You can delay foreclosure through immediate action which involves contacting your lender to discuss available options including loan modification programs and forbearance agreements. The procedure establishes a vital timeframe which enables organizations to establish enduring solutions. The methods which prove most effective include refinancing and bankruptcy filing to trigger an automatic stay and quick property sales to settle the mortgage before the auction date.

Your First Moves to Delay Foreclosure

Foreclosure notices create a sense of being stuck but you can defend yourself most effectively by taking fast and focused action. The time between the Notice of Default and auction date serves as more than a waiting period because it provides a chance to act.

The authorities will speed up the process if you decide to ignore their letters and phone calls. The situation will transform completely when you decide to take preventive actions. Your main goal right now is simple: open a line of communication with your lender and show them you’re serious about fixing this.

The process requires time to find an effective treatment solution. The main objective involves buying yourself extra time to arrange your finances and research all available options before making an informed choice. Many lenders show their readiness to work with homeowners who share their financial difficulties openly.

Understanding the Timeline

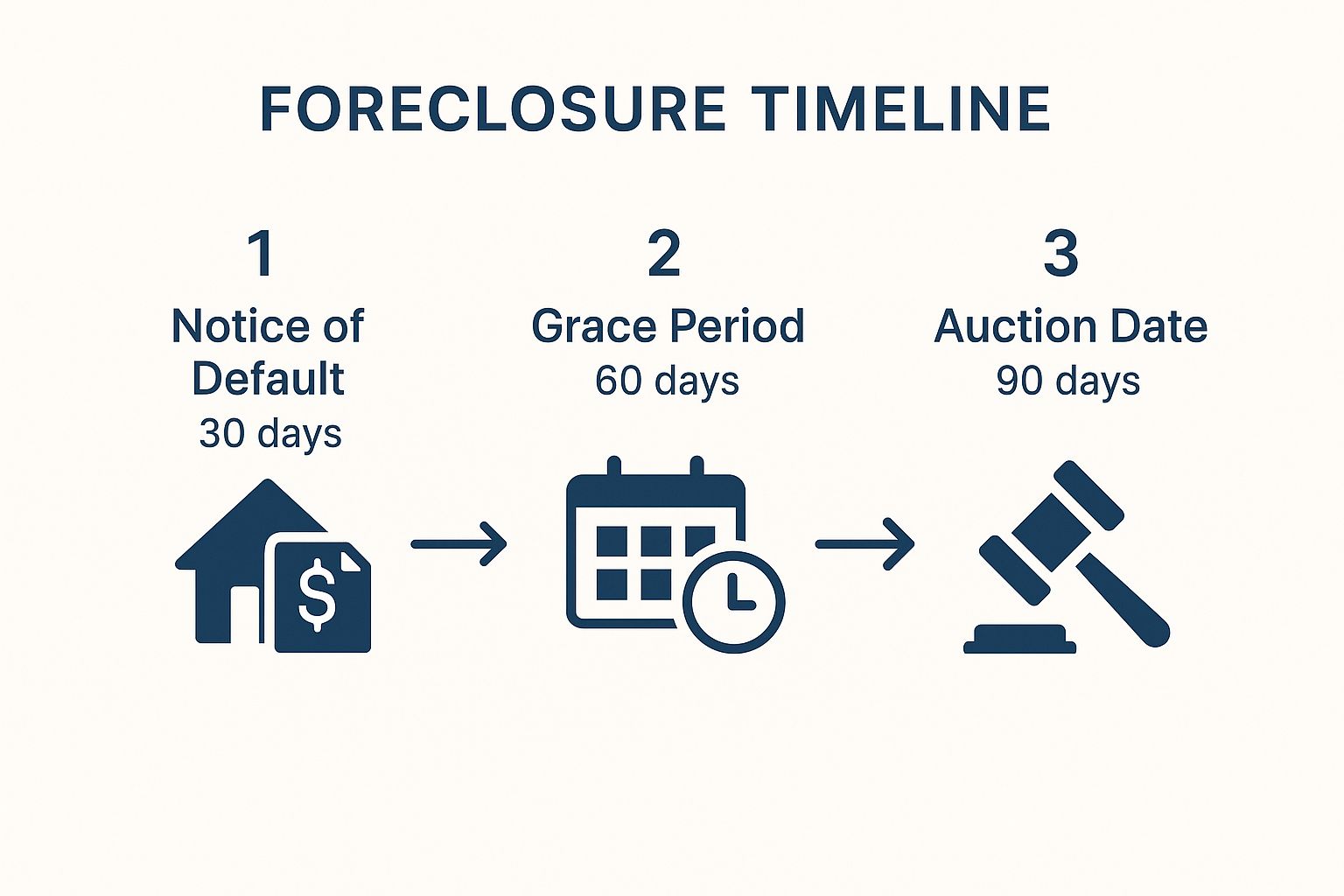

The foreclosure process follows a set timeframe which leads it to repeat predictably. The information about critical phases enables you to know the exact duration of your available time. The earlier you jump in, the more power you have.

The graphic shows the normal progression of default notices from start to possible auction stage so you know when to intervene.

The entire process presents various chances to progress through every stage. The method helps you use particular tactics to slow down time and regain control of your situation.

The first choices you make will belong to specific categories which correspond to particular circumstances. You might need to pause your payments for a brief period because of a sudden financial emergency which includes an unexpected medical expense. Your permanent income changes require you to modify your loan structure for an extended period.

The exploration of these routes requires critical attention. For a deeper dive, check out our guide on the 7 ways to avoid foreclosure, which breaks down everything from lender negotiations to legal options.

According to my personal experience homeowners tend to delay their most significant mistake. You need to begin searching for solutions right when you suspect a mortgage payment might become overdue. Time stands as your most precious resource during this time.

