Absolutely, you can sell a house before foreclosure. The financial protection method safeguards your credit score and home equity to serve as a vital defense against financial risks.

This process is known as a pre-foreclosure sale. The process requires you to sell your home after you receive a default notice from your lender but before the property moves to the auction stage. Your capacity to make fast decisions determines your path to financial success because speed controls both your sales results and financial returns.

Your First Steps in the Foreclosure Timeline

The experience of getting a foreclosure notice causes intense emotional distress which feels exactly like getting hit directly in the chest. The clock starts ticking and you feel like you are losing your grip on everything. The situation feels out of control but you can regain control by first understanding the situation and the exact time remaining.

This decision requires you to face your problems directly instead of avoiding them. You must actively choose to defend your accomplishments which required years of devoted work.

Homeowners face a state of paralysis when they reach this stage yet the timeframe between their first missed payment until foreclosure sale date gives them a chance to take action. The system provides this period which allows you to find a solution.

Decoding the Critical Notices

The first official mail you will get is the Notice of Default (NOD). The document functions as a warning system which does not serve as an eviction notice. The notice functions as an official document from your lender which proves they started legal action because you failed to make your payments on time.

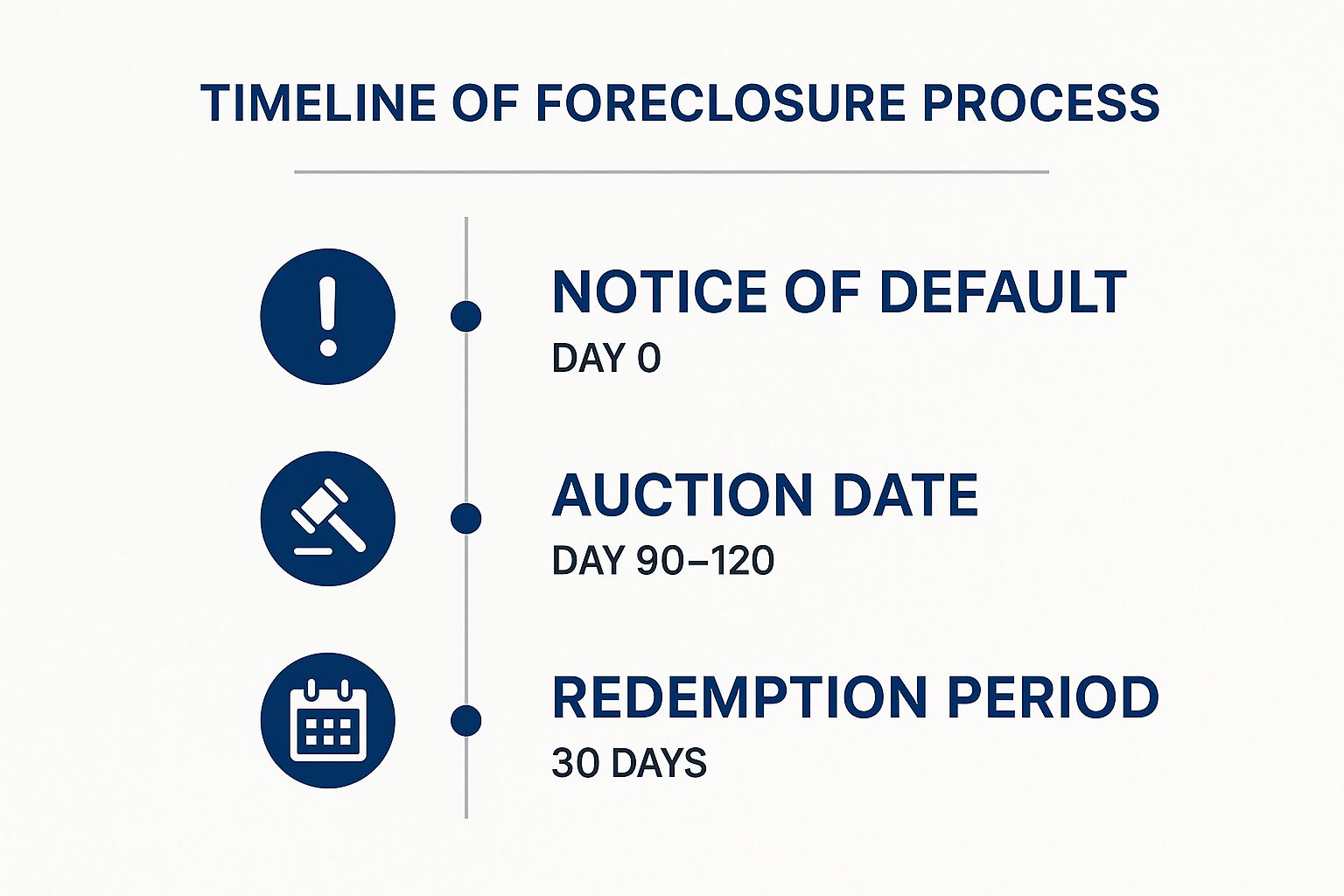

The notice initiates a particular time period which most states set between 90 and 120 days to enable you to correct the default and start making your payments again.

This is your prime time to make a move. You have several options to choose from:

- Loan Modification: You can try to negotiate with your lender to permanently change your loan terms, like lowering the interest rate or extending the payback period to make your monthly payments manageable.

- The Forbearance Agreement provides a short-term solution to reduce or stop your mortgage payments so you can handle an immediate financial emergency. Your lender will allow you to make monthly payments which include your normal mortgage payment plus additional amounts to help you pay off missed payments.

