When you default on your mortgage you face a series of intense challenges that damage both your current home and your entire financial stability. The most immediate effects consist of severe credit score destruction together with mounting late fees and interest charges and the start of legal foreclosure proceedings which might end with home loss.

The first missed payment marks the beginning of this process. The solution requires knowledge about this process to solve it. The good news is you have options, and acting quickly gives you the most control.

What Really Happens When You Default on Your Mortgage

Millions of homeowners have experienced this frightening situation which means you are not experiencing this alone. Simply put, a mortgage default happens when you break the terms of your loan, which almost always means you’ve stopped making payments.The process begins after you have been late on your payments for 30 days.

The timing starts when you miss your first payment. The lender will start contacting you while your debt will grow because of late payment fees which will make your financial situation even worse. The critical moment occurs when the situation has the chance to either stabilize or become more dangerous.

The First Dominoes to Fall

The first effects of default create financial problems together with personal stress which become apparent right away. Knowing what’s coming is the first step to getting things back on track.

- Your Credit Score Takes a Hit: Lenders report late payments to the credit bureaus.Your credit score will decrease by a large amount because of one 30-day late payment which will create difficulties when you try to get a car loan or credit card or mortgage in the future.

- The Debt Piles Up: You have to focus on more than just the missed payment. The amount you owe will increase rapidly because of late fees and interest charges.

- The Phone Starts Ringing: Expect to hear from your lender’s loss mitigation department.Your financial situation generates a large amount of calls and letters which serve as your chance to discuss your options before things get worse.

A mortgage default isn’t just a missed payment.The process of debt collection begins at this point for lenders to recover their funds which leads to the start of foreclosure proceedings.

This early stage is your best chance to take action.The window exists to stop the lender from starting official legal proceedings. Learning how to stop foreclosure today will bring you the best advantage of all. The knowledge of what lies ahead enables you to make logical choices instead of emotional decisions.

Quick Summary of Mortgage Default Consequences

The table displays all the primary effects which occur when you default on your mortgage payments.

| Consequence | Typical Impact | Timeline |

|---|---|---|

| Credit Score Damage | A potential drop of 100+ points over time. | Begins after the first 30-day late payment. |

| Foreclosure Process | The legal process where the lender repossesses the home. | Typically starts 90-120 days after the first missed payment. |

| Deficiency Judgment | A court order to pay the remaining loan balance after foreclosure. | Can occur after the home is sold at auction if state law allows. |

| Tax Implications | Potential for canceled debt to be treated as taxable income. | Occurs in the tax year following a short sale or foreclosure. |

The following sections will examine the various effects in detail.

How Default Impacts Your Financial Reputation

The first major consequence of mortgage default leads to severe damage to your financial reputation. Your credit score functions as a financial greeting because it creates the first impression lenders and landlords and certain employers see about you. Your financial reliability shows as a single number which serves as a credit score.

The big three credit bureaus Equifax and Experian and TransUnion receive a report from your lender when you miss a mortgage payment. The late payment will generate a adverse entry on your credit report. Your credit score will experience a noticeable drop after one missed payment but the damage becomes more severe with each additional missed month.

The Credit Score Cascade Effect

The financial collapse goes beyond a minor setback because it creates a situation which takes multiple years to overcome. Your credit score will drop dramatically when a default becomes a foreclosure.

The debt creates a chain reaction which affects all areas of your financial situation.

- Higher Interest Rates: Need a car loan or a new credit card? Your credit score will take a hit because lenders now view you as a high-risk applicant. The lender will defend themselves through charging you extremely high interest rates which could add thousands of dollars in extra costs during the entire loan period.

- Difficulty Renting: Finding a new place to live becomes a massive hurdle.Your credit history will determine whether landlords choose to approve your rental application because they usually perform credit checks and a foreclosure record usually results in an automatic denial.

- Insurance Premium Hikes: Believe it or not, even your car and home insurance rates can go up.Your credit score determines insurance rates because insurers base their pricing on a modified version of your credit score and they view high-risk customers as those with low scores.

A mortgage default stands as the most severe factor which can harm your credit rating. The guide you can find here will help you understand the various reasons behind credit score decreases.

The Numbers Behind the Damage

Your credit history before the default will determine the exact amount of point loss but the damage remains substantial. The journey of homeownership disappears for countless families when they face foreclosure because their years of financial planning become useless within a few short months.

The loss of your home through foreclosure leads to credit score destruction because it creates damage that reaches between 100 and 160 points or even higher. The destruction of your home brings about two major problems because it stops you from getting future loans and it decreases the value of properties in your community which leads to neighborhood decline.