Your financial situation together with your specific objectives for the upcoming years will determine which option suits you best for starting. You need to make a decision right now whether to ask for forbearance or apply for a loan modification or think about selling your home. The method enables you to prevent future disasters while creating financial protection for your upcoming years.

How to Negotiate a Solution with Your Lender

Calling your mortgage lender makes total sense to create anxiety in your stomach. But that one phone call is often the single most powerful step you can take to stop a foreclosure in its tracks.

The situation appears from the viewpoint of lenders who operate as commercial entities because they would choose to avoid the costly and time-consuming process of foreclosure.

You establish yourself as a person seeking solutions when you start communication which ends your time as a case number. The process demonstrates your dedication which will reveal more possibilities than you ever thought existed. Your ability to negotiate with creditors depends on this because you need to prepare yourself for direct and honest communication about your financial state.

Getting Your Ducks in a Row Before the Call

You need to organize your paperwork before you start making calls. Your preparation for this discussion will demonstrate to your lender that you are serious about finding solutions which helps them identify suitable relief programs for your needs.

Have these items ready to go:

- Proof of Income: Grab your most recent pay stubs, W-2s, or anything else that shows your current household income.

- Financial Snapshot: Pull together recent bank statements and make a simple list of your monthly expenses. You need to paint a clear picture of what’s coming in and what’s going out.

- Write a brief and simple explanation about your situation in your hardship letter. Did you lose a job? Face a medical emergency? Go through a divorce? Be honest.

- Mortgage Statement: Have your latest statement handy for your loan number and other account details.

The preparation work enables you to transform what could be a frightening phone conversation into an effective business discussion. You are developing a proposal which can benefit both your financial position and the lender.

Exploring a Loan Modification

People should consider a loan modification their best achievable option among all available choices. Your new loan agreement will replace your current mortgage with permanent modifications to your original contract which will lower your monthly debt payments.

A successful modification could look like:

- The lender will agree to lower your interest rate.