The first step in your exploration process requires you to understand all available tools which include foreclosure bailout loans as an option. Evaluating all financial options enables you to discover the most suitable path for your current circumstances.

Mapping Your Timeline to Sell a House Before Foreclosure

The timeline shows standard growth benchmarks which help you determine the right time to start.

The takeaway here is crystal clear: you have the most control and the best options right after you receive the Notice of Default. The amount of leverage you can use decreases when the auction date approaches.

Foreclosure prevention functions as a concept which people have been aware of for numerous years. The government and lenders created programs which assist people who want to remain in their homes. These programs completed 54,750 foreclosure prevention actions during their most recent quarterly report.

The biggest mistake you can make is waiting. Your available options decrease every day while the stress level continues to rise. Your best defense comes from making quick choices that rely on solid information.

The table below provides a detailed overview of the pre-foreclosure process which helps you understand the timeline and available actions to manage the situation.

Key Pre-Foreclosure Stages and Strategic Actions

| Foreclosure Stage | Typical Timeframe | What Happens | Your Best Action |

|---|---|---|---|

| Missed Payments | 1-90 Days | Lender sends late notices and may start calling. Your credit score begins to be impacted. | Contact your lender immediately to discuss options. Assess your budget and situation. |

| Notice of Default (NOD) | 90-120 Days Post-Missed Payment | A formal, public notice is filed, officially starting the foreclosure process. | This is the crucial window. Choose between loan modification and forbearance and pre-foreclosure sale options. |

| Notice of Trustee’s Sale | 20-30 Days Before Auction | The lender sets an auction date for your home. The date, time, and location are publicly advertised. | Time is critical. A fast sale to a cash buyer is often the only remaining option to avoid the auction. |

| Auction Date | Set Date | Your home is sold to the highest bidder at a public auction. You lose ownership and any equity. | At this point, your options to sell are gone. The goal is to act long before this day arrives. |

The knowledge of these phases enables you to develop planned responses instead of making hasty reactions.

Loan modification programs and forbearance options serve as vital assistance programs yet applicants face long uncertain approval times which do not guarantee successful outcomes.

