A short sale occurs when a lender permits you to sell your property at a price which falls below your current mortgage debt. Homeowners who face financial difficulties can prevent their homes from going into foreclosure through this process which enables them to sell their homes for less than their remaining mortgage debt. The lender needs to provide its complete approval for this process to work.

What is a Short Sale, Really?

The explanation becomes clear when we look at an actual situation. The home you bought for $300,000 now stands at a market value of $250,000 because the housing market in your area has changed. The financial situation blocks you from selling because you have no way to pay back the entire loan amount.

Short sales provide an answer to this particular situation. Your lender gives you the green light to sell the house for its current $250,000 market value. They accept the payment amount although it falls below the $300,000 debt you need to pay.

Why Would a Bank Ever Agree to Lose Money?

The concept appears unusual because it shows banks intentionally create financial losses for themselves. The situation requires me to find the best solution for this difficult circumstance.

A lender must deal with foreclosure as their most time-consuming and costly problem. The process requires court expenses together with lawyer bills and property upkeep costs and it threatens to reduce the market price of the property. A short sale allows them to limit their losses while receiving a fast payment of their money and they can proceed with their business. The decision rests completely on financial factors.

The economic environment has caused short sales to become a standard occurrence which affects numerous people. The rising interest rates create shocked homeowners because their adjustable-rate mortgage payments become much more expensive. The market peak buyers now face a difficult situation because they purchased their properties during the market peak. CrispShortSales.com provides homeowners with additional valuable information about how these market changes affect their properties.

Short sales require multiple essential participants to work together as a team. This is a quick overview which shows the different roles that people play in this situation.

Key Players in a Short Sale and Their Roles

| Player | Primary Role |

|---|---|

| Homeowner (Seller) | The homeowner asks the lender to approve a short sale because they need financial help. |

| Lender (Bank) | The lender analyzes the seller’s financial condition together with the purchase offer to determine their short sale approval status. |

| Real Estate Agent | The real estate agent promotes the property until they find a buyer who meets the requirements before working with the lender to finalize the transaction. |

| Buyer | The buyer submits a property offer while understanding that the procedure might take longer than a standard home sale. |

A successful short sale requires teamwork from multiple participants who work together to achieve this goal. The team members each have specific responsibilities which will lead to the successful completion of the deal and protect the home from foreclosure.

Navigating the Short Sale Process Step by Step

You face a complex system when you attempt to understand the process of short sales. The correct path becomes clear when you discover the right route which allows everything to make sense. People with unique characteristics experience a common path which consists of standard stages. The roadmap enables you to stay organized while you manage your expectations about this extended process.

The homeowner needs to negotiate this situation with their lender and any potential buyers who might be interested. The team needs each member to perform their essential duties which will lead them to victory.