- The borrower can extend their loan repayment period by adding ten years to their existing 30-year term.

- The borrower can merge their overdue debt into their current loan amount which will spread out the payments throughout their new loan term.

Don’t underestimate how common this is. Lenders have used modifications to help millions of homeowners. These programs work, and there are real numbers to back it up. Homeowners receive assistance from lenders which slows down the number of home foreclosures.

What About a Forbearance Agreement?

A forbearance agreement serves as an ideal solution when financial difficulties seem to be short-term problems instead of permanent changes in your situation. The main difference between forbearance and modification lies in the fact that forbearance does not change your loan terms permanently.

Your lender will establish a specific timeframe during which your mortgage payments will either be decreased or eliminated.

This solution works well when you need a short-term fix because of illness or job loss and you know when your paychecks will start arriving again. The program allows you to recover from financial problems while eliminating the risk of foreclosure.

Remember, the people in the lender’s loss mitigation department are there to find solutions, not just to collect a check. You need to tell them what you can pay and they will create a payment plan that works for your situation.

Ultimately, whether you land on a modification, forbearance, or something else, the conversation itself is what starts the process. The actual process of foreclosure prevention starts when you begin talking with your lender. The knowledge of all available options will help you decide between short sales and foreclosures. The guide provides detailed information about solving foreclosure problems through different methods which might suit your needs better.

Using Legal and Financial Tools to Stop Foreclosure

Sometimes, negotiating directly with your lender just isn’t enough. When you’ve hit a roadblock, it’s time to bring out the bigger guns. Legal and financial strategies can act as a powerful shield, forcing a hard stop to the foreclosure process and giving you the breathing room you desperately need.

These aren’t just hail-mary passes; they are established, structured options designed to provide real stability. From swapping your old, unmanageable mortgage for a new one to using the full protective power of the courts, let’s dive into how these tools can fundamentally change your situation.

Can Refinancing Be Your Solution?

If your credit is still in decent shape and you have some equity built up in your home, refinancing might be a fantastic option. Put simply, you’re taking out a brand-new mortgage to completely pay off the old one. The goal is to lock in a new loan with better terms, like a lower interest rate or a longer repayment period, which brings down your monthly payment.

For many homeowners, this is the fresh start they need. A more affordable mortgage can get you back on track and out of default. Before going down this road, it’s worth understanding how to refinance your mortgage to see if it’s a good fit for you.

Just be aware, refinancing has some strict requirements:

- Good Credit: Lenders will scrutinize your credit history, which can be a tough hurdle if you’ve already missed several payments.

- Home Equity: You’ll typically need at least 20% equity in your home to qualify for a traditional refinance.

- Stable Income: You must prove you have a steady income that can comfortably cover the new payments.

If you can check these boxes, refinancing is a clean and effective way to stop a foreclosure in its tracks by replacing the defaulted loan with a new, current one.

The Power of Bankruptcy and the Automatic Stay

The word “bankruptcy” can sound scary, but in reality, it’s a legal process created to protect people from being crushed by debt. When it comes to foreclosure, its most potent weapon is something called the automatic stay.

The moment you file for bankruptcy—whether it’s a Chapter 7 or Chapter 13—the court issues an immediate order. This automatic stay is a legal injunction that forces every single one of your creditors, including your mortgage lender, to cease all collection activities. That means the phone calls, letters, and the foreclosure process itself must stop cold.

The automatic stay isn’t a polite request; it’s a federal court order. It provides instant relief and gives you the space to figure out your next steps without the constant threat of a looming auction date.

This powerful legal shield doesn’t make your mortgage debt disappear, but it buys you incredibly valuable time.

Chapter 13 vs. Chapter 7 Bankruptcy

While both types of bankruptcy initiate the automatic stay, they have very different outcomes for homeowners trying to save their homes.

