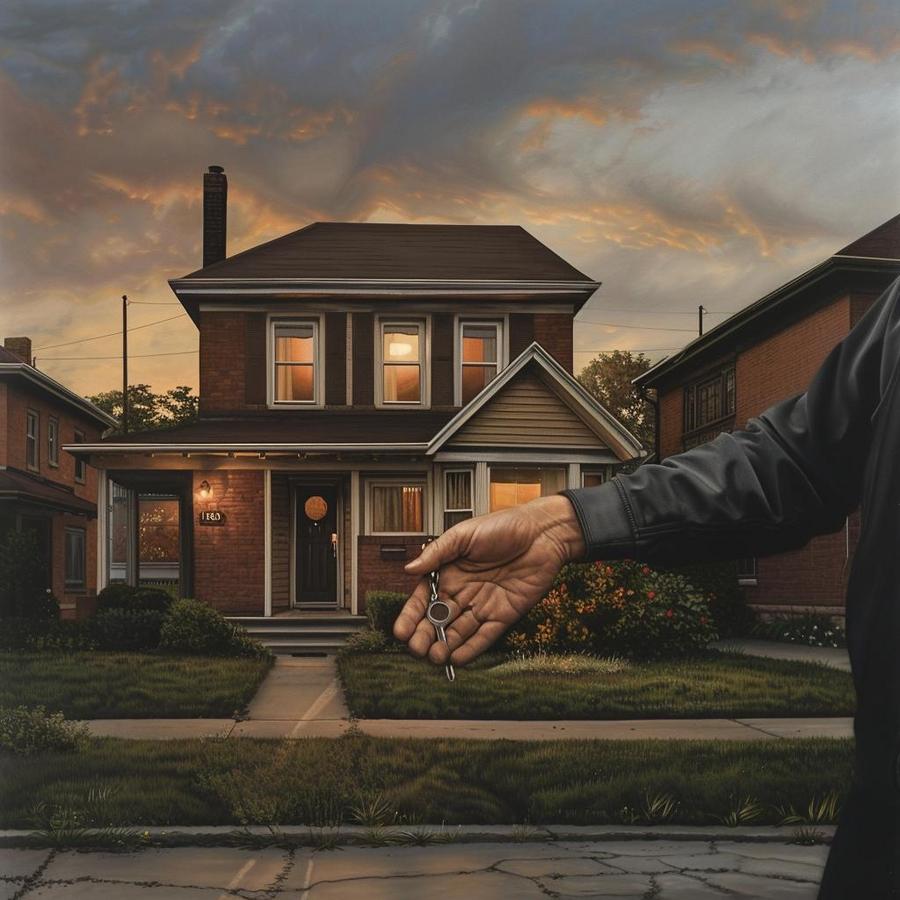

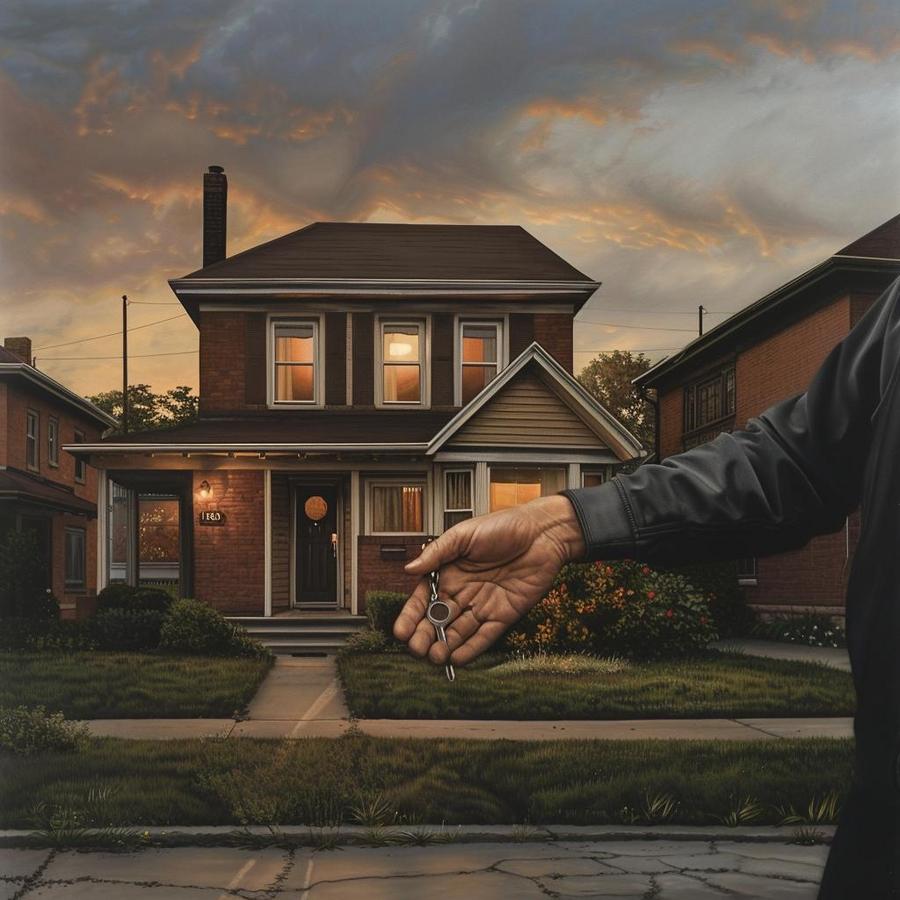

Wondering if you can sell a house in foreclosure? You’re not alone, and the answer is yes—though you’ll need to move fast. Sell my house fast in Richmond and similar markets is possible even after missed mortgage payments. Let me walk you through the timelines, legal rules, and ways to get the best possible outcome when you’re facing this kind of pressure.

What Does it Mean to Sell a House in Foreclosure?

Foreclosure happens when your lender starts the process of taking back your home after you’ve missed mortgage payments. Here’s the thing though—during pre-foreclosure, you still own the property. You can still sell it. If you act early enough, you might be able to control the sale price and possibly walk away with some equity. But once you hit full foreclosure? The clock speeds up and the lender starts calling more of the shots.

The Difference Between Pre-foreclosure and Foreclosure

Pre-foreclosure kicks in after you’ve missed payments but before the lender has gone through all the legal hoops. This is when you’ve got the most wiggle room. Once you’re in actual foreclosure, the lender has already filed official notice and the property could head to auction. From what I’ve seen, selling during pre-foreclosure usually means a better price. It also tends to be less chaotic.

How to Navigate the Pre-foreclosure Process

Steps to Take Immediately After Missing Mortgage Payments

- Pick up the phone and call your lender—don’t wait.

- Look into whether loan modification might work for you (loan modification explained by CFPB).

- Figure out what your home is actually worth compared to what you owe.