Most homeowners would find selling their house before the bank takes ownership to be the quickest and most definite solution. A sale enables you to discharge your entire debt to the lender while safeguarding your credit score from the harmful effects of foreclosure and in many situations you can retain your remaining home equity. To learn more, check out our guide on https://www.eaglecashbuyers.com/blog/7-ways-to-avoid-foreclosure/.

Calculating Your True Home Equity Under Pressure

You need to start by taking a real look at your financial situation before you can start planning. The situation demands exact numbers instead of approximate estimates or unfulfilled assumptions. Your home equity value functions as the base for all future financial decisions because it shows the amount of resources you can use and the limits you have.

The difference between your property market value and your current debt obligations equals your equity. But when foreclosure is on the table, the “what you owe” part gets a bit more complicated than just your mortgage balance.

Tallying Up the Total Debt

Your first move should be to get an official payoff statement from your lender. The actual number tends to be higher than what you expect because it usually turns out to be more than you think.

Lenders start adding extra fees when the foreclosure process begins to unfold. The total amount you owe will probably include the following:

- Missed mortgage payments: The total of all payments you’re behind on.

- Accrued late fees: These penalties stack up fast and can be a significant chunk of the total.

- Legal and administrative costs: Fees your lender paid to attorneys and other parties to initiate foreclosure.

- Property tax or insurance payments: If your lender had to cover these costs to protect their asset, they’ll pass them on to you.

You need to use the official payoff number that you received instead of the amount that appears on your last statement. This is the real figure you need to clear to walk away clean.

Determining Your Home’s Realistic Market Value

Next, you need a realistic price for your home in its current condition. The online “zestimates” function as initial reference points yet they cannot detect your bathroom leak or the recent house sale at a low price in your neighborhood.

You need to choose between two reliable approaches to find out a trustworthy number:

- Comparative Market Analysis (CMA): A local real estate agent can run one of these for you, usually for free. The tool collects data from recent home sales in your area to show you current market values.

- Professional Appraisal: This is the gold standard for valuation, but it’ll cost you a few hundred dollars. The time constraint makes CMA analysis sufficient for producing the necessary outcome.

Be a realist, not an optimist. The only thing worse than overpricing is when the clock starts ticking. Your price needs to reflect the “as-is” condition of your home, because you likely don’t have the time or money for a big renovation.

Putting the Numbers Together

Once you have your two key figures—the total payoff amount and your home’s realistic market value—the math is simple. The outcome of this calculation will define the direction for your entire strategy.

[Current Market Value] – [Total Loan Payoff Amount] = Your Equity

Let’s run through a quick example. Say your home could realistically sell for $320,000. Your lender’s payoff statement shows you need to pay $280,000 after all additional costs and unpaid amounts. In this scenario, you have $40,000 in positive equity.

Knowing this number is a game-changer. The formula shows whether you will get money back or end up with a balance that exceeds the value of your home. To understand your current position better, check out our complete guide about home equity requirements before selling.

Your equity position dictates your path forward. The possession of positive equity opens up multiple paths for you to take. Your plan needs to become more specific when your account balance shows zero or falls below zero. People who require immediate assistance find fast guaranteed offers to be very helpful. An experienced cash buyer will present you with a direct offer without any obligations which you can use to make your final decision.

Comparing Your Realistic Selling Options

When the foreclosure clock is ticking, selling your house isn’t business as usual. The standard playbook of waiting for the perfect offer gets tossed out the window. Your focus has to shift to what matters most: speed, certainty, and minimizing the financial damage.

People face the same battle that you do. A mid-year report from ATTOM showed foreclosure filings hit over 187,000 in the first half of the year alone. The home price index rose by almost 6 percent during the past year. You can read the full report on foreclosure activity to see the trends for yourself.

With time working against you, you essentially have three paths to consider. Every method shows different advantages and disadvantages which become apparent when you operate under this type of stress.