-

Chapter 13 Bankruptcy: Think of this as a reorganization. Often called a “wage earner’s plan,” it lets you bundle your past-due mortgage payments and other debts into a single, manageable repayment plan that lasts three to five years. This is an excellent tool for stopping foreclosure because it gives you a clear path to catch up and get current on your loan.

-

Chapter 7 Bankruptcy: This is a liquidation. It’s designed to wipe out unsecured debts (like credit cards and medical bills) quickly. While it does provide a temporary automatic stay, it doesn’t include a repayment plan for your mortgage. The lender can, and likely will, ask the court for permission to resume the foreclosure.

For most homeowners who want to keep their property, Chapter 13 is the far more strategic option. It provides a structured way to get back on solid ground. And if you find you need to sell your home during this process, it’s crucial to know how that works. You can learn more by reading about whether you can sell your house while in Chapter 13 bankruptcy.

Filing for bankruptcy is a major decision with lasting effects on your credit. But when you’re facing the certainty of losing your home, it can be a powerful and strategic move to regain control.

Finding Short-Term Relief with Forbearance Plans

https://www.youtube.com/embed/a4KeciIUXtY

Sometimes, financial trouble feels less like a permanent new reality and more like a sudden, violent storm. When that happens, a forbearance plan can be an absolute lifesaver. It’s not a get-out-of-jail-free card, and it definitely isn’t loan forgiveness.

Think of it as simply hitting the “pause” button on your mortgage. Your lender agrees to either temporarily reduce or completely suspend your payments for a set period. This gives you that critical breathing room to handle a short-term crisis without the immediate threat of foreclosure hanging over you.

This strategy is perfect for homeowners who have a solid financial history but have been blindsided by a major life event.

Forbearance makes the most sense in situations like:

- A sudden job loss or a drastic cut in your work hours.

- An unexpected medical emergency that comes with huge out-of-pocket costs.

- A natural disaster that has damaged your property or disrupted your income.

- A divorce or separation that throws your household finances into temporary chaos.

The entire point is to build a short-term bridge—just enough to get you from financial distress back to solid ground.

How to Request a Forbearance Plan

Getting a forbearance plan isn’t passive; you have to ask for it. The first step is to get on the phone with your lender’s loss mitigation department. These are the folks trained specifically for these situations.

When you call, be ready to explain your hardship clearly and honestly. Vague stories won’t get you far. You’ll need to back up your claim with documentation.

Typically, you’ll need to gather:

- Proof of Hardship: This could be a termination letter, big medical bills, or an insurance claim from a disaster.

- Income Verification: Recent pay stubs (if you have them), unemployment benefit statements, or any other proof of what money is coming in.

- A Hardship Letter: Keep this short and factual. Explain what happened, why you can’t pay, and when you realistically expect to be back on your feet.

Having these documents organized and ready to go makes the process much smoother. It shows the bank you’re serious and organized, not just trying to avoid your payments.

Your lender is looking for a temporary problem with a clear end in sight. Frame your request that way: “I’ve hit a temporary setback, but here is my plan to get back on track within X months.”

Understanding What Happens After Forbearance Ends

This is the part everyone needs to understand: the paused payments don’t just vanish. Once the forbearance period is over, you have to repay every penny you missed. Lenders have a few different ways of handling this, and it’s critical you discuss these options before you agree to anything.

Here are the most common repayment structures:

- Lump-Sum Payment: You pay back the entire missed amount all at once. Frankly, this is tough for most people just getting back on their feet.

- Repayment Plan: Your lender will tack on a portion of the past-due amount to your regular monthly mortgage payment for a certain number of months until the debt is paid off.

- Loan Modification: In some cases, the lender might agree to a permanent change. They’ll add the missed payments to your loan balance and recalculate your payment over the remaining term of the loan.

Forbearance has been a massive help for homeowners trying to delay foreclosure, especially during big economic downturns. During the COVID-19 pandemic, for instance, over 7 million U.S. homeowners used these programs to pause their payments. While foreclosure filings have ticked up as these protections expire, the programs remain a vital tool.