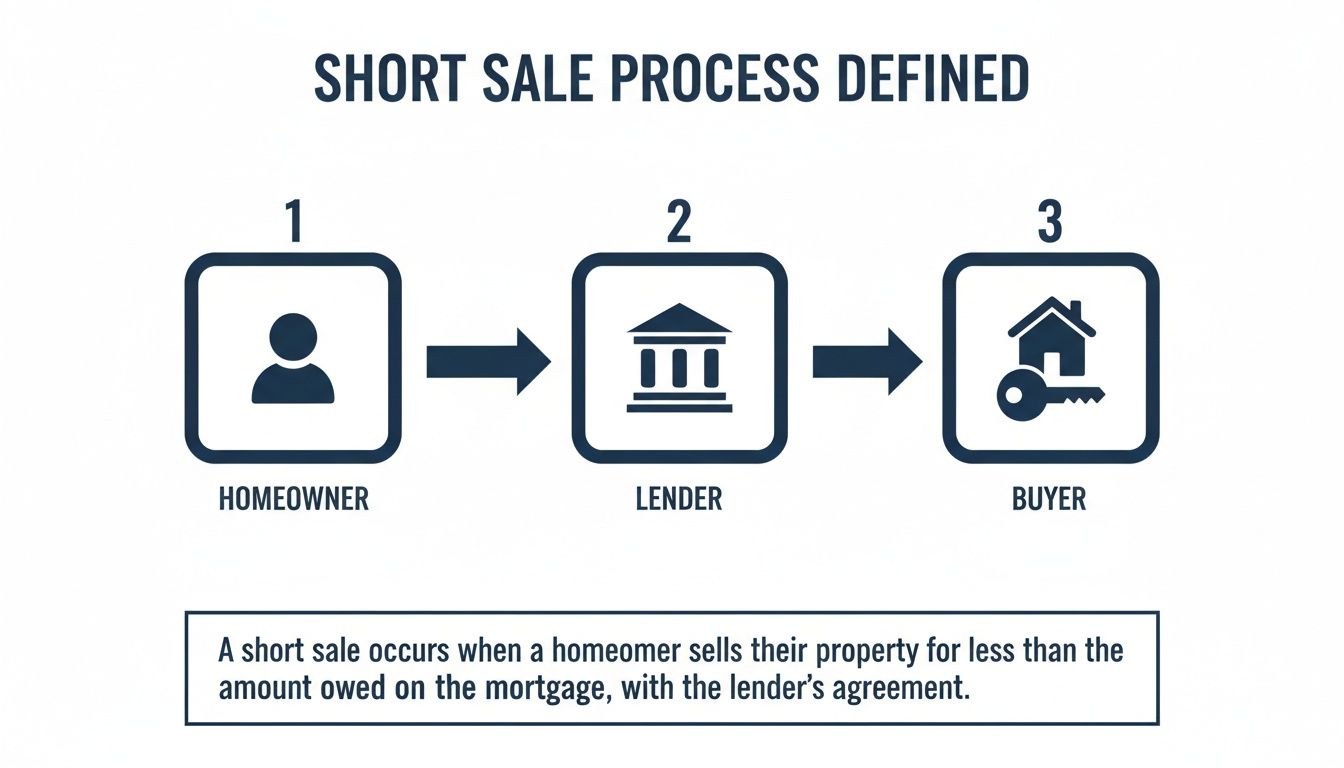

The visual guide presents three essential participants who perform vital duties to achieve short sale success.

The process begins with the homeowner before reaching the lender who makes critical choices and ends with the buyer who finalizes the sale.

Step 1: Contact Your Lender and Prove Hardship

Your very first move is getting on the phone with your lender. You need their first agreement to start any short sale process. The purpose of this discussion exists to demonstrate that you have a real monetary emergency which prevents you from making your mortgage payments.

Lenders require evidence beyond your statements because they need to see proof of your situation. The process requires you to build a complete financial package. The process needs you to create a formal hardship letter which explains your situation while you must provide proof through recent pay stubs and bank statements and tax returns. The process will face major problems when you submit an incomplete package which contains sloppy work.

Step 2: Find the Right Real Estate Agent

Most real estate agents lack the necessary skills to handle short sale transactions. This work requires specialized skills because it demands bank negotiation experience and ability to handle complex document processing. You need to find an agent with a proven track record of getting short sales across the finish line.

An experienced agent will help you price the home correctly—high enough to satisfy the lender, but low enough to attract serious buyers. The champion will manage all communication between you and the buyer and the bank loss mitigation department. You need a specialist who will assist you through this process because this situation differs from standard sales.

Step 3: List the Home and Review Offers

You should start the home listing process after you have selected an agent to represent you. The listing needs to display either “short sale” or “subject to lender approval” for proper disclosure. The system establishes proper buyer expectations because it shows this process will not become a fast sale.

The seller needs to accept the offer before you can decide what happens next. Your lender needs to receive the offer as part of the complete short sale documents which you must submit. Your agent will help you find the best offer which combines the highest price with a buyer who understands bank processes and can wait for bank approval.

People mistakenly believe that the word “short” in short sale means the process will finish quickly. The situation actually works in reverse. The approval process for these deals takes between 60 and 120 days to complete after the lender receives an offer.

Step 4: Submit the Short Sale Package to the Bank

The process requires you to wait for an extended period which becomes the most annoying stage of the entire procedure. The agent will send the buyer’s offer together with your complete financial hardship package to the lender. The bank requires all documents to be in perfect order before they will start their review process.

The lender then does its own homework. The lender will order either a Broker Price Opinion (BPO) or a complete appraisal to determine the market value of your home. The buyer needs to prove their offer price while the bank must establish that approving the short sale will generate more money than pursuing a foreclosure process. Our guide on how to sell a house during foreclosure covers additional difficult decisions which home sellers need to handle.

Step 5: Get the Lender’s Decision and Close the Deal

The lender will make their decision after an unending wait. The decision will take one of three possible forms:

- Approval: The bank accepts the offer. You’re cleared to move toward closing.

- Counteroffer: The lender rejects the offer as-is but might agree to a higher price or different terms.

- Denial: The bank rejects the short sale proposal completely.

The bank will send you an official letter which describes all the terms after they approve your application. The process starts to resemble a standard closing after this point. The buyer completes their financing process while the title company performs their work which results in the property ownership transfer.

Determining If You Qualify for a Short Sale

A short sale does not provide an automatic escape route for all homeowners who find themselves in financial trouble. The lending institutions have established particular requirements which make them reluctant to lose money. Two essential pieces of evidence need to be presented before a bank will consider taking less than your mortgage debt. You must demonstrate that you face a real financial emergency and that your property value has dropped below your loan amount.

Think of it as building a case. You need to present a clear, documented argument that leaves them with no other reasonable choice.

Proving Genuine Financial Hardship

The absolute foundation of any short sale application is proving financial hardship. The situation does not resemble a tight monthly budget. A major life event has occurred which prevents you from maintaining your mortgage payments.

You should write your lender a formal hardship letter which explains your situation using your personal words. Your story requires additional evidence to support it.

Lenders recognize the following types of hardships as common examples:

- Job Loss or Income Reduction: A sudden layoff or a major pay cut that completely upends your finances.

- Major Medical Event: An unplanned illness or severe injury which causes you to accumulate large medical expenses while requiring you to stop working.

- Divorce or Separation: The financial fallout from splitting a household can make it impossible for either person to cover the mortgage alone.

- Sudden Mortgage Payment Increase: A massive jump in your payment, often from an adjustable-rate mortgage (ARM), that pushes it far beyond what you can afford.

The lender base their decision on business considerations when they decide to grant credit. They need to determine if your reported hardship meets the requirements for loan loss compensation because it is valid and severe enough to justify loan loss. Your story needs to be interesting yet it must rest on verified evidence.

Demonstrating an Underwater Mortgage

The process of proving hardship represents only fifty percent of the challenge. You need to show that your home is “underwater”—a term we use when you owe more on your mortgage than the house is currently worth. If you could sell your home and pay off the loan in full, the bank would simply expect you to do that.

For example, imagine you owe $350,000 on your mortgage, but a local real estate agent confirms that in the current market, your home would only sell for $300,000. The available funds do not cover the debt so you must find $50,000 to make up the difference. The negative equity represents the essential part which completes this situation. The lender will not accept your word alone because they will get their own valuation through a Broker Price Opinion (BPO) which they use to verify the property’s value before they approve anything.

Our guide offers additional details about what happens when you want to sell your house but are behind on payments.

Your Essential Document Checklist

You must establish your position by collecting various financial documents. Staying organized here is absolutely critical. The absence of complete paperwork stands as the primary reason why short sales experience delays and get denied.

Get ready to provide the following:

- A Signed Hardship Letter: Your personal story explaining the circumstances.

- Recent Bank Statements: Typically the last two or three months for every account you have.

- Recent Pay Stubs: Proof of your current income from the last 30 days.

- Federal Tax Returns: Your last two years of filed returns.

- A Detailed Financial Worksheet: This is the lender’s form where you break down all your income, assets, and monthly expenses.

Short sales have become more popular again. The number of short sale listings in Sacramento and Phoenix has increased by 25% to 140% when comparing current numbers to previous years. You can learn about this trend and investor reactions through dominionfinancialservices.com.

Comparing Your Options: Short Sale, Foreclosure, and a Cash Sale

The inability to pay mortgage bills creates a situation where homeowners experience increasing pressure from their property. The situation creates overwhelming stress but you should remember that you have multiple solutions available to you. The first step to gaining control requires you to understand your available options together with their actual consequences.

Your credit history will experience permanent effects because of every choice you make which will also affect your financial situation and your ability to start fresh. We will analyze three typical situations which homeowners encounter.

Short Sale vs. Foreclosure: The Core Differences

Short sales and foreclosures exist as two different real estate processes which most people confuse with each other. Short sale functions as a proactive strategy which serves as an example. The process enables you to obtain your lender’s authorization to sell your property at a price below your outstanding mortgage debt. You maintain control of the process while working with an agent to promote the property until you locate a buyer.

A foreclosure represents a different process which happens automatically without any homeowner involvement. Your lender will start legal action against you because you failed to make several mortgage payments. They take possession of the property to reduce their financial losses while you lose total control of the property. Our guide on the differences between a short sale and a foreclosure provides detailed information.

A Side-by-Side Look at Your Choices

You can evaluate your situation by viewing all available options when they appear in a side-by-side comparison. The table below shows the essential elements which will determine how your future will develop for many years to come. A direct cash sale exists as an alternative solution which homeowners find valuable.

Comparing Your Options: Short Sale vs. Foreclosure vs. Cash Sale

The following analysis shows you the main differences between short sales and foreclosures and cash sales which will help you pick the best option.

| Factor | Short Sale | Foreclosure | Cash Sale |

|---|---|---|---|

| Control | You have some control, but the bank has the final say on the sale. | None. The lender controls the entire legal process. | Total control. You decide if and when to sell on your timeline. |

| Timeline | The process moves at an extremely slow pace which makes it impossible to predict its timing. The process takes between four and twelve months to complete but there is no assurance that your application will get approved. | A long, drawn-out legal process dictated by the lender and the courts. | Fast and certain. You can close in as little as 7 days or on a date of your choice. |

| Credit Impact | Significant damage. Expect your score to drop by 50-150 points. | The most severe damage. Your score could plummet by 100+ points. | Zero impact. You pay off the loan, which can actually prevent credit damage. |

| Future Home Loan | You can often get another mortgage in 2 years. | You’ll have to wait 3-7 years to qualify for another loan. | You can buy another home immediately, as your credit is unaffected. |

| Privacy | The sale is public record, often listed as “subject to bank approval.” | The foreclosure becomes public information because it appears in official records which anyone can access. | The transaction operates with complete privacy because it follows a straightforward process. |

| Hassle & Stress | High. Constant uncertainty, paperwork, and dealing with the bank. | The entire process creates extremely high stress because it requires you to go through an invasive procedure which produces emotional exhaustion. | The process requires minimal effort because you do not need to perform repairs or stage the property or negotiate with anyone. |

The results show that short sales provide better outcomes than foreclosures but they do not solve all problems. The process of waiting together with having no answers and the damage to your credit score remains a major obstacle. The cash sale option provides an additional solution which could help you.

A Faster, Simpler Alternative: The Cash Sale

The process of short sales and foreclosures stretches over long periods while causing significant emotional distress to all parties involved. A direct cash sale provides an alternative method which delivers fast results through a simple and certain process.

A direct cash sale means you bypass the traditional real estate market completely. A professional home-buying company will buy your home directly so you can skip the listing process and receive a guaranteed cash offer.

This approach gives you a predictable end date, something a short sale can never promise. The process which used to take months now allows you to receive your payment within days. Homeowners who need quick solutions with guaranteed results should choose this path because it allows them to pay off their debts while avoiding both credit score impacts and foreclosure or short sale stress.

What a Short Sale Really Does to Your Finances

A short sale decision forces you to make a choice which extends past the basic process of home selling. The event stands as a major financial occurrence which prompts people to ask two essential questions about their credit standing and their tax obligations. I will explain what you should expect in this situation.

Your Credit Score Will Take a Hit

A short sale will negatively affect your credit score according to my straightforward explanation. No one can avoid this situation. The lender will report this settlement to credit bureaus because your lender agreed to accept less than what you owed on your loan. The situation results in a major negative impact.

The situation depends completely on how people choose to see things. A foreclosure creates a destructive impact on your credit because it usually causes your credit score to drop by 100 points or more. A short sale, on the other hand, is usually a less brutal blow. The credit score will drop between 50 and 150 points based on your initial credit strength. Our guide on how a short sale affects your credit provides additional information about this topic.

The credit report will show a short sale and a foreclosure for seven years but each one follows a different path to recovery.

- After a short sale: Many people find they can qualify for a new mortgage in as little as 2 years.

- After a foreclosure: You’re looking at a much longer wait, usually somewhere between 3 to 7 years, before most lenders will even talk to you.

Untangling the Tax Implications

The entire situation has become extremely difficult to handle. Homeowners face their biggest fear because they might receive an unexpected large tax bill after their property sale completes. The IRS treats debt forgiveness as taxable income when lenders choose to forgive debts.

You have a $300,000 mortgage debt but the house sells at a short sale price of $250,000. The bank forgives the $50,000 difference between the loan amount and the sale price. The IRS views this transaction as if you received $50,000 in cash directly from someone.

Crucial Disclaimer: Tax laws are incredibly complex and depend entirely on your personal situation. What follows is general information, not professional advice. You absolutely must speak with a qualified tax advisor and a real estate attorney to figure out what this means for you.

The good news is that there have been protections in place. The Mortgage Forgiveness Debt Relief Act protects homeowners from paying taxes on this “phantom income” when they sell their main residence. But tax laws are constantly changing, making it essential to get up-to-date advice from a professional.

Weighing Your Financial Reality

You need to understand the financial outcomes before you can decide on the right path. A short sale offers a more dignified way to exit than foreclosure but it requires a lengthy process which will cause you financial losses.

The current market situation presents an excellent opportunity for buyers. Short sale properties have historically sold at a significant discount, often going for 10-12% below list price. The property value decreases by a larger amount than what happens during a foreclosure or standard home sale. You can read more about these market trends over at royalexaminer.com.

Homeowners who need to break their connection with their current situation quickly have multiple options available to them. You can avoid the entire credit damage and tax complications by selling your home directly to a cash buyer. The process allows you to resolve your debt while receiving cash without experiencing the long-term financial damage which short sales typically cause.

Considering a Faster Alternative to a Short Sale

A short sale fails to deliver the brief transaction time which its name suggests. The process takes an extended duration which creates an anxious situation for you because you remain stuck in uncertainty. The process of waiting for months while handling documents will end with the lender canceling the agreement at the final stage. The complete absence of control together with unending unpredictability leads to total exhaustion.

But what if there was another way? The path enables you to skip lender discussions while you wait no time at all because it restores your complete control.

The Power of a Direct Cash Sale

You can sell your home directly to a cash home buyer instead of listing it and hoping for someone willing to deal with the short sale process. The process eliminates all intermediaries because it allows you to deal directly with buyers and banks and appraisers for a simple transaction.

The main benefit of this system allows you to schedule your sale whenever you want. The fast process becomes a total transformation for homeowners who need to handle foreclosure or other financial problems.

Key Benefits of Selling for Cash

The cash sale method provides buyers with several major benefits which help them achieve financial stability during their most essential time.

- Guaranteed Closing: The sale includes a guaranteed closing because there are no financing contingencies which could cause the transaction to fail. The offer becomes final once you accept it.

- Sell As-Is: You can skip all repair work and cleaning and staging requirements because you can sell the property in its current condition. The property is available for purchase at its present state without requiring you to spend any money on repairs. We buy it in its current condition.

- No Fees or Commissions: A traditional sale can cost you thousands in agent commissions and closing costs. With a direct sale, you avoid these expenses.

- You Control the Timeline: You choose the closing date. This gives you the breathing room to plan your next steps without being rushed.

A cash sale simplifies a complex problem. The solution provides a quick and definite answer which eliminates the need for dealing with lender bureaucracy for an extended period. The solution enables you to finish your business matters so you can start your future.

Making an Informed Decision

The first step to finding the right solution requires you to know all your available options. A short sale might work for some people, but its long timeline and unpredictable nature are serious downsides.

Cash sales present homeowners with a fast solution which requires no waiting period to achieve guaranteed outcome results. The program allows you to avoid foreclosure while you pay off your debts and regain financial stability without experiencing any additional stress.

You need to understand the complete operation of this path to determine if it suits your needs. Our guide which explains the meaning of cash offers on houses will provide you with additional information. You should select the best option which suits your current situation after you have evaluated all your available options.

Common Questions About Short Sales

The possibility of a short sale makes you wonder about all the possible questions you might have. The process exists as a complicated system which does not create any doubt about its complexity. Homeowners who contact us most frequently ask these questions which we answer to help them understand the situation better.

How Long Does the Entire Short Sale Process Usually Take?

The term “short sale” in real estate represents an ironic situation because it has no connection to the actual time duration involved. These things are a marathon, not a sprint.

You need to locate a buyer who will submit an offer before your lender will start their evaluation process. The process of getting their approval will take between 60 and 120 days but could extend even further. The time between your home listing and final closing could range from four months to an entire year. The situation requires you to have patience because it serves as an essential requirement.

Can I Live in My Home While It is Being Sold?

Yes, absolutely. You should plan on staying in your home for the entire duration of the sale. Lenders actually prefer it this way. An occupied home tends to be in better shape, which protects the property’s value and makes it far more appealing to buyers walking through.

Your agent will help you schedule showings for potential buyers but you need to wait for the lender to give final approval before you can start packing for your move.

What Is a Deficiency Judgment?

The term represents an essential concept which requires your full understanding. A deficiency judgment is what happens when your lender sues you for the difference between what you owed on your mortgage and what the home actually sold for. That leftover amount is called the “deficiency.”

You have a $300,000 loan but the highest offer you receive is $250,000. The deficiency is that $50,000 gap. Depending on your state’s laws and the specific agreement you reach, the bank could legally come after you for that money. Your attorney must fight for a “deficiency waiver” in your approval letter to protect you from this debt for life.

Do I Have to Pay Any Fees to Complete a Short Sale?

In most cases, no. The seller typically walks away without paying a dime. The lender pays for all seller closing expenses which include real estate agent fees and title costs and approved repair expenses.

Why would they do that? It’s simple math for them. The cost of these payments remains lower than the expensive and time-intensive foreclosure process. The main purpose of a short sale is to help homeowners who already face financial difficulties so you should not need to bring cash for closing.

The short sale process involves multiple uncertain stages which make it difficult to determine when it will end. Homeowners who need a faster solution with guaranteed results should consider cash sales as their best option. Eagle Cash Buyers offers companies that will provide you with a cash offer without any obligations. You can set your own closing date while protecting your credit score and starting your new life. Get your free, no-obligation cash offer today.