from legal and financial problems.

Homeowners need to evaluate all their available options when they face complicated property situations. The direct sale to a cash buyer represents a simple method which allows property owners to bypass the traditional market. Eagle Cash Buyers provides property owners with a fast cash solution which eliminates the need for repairs and agent fees and closing expenses. You can learn more about how the process works at https://www.eaglecashbuyers.com.