A forbearance plan can be a powerful way to temporarily halt a foreclosure, but it’s just one tool in the toolbox. It’s so important to understand all the strategies you have at your disposal. You can learn more about how to stop foreclosure in our detailed guide, which gets into other powerful solutions that might be a much better fit for your long-term goals.

When a Quick Home Sale Is the Best Option

After learning about negotiation techniques and legal protections and temporary solutions we need to explore one final powerful approach. Sometimes, the most practical way to stop a foreclosure isn’t about delaying it—it’s about getting ahead of it by selling the property on your own terms.

The process of surrendering property does not mean defeat. Far from it. The method enables you to regain control of your present circumstances. A foreclosure auction creates a risky situation which can damage your credit score for seven years. The sale of your home through a private sale will enable you to settle your mortgage debt while protecting your financial future and keeping your dignity intact.

Time emerges as the most significant challenge which stands in our way. The process of selling a traditional home through showings and inspections and financing can take several months to complete. You don’t have that luxury when an auction date is right around the corner.

Why a Traditional Sale Often Fails in Foreclosure

The majority of people choose to list their homes through real estate agents yet this process contains multiple delays which prove unsuitable for foreclosure situations.

Think about the common roadblocks you’d face:

- Time on Market: The average home stays on the market for several weeks to months even when the market shows positive signs.

- Buyer Financing Issues: The deal often collapses at the final stage because the buyer’s financing application gets rejected.

- Repairs and Inspections: The home inspection process leads buyers to request expensive repairs which create additional costs and delays that you cannot afford to handle.

The variables create excessive risk when you need to complete the task under time constraints. You require both speed and certainty. That’s where a different kind of sale comes into the picture.

The Cash Sale Advantage: Certainty and Speed

Selling your home directly to a cash buyer provides you with a quick and reliable solution that needs no additional work. The system eliminates banks and appraisers and agents from the process to establish a direct connection between buyers and sellers.

The biggest benefit is speed. The home-buying company provides a fast offer that takes less than 24 hours to process and the entire transaction can finish within two weeks. The quickness of this method proves essential when you need to beat a foreclosure auction deadline.

A quick cash sale proposition includes two fundamental elements which are immediate property sale and immediate cash payment. The system enables you to swap the uncertainty of unknown dates for definitive closing dates which allows you to take control of your financial future.

Homeowners in urgent need of cash benefit from the fast payment option that cash sales provide. You will not encounter any unexpected expenses or last-minute surprises.

Key Benefits of a Quick Cash Sale

The benefits of foreclosures reach past the need for a quick sale. The process exists to help people manage their most intense stress that happens when they need to sell their homes quickly.

- Sell “As-Is”: You won’t have to spend a single dime on repairs, cleaning, or updates. Cash buyers purchase the property in its current condition, saving you time and money that you don’t have.

- No Commissions or Fees: Traditional sales require sellers to pay agents a commission that usually equals 5-6% of the sale price together with additional closing expenses. With a direct cash sale, you skip all of that, which means you keep more of your home’s equity.

- Guaranteed Closing: The sale does not need financing approval because no lenders participate in the transaction. The sale becomes final when you accept the offer.

- Flexible Timeline: The buyer receives the power to select the closing date. The auction can be stopped by closing within 14 days. The packing and organization process can be delayed for a short period.

The method enables you to start fresh. You can satisfy your mortgage debt, prevent a devastating foreclosure from ever appearing on your credit report, and start fresh with whatever equity is left over. Most people choose bankruptcy because it leads them to financial recovery. The bank sale of your home requires immediate action so you should study our guide for selling your house before foreclosure.

Eagle Quick For Cash offers homeowners in this position a cash deal that needs no commitments. The program exists as one of multiple powerful options which enables you to select the best path for your needs without any obligations. The service provides a dependable solution to solve your problem while protecting your credit rating and enabling you to make progress.