Listing with a Real Estate Agent

This is the path most people know. A good agent, especially one who specializes in distressed properties, can be a huge asset. Your real estate agent understands the emergency situation so they will execute a fast marketing plan to get buyers interested immediately.

The traditional market operates at its own rhythm which tends to move at a slower pace. The home sale process takes about thirty to sixty days to finish after you sign the acceptance of the offer. Your home will be listed for sale after the preparation process ends and you have found a buyer. You will have to pay an agent commission of 5-6% which will reduce the total amount you receive from the sale.

The biggest risk here? Uncertainty. A buyer’s loan can fall through at the eleventh hour, sending you right back to square one with even less time to spare.

Going the For Sale By Owner (FSBO) Route

The main appeal of selling FSBO is obvious: avoiding those hefty agent commissions. When every single dollar counts, that can seem like the best move you can make. You control the entire process because you handle the listing and marketing and all negotiations.

But that control comes at a steep cost. Through the process of selling your home you will take on all duties that real estate agents perform including professional photography and marketing activities and legal document management and buyer screening. Selling a house requires complete dedication of your time because the entire process becomes extremely challenging when facing an impending foreclosure.

A simple mistake in pricing or a missed detail in the paperwork can cause delays you just can’t afford. Your savings on commission fees will disappear if you cannot complete the purchase before the auction date.

The reality is that when time is your enemy, taking on the entire sales process yourself is a high-stakes gamble. Avoid the risk of failure because savings might not compensate for the lost chance.

Working with a Cash Home Buyer

Your third option is selling directly to a cash home buyer. The platform exists to achieve one objective which is to complete transactions at high speed without any uncertainty. Because cash buyers use their own funds, they skip the entire mortgage approval maze that slows down traditional sales.

This means a sale can be wrapped up in as little as 7 to 14 days. Your selling process will stop because you need to stop all showings and open houses and stop spending money on repairs. Cash buyers purchase properties “as-is,” which is a lifesaver when you’re short on time and cash.

Of course, there’s a trade-off. A cash offer is typically less than the top dollar you might get on the open market. The convenience of a fast transaction comes at the cost of reduced price value. The number they offer you is what you get—no commissions, closing costs, or repair fees are subtracted later. The process provides better outcomes than a short sale because it does not require lender approval for selling below debt amount. To better understand the differences, check out our guide comparing a short sale vs. foreclosure.

How Your Selling Options Stack Up

A time crunch demands you to present all your information in a single overview. Each method requires different timeframes to complete and produces distinct results.

| Selling Method | Typical Timeline | Key Benefits | Potential Downsides |

|---|---|---|---|

| Real Estate Agent | 60-90+ days | Highest potential sale price; professional guidance | Long timeline; commissions (5-6%); risk of buyer financing falling through |

| For Sale By Owner (FSBO) | Varies widely | No agent commissions; full control over the process | High stress; requires expertise; risk of costly mistakes and delays |

| Cash Buyer | 7-14 days | Extremely fast closing; no repairs needed; sale is certain | Offer is below top market value; less room for negotiation |

Cash buyers offer a direct solution which lets you sell your property without any obstacles. Most homeowners place more value on having a set closing date than on trying to get a higher price that might never materialize.

You should check out a cash offer to determine if speed and certainty matter most to you. Reputable companies can provide a fair, no-obligation offer fast, giving you a concrete number to work with so you can make the best decision for your family.

How a Direct Cash Sale Can Be Your Best Move

Your most valuable resource during the process of selling a house before foreclosure is the remaining time available to you rather than the equity built up in your home. The quick guaranteed sale evolves into a vital solution which enables you to escape financial disaster while restoring your financial stability.

The search for options outside traditional real estate markets requires this level of attention.

Listing with an agent can be a great route for some, but it’s a process loaded with variables. You’re at the mercy of picky buyers, sluggish mortgage approvals, and deals that can fall apart right before closing. The uncertainty that comes with an upcoming auction date makes it impossible to take risks.