- Talk to at least three agents who’ve handled foreclosure sales before.

- Get your house ready for showings (even if it’s just basic cleaning).

Communicating With Your Lender

Being upfront with your lender might open doors you didn’t know existed—repayment plans, short sales, maybe even a temporary pause on payments. Virginia moves pretty quickly on foreclosures, so don’t sit on this. If you can sell before the foreclosure goes through, it could save your credit score from taking the full hit. Not to mention your sanity.

Is Selling During Foreclosure Legally Possible?

Short answer: yes, but the specifics depend on where you live. If you’re selling a house in Virginia, you can technically list it right up until the auction date. Just make sure you’re working with an agent who actually understands the local foreclosure laws—this isn’t the time for someone learning on the job. And be straight with potential buyers about the situation. Hiding the foreclosure status almost always backfires and can tank deals at the last minute.

Examining the Foreclosure Timeline

After that first missed payment, you probably have somewhere between three and six months before the foreclosure sale happens. That’s your window. Let me give you a real example: Say your home could sell for $220,000 as-is. You need about $10,000 in repairs to make it marketable, and selling costs (agent fees, closing costs) run another $15,000. If you owe $180,000 on the mortgage, you’re looking at potentially walking away with $15,000. But that math only works if you move quickly—wait too long and those numbers start shifting against you.

Alternatives to Selling in Foreclosure

- Loan modification might lower your monthly payments to something manageable.