Common Questions About Delaying Foreclosure

You’re probably overwhelmed with questions when you try to discover methods for delaying foreclosure. The situation seems overwhelming at first but the search for simple answers will lead you back to control. The following list contains several typical inquiries which homeowners frequently ask me.

How Long Can I Realistically Delay a Foreclosure?

The answer to this question depends on your specific circumstances and chosen approach and your location. There’s no one-size-fits-all timeline. The amount of time you can buy yourself can range from a few months to several years.

- Forbearance: This is a short-term fix. The program allows you to stop your payments for three to six months but some pandemic-related programs provided extended coverage. Think of it as a temporary breather.

- Loan Modification: This isn’t just a delay; it’s a permanent solution. The bank will adjust your loan agreement to stop the current foreclosure process permanently once you get approved and then create a new payment schedule that fits your budget.

- Bankruptcy: Filing for Chapter 13 bankruptcy triggers an “automatic stay,” which legally and immediately halts the foreclosure process. The protection continues as long as you follow the repayment plan that the court approved which usually lasts between three and five years.

- Selling Your Home: A quick sale to a cash buyer can stop a foreclosure dead in its tracks. The entire process ends when you pay off the lender before the auction date which usually takes less than two weeks.

The main factor which needs speed to move forward. The moment you get that notice of default, the clock is officially ticking. The earlier you act the more time and choices you will receive.

Will Talking to My Lender Make Things Worse?

The feeling of fear seems entirely normal to me. Many people worry that calling their lender is like waving a white flag and admitting they’ve failed. In my opinion the situation presents precisely the reverse of what the author describes. Being proactive is one of the smartest moves you can make.

Here’s something to remember: foreclosure is a long, expensive headache for lenders, too. The lender will choose to keep you in your home by accepting lower payments instead of starting the repossession process.

The process of contacting your lender will not activate any warning signals because it creates new possibilities for you. The notice serves to prove that you handle your home responsibilities properly while dealing with your current financial problems.

The conversation between you and the other person will change when you share your difficulties and show that you want to find solutions. The process of conflict resolution transitions from opposition to partnership when both parties work together to find solutions. The simple change enables you to access new options which include loan modifications and forbearance plans that you would not receive if you continued to remain silent.

How Does Delaying Foreclosure Impact My Credit Score?

The truth is your credit score probably suffered several times because of missed mortgage payments before foreclosure became a possibility. The main concern lies in how you will handle the damage from this point forward.

The final foreclosure stage produces the most damaging entry which can appear on your credit report. The negative mark stays on your credit report for seven years which creates major difficulties for future credit applications including car loans and mortgages and credit cards.

Here’s a quick look at how the different strategies stack up:

| Strategy | Impact on Credit Score |

|---|---|

| Loan Modification | The impact on your credit score remains less severe than a foreclosure would be. The bank will use its communication efforts to prove to future lenders that you attempted to resolve the problem. |

| Forbearance | Usually has a minimal impact, especially if your lender agrees to report your payments as current during the pause. |

| Chapter 13 Bankruptcy | The process generates major negative effects. The court will evaluate your bankruptcy filing more positively than a foreclosure because it proves you attempted to repay your debts. |

| Quick Cash Sale | This is the best-case scenario for your credit. The loan is paid in full, and a foreclosure is never recorded on your report. The two properties separate from each other with no common walls. |

Your financial health will improve when you select any path which keeps you from completing a foreclosure. Your home will face less damage to credit when you choose bankruptcy as a solution. And if a quick sale makes sense for your situation, it lets you sidestep the credit damage completely.

You will encounter difficulties when choosing between these options but professional help is available to guide you through this process. Eagle Quick For Cash provides a no-obligation cash offer to help you resolve your situation through a quick sale that protects your credit and lets you start fresh. Find out more at https://www.eaglecashbuyers.com.