The direct cash sale process enables you to avoid all the interference.

Bypassing the Hurdles of a Traditional Sale

The biggest advantage of working with a cash buyer is straightforward: they use their own money. The mortgage process stands as the main cause of delays in real estate transactions but this one fact removes it completely. A typical buyer needs 30 to 60 days to get their financing in order, and that’s if everything goes perfectly.

A cash buyer can often close in as little as 7 to 10 days. The fast speed of this process becomes extremely important when you receive a Notice of Sale.

The accelerated process provides you with multiple important benefits:

- Certainty: A cash offer is a solid commitment. The buyer will not need to worry about loan approval.

- Speed: You can beat your lender’s deadline, pay off what you owe, and stop the foreclosure dead in its tracks. The process lets you settle your debt at your own time which enables you to manage your financial affairs.

- Control: It puts you back in the driver’s seat, letting you finalize the sale on a schedule that works for you.

The Power of an ‘As-Is’ Transaction

Selling your home with an ‘as-is’ condition will free you from a major burden. Your home must reach market-ready status before it can be sold through a typical sale. The entire process needs you to spend thousands on repairs and deep cleaning and possibly staging your home which you probably cannot afford because you are already struggling with payments.

Cash buyers aren’t worried about leaky faucets or outdated kitchens. The buyers evaluate the property based on its renovation potential because they want to handle the renovation process on their own.

Through this method you can sell your property without making any further investments. The program helps buyers avoid the stress of property renovations and expensive repair costs which they would need to perform when dealing with retail properties.

The “as-is” method simplifies everything because it enables you to concentrate on your debt repayment and financial security. Your next step in the decision-making process requires you to identify all the advantages which emerge from selling your home for cash at these particular moments.

A direct cash sale provides you with an immediate sale but also presents a guaranteed exit route. The method provides a direct solution to pre-foreclosure problems which leads to a complete resolution.

Finalizing the Sale and Securing Your Fresh Start

https://www.youtube.com/embed/z3U0FRb9yr4

The acceptance of an offer on your home brings you an enormous feeling of relief. You will see the light at the end of the tunnel when the time comes. Your journey has reached the penultimate point but you need to go further. The completion of this stage determines whether you will achieve closing success which leads to your next life phase.

The main focus of this stage requires rapid communication along with fast execution.

The single most important thing to do right after signing a purchase agreement is to send a copy straight to your lender. The first step requires you to send a copy of your signed purchase agreement to your lender. Your plan to repay the debt will help you stop the scheduled foreclosure auction. To them, a signed contract isn’t just a piece of paper; it’s a viable solution.

What to Expect During the Closing Process

The closing process known as escrow begins after your lender receives notification about the transaction. The legal transfer of property ownership requires a third-party neutral entity to execute all financial and legal procedures. The final stage starts here.

The title company will start by running a title search. The title search process serves to verify your ownership of the property while revealing all existing liens and claims against it. The standard procedure applies to all home sales but it becomes especially crucial when you need to sell your property before foreclosure.

You will complete several financial procedures throughout the offer process. Real estate transactions require buyers to know about earnest money because it serves as a deposit that proves their genuine intent. The money remains protected in escrow until it gets applied to the down payment or closing expenses.

Life After the Sale: Rebuilding Your Foundation

The closing of a sale marks the end of a stressful period in your life. The process of selling your home during these circumstances presents numerous difficulties but it establishes a better position than facing foreclosure. Your credit score will experience damage but the impact remains less severe than a full foreclosure which can stay on your credit report for seven years.

You must make sure that any money received from the sale gets handled properly. The cash you receive from equity will serve as a crucial resource for your rebuilding process.

Create a new budget during this time while establishing an emergency fund and working towards financial stability. The sale represents a new beginning rather than a conclusion because it provides you with a blank slate for your future endeavors.