A negative mark like a foreclosure can stay on your credit report for up to seven years.The time you spend with this obstacle in front of you will determine how long it takes to reach your financial objectives.

Navigating Your Options

Knowing what’s at stake is the first step.A foreclosure is typically far more damaging to your credit than other options because it’s an aggressive legal action the lender takes against you.

The process of selling your home through a short sale with lender approval helps you minimize the financial damage. It’s still a serious financial event, but it’s often viewed more favorably than a full-blown foreclosure.Study our short sale versus foreclosure guide to understand the essential distinctions between these two processes.

The best approach maintains foreclosure prevention as the highest priority. You should explore all available options because negotiating with your lender and selling your property for quick cash can help you regain control of your finances while reducing long-term financial damage.

Navigating The Foreclosure Process

The word “foreclosure” produces a sense of fear which makes homeowners feel terrified. The foreclosure process contains various stages which require specific amounts of time to complete before the property gets sold. Learning the timeline structure proves essential because it reveals when you can still influence the final result.

The train begins to move when a passenger boards the train. The train starts to move when you miss the first mortgage payment but several stations exist between the first missed payment and the final stage which results in permanent home loss. Every stop during your trip allows you to exit or change your direction.

The process starts when the pre-foreclosure period begins. The first missed payment starts this phase which continues for approximately 90 to 120 days. Your lender will contact you through letters and phone calls during this period. The collection agency must provide debt repayment options when they contact you. This is your most flexible time to negotiate a loan modification, a forbearance plan, or some other arrangement.

The Formal Notice of Default

The situation will become more dangerous if you fail to recover from pre-foreclosure. Your lender will then file a Notice of Default (NOD), a public document that officially kicks off the legal foreclosure proceedings.The NOD gets recorded with your county, making your financial trouble a matter of public record.

The NOD starts a fast countdown process when you receive it. The notice will establish a precise deadline for you to repay all your debts within 90 days but the exact time period differs between states. The process of bringing your loan back to current status after being delinquent is known as “curing the default.” The lender will schedule your home for foreclosure auction if you cannot get the funds needed.