- Refinancing could give you better terms (though it’s harder to qualify once you’ve missed payments).

- A short sale, where the lender agrees to accept less than what’s owed.

- Renting out the property—if your lender allows it and the numbers work.

The Role of a Real Estate Agent in Foreclosure Sales

A good agent who knows foreclosures can be worth their weight in gold. They’ll know how to price your home to move quickly without leaving money on the table. They understand how to talk to lenders. Most importantly, they’ve been through this before. Don’t just go with your cousin’s friend who just got their license—check their actual track record with distressed properties in your area.

Preparing Your Home for a Foreclosure Sale

You don’t need to renovate the kitchen, but fixing that leaky faucet and patching obvious holes in the walls? That could make a difference. Clean rooms photograph better and show better. Sometimes just removing clutter can add thousands to your sale price.

Marketing Strategies for Foreclosure Properties

Get your listing everywhere—Zillow, Realtor.com, Facebook marketplace. Price it right from the start. Here’s what I mean: if comparable homes are selling for $200,000 but yours needs $15,000 in repairs, pricing at $180,000 might actually bring in multiple offers and push the price back up. It seems counterintuitive, but underpricing slightly can create urgency. For those needing to sell your home quickly in Norfolk, this strategy often works well.

Navigating Offers and Negotiations in Foreclosure Sales

When offers come in, don’t just look at the price. Can the buyer actually get financing? How fast can they close? Sometimes a lower cash offer that closes in two weeks beats a higher offer that might fall through in 45 days. Keep your lender in the loop—they might surprise you by approving a short sale if it means avoiding the hassle of foreclosure. If time is really tight, you might consider options to sell a house fast in Virginia Beach.

Understanding Foreclosure Auctions

Auctions are a different beast entirely. They happen fast, and homes typically sell for less than market value. Sure, you skip the repairs and showings, but you also lose any say in the final price. In a hot market with lots of investors, bidding wars can happen. In a slow market? Your house might go for just enough to cover the debt—or sometimes not even that.

The Consequences of Selling a Home in Foreclosure

Let’s be honest—this isn’t going to be great for your credit either way. But selling before the foreclosure completes usually dings your score less than letting the bank take the house. If the sale doesn’t cover what you owe, you might still be on the hook for the difference (called a deficiency judgment), though some states protect you from this. The earlier you act, the more control you have over the damage.

Moving Forward After a Foreclosure Sale

Post-sale Options

Start thinking now about where you’ll live next. Renting for a while isn’t the end of the world—it gives you time to rebuild. Some people even find they prefer it after the stress of homeownership gone wrong.

Rebuilding Financially and Emotionally

Pay everything on time from here on out. Check your credit report for errors. And don’t underestimate the emotional toll—this is hard stuff. Talk to someone if you need to, whether that’s a therapist, a support group, or just a friend who’s been there.

Seller Checklist

- Call your lender today (seriously, don’t wait).

- Find an agent who’s done this before.

- Get a realistic home value and repair estimate.

- Price to sell, not to dream.

- Blast your listing everywhere online.

- Be honest with buyers about the situation.

- Have a plan for where you’re going next.

FAQs

Can I sell my house after receiving a foreclosure notice?

Yes, you can. Until that auction actually happens, the house is still yours to sell. But you’ll need to hustle—find an agent who knows the foreclosure timeline in your area and can work fast.

Will selling in foreclosure hurt my credit?

It probably will, but not as badly as a completed foreclosure would. When you sell before foreclosure, it shows you took responsibility for the debt. Future lenders tend to look at that a bit more favorably, though you’ll still have some rebuilding to do.

Can I sell directly to an investor?

Absolutely. Investors can close quickly and buy houses in any condition, which might be exactly what you need. You’ll probably get less than market value, but sometimes that certainty is worth it. In places like fast home sale in Chesapeake, this can make a lot of sense.

What happens if my sale price doesn’t cover the mortgage?

You’ll need your lender to agree to a short sale. They might forgive the difference or work out a payment plan. It’s not ideal, but it beats foreclosure most of the time. The key is starting these conversations early—lenders are more flexible when they see you’re trying to solve the problem.