Data on foreclosure-related sales backs this up. The United States experienced a 10% decrease in foreclosure filings during the past year but the situation differs based on your residential location. The states of Florida and New Jersey experience elevated levels of foreclosures. Your property sale gives you control over the situation which proves to be an effective method for managing risks.

Multiple methods exist for completing a pre-foreclosure sale but each method requires different timeframes and presents unique challenges. The shortest path usually turns out to be the most effective solution. A direct sale to a cash buyer provides homeowners with an immediate solution which delivers quick certainty.

If you’ve reviewed your options and decided a direct sale is the best path, working with a trusted local buyer is key. The no-obligation cash offer from Eagle Quick For Cash allows you to select your closing date so you can complete your sale and move forward with confidence.

Common Questions About Selling Before Foreclosure

Your mind probably runs through many urgent questions when you face the stress of a pre-foreclosure sale. The fear of the unknown creates paralysis yet obtaining direct answers enables us to regain stability.

The business world has been my workplace for many years during which I have heard numerous homeowners express the same concerns. The following section provides answers to typical questions which will help you gain the knowledge you need.

How Much Time Do I Really Have to Sell My House?

This is always the first question, and for good reason. The timeline depends entirely on your state’s laws, but you generally have the time between receiving a “Notice of Default” and the scheduled auction date.

The pre-foreclosure period exists between 30 and 120 days with some cases reaching beyond that timeframe.

You must be aware of your state regulations while tracking every single deadline which appears on your lender notifications. Various states provide additional time for homeowners to stay in their homes. The California legislature has established a law which enables homeowners to delay foreclosure sales for 45 days after listing their property and another 45 days after presenting a signed purchase agreement. The court shows that even the legal system wants you to find a solution outside of foreclosure.

The key insight shows that your available choices diminish as time passes toward the auction date. Your prompt action will lead to the finest outcomes and full control over your situation.

What Is a Short Sale and Should I Consider It?

A short sale is when your lender agrees to let you sell the home for less than what you actually owe on the mortgage. The method appears to be successful at first glance but it creates numerous challenges when determining the right price.

The bank has to approve every single part of the sale. The process extends over a lengthy period because lenders do not guarantee acceptance of your offer.

Worse yet, depending on the deal and your state’s laws, the lender might still be able to come after you for the leftover debt. The deficiency judgment process creates an unwelcome situation. A short sale can be the right tool for some, but it’s often a last resort compared to a sale that covers your debt and keeps you in the driver’s seat.

Can I Stop the Foreclosure Auction If I Have a Buyer?

Yes, absolutely. This is one of the most powerful moves you can make.

The presentation of a signed purchase agreement from an actual qualified buyer to your lender will typically stop an auction from occurring. Your plan to repay the loan will get approved.

A contract from a cash buyer is like gold in this situation. The process eliminates the risk of financing breakdowns because it happens quickly. Lenders see it as a sure thing, and that’s exactly what they want instead of a long, expensive foreclosure process.

What Is the Biggest Mistake Homeowners Make?

Inaction. The most common and expensive mistake people make is waiting.

People stand still while their most valuable resource of time continues to pass away. The natural human response to fear restricts all available options while it disables our capacity to negotiate.

The second biggest mistake? Getting obsessed with hitting a top-dollar, retail price. Your priority must be to get a quick guaranteed sale which protects your credit score because the risk of losing your home outweighs any potential increase in price.

You can learn more about the specifics in our guide covering if you can sell a house in foreclosure and what that process really looks like. The right decision becomes clear when you evaluate the definite outcome of closing against the potential risk of a deal falling through. The real goal is to solve the problem and protect your financial future.

The guide has shown you all your current options. Handling them under severe stress becomes extremely difficult. Eagle Quick For Cash provides assistance to people who need a fast guaranteed sale. The program offers a no-obligation cash offer which enables you to pick your closing date for foreclosure prevention and starting fresh. Learn more at https://www.eaglecashbuyers.com.