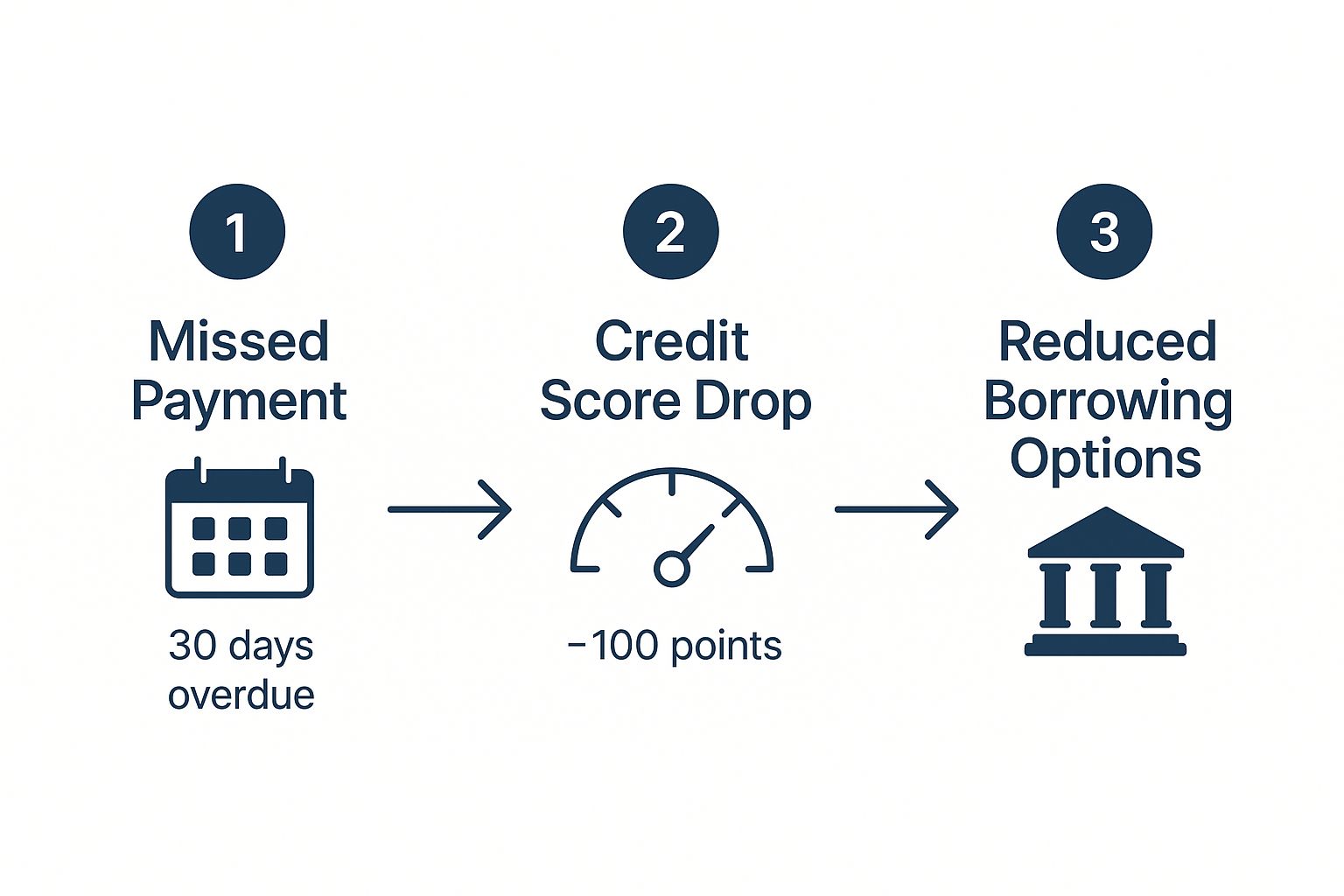

The image below demonstrates how one missed payment starts a chain reaction which damages your credit and reduces your financial options.

The effects accumulate on top of each other as shown. That’s why acting early is the single best thing you can do to protect your financial stability down the road.

The Foreclosure Auction and Aftermath

If you cannot fix the default by the deadline your home will go to public auction which takes place at the county courthouse. The property will be sold to the highest bidder who could be an investor or the bank if they choose to take ownership. The ownership of the home transfers to the new owner when the auction ends.

The new owner will begin eviction procedures to remove you and your family from the property. The final step of this process shows how dangerous mortgage default situations actually become.

Knowing the foreclosure process helps you identify your last opportunities to regain control. You still have time to prevent your home from being sold at auction after a Notice of Default has been filed.

Your Options at Each Stage

The knowledge of foreclosure timelines enables you to create strategic plans that produce successful outcomes. You will always have the power to make changes but you need to take action.

- Pre-Foreclosure (First 1-3 Months): This is your prime time to act.Immediately contact your lender to discuss loan modification or forbearance or create a repayment plan. The time has arrived to decide when you want to sell your home.

- Notice of Default (Next 3 Months): Your options start to narrow, but they haven’t disappeared. You can still try to reinstate the loan by paying the entire past-due amount.The process of foreclosure auction can be stopped by a short sale or selling your property to a cash buyer.

- Scheduled Auction (Final Weeks): This is the eleventh hour.The only solution left to pay off your mortgage debt and stop the auction process is to sell your property quickly.

The overwhelming stress makes it difficult to find any direction. The ticking clock creates a sense of entrapment but people need to recognize that solutions do exist. Our guide on how to delay foreclosure contains essential information which shows you specific methods to gain additional time. You will understand what to expect in each phase which will help you select the best option to protect your family’s financial security.

The Financial Fallout You Don’t See Coming

Your two primary concerns during mortgage default are home loss and severe damage to your credit rating. The big, obvious consequences. The financial problems usually persist after the home sale has occurred.

After the foreclosure sale there are several unpleasant financial shocks which can emerge. Think of them as the aftershocks of the initial earthquake.Knowing what they are is the first step in protecting yourself and making a smart decision for your future.

The Specter of the Deficiency Judgment

The bank performs a foreclosure auction sale after it starts the process. What happens if the sale price doesn’t cover what you still owed on the loan?The difference between the sale price and your outstanding mortgage debt creates what is known as a deficiency.

Let’s walk through an example.Say you owed $250,000, but at the auction, your house only fetched $200,000.The amount you need to pay back is $50,000.

Here’s where it gets serious.Your lender could take legal action against you for the remaining $50,000 depending on your residential location.

If they win in court, the judge issues what’s known as a deficiency judgment.Your debt becomes a personal liability through this court order. The lender uses this judgment to perform aggressive collection methods which include the following actions:

- Garnishing your wages (taking money directly from your paycheck).

- Levying your bank accounts (freezing and seizing your funds).

- The lender can use the judgment to place liens against your assets including your car and second property.

A deficiency judgment will convert your previous mortgage debt into a single debt that needs to be paid. The debt continues to exist after your home has been lost.

The ability of lenders to pursue deficiency judgments depends on state laws because some states do not permit deficiency judgments and the rules regarding them remain complicated. Still, it’s a massive risk that catches many homeowners completely off guard and underscores why settling the debt before an auction is so critical.

The Surprise Bill from the IRS

The IRS will send you a bill for unpaid taxes through your mail system. The government treats forgiven debt from short sales or foreclosures as taxable income according to current tax laws.

Why?According to the IRS the lender has given you cash money. Your lender will issue a Form 1099-C Cancellation of Debt to the IRS. Being insolvent or filing for bankruptcy might protect you from this tax hit but it is not guaranteed. The unexpected arrival of a tax bill for tens of thousands of dollars creates a severe financial burden while you are attempting to recover financially.

The hidden expenses create major problems for you but you do exist in a position of strength. The key is to act before the bank does. One of the cleanest ways to avoid both a deficiency judgment and a potential tax nightmare is to pay off the mortgage entirely.Most people would have to sell their house right away to get out of this situation.

If a quick, certain sale is the right solution for you, a cash home buyer like Eagle Quick For Cash can provide a direct path to sell your house, often in as little as 14 days.The funds enable you to pay off your entire mortgage before the foreclosure auction takes place which removes the risk of deficiency and lets you start fresh with no debt.

Exploring Your Alternatives To Foreclosure

The knowledge of mortgage default realities can feel too much to handle but your story continues to unfold. Far from it. This is your chance to shift from a defensive stance to an offensive one by exploring all the paths still available to you.

Foreclosure is not the automatic result of the process. When all other attempts to resolve the debt have failed this is what happens. The good news is that there are several powerful alternatives you can pursue to avoid that last resort, protect your financial future, and take back control of the situation.

Working Directly With Your Lender

Your first step requires you to call your lender immediately. The assumption that lenders operate as adversaries is incorrect because they prefer to work with you since foreclosure creates expensive prolonged issues for them too. The company needs you to find a solution which enables you to resume your payments.

The loss mitigation department at the company provides these primary choices when you reach out to them:

- Loan Modification: The loan modification process changes your existing loan agreement into a permanent arrangement which establishes new payment terms that suit your budget. The lender might reduce your interest rate or lengthen your loan term or in particular cases decrease the total amount of debt you owe.

- Forbearance Agreement serves as a temporary suspension of payments.Your lender permits you to stop making payments during a predetermined time frame. The program provides quick help for temporary financial emergencies because it assumes your income will return to normal shortly.

- Repayment Plan: A repayment plan can help you get back on track if you have fallen behind on your payments. You must pay your regular mortgage payment along with additional amounts each month to eliminate your overdue debt until your account becomes current.

Proactive communication is everything when dealing with your lender.Your chances of finding solutions will rise when you act quickly. Your ability to negotiate will drop significantly if you wait until the bank files a Notice of Default.

Solutions When Keeping The Home Isn’t Possible

Life sometimes brings changes which make it impossible to stay in your current home. The main objective during these situations requires stopping the mortgage debt process with minimal financial damage while striving to protect your credit score from becoming permanently damaged.

Here are two common exit strategies your lender might approve:

- Short Sale: This option is for when your home is “underwater,” meaning you owe more on the mortgage than the property is worth.The lender must approve your sale at market value because they will use this as the complete payment for your remaining debt.

- Deed in Lieu of Foreclosure: This is exactly what it sounds like.The deed of the property will be given to the lender through your voluntary action. The lender will erase your entire mortgage debt. This is usually only an option if you don’t have any other liens (like a second mortgage) on the property.

The two options present less harm to your credit rating compared to complete foreclosure. But they come with a catch: the lender has to approve everything, a process that can be agonizingly slow and buried in paperwork.The evaluation of refinancing costs will help you decide if this approach will stop your default from happening.

Taking Control With A Quick House Sale

Working with your lender provides results yet you need to wait for their approval which might never come. The solution for homeowners who want an immediate guaranteed answer is to sell their property to a cash buyer.

The process enables you to avoid the frustrating and unpredictable waiting periods that come with modifications and short sales. The method provides immediate feedback which enables you to stay in control. A cash sale gives you the money to pay off the mortgage completely before the bank can foreclose, stopping the legal process in its tracks.

The strategy provides several important benefits to the organization.

- Speed: A cash sale can close in as little as 14 days.The negotiation process with lenders can take several months to complete while the bank uses its own schedule.

- Certainty: Once you accept a fair cash offer, the deal is solid.Your sale becomes final when you accept the cash offer from a retail buyer because it protects you from any loan rejections that might occur.

- Clean Slate: Selling for cash wipes the slate clean.Your mortgage debt will be fully paid off and your lender will consider you free of debt without any foreclosure damage to your credit rating.

Comparing Your Foreclosure Alternatives

The stakes are high so it helps to know all your options in detail. The table presents various paths with their advantages and disadvantages to help you choose the best option for your personal situation.

| Option | Best For… | Impact on Credit | Typical Timeline |

|---|---|---|---|

| Loan Modification | Homeowners with a long-term income reduction who want to stay in the home. | Moderate negative impact, but less severe than foreclosure. | 3-6 months or more |

| Forbearance | Those facing a temporary financial setback who can resume payments soon. | Minimal impact if payments are caught up as agreed. | 3-12 months of relief |

| Short Sale | “Underwater” homeowners who can’t afford the home and need to sell. | Significant negative impact, but better than foreclosure. | 4-12+ months |

| Deed in Lieu | Homeowners with no other liens who want a clean break from the lender. | Significant negative impact, similar to a short sale. | 3-6 months |

| Quick Cash Sale | Anyone needing a fast, certain exit to pay off the mortgage and avoid foreclosure. | No negative impact from foreclosure; the mortgage is paid off. | 1-4 weeks |

Your financial position together with your personal goals will determine which path you choose to take. Eagle Quick For Cash provides a quick and dependable solution for people who want to sell their homes right away.

Common Questions About Mortgage Default

The experience of dealing with a mortgage default feels overwhelming because it makes you feel isolated from everyone else. Many homeowners have faced similar situations as you and they asked the same questions that you are now asking.

The process of finding answers will help you get back in control. The following section addresses typical questions to help you understand the correct path forward.

How Long Does The Foreclosure Process Usually Take?

The answer to this question is vital but it varies based on your location. Different states follow different rules because some states require judicial foreclosure procedures while others use non-judicial methods.

The foreclosure process in non-judicial states proceeds at a rapid pace because it can finish within a few short months. Your lender needs to start a court case in judicial states which leads to a prolonged process that can last more than a year.

Your missed payment period of three to six months triggers the start of the countdown. You will get a formal Notice of Default at this point. The biggest takeaway here?Your best choices appear at the start of the process. You need to reach out for help right away if you anticipate any problems with your payments.

Can I Still Save My Home After A Notice Of Default?

Yes, absolutely.The legal process starts when you receive a Notice of Default but this document does not represent the last stage in the process. The present moment requires urgent decisions about what to do next.

The process contains several tools which you can use to block its progress.

- Reinstate the Loan: Most of the time, you have a right to “reinstate” the mortgage.Your loan becomes current when you pay all past-due amounts together with any additional late fees and penalties.

- Negotiate a Workout Plan: Contact your lender immediately by phone. You can request a loan modification which permanently adjusts your loan terms or a forbearance agreement that temporarily stops your payments until you regain financial stability.

- File for Bankruptcy: The process of filing for bankruptcy results in an “automatic stay” which protects you from creditors. The court order prevents the foreclosure sale from proceeding which gives you essential time to organize your financial situation and develop a sustainable plan for the future.

Is A Short Sale As Bad For My Credit As Foreclosure?

A foreclosure produces more damage to your credit score than a short sale although both situations create negative impacts. It all comes down to cooperation versus a forced legal action.

A foreclosure is a lawsuit your lender files against you.The negative impact on your credit report from a foreclosure remains visible for up to seven years. A short sale, on the other hand, is an agreement you make with your lender to sell the house for less than you owe. The negotiation process functions differently from the legal system.

A short sale appears on your credit report as “settled for less than the full amount” which lenders consider to be better than a foreclosure. As a result, you’ll typically be able to qualify for a new mortgage much, much sooner after a short sale.

Is Selling My House For Cash A Good Way To Avoid Foreclosure?

Cash offers serve as an effective method to prevent foreclosure for many homeowners who need fast solutions. The two biggest advantages are speed and certainty—two things you just don’t get when you’re at the mercy of a bank’s timeline.

The sale process through cash offers typically finishes within two weeks which enables you to pay off your mortgage before the foreclosure process starts. The process halts foreclosure proceedings and keeps them from appearing on your credit report. The deal could include an additional payment to you. Our guide provides answers to this question. can I sell my house if I’m behind on payments? It’s a powerful alternative